The news was full of the story that 1 million people will pay £100 fines for submitting their tax returns late yesterday.

Except they won't.

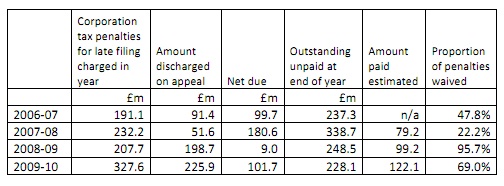

I did some research on tax penalties a year or so ago. The data here all comes from my report on small company administration (around page 50). It is all based on parliamentary answers. These showed the following with regard to penalties issued for corporation tax over a number of years:

Vast numbers of penalties were waived: they were simply for returns not due, or that could not be traced.

But staggeringly of those due, almost no recovery was made. Years worth of unpaid penalties were outstanding at each year end.

That's the price of not having enough staff to collect debt at HMRC. But just think what could have been done with that money if it had been collected. And without a shadow of doubt if HMRC had kept on top of this issue much more could have been collected than was, and cost efficiently too.

In the meantime, assume that due to mismanagement at the top of HMRC the £100 million opportunity for the state that lat payment penalties represent at this moment will just be more money squandered away.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The news story was dealing with personal tax returns yet you are talking about corporate tax returns.

Well actually, no

He got his income through a company

And HMRC deals with both

But while it may be true that limited companies are not pursued for penalties, do you have any evidence that personal penalties for late filing are not pursued. I think not. After all, these are added to your SA statement of account, and do not get cancelled, except in rare cases.

Vast numbers are cancelled – many are still duplicates

I can assure you that the penalties on SA remain unpaid as well

I know

That’s why I said so

he? im reading the telegraph story about 1 million late income tax returns…..why are you seeking to connect corporation tax late filing penalties with income tax late filing penalties. the stats you state are bad enough….why are you trying to link them or confuse them?

I have already answered the point

I linked via the Student Loan Company story

And the penalties are issued by the same organisation – HMRC

Looking at the figures in the table, I don’t think any account has been taken of returns with nil/low tax to pay.

Until last year, if a return wasn’t filed on time, the £100 penalty would be imposed. But when the return was finally submitted, that penalty was limited to the tax actually due… so, you could incur the late filing penalty of £100 and this would be reflected in the table above, but you could then submit a return showing nil tax due and the penalty would be reduced to zero. There’s nowhere in the above data to reflect that outcome.

I’d think it’s quite common that companies and individuals are lax about sending a return in if they know there’s no tax to pay… does this affect the analysis of the data table?

Of course, all that changes this year with the mitigation for low/no tax due being removed.

Read the rest of the report and you’ll find the returns are simply never submitted in most cases – so no it does not change the analysis – the debt is just written off

Richard, you’re right.

The table on page 48 of the report gives the number of returns filed after the filing date as just 21,000. If each and every one of those returned a nil tax liability and reduced the penalties to nil, that would reduce the overall penalty payments collectible by £2.1m, which isn’t very much at all.

The remaining amount uncollected must have been successfully appealed… I really can’t think why. Perhaps the situation will change now that there is no longer a reduction in penalty for low/no tax payable… but I doubt it.

I’m looking for a positive here… so it’s good to see that the late filed returns seem to be dropping drastically (from 184K in 2008 to 98K in 2009 to 21K in 2010)… I assume this is down to online filing, so that’s a plus, right? I know… cold comfort.

At least we’re away from the bad old days when peaople had to file by 31st January and HMRC made id clear that 31st January MEANT 16th February…