The government published draft regulations to enforce country-by-country reporting for tax purposes by multinational corporations yesterday. The regime, which is already hopelessly inadequate by denying the public the right to see this essential data, applies to multinational companies turning over more than £586 million a year.

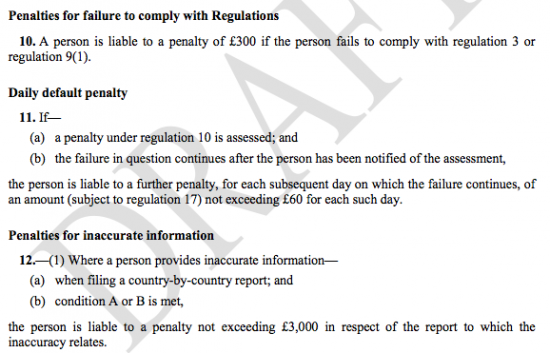

There is a problem though. The penalty regime is as follows:

So, the penalty for not bothering is £300 plus £60 a day, or £22,200 a year.

That means it is cheaper to not supply country-by-country reporting data than comply.

It means the fine is 0.004% of turnover, at most.

It means that HMRC is saying ot really can't be bothered whether large companies do this, or not.

The penalty will, in fact, be smaller than many imposed in tax settlements on sole traders.

If you want the evidence that HMRC is not serious about collecting tax from big business then then this is it.

And if you want to know where I would start the penalty process, the fine would be £1,000,000 plus £5,000 a day, or £2,825,000. And maybe I'm being a little too generous even then given the amount of tax come large companies might save through their abuse.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Filing an inaccurate, or better still, an incomplete return might be an even better bet, risking only a £3000 fine/fee? Perhaps reporting for a few high tax countries and lumping the rest in “other”.

The biggest obstacle to this working might be cuts in HMRC staffing so that very few of the reports are looked at critically or challenged.

The most effective deterrent to criminal behaviour is the probability of being caught. So HMRC needs a fit for purpose compliance capability.

Combined with proportionate fines which get the attention of the shareholders, and “naming and shaming”, you have a system that can work.

“So, the penalty for not bothering is £300 plus £60 a day, or £22,200 a year.

That means it is cheaper to not supply country-by-country reporting data than comply.”

That’s probably true – I’m just in process of recruiting an extra person in Europe and it is primarily driven by the extra compliance from CBCR etc. And that’s just Europe. At a group level there will be additional cost too. So in our group it will certainly cost us more than £22k per year.

At least you are now recognizing that this will be a non significant costs for group’s to comply with this additional burden. I seem to recall some while back you were suggesting that the extra burden would be minimal. But I can assutre you it isn’t.

Ho hum, c’est la vie and now back to work 🙂

£22,000 is insignificant

An assistant is not a lot either

Both statements are true

Whether £22K is significant depends on the size of company. Surely penalty should be a minimum and then a % of turnover or similar measure in relevant country.