HMRC have issued their tax gap report for 2014, which relates to the tax year 2012/13.

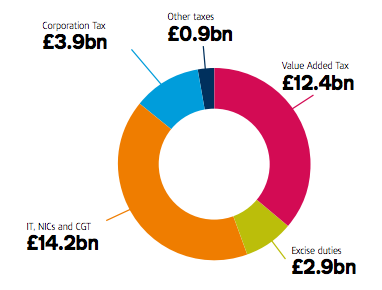

Predictably the figure is ludicrously low. They say it is £34 billion, made up as follows:

My estimate of the same tax gap is £119.4 billion.

To give some idea of the differences in estimates this is the causation according to HMRC:

Their estimate of tax evasion in 2012/13 is £4.1 billion.

Mine is £45.6 billion for unrecorded trading alone, and from evasion as a whole is about £80 billion.

Now it is likely that neither of us is right, of course: these figures are estimates. But the gap in this one estimate alone is enough to explain much of our difference of opinion so it is important to explain how it arises. That's simple. HMRC only look for errors within the tax returns that they get to come up with their estimates. That ignores the fact that tax evaders choose not to submit tax returns. This glaringly obvious point appears to be wholly unknown to the HMRC publicity machine, although I know its staff are acutely aware of it.

Now this would not be problem if there were just a few tax returns not submitted each year, but looking at companies alone my work has shown that HMRC chose not to ask for corporation tax returns in 2011/12 (for which I have most recent reliable data) from up to 800,000 companies and failed to collect tax returns from another 270,000 from which they did request returns whilst of those submitting returns about half a million said they had no income even though data on PAYE and VAT registrations suggests that is a serious understatement and as a result the fact that only 900,000 or so of the 2.6 million companies in operation during that year actually paid tax is as much due to HMRC negligence in requesting tax return data, and failing to pursue those who do not, as it is to anything else. But of course none of these deficiencies come up in the HMRC stats that assume that all these missing companies are honest non-taxpayers who are fully compliant with their obligations despite the fact that hundreds of thousands of those companies ignore them.

In the meantime, this data is best considered a work of fiction.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The basic premise that HMRC should estimate the Tax Gap is just plain stupid.

It’s like students marking their own examination papers.

I am not keen on Quangos but this would be an exception- An Independent body staffed

by a range of Interest Groups should be compiling data on the Tax Gap.

Agreed whole heartedly

This might be a good area where you seek support from all areas of political opinion

and build a campaign- it has a specific and identifiable objective.

It would start to make a move from the philosophy of tax as a requisition of private property to tax as a means of social good.

Again, I’ve got to say that this whole thing seems all too deliberate to me. A deliberate shambles to help corporations who wrongly claim in law to be ‘persons’.

Oh and the very, very rich too who pootle about in their Roll Royces and high performance guzzlers on our roads that magically ‘just appeared’ and ‘repair themselves’ or the airports where they fly in on their private jets or the air traffic control system that helps them to get there safely – no all of those things just ‘appeared’ out of nothing – not out of taxes or prudent Government borrowing for investment. I have to laugh in despair though, so here’s a little story.

I’m one of those people who still likes to use film in his camera so I used to buy it from the Channel Islands where I understood it was offshore and tax free just to keep a harmless hobby going you understand. It was cheap.

When that brave and bold Mr Osbourne took control of the Treasury in 2010, he closed a Channel Island tax loop hole for little old me (and others) which meant that 20% was added to my roll of film. Hence I buy less film and when I buy it a deficit busting £2-3 is added to each roll in tax. Wow! Talk about under-promising and over delivering Mr Chancellor! ‘Way to go George’ is what your neo-lib mates -sorry – ‘buddies’- will be saying over the pond!

The point I’m making is that there has been a lot of window dressing about collecting taxes, reducing benefit fraud etc., by this Government but the real big deficit busting amounts of money (as shown above) lie in the taxes this Government (and others perhaps before it) have deliberately chosen not to pursue.

Just for the record I do not mind people getting rich; what I do mind is 1) when in doing so they make me and my children poorer and 2) when they use their money to influence politics for their own personal gain and create 1 above. That’s not on. Oh, and treating the rest of the world as a toilet whilst you live on your secluded islands and gated communities isn’t on either.

I didn’t retrain myself at my own personal expense to end up on the scrapheap because someone wants to give my job to some man in Asia at a call centre to increase the returns for someone who is already rich or because I work in a sector the ‘Conspiratives’ don’t think should exist; nor do I want some Daily Mail or Sun reader or columnist telling me that I shouldn’t have had kids even when my wages were keeping pace with inflation and we could afford it when we did have them at the time. But that’s what I’m looking at right now if this shower get into parliament again.

Finally, one of the tragedies of our times is that I am quite sure that if these corps’ and individuals left the country (as they often threaten to do) because we started to tax them properly I believe that they would be replaced by lots of talented & driven small business people and Entreprenuers who would be content with smaller amounts of remuneration etc., (certainly not the £14 million pay-packet of the latest super CEO reported recently).

Thank you again Richard for the information and I’m sorry if this comes across as a rant and doesn’t do your forensic analysis justice. I am one of the so-called squeezed middle.

My father was a toolmaker who lost his job in the mid 70’s via a buy out by an American firm who were basically asset strippers (there was a lot of that happening at the time – Tiny Rowland etc.,). He ended up cleaning buses for the rest of his life. So to avoid being a down-trodden working class like him, he begged me to work hard and get into University and become middle class where I might not face the same challenges he’d had to deal with. He wanted me to be safe. Throughout his life he advocated that people needed to be put back into the tax system (by working) because it was a public good and needed to be funded. He died in 2008, aged 74. I wonder what he’d be saying now if he could see this?