Vodafone published a statement on its tax affairs yesterday. It was robust and defiant. And it was a PR disaster.

Vodafone paid no corporation tax and reduced its UK tax bill by a fifth last year. The company defends its arrangements in a 3,600 word statement that Channel 4 News hears is "smoke and mirrors".

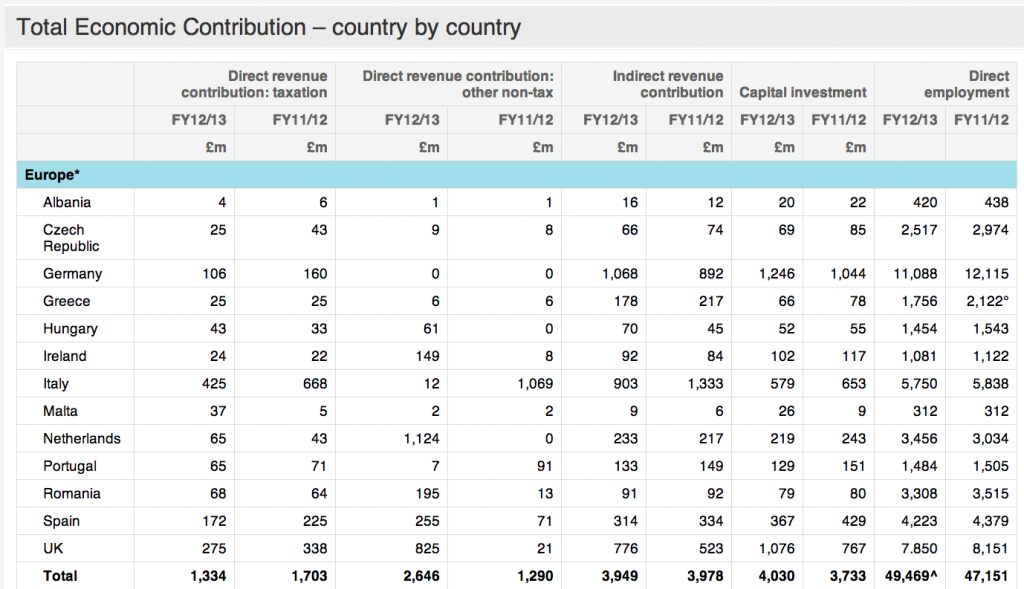

The telecoms company paid £275m in British taxes for the year up to March 2013 — down from £338m the year before.For the third year in a row, Vodafone paid no corporation tax in the UK.

But as they added:

This time, the telecoms company announced its affairs in a long statement with a handy "in focus" box entitled: "Why does Vodafone pay little or no UK corporation tax?"

Vodafone said that critics failed to understand the complexities of the tax system, and said: "tax law is often unclear and subject to a broad range of interpretations". The statement pointed to the £1bn of investment in the UK and to the £600m a year of UK borrowings, which can be claimed for tax relief.

And then, they noted me saying:

However accountant and tax campaigner Richard Murphy said the 3,654 word statement was purely "smoke and mirrors", and was "patronising" to the British public in leaving out crucial information — including profits.

"Without knowing what the profit is, Vodafone is giving us an incomplete view, or at least, a very selective view," he told Channel 4 News.

"Alistair Campbell would be proud — this is pure spin."

He added: "They have written very long excuse for their behaviour. The moment I read it, I thought I could just hear Margaret Hodge (chairman of the public accounts committee) sighing."

Let me expand on that. This is what Vodafone actually report:

The problem with this supposed 'accounting' for tax is that it is not in a very real sense accounting at all. It is disclosure of what has been paid, but that's something different. In accounting data what is provided lets is interpret the data for ourselves. So, for example, to understand tax paid on profits we need to know what the profit is, and to understand VAT paid we need to know want sales are, and so on. Vodafone does not tell us that and in that case this data is curious and vaguely interesting as time series information, maybe, but this is not country-by-country reporting, whatever Vodafone might say, and second this is not helping use very much. It's PR, but it's decidedly selective PR and that's of no use to us at all.

The long text documents issued by Vodafone are as bad. They sound like an aggressive defence of the indefensible, because they are just that. Candidly, they're also seriously misleading.

For example, Vodafone says it does not pay tax in the UK because of interest paid. It fails to mention it may have significant borrowings in the UK that may not relate entirely to its UK operations because the Uk is remarkably generous with its tax relief on interest. Nor does it say where that interest is paid to.

And it says it only locates business where there is commercial substance to what happens but then admits it is in Luxembourg to claim the tax relief that Luxembourg permits on the writing down of the value of investments that is rare in Europe, coupled with the fact that it can easily shift profits from its European operations into Luxembourg via interest paid to mop up the tax relief available there and avoid paying tax on a significant part of its income as a result, in all likelihood. But so incomplete is Vodafone's supposed country-by-country reporting that they don't disclose figures for Luxembourg so that part of the story is hidden from view!

It is, perhaps, that last point that reveals most tellingly the farce in this PR exercise. Whilst Vodafone clearly admits it has a problem with its PR image and tax in Luxembourg it won't give us the data to work out what is going on there. So what has it got to hide? That's the very obvious question that follows on from that.

Until we get full trading data for each country and full details of how and why tax is paid in each place where Vodafone operates and how that is impacted by its intra-group trading - data that full country-by-country reporting would provide - then exercises like this will back-fire on the groups that do them.

We have a long way to go on tax disclosure is the message of the day.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Also, why this continued obfuscation with listing their “direct taxation” payments? I think even those of us that are not experts or even laymen in terms of taxation law understand the significant difference between taxes like PAYE, rates on buildings, stamp duty etc and Corporation tax.

It’s got to be a good sign that corporations are now *pretending* to do country-by-country reporting, isn’t it?

As long as people realise that this isn’t the real thing, that is.

“He added: “They have written very long excuse for their behaviour. The moment I read it, I thought I could just hear Margaret Hodge (chairman of the public accounts committee) sighing.”

I can’t see this getting past you Mr. M., but, I don’t want to sound too churlish but haven’t MH and her family also benefitted from careful, ummm, tax planning.

Incidentally, Mr. M. can you please explain to me, why as individual I shouldn’t arrange (if I had the cash) to arrange my affairs to pay as little tax as possible….

…..you see, I don’t mind my taxes going on nurses, doctors, dentists, fire service personnel, the Police, HM Forces, Social Workers and such like….

…it’s just that I’m not sure we should be funding non-jobs like Diversity Officers or Climate Change Managers or even “Future Shape Programme Manager”.

Again, I suspect my view of the world and yours is a little different, but then again I work shifts and work in an environment where people don’t earn lots of cash and I’d rather see taxes spend on productive activities not a huge army of on-jobs created by Gordo the Ungreat to buy votes.

Shall I summarise this?

What you’re saying is you don’t believe in democracy

And I do

I agree with democracy but I also think that not every possible job paid for by taxes is totally vital…..

Seeking to undermine democracy by not paying does not evidence belief

I’m sorry – your words fail you

“Seeking to undermine democracy by not paying does not evidence belief…”

Sorry Mr. M. you’ve lost me a bit on that one. I’m not sure how I’m undermining democracy by saying that (I bet like most people) if I had shed loads of cash, I’d use every lawful means to reduce my tax bill….

….I guess you run a business and I’ll also guess that you also claim for everything you can….to reduce your overall bill.

I have never minimised by tax bill

Or claimed anything I do not think wholly justified

Candidly, both are absurd things for a rational person to do

“Or claimed anything I do not think wholly justified”

Respectfully Mr. M., isn’t that what Vodafone et al. are engaged in – using the law to wholly justify their tax bill.

well, no actually

rather a lot of people think they claim things they cannot be sure are wholly justified

Do you remember they paid over a billion?