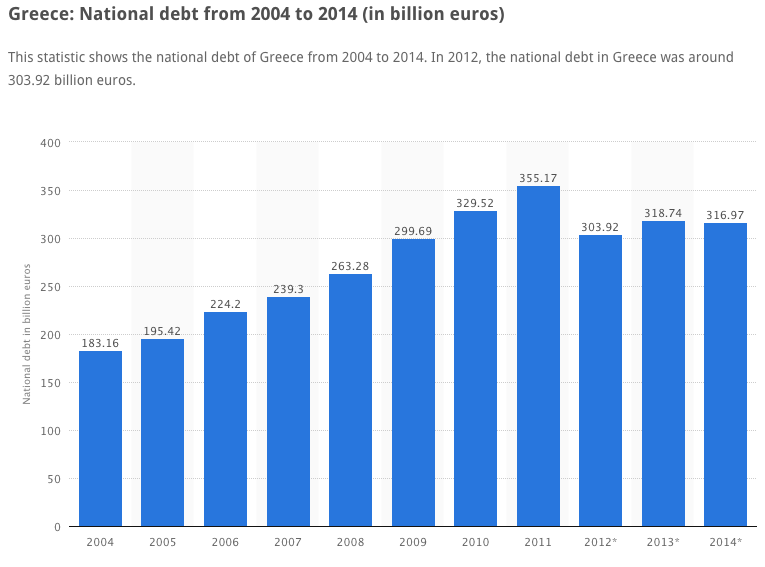

This is the size of Greek debt:

The latest data I have on Greek GDP is €182.4 bn in 2013. So debt was 175% of GDP.

Today I have had comments on the blog like this:

If and when they default, massive losses will be felt all over Europe, whose taxpayers will be forced to take much of the pain.

We need to contextualise that pain. This comes from the Telegraph in November 2014:

[P]enalties for foreign exchange manipulation, Libor-rigging and mis-selling could take the total fines levied on the banking industry above $300bn (£190bn), analysts have predicted.

Now, no one is saying that Greece will default on all debt. I can hardly see it happening, and no one expects that. So, even allowing for the fact that the Euro is not the dollar (€1 = ¢1.13 right now) the total amount by which Greece could possibly default is much loss than the cost to banks of their crimes and mis-selling.

Oddly, no commentator from the right wing is saying banks must be forced out of business because of what they did, even though without exception they are only in business because of state aid.

And none are saying the massive cost banks have imposed is a crisis for pensions or anyone else.

And no commentator who is castigating Greece is saying bankers must bear the burden of their errors.

But they are queuing up to say the Greeks must bear the burden of what 99% of them did not known about and could not have been responsible for.

Why is that?

Could it be that bankers are favoured in this equation and Greece is not?

Surely not?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I read that something like 80% of the Greek debt is owned by the ECB and IMF in any case. Bank exposure is quite limited.

You are right

But you would never think it form what is said

This is really disappointing stuff.

80% of Greek government debt is held by central banks, the IMF and ECB and government-owned institutions; most of the rest is owned by Greek domestic banks and institutions. Only a tiny sliver (5%? I haven’t seen up-to-date figures) is owned by foreign investors (mostly non-bank “vulture funds” who objected to the 2012 restructuring).

There are only three options on the table: Greek austerity continues (politically tough in Greece); other governments bail out Greek debt (politically tough in Germany and France); Greece leaves the Euro (politically tough everywhere). All very depressing.

Economists write the equation, bankers put it into practice and politicians propagandise and legislate on their behalf. The public pick up the tab. The Greek working class represent us all here.

My goodness – it’s just incredible.

There is something truly evil at work here.

Richard,

I continue to be staggered by the debate on Greece, the Green New Deal and Green QE. Politically, economically and scientifically the case has been made, primarily on these pages, by civil society as a whole. Precisely what are these neoliberal fanatics searching for?

They have nothing to add to the debate, other than their own failed theories of selfishness, why are they even allowed to have a seat at the table? Why are they even in the room? The buildong? You get the point.

I suspect you know as well as I do why there’s such an outcry about Greek debt, Richard, and how and why it must be repaid otherwise the world as we know it will collapse.

It has very little to do with any form of rationale argument. It is, quite simply, a device to wreck the Syriza government as quickly as possible, and to make sure that what happens can be laid at the feet of that government, and not blamed on the ECB, IMF, EC, or any other EU country, or – and this is most important – global capital (by which I primarily mean multi-national corporations, the 1% and their agents and supporters).

And why is that necessary? Because the full significance of the recent events in Greece are far, far broader and deeper than simply whether Greece repays its debts or not. For the first time in Europe for a very long time a progressive political party that is not either beholding to and/or implicitly supportive of the neoliberal project has got into power. Not only have they got into power, but they’ve done so with a clear mandate for pursuit of an entirely un-neoliberal agenda.

Now think of what happens if having won power Syriza goes on to deliver even half of the policies that they’ve promised to pursue (and I understand some of these will be passed through the Greek parliament as early as Wednesday). Where does that leave the likes of our own government, that of Germany, almost every newspaper and media owner in the world, the big four, almost every politician in a so called “left” or social democratic party (eg. Ed Miliband), every organisation that makes its money from lobbying in support on big business or providing any other service that promotes or delivers any aspect of the neoliberal project, the rich, The City, the EC, and so on and on. Any and all of these have spent years telling us there is no alternative.

In short, Syriza represent a direct challenge to those who have spent decades designing and imposing neoliberalism on Europe and the world. They are equivalent to the Allende government in Chile in the 1970s – and many of us are old enough to remember where that threat to the “world order” – as so many so called democrats saw it at the time – ended.

For me then – and for the sake of Syriza and the Greek people – the debate needs to move away from debt as fast as it can, because that’s just a smokescreen to hide the true nature of the forces that are about to be deployed to undermine the potential success of this movement. We must not forget, and I hope/assume (given their backgrounds)those involved in the Syriza government are fully aware of this, that the agents of neoliberalism have spent 40 years establishing the hegemony of their project and they are not going to allow that to be challenged now and anything and everything will done to ensure that remains so.

This comment will be re-appearing as a guest post shortly

Unfortunately, civil society stops when the bank account fills.

Don’t ever forget: The financial industry makes and enforces the laws to suit itself (or at least, its paid servants do; the ones we elect)

And then there is this:

http://www.theregister.co.uk/2015/01/27/hmrc_failes_to_plan_for_104bn_contract_exit/

I agree Richard, Ivan’s comment is so incisive (as are your blogs) Trouble is you need to get this out on social media in a form that the easily led public understand.

We don’t have a left wing party or a social democratic party Blair saw off any of that when he came to power. I am now thinking of moving to Greece!

Ivan’s comment elsewhere this morning on parallels from history is timely. We are living in an age of parallels.

Nowhere is this more apparent than in comparisons with Germany following the first world war, and the humiliation it suffered as a result of the ‘imposed peace’ of the Treaty of Versailles. The catastrophic social and economic consequences of which would reverberate throughout Europe for nearly half a century. Then as now the debt was accompanied by the imposition of austerity and the collapse of employment and social services. In Germany then, like Greece now, the unrepayable debt was restructured (under the Dawes and subsequently the Young plan) with loans underwritten by private banks. In Germany then, like Greece now, the leaders of the far Right were languishing in gaol. In Germany then, like Greece now, the citizens felt anger and humiliation.

By contrast we have Germany’s treatment after the second world war when leaders with a sense of history reduced German debt by 50% (at the time about 15bn Marks) and increased the repayment period to around 80 years, a move that made repayments so small as as to be negligible. The Wikipedia entry on the London Debt Agreement says

‘The agreement significantly contributed to the growth of the post-war German economy and reemergence of Germany as a world economic power. It allowed Germany to enter international economic institutions such as the World Bank, International Monetary Fund and World Trade Organization.’

Albert Einstein said something like ‘madness is doing the same thing over and over and expecting different results’. You would think that Merkel, Shaueble et al would at least be mindful of lessons from their own history.

But as we know where History once stood there is now simply a screen message that reads

‘This page is currently closed for reconstruction’.

I would reiterate what I said at the weekend. The ruling hegemony will do everything in their power to thwart the will of the Greek (and Spanish, Portuguese, and Italian) people, including making a new Cuba of the country.

Thanks Martin

wow so many bitter conspiracy theorists on here. You’re getting your excuses in early for when Syriza fails – “it was a conspiracy by those neo-liberals”. The truth is socialism doesn’t work, as nearly every socialist country there has ever been proves, you can’t fund a bloated state through excessive borrowing forever and eventually the state collapses.

Also, why do none of you follow your theories through, if Greece defaults/negotiates a reduction in its debts the knock on effect will be disasterous, Portugal will want to do the same as will Spain, then Italy, then maybe even France. These debts make greeces look like pocket money. Luckily you are in the minority in this and most other countries.

How do you explain the fact that the UK has borrowed since 1692?

Or he success of the post war era?

Or that, as is very clear, markets fail without government support (2008)?

Please just try

If one thing characterises the behaviour of the political Right is the use of pejorative to describe anyone who’s political views stand without of their own narrow political paradigm. Hence, anyone who recognises the right wing agenda behind European economics is now a ‘conspiracy theorist’ (a phrase popularised recently by no less than David Cameron-it was only a matter of time before his supporters latched onto that one). And this despite the fact that in all the coverage of the Greek election only one media source (Channel 4 News) had actually bothered to interview anyone from the new coalition Government. C4 were also notable for the fact that, amidst the slew of interviews from German Investment bankers, and ‘dire warnings from Berlin’, they managed to mention the fact that Syriza had received warm overtures from many European Governments, including France, Spain and Italy.

On the subject of Greece, and its relationship with Europe, it is interesting to note that newly incumbent Finance Minister Yannis Varoufakis has long held to the belief that the size of the bailouts given to Greece were overly large and inappropriately targeted. In fact, the sums given to Greece have served only to ensnare the country in ever more untenable debt whilst achieving little for the real economy.

The truth is that the single European currency has crippled the economies of Southern Europe (and was always destined to do so from its inception) without the requisite social, economic, and political harmonisation. That harmonisation was the essential precept of a successful union, but was derailed by De Gaulle’s unhelpful intervention. Conversely it has of course massively benefitted Germany (who incidentally insisted as part of the bail-out conditions that the majority of the liability for the massive Greek debt held by their private banks (fiscal responsibility?) be defrayed to European Governments) who would rather see Peoples crushed than abandon the cash cow that is the single currency. I include below a link to an article that explains better than I can why Greece is the victim in all this. It comes from that hotbed of ‘Neo-liberal Conspiracy Theory’ the Economist.

The austerity measures foisted on the Greek people are viewed as some sort of panacea by right wing commentators and economists, despite the fact that GDP has collapsed along with productivity, while unemployment has soared, with more young people in Greece now unemployed than working. The same commentators of course ignore the fact that a Nation is, by definition its people. Thousands of those people are now forced to scavenge in rubbish dumps for food, sleep in the streets or die for want of medical attention. Some panacea. Meanwhile the architects of Greece’s near demise walk away with their pockets full. No mention of the Global banking corporations who falsified accounts to facilitate the country’s entry into the Euro, while it is the ordinary Greek People who are left to pick up the pieces.

http://www.economist.com/node/21555927

There you go with the conspiracy theories again, it’s everyones fault but Greeces.

But then again I’m wrong, I’m always wrong. It’s impossible to have a different opinion without being….wrong

You said it

So please stop wasting my time

Thanks for setting straight the ‘conspiracy theory’ jibe, Martin. Much like the ‘politics of envy’ that’s also routinely leveled at those of us who dare to say anything against neoliberalism. Also for the historical contextualisation, which here and elsewhere across Richard’s blogs is always excellent and highly informative.

As you note, the new Greek Finance minister is right, of course, and has said so consistently since the bailout. But as with surgeons of old (many of whom were barbers if I remember my history correctly), if bleeding a patient with an illness doesn’t work, then the problem is you need to bleed them some more – until they become so weak they die anyway.

For many decades that approach could be blamed on ignorance, of course, though some clung to the practice long after it became evident that it could be extremely harmful. But in the case of the troika we can’t blame their attempt to bleed Greece to death on ignorance, as you rightly illustrate with the parallel between the treatment of Germany after the two world wars. That said, the IMF for one has a long history of visiting suffering and destruction on the ordinary citizens of nations while the “elite” few are empowered to prosper. But then that’s just me advancing another conspiracy theory, isn’t it?!

There is nothing wrong with borrowing within your means. Excessive borrowing is the problem, which is the only way socialist governments can pay for their policies.

You mean the post war conservative era between 1951 and 1964?

Government support yes (only for retail banks to prevent citizens losing their savings), not market intervention.

I think I’ve tried and succeeded.

The Tories followed labour lead from 1951 to 64

It was called Butskillism

And state sponsored growth cleared debt

It always does

That’s why you’re wrong

Thanks for that Ivan, much appreciated.

Interesting aside – a Guardian newsfeed informs me that BOE Governor Mark Carney has launched a surprisingly frank attack on austerity in the Eurozone

– another Conspiracy Theorist do you suppose?

That’s an interesting development

He may simply be worried about UK external demand of course

This may just be self interest

Quite possibly, Richard, but the timing is interesting though.