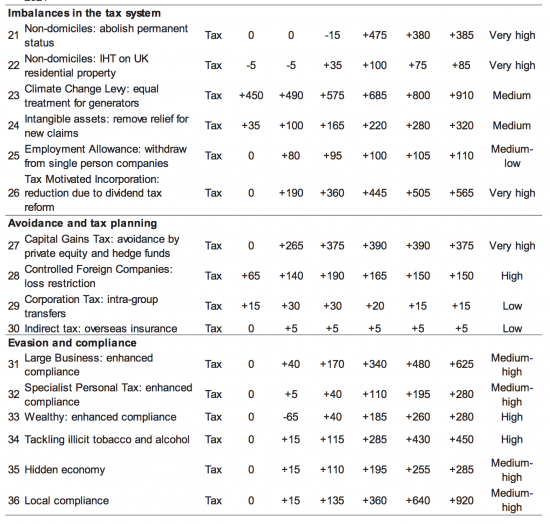

This, according to the Office for Budget Responsibility, is where a little over £5 billion of savings from tackling tax avoidance and evasion come from over the next five years:

The columns represent 2015-16 to 2020-21 and the OBR risk assessment.

Those risk assessments are interesting: many of the biggest numbers appear to have high levels of risk attached to them. This is unsurprising. The OBR obviously have doubt that, despite the supposed allocation of new funds to HMRC that it has sufficient resources to do its job, saying:

Our forecast assumes that HMRC's compliance activities will be sufficient to reduce the implicit ‘tax gap' between actual receipts and the theoretical amount that would be received if compliance with the tax system was 100 per cent. As explained in Annex A, we have sought assurance from the Treasury that both the baseline compliance activity implicit in our pre-measures forecast and the additional measures that appear on the scorecard will be adequately funded. We will keep this funding and the receipts effect of HMRC compliance activity under review in future forecasts.

It's hardly a ringing vote of confidence. And with good reason. First, the additional local compliance recovery appears to be based on this Budget report forecast:

2.98 Investment in analytical team for illegal working — The government will invest an additional £0.8 million in 2015-16 to create a data analysis resource in HMRC to tackle illegal working and enable closer joint working with other agencies.

Yes, that is just £800,000 of spend.

Second, the HMRC business plan says it will save £205 million in 2015-16 and the net new investment announced yesterday was £60 million in the same year with £225 million extra the year after. That's called standing still, at best.

The chance that these savings will come from the actions planned looks very low indeed to me. And that's absurd when so much more is on offer in this area, as I have long explained.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

These forecasts are all very well, but it would be interesting to see similar effort put into checking back what forecasts were made 5 years ago (or even over the last year or two) to see how things actually turned out in practice.

These forecasts are rarely if ever reported on after the event

It is why I have called for an Office for Tax Responsibility

I think those forecasts went down the memory hole at “Mini True”!

So the largest single component is “Climate Change Levy: equal treatment for generators” – i.e. taxing renewable energy companies for the impact of fossil fuel companies on climate change?

That’s one of the biggest – yes

To me, a polluters tax on non-polluters looks like a new tax rather than the closure of a tax loophole.

To me too

Absurd to call it a loophole