I am intrigued by an issue developing as a result of the discovery that nPower has not paid tax in the UK for at least three years, as disclosed on Monday by a parliamentary hearing, despite making £766 million of operating profit. 38 Degrees, the campaigning organisation, has said about this:

Is Npower the new Starbucks? At the same time as hiking our energy bills, Npower are using accounting tricks to dodge paying their fair share of tax in the UK. Yesterday it was revealed that they haven't paid a single penny in corporation tax for the last three years!

NPower's accounting scam works like this: they are turning UK operating profits into accounting and tax losses by making large “interest payments” to other parts of their own business, based overseas. This is currently legal — and in the longer term, we need to push the government to close this blatant loophole. But right now we have a chance to force Npower to drop this scam — so please sign the petition now.

Initially nPower's defence to non-payment was this, offered by its CEO:

Mr Massara replied: 'We have invested £5billion in the last five years building power plants, creating jobs, creating employment and helping to keep the lights on.

'There is no mystery to it, there is no desire not to pay tax. The fact is you are allowed depreciation for your investments. And we have been the biggest investor by a mile in the renewable offshore business.

'If we had not made that investment, we would not have the (tax) deductibility that we would be allowed. That is a simple UK accounting rule.'

Now the defence is:

In response to the 38degrees campaign — this is not an “accounting scam”. Like almost every company in the UK, our business is financed by a mixture of equity and loan capital — this is standard business practice. We do borrow from our parent company, RWE — this is because the interest rates we pay to RWE Group are the same as, or often lower, than we would pay to a UK bank. This is not only perfectly legal, and something HMRC is fully aware of - it is common practice.

So what is happening here?

The first thing to say, simply because it is glaringly obviously true, is that nothing illegal is going on here, and as far as I can see no one has ever said otherwise.

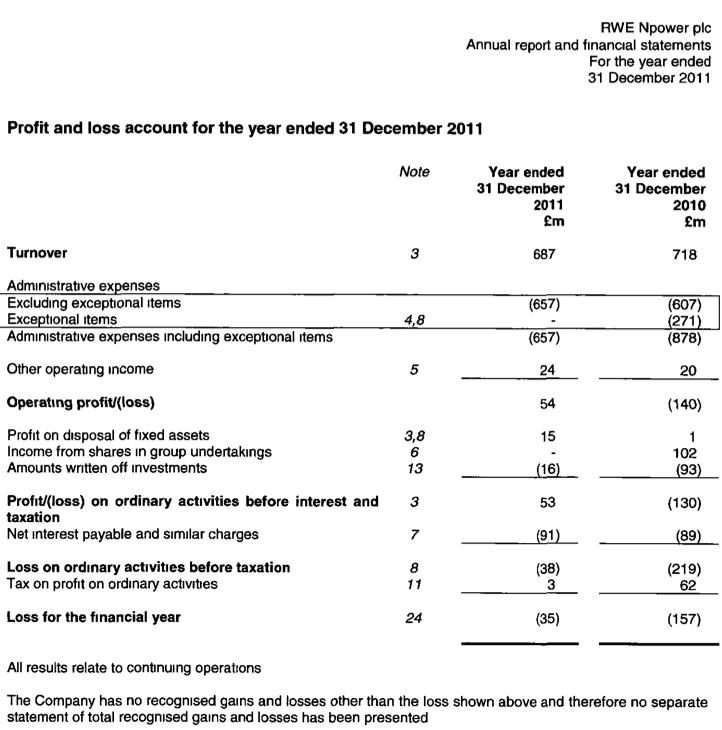

The second thing to do is look at the accounts. This is 2011 and 2010 (2012 are not published):

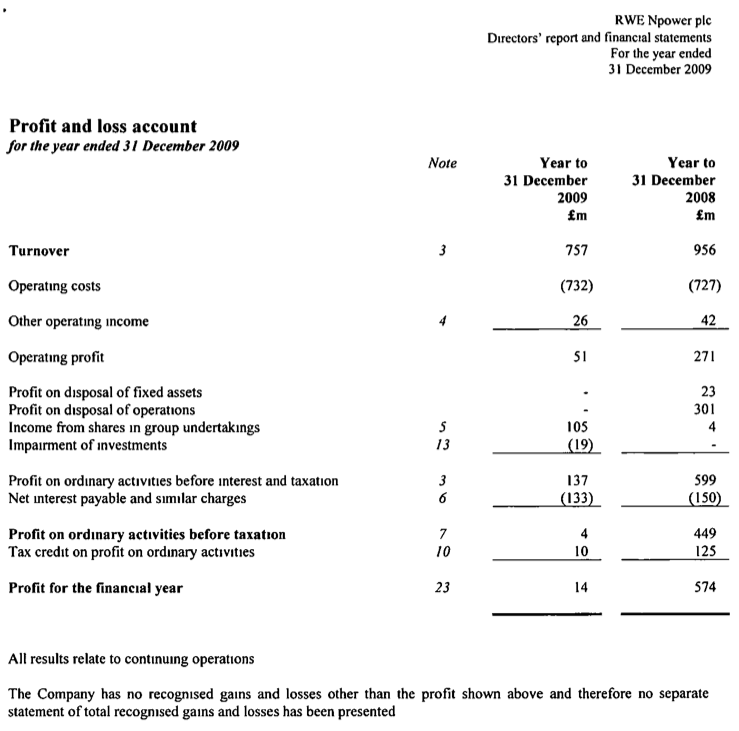

And this is 2008 and 2009.

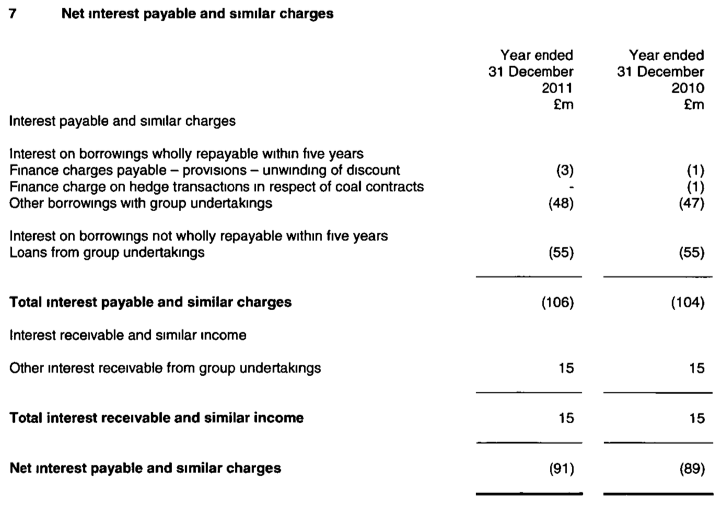

For some element of completeness this is the note on interest paid in 2011:

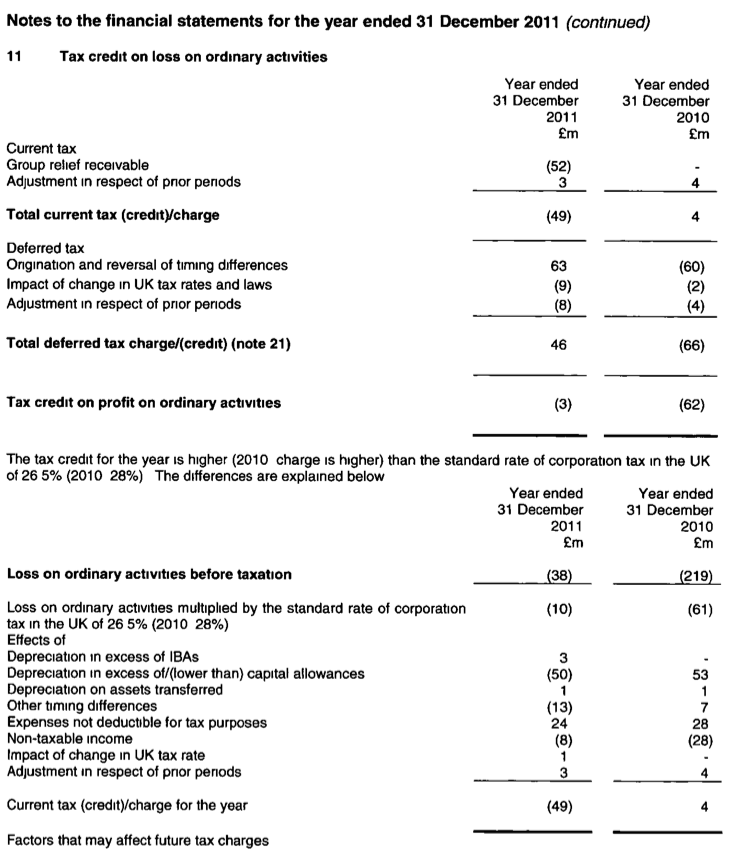

And this is the 2011 tax note:

Please accept my apologies for a lot of data: sometime it's necessary.

So let's first of all look at the first claim nPower made, that their tax charge was being reduced by the effect of investment. The answer to that is to be found in that last item - the tax note, and in the line in the bottom of the two tables referring to 'depreciation in excess of / (lower than) capital allowances'. Note that in 2011 this is in brackets. That means in that year the tax effect of tax allowances on investment was to reduce the tax bill by £50 million because more was spent on investment than was charged for in the accounts. But the previous year the impact was the other way round - the depreciation charge in the accounts on investment was much more than the amount of tax relief on investment - increasing the tax bill by £53 million. Now I accept that in 2009 there was excess tax relief worth £70 million. But let's be clear, when this number can swing that much and almost reverse from one year to the next this investment is not enough to explain why over time the company is not paying tax, at least in full, as the first explanation nPower offered suggested was the case.

There are other explanations. First, in 2009 some tax losses reduced the bill, which is fair enough, although the reason for the loses has to be considered, which I do below, and for that reason I do not accept this claim at face value.

Second, in all years there was some non taxable income in the form of dividends from subsidiaries - non taxable because it is assumed the subsidiaries have already paid tax before making a dividend payment. This is indisputably acceptable.

But thirdly, the fact is that the company was, on the face of it, really not very profitable when it came to tax. It made operating profits before exceptional items of £53 million in 2011, £131 million in 2010 (add back the exceptional of £271 million to get there), and £51 million in 2009. That's before considering exceptional items a total of £235 million. Which sounds pretty good.

But against that it offset £271 million of exceptional items in 2010 and, much more importantly, £313 million of interest paid (the charge was £133 million in 2009). Of this charge almost all was with group undertakings, as the note shows. In fact it looks like some £358 million was paid in interest to group undertakings (which nPower admit to be its German parent) over the three years. So, even if there had been no exceptional items, and ignoring the tax free income from dividends (which seems fair) on the core underlying trade as reflected by the operating profit nPower was actually structured so that the whole operating profit of £235 million was bound to be cancelled by interest paid.

And that is the best explanation as to why this company is not profitable and does not pay tax. It's been designed to ensure that outcome.

Now it is of course up to a business to decide how it structures itself. That is a legal choice. But it's also a matter of fact that the UK tax system is remarkably generous in giving tax relief on the payment of interest - much more so than the German system is, for example. It's not true to say we allow all interest without question, but the latitude is very high. The result here is that by choosing to fund much of the UK business of nPower with loans on which interest is paid the profit that would otherwise be taxed in the UK is essentially shifted to Germany where the interest is received and it appears as a result that nPower is a wholly unprofitable business in this country even though the operating profits indicate otherwise.

Now we've been here before of course: this is the Starbucks, Google and Amazon stories all over again. Everything is legal, of course, but the profits have moved location. And they clearly have in this case. nPower is not an unprofitable business, overall. Far from it, in fact. But because of decisions made on business structuring, which are clearly very advantageous under the UK tax system, the UK loses out on all tax being paid by this company although Germany might benefit considerably.

So the question is, and 38 Degrees are right to ask it, is whether this is ethical? My suggestion is that it is not. If tax compliance is paying the right amount of tax (but no more) in the right place at the right time then I think the structure used means that tax is paid in the wrong place - i.e. in Germany and not here. And when this is a public utility servicing the UK consumer I think that is unacceptable. And in that case I think 38 Degrees are right to protest and to suggest that reform is needed to the Uk tax system to end this possibility. What is more, I think nPower, by offering an excuse for non-tax payment that simply does not consistently stack shot themselves in the foot and showed they had something to hide here.

So keep protesting 38 Degrees, I say. You got this right.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Not sure i follow why there’s a tax advantage for them in paying interest to Germany… isn’t the rate of German corporation tax higher than the rate in the UK? If it was a Jersey or Luxembourg borrower I’d see your point…

Headline rates and effective rates may not be the same

Germany has a big problem with effective rates

i think we probably need to look at the German group position to see if there is anything “dodgy” going on. Frankly pushing interest income into Germany is the last thing you would want to do from a tax efficiency perspective (all things being equal) for a number of reasons.

HMRC have the power to challenge the interest payments in any event via the transfer pricing rules which must assume they havent (or at least not got around to yet)

would we feel differently if the interest was paid to a UK bank (as it appears there isnt any non-connected party debt in the UK)? I ask because I think UK banks arent paying much tax on interest income due to brought forward losses…………..

I am drawing attention to an issue of profit shifting using interest – which is widely acknowledged to be a major concern

I would have less problem if the interest was paid to a UK bank

Is it possible to tell from the RWE accounts how much they are actually paying? If so, that would go a fair way to indicating if these are tax-related shenanigans.

Yes it is. 24% effective tax rate last year, 28% the year before. The current tax is rather worse, as they’ve got a fairly chunky credit through deferred tax.

Over 2011 and 2012, their effective current tax rate was 28.5%. Well above the headline UK rate.

So?

And note they save considerably on overseas tax – does that interest really go to the parent company?

I don’t know – but nor do you

If the interest payments were made to a uk bank would you still have an issue? Surely it comes down to whether the interest paid to the parent company is reasonable given the capital borrowed? If it is are they doing anything wrong?

If the interest was paid to a UK bank it would be taxable here

And what if the loan was from a German bank? Still a problem?

Yes

And that’s where your arguments flawed, Npower are not avoiding tax, this is not their liability to pay. The interest payments are legitimate, it’s up to them where they loan capital from.

And I am saying it should not be their choice

The argument is very clear

And your side have now lost this “freewill” on tax debate

If the interest were paid to a UK bank, it would be because a UK bank had lent cash to nPower rather than to someone else. So UK tax would be paid on the nPower loan, but would be lost on the other loan – net result, no additional UK tax (assuming the same interest rate).

Alternatively, the UK bank might have borrowed more to make the nPower loan in addition to its existing loans. In which case the UK bank would get a deduction for the interest on the borrowings – net result, not much extra UK tax (just on the bank’s margin).

But in any case, I’m not sure why it’s odd or objectionable for a German group to decide not to use a UK bank.

Please don’t be absurd

Loans are not limited by deposits

Do you know nothing about banking?

This is just crass

I don’t know a lot about banking, but I do know that banks can’t simply magic money out of nowhere.

For a UK bank to lend money to a business, it has to have that money available to it in some form, does it not?

And if that money is available, then surely there is an opportunity cost associated with lending it to one company rather than doing something else?

That’s where your wrong

Banks just print money

You may be repelled by the idea

But that’s exactly what they do. Read:

http://www.taxresearch.org.uk/Blog/2011/06/17/all-money-is-a-confidence-trick-2/

So basically what you are saying here is that you are anti cross border loans being granted to UK taxpayers, irrespective whether the loan in commercial or intra-group. The rationale appears to be that the income arising from such loan will be taxed outside UK, usually because of treaty provisions or EU Directives.

So the N Power issue has nothing to do with tax avoidance at all – you object to the pre-existing policy.

Trust you will accept that where UK banks make loans offshore, that you will be happy to see no tax arising for UK bank in the UK. Correct?

Tax already does not arise on loans made outside UK by UK banks

Don’t you realise we have moved to territorial taxation?

Please keep up with the game

What we’re saying is noi tax in and all tax relief out – and yes, I do object to that

I suspect that you don’t understand banking.

Your argument is that if I borrow £10k the amount I owe the bank and the amount that the bank owes to me net off to nil. Fair enough.

So I immediately withdraw £10k in cash. The bank now owes me nothing, and that symmetry breaks. How does its double-entry work? Debit creditor, credit cash. How does it get the positive cash balance in the first place? By borrowing from the Bank of England…

What you forget is cash withdrawn becomes cash deposited, so the system balances…

This is fractional reserve banking

UK banks making loans outside the UK do get taxed on their interest receipts.

Overseas subsidiaries of UK banks are another matter, of course. If a German subsidiary of a UK bank lent the money, the interest would be taxable in Germany. Where the bank is…

And as you know UK banks will not lend overseas from the Uk in most cases for exactly this reason

Territorial taxation doesn’t mean that a UK bank is not taxed on the income from loans that it makes cross-border. If the loan is from the UK operation then it is taxed in the UK.

If it loans through an overseas subsidiary then that’s different, but that isn’t what the commentator was talking about. The point is that if you deny tax relief for cross-border loans into the UK, then you also sacrifice tax revenue on the profit from cross-border loans out of the UK.

I look forward to you cheering on any UK-based multinationals who claim that they deserve a tax rebate on all the profits they’ve previously recognised from group financing arrangements.

Shall we get real here?

The loan will not be made form the UK, will it?

Let’s not be silly

So far as I’m aware, UK banks don’t like lending to non-UK customers because they’re not in the UK and so the legal recourse gets tricky – nothing to do with tax. Oh, and because a local link between lender and borrower is handy, so everyone knows who’s who.

Cross-border lending within a group is an entirely different matter, and that’s what Lee T seems to be referring to.

There is no reason at all why one entity in one country shouldn’t lend money to a related entity in another country. UK companies lend an awful lot of money to related parties outside the UK, and the income on that is taxed here.

The quid pro quo for the nPower interest being taxed in Germany rather than here is that a lot of interest in other groups is taxed here rather than in Germany. If you require all inward investment to be in the form of equity, then surely all outward investment should also be in the form of equity – and therefore raise no tax for the UK.

And I am saying there should be reason

And I suspect there will be too, in due course

UK companies investing overseas already raise no tax for the UK

Don’t you know?

Haven’t you been following tax law changes?

Rather more than you, I suspect.

Companies investing through capital pay little or no tax on returns on that investment, which seems to be in line with what you’re suggesting is correct.

If the CFC rules kick in for a company, they do pay tax.

If they invest via debt, they pay tax on the interest income. At least, all the ones I’ve worked with have done.

So the tax that is raised in the UK through investment overseas is on income that you think shouldn’t exist; your preferred investment method would raise no tax at all. Yet you complain about avoidance!

And now treasury functions will be outside the UK – 5% tax – even if a CFC

You can’t win this one

“You can’t win this one”

Not when you everything I say is subject to your approval and moderation, so posts you don’t like don’t make it through.

Fair enough: it’s your blog after all.

Oh utter nonsense

I only delete you when candidly I’m bored of having a blog with more comments by you on it than by me

Alternatively, of course, we could harmonise our tax system so that it is closer to that of Germany (which is hardly a notorious tax haven!).

I assume the interest is at market rates (and presumably it is, or HMRC would have disallowed part or all of it). If the funding had been provided by a third party then I assume you would have no problem with the interest? In which case what’s the problem? Interest is a cost of business, after all.

And presumably interest received is taxed in Germany?

You make a massive range of assumptions which undermine your claim

Tax is not paid here

That’s my point

And interest has been used to shift it, unambiguously

Accounts also say that capital employed is c. £2.5bln – Assuming a loan of that amount is to be taken out, then interest at c. 6% would be £120m?

Checking the German tax rates, however, I note that German corporation tax (when you include local as well as federal tax) is rather higher than UK rates.

So if large amounts of interest are being paid to Germany, I think you are correct that the effect is that nPower is paying less UK tax; but I would point out that it will be paying more tax overall once you include the German tax bill

As such it seems unlikely that the debt structure is there for tax reasons.

Oh come on – tax rate is a poor indicator as you well know

Base is the issue

Are you suggesting Germany doesn’t tax interest income?

I am saying it has different rules fo deductibility and therefore the UK may be a better place to charge it

I’d be concerned if Germany might allow a higher deduction than the UK does, but as the UK gives full deduction (subject to thin cap rules etc) and Germany has a number of restrictions that the UK doesn’t, I don’t think that’s likely.

If anything, the German tax base for interest is probably wider than the UK base, as well as being taxed at a higher rate.

We are told that nPower paid no tax on £766m of operating profits over the past three years. Either someone is looking at the wrong numbers, or their operating profit for 2012 must be £852m. Which seems unlikely.

The operating profit figure included 2008 – I think inappropriately\

I also think I have used consistent data

You seem to have used entirely reasonable data.. you’re looking where I would look.. but there’s still no way of getting from that to the headline figures from 38 degrees.. and £766m is a pretty precise figure.

Whilst it may not change the conclusions drawn, it’s pretty clear that you and 38 degrees are not working with the same information.

They have confirmed it….in a press release

R

Confirmed what?

Why there’s a vast discrepancy between the numbers that you have analysed and the numbers that 38 degrees have publicised?

I am not saying anyone is wrong/lying… just that you’re looking at different numbers… and it’s absurd to try and suggest otherwise. I didn’t make the observation in order to undermine anything.. but I’m at a loss ot understand why you’re refusing to acknowledge something that it so obviously true.

They confirm the number you challenge

But isn’t tax paid on the interest income in Germany? You say the intra-group borrowing is with the German parent, and corporation tax rates are higher there, so where’s the avoidance?

Genuinely, I don’t understand what the problem is here.

If your argument is that they are paying the right amount of tax but in the wrong place, then please be clearer about that because npower are being painted as tax avoiders here which sounds wrong to me (unless there’s something about the loan structure I’m not aware of).

If it was all going off to the Cayman islands via DDL arrangements then fair enough, but I don’t think you are saying that.

I am saying very large amounts of interest are being offset against UK tax

There are much stronger caps in Germany on interest offset

I am saying profit is being shifted

I am saying profit shifting via interest is a major problem in base erosion

You may be aware that the OECD is looking at the whole issue

That interest would be offset against tax whether they loaned from a uk bank or their parent company. Your argument centres around the fact that they should have ‘bought British’ with the loan capital which is ridiculous.

Why?

Why?

Because telling companies that they’re not allowed to bring in financing/invesment from overseas is really stupid? Because investment from overseas is a good thing?

It’s one thing to say that we should have more restrictions on interest deductibility, or to criticise who route financing through tax havens.. but do your really think that bona fide investment from a genuine overseas parent (presuming that’s what this is) is something that companies should be vilified for?

This doesn’t sound like ‘tax justice’.. it sounds like a hate campaign against any company with the temerity to be a multi-national.

Investment is fine

Use capital.

That results in tax being paid here.

Easy.

Problem solved.

So based on your response they are shifting profits not avoiding tax. This is not what have have said in the above article. You need to have a consistent argument otherwise yogis just sounds like a vendetta.

Profit shifting is avoiding tax

“Use capital”

I think that’s a fair enough request, but given that the whole UK business culture and tax system is set up and incentivised along different lines.. it’s really not appropriate to shout ‘tax avoidance’ and attack individual companies. What they are doing is not unusual, not devious, not clever, and not anything different to everyone else. It’s probably not even saving them any money.

That isn’t ‘tax avoidance’ that’s the system working differently to the way you’d like it to.

And I’m quite good at changing it to get it to work the way I like now

Interest shifting is a change I want

And even the OECD agree it is tax driven profit shifting and think action is needed

So let’s stop the silliness

Also are you suggesting only companies who don’t new to borrow should invest in the uk? In which case I don’t think we would be seeing any more investment.

I have no problem with borrowing

I have problem with profit shifting

“And I’m quite good at changing it to get it to work the way I like now”

So you are officially changing your definition of tax avoidance to ‘anything that’s not how Richard Murphy thinks it should be?’

Because that’s what this is. There’s no reference back to the intention of parliament, or the law (either in spirit or in letter), or HMRC or anything beyond your view of how the world should work.

You’re entitled to that view, and you’re entitled to share it and say why you think that things would be better.. but this is beyond that. You’re attacking a business for not complying with a set of rules that don’t exist.. but presenting it as if they’re doing something wrong under the rules that do.

You’re throwing mud because you know it sticks and taking advantage of the fact that most people lack the interest/knowledge to dig any deeper. Shame.

Hang on a parliamentary committee started this

I’m a late comer to it

And yes – I am allowed to call things that are legal tax avoidance – all tax avoidance was legal until recently and this still is

“a parliamentary committee started this”

The first I heard was criticism from an MP that they paid no tax despite £766m of operating profit.

The very fact that this MP thinks that tax is based on operating profit tells us all we need to know about the extent to which he understands what is happening.

You have dug a bit deeper and come up with an explination for the amount of tax (not) paid… but you’re the only one who’s decided that you don’t think that the arrangements are appropriate, the parliamentary comittee doesn’t appear to have considered the substance of this matter at all.

I beg to differ

Now stop wasting my time

If we assume for the sake of argument that nPower is using debt levels to avoid UK tax, the obvious thing to do would be to capitalise that debt such that there was no longer a UK tax deduction.

If we say that the interest is £100m per annum, that would (at current rates) mean £23m more UK tax payable.

I don’t know the total rate in Germany, but from what I gather it varies between 23% and 33% depending exactly where you are. If we call it 28%, being the mid-point of that range, then the German tax paid would fall by £28m.

So the counter-action to the tax avoidance you perceive would reduce the group’s tax bill by £5m. Would you recommend that HMRC insist on such a treatment?

That assumes that interest is taxable in Germany, of course – but I’m not aware that any major jurisdiction fails to do. And in any case, UK anti-avoidance rules woudl already deny a UK deduction for interest not taxed elsewhere. So the assumption seems fairly safe.

I am arguing that the interest tax relief is too generous and this distorts capital structures

And yes I do think tax should be paid here as a result

I am far from alone in thinking so

So in effect you are arguing that nPower has paid about £5m a year too much tax, the only problem being that it’s in the wrong place?

I agree with you about the differing treatment of debt and equity causing tax anomalies, by the way. I’m not sure what the best way to solve them is, given that debt and equity do have different commercial and legal implications, but I think the binary “deductible or not” tax impact is a crude approach compared to the wide spectrum of financing available, from ordinary shares through prefs to various flavours of debt.

Nuance is key

But what is certain is that we have it wrong now

And we all pay for it

And are deliberately exploited by structures hat strip profit from the UK

It might be worth running your expert eye, or that of a tax accountant over parent company RWE’s annual report which deals in detail with its tax rates and how the group works.

http://www.rwe.com/web/cms/mediablob/en/1838516/data/110822/11/rwe/investor-relations/reports/RWE-Annual-Report-2012.pdf

I have

The save a great deal in tax, I note

leave npower show them you are concernd about tax avoidance go to a good honest suppleir

I have

The Coop