The 50p tax rate debate will take headlines for a day or two. I think that's deliberate and even desired by Labour: the current leadership has always sought a popular tax announcement at the Fabian conference to cover for the economic policy announcements Ed Balls makes at the same time, which has almost always been unacceptable to most in Labour.

I think the 50p tax rate is important. I think, contrary to what the IFS says and what the Treasury says that it will raise money. I say that because most of those who are working for both those bodies are economists with little idea of how tax actually works in reality. And I think Labour is right to say it did raise money. But it's more than that; as I argued here it's important for the debate on equality and for actually tackling inequality - which even the IMF says is a major threat to world economic stability.

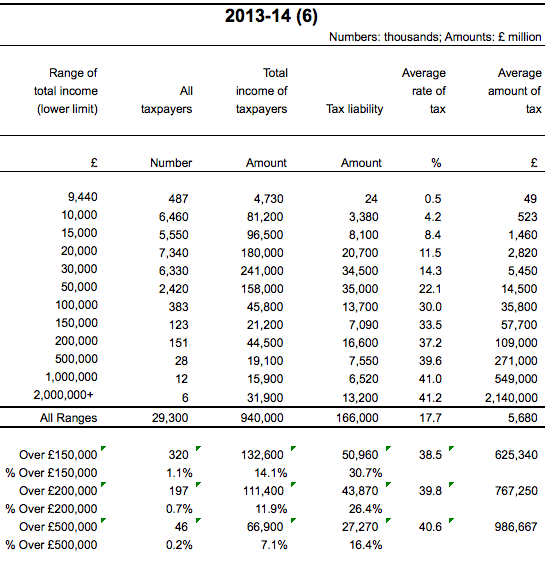

So there are excellent reasons for having a 50p tax rate. But let's also have some facts to counter the nonsense that will be spoken on this issue. This table comes from HMRC and is their latest estimate of the current year tax take:

I would stress, I added the last six lines.

What's important to note is that no one pays tax at 45% at present. Average tax rates just creep over 40% on average for even the highest paid.

Those highest paid settle between them just over 30% of all tax, but enjoy between them 14.1% of all income even though those earning over £150,000 are just 1.1% of all tax payers. They pay more because they can afford to pay more.

And simple linear extrapolation would suggest that additional tax due by increasing the marginal tax rate by 5% might add a little over £5 billion to the tax take.

Now of course there will be a little planing in year one. But over time that's the likely outcome. I call that income worth having when a deficit needs cutting.

But let's also look at this in context, considering just those in the bracket £150,000 to £200,000 (the supposed middle class who are hit if the Daily Mail is to be believed that these people really are in the middle class and assuming that even they believe that some who pay tax at this rate have to be wealthy). For these people the maximum additional tax take will be 5% additional tax on their income over £150,000. That is a maximum of £2,500. On average a figure of £1,250 or less is, of course, much more likely in this band since incomes will be weighted to the bottom end of it.

Now let's consider the impact of a Coalition tax change that did not attract letters to the Telegraph from business leaders about its massive likely effect on the state of incentives in the British economy. This is the withdrawal of Child Benefit for those earning over £60,000 a year; a figure many more Mail readers are likely to aspire too. For a Mail reader with three children this increased their tax bill by £1,929 a year.

So, for a Mail reader on £60,000 the impact of the withdrawal of Child Benefit increased their overall tax rate by 3.21% whilst for the average person earning between £150,000 and £200,000 being a 50% tax payer will increase their overall tax rate by 0.71%.

Now, which one is likely to have a bigger disincentive effect?

In fact, it is only when someone earns £400,000 a year that the proportionate effect of the 50% tax rate will be bigger than the withdrawal of child benefit for three children from people earning £60,000 a year. And the vast majority of those paying 50% tax will earn less than £400,000.

So why then all the fuss?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting. Are there any actual figures to go on ie the amount of tax raised before 50pc came in versus the amount raised whilst 50pc was in? That ought to kill the debate once and for all!

The data is not agreed

I suggested significant potential revenues

HMRC say none

The IFS say it may not have generated much but the data is unclear

That is because of abuse on introduction and withdrawL meaning there was never clean data so the argument is still open

“I think the 50p tax rate is important. I think, contrary to what the IFS says and what the Treasury says that it will raise money. I say that because most of those who are working for both those bodies are economists with little idea of how tax actually works in reality”

This is the nub of it really. You, a self-appointed expert with an axe to grind say it matters, but the data collected by two serious and respected authorities (as well as HMRC itself) says otherwise. Who are we to believe?

“And simple linear extrapolation….”

Which is of course non-sense. Tax collection, as we well know, is decidedly non-linear. By your logic we could extrapolate to near 100% tax rates and come out with a sensible answer, when clearly in real-life the answer would be very different.

Tax need not be non-linear if we beat abuse

Tax is most definately non-linear.

Even if you manage to beat all so-called abuse, one can perfectly legitimately plan for tax – increase pension contributions or ISAs for example – which are a big factor in defining that linearity.

Likewise, get close to 100% taxation levels and people simply are not not incentivised to work – we can see the evidence when we look at marginal tax rates for the low paid. By the very same token, at very high marginal tax rates over a particular threshold, people may simply decide the extra work necessary per unit of income is not worth it.

This blogpost I did for the TUC Touchstone blog in 2012 covers the issues reasonably well and is still relevant: http://touchstoneblog.org.uk/2012/03/did-the-50p-tax-rate-really-raise-less-than-1-billion-in-201011

The crucial points are:

1) The HMRC research was based on data for one year only – 2010/11, and due to the amount of forestalling (shifting income forward from 2010/11 to 2009/10) going on in 2010/11, those estimates are going to be very unreliable indeed.

2) recent academic research (referenced in the blogpost) suggests that the Taxable Income Elasticity is likely to be lower than the 0.46 estimate which HMRC used.

In addition, if combined with the kind of package of tax reforms to reduce avoidance which Richard has advocated on this blog for years, the 50p rate has the potential to raise several billion pounds – not enough to close the deficit by itself but a useful contribution.

Hi Howard,

I’ve read your piece, and whilst I can’t find major fault with the body of it, there are a few things I would mention.

1. The TIE rate could be in a range, and HMRC are using 0.46. I’ve seen other estimates in a wide range from 0.12 to 0.5, with the realistic estimates from aroun 0.35 to 0.5. This means HMRC isn’t miles out – and as we know these numbers are near impossible to pin down. They do also have a pretty full discussion of why they used that rate, and the effects of changing that rate.

2. You seem to ignore the easiest and most common method of tax avoidance – pension contributions. It’s pretty common for people to contribute more from their over 150k pre-tax income to their pension pot simply to minimise the amount they pay at the top rate. Perfectly legal and much easier than any of the other avoidance schemes you mention.

3. HMRC also make an estimate of the impact on indirect tax revenues – which you don’t seem to cover.

4. You don’t make any estimates on how much money the 50p rate raised, other than it could be higher than the HMRC estimate, and you also as part of the conclusion intimate that the law would need to be changed.

Assuming no changes of law, and understanding that these calculations are estimates, how much roughly do you think the 50 tax raised?

Let’s start with a simple response – pension contributions are capped

This is the sort if mistake most economists make – ignoring fax reality

“Let’s start with a simple response — pension contributions are capped”

Yes, at 50,000 GBP.

Which means that at the normal 7.5% contributon rate you would have to earn over 600k to hit the cap. So, for the bulk of people in the 50p tax bracket, earning between 150k-600k, you can easily and at a stroke reduce your tax bill by filling up your pension till you hit the 50k cap.

According to the numbers in your table above, only 46 people in the UK wouldn’t be able to (fully) benefit from that simple move.

Normal does not apply in this range

Get real

Richard

Are you sure your maths work on this?

If the vast majority of those paying the 50% tax will be earning less that £400,000 per annum then can it possibly raise the £5bn you mention?

Even if the average taxpayer impacted by the 50% rate earned 400,000 then wouldn’t that require there to be 400,000 taxapers earning that amount?

On the data above there are only 197,000 tax payers earning more than 200,000, of whom there are 18,000 earning more than 1,000,000.

Do you think there really is the number of tax payers with income at the top end to generate the £5bn you estimate as the data doesn’t suggest that there are.

What extrapolation are you doing to get to your £5bn?

And yet a tax hike of VAT to 20 percent, a tax that primarally hits ordinary folk is perfectly OK!

How strange!

Quite obviously, VAT @ 20% is predominantly on luxury goods and this readily avoidable if you desire. It is a consumption tax.

Income tax is a tax on employment, on those who are already paying much more than their “fair share” to fund the benefits, education and public services that many people take for granted.

The 45% is 5% more than the top rate which was considered appropriate for a long time – i.e. the richest are already paying a 5% extra tax to help resolve the deficit.

Clothing is a luxury good?

And so is petrol?

And some food?

On yes?

Please do not be absurd

Fish and chips are now a luxury food items? And takeaway pizza? That’s news!!

Mind you, the price of them, it may be arguable it IS a luxury!! 🙂

(In fairness, I think Inconvenient Truth was alluding to “essentials”. The waivers for food and children’s clothes). But these are so limited – I’m not sure he knows too much of the detail.

VAT hits many more “essentials”. Clothing, shoes, heating, take-away food (vital when you’re homeless or housed in temp accom!) – it’s a punative and regressive tax.

We should also remind ourselves that under Thatcher the top rate was … 60%.

What really sticks in my craw is the willingness of the Tories to tax us and spend money on “iconic” vanity projects. They have no problem with increases to the London 2012 Olympic Games, (£9bn) a ludicrous Thames cable car, Bicycles in London (losing £200m a year), but stop benefits for disabled people dying of cancer for refusing to attend Job Centres because they are too ill and who die the following week. Shameful.

What really sticks in my craw is the willingness of the Tories to tax us and spend money on “iconic” vanity projects. They have no problem with increases to the London 2012 Olympic Games, (£9bn) a ludicrous Thames cable car, Bicycles in London (losing £200m a year

Olypmic games was decided and budgeted under Labour – current govt could hardly stop it, and I understand they managed to cut costs.

Thames cable car was paid for by Emirates airlines.

Boris bikes are paid for by barclays….

“(In fairness, I think Inconvenient Truth was alluding to “essentials”. The waivers for food and children’s clothes). But these are so limited — I’m not sure he knows too much of the detail.”

You might be willing to give him the benefit of the doubt, but he probably knows full well that VAT is a regressive tax.

I certainly suspect so.

That’s odd.

Elsewhere on your site you claim that ONS statistics show that when you take other taxes into account the poorest pay more as a percentage of their income. Yet those ONS statistics show the lowest quintile paying an average 35% of income in ALL taxes yet now you accept that the very wealthy pay over 40% in income tax and NI alone, before other taxes are taken into account. You seem to use whichever statistic of the day suits you until it doesn’t then you abandon it and say the next statistic is the one we should look at.

You also rather bizarrely base your argument on everyone who might be affected by a 50% tax rate also being affected by child benefit charges. Quite obviously many high earners won’t have children or will have children over 16.

You also blithely claim that the tax take would be linear ignoring pensions on the grounds that contributions are capped (yet £40k would take a huge chunk out of most people’s income) and ignoring many other tax exempt uses of money such as charitable donations and investment schemes such as EIS and VCT. Unless of course you propose scrapping such schemes? Terrific boost to the economy that would be, stopping the incentive to invest in small businesses.

Still, I suppose it all comes down to your basic idea that everything belongs to the state, except of course your own little pile which would no doubt be exempt.

Wring again

This figure is based on taxable income

Income is higher

Please get your stats right