HM Revenue & Customs have published the 2010 version of the tax gap.

It’s three months earlier than last year’s version and please don’t for a minute think I’m suggesting anything when I say it’s odd it came out at the close of the week of TUC conference — when it has been widely discussed.

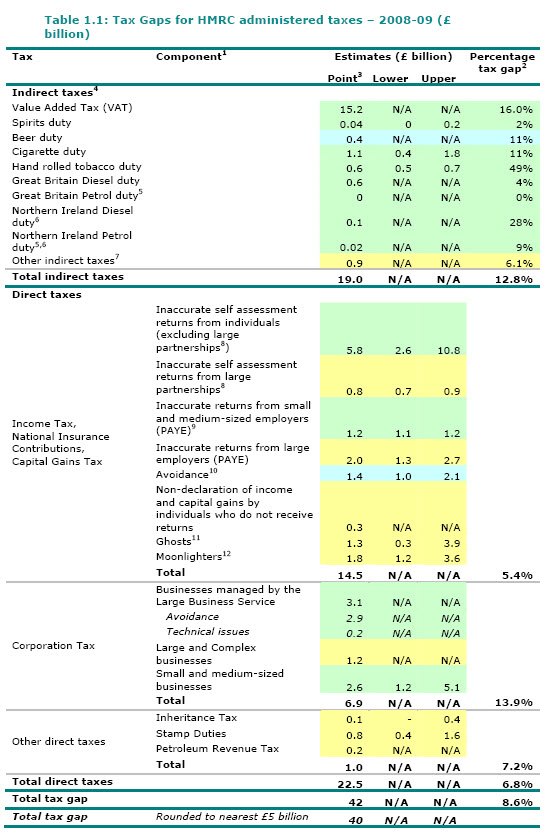

Let’s for a moment just look at what this new report says. It summarises the gap like this:

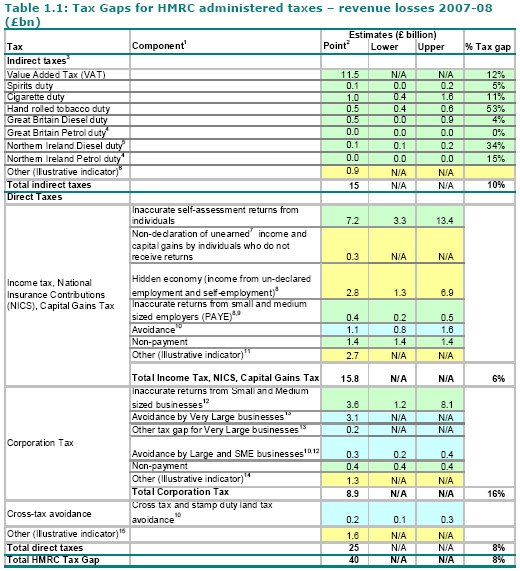

And let’s for the record put up the previous version:

I could, of course, spend some time explaining just exactly why HMRC’s data is wrong. I’ve done so already though, here, so I won’t repeat myself. Nothing in what has been published now changes my argument. Indeed, the above data reinforces what I have had to say.

Look at some of the absurd claims made.

That Inheritance tax avoidance and evasion is £0.1 billion when this tax is so widely known as an ‘honesty box’ tax — requiring for a start retrospective declaration of gifts made in the seven years prior to death — of which the executors may well be wholly unaware?

That tax avoidance of income tax, Capital Gains Tax, and national insurance combined is just £1.4 billion when George Osborne admitted that avoidance of CGT alone was more than £1 billion in his June budget speech? So there’s almost no income tax avoidance at all then?

That the 20 million or so people who do not receive tax returns each year — including every single person who trades in the shadow economy — between them evade just £0.3 billion in income tax — when the World Bank says that the UK shadow economy is 13.5% of GDP?

there’s even the absurd rounding of the total downwards to try to make it look as though the gap did not change from the previous year. What sort of crass manipulation is that?

I could (and will — I have no doubt) go on but for now let me draw the obvious conclusion — that this data is ridiculous. Those putting them out are either incompetent or deliberately mis-stating the truth. I know that’s harsh, but I have to be. The issue is too important to say anything else.

And yes — I know they know I am saying this. As the FT notes this morning:

The Office for National Statistics’ analysis was challenged by Richard Murphy, a campaigner and TUC adviser, who said the figures were an underestimate and an aggressive programme of tax-collecting would provide a partial alternative to cuts. He said evasion cost Britain £70bn and avoidance £25bn. The Treasury said it stood by its figures.

Let it: it doesn’t alter the fact they’re wrong.

And this does not alter the fact that by refusing to recognise the true scale of this problem — not the 5% or so of tax they claim but the 13% or more that I am sure is the truth — they deny something much more important, which is this:

There will be many more — particularly in Government — who do not like the fact [Richard Murphy’s analysis] provides a narrative that challenges the inevitability of a huge cuts agenda. This is a point he makes on his blog in no uncertain terms.

“First it says there is an alternative to cuts. That’s obvious. I don’t for a moment suggest that £120 billion of tax can be collected and the tax gap closed. I live in the real world. But I do think £26 billion of outstanding debt could be reduced by £5 billion. I do think a General Anti-avoidance Provision, tackling the domicile rule, tackling residence abuse and tackling income shifting plus better rules on corporate residence could dramatically change the loss to tax avoidance and recover £8 billion a year — or one third of the tax avoidance gap. And I do think that tax evasion could be reduced by at least £7 billion a year — and probably somewhat more — if (and it’s an important if) enough resources were dedicated to the job.

“That’s up to £20 billion of additional tax available meaning a whole raft of cuts — real cuts that will impose real pain on real people and leave our economy in the doldrums of recession and massive numbers of people in the despair of poverty and unemployment — can be avoided.”

It’s a powerful message. And one that’s hard to dismiss. If, as Mervyn King suggests, the onus is on critics to come up with a better way to reduce the deficit then Murphy has found more than a credible place to start.

And let’s be clear, that is the issue at the end of the day: it’s not about technical spats.

The question is a simple one: is it better that crooks and cheats have this money or that it be spent on education, health, pensions and investment in jobs?

There’s only one answer. As the FT notes:

David Gauke, exchequer secretary, said: “The tax gap number is staggering and this government is committed to taking the necessary action to bring it down — taking steps to reduce tax avoidance and evasion, including by the richest people in our society, so that everyone pays their fair share and we reduce the tax gap over the coming years.”

But that’s nonsense unless he recognises the true scale of the gap. Until then he’s on the side of the crooks and cheats. And that’s the real political issue inherent in the tax gap.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard

Hope you are well.

My question is not about the Tax Gap itself, but the nature of the debate. I would appreciate clarification.

Before the debate even started, I think it is fair to say most of us non-tax people thought the tax system (rules, system of collection) was not fit for purpose. And that’s being kind.

The whole stinking thing was an utter mess. Huge, complex, intrusive, unclear rules, costly for both taxpayer and the state, turned ordinary people (e.g. cleaners working for small amounts of cash) into criminals.

It seemed to me (and still does) a giant scam that enriches both poachers (e.g. accountants) and gamekeepers (HMRC, unions etc) so that neither had any heart for serious change. They pretend to be at loggerheads, but really, it is all just for show. Any reform involves just more pages of tax code, more vague rules and discretions for tax officials (which the big boys have the muscle to stand up to, the little guy does not), and more of the same sheer idiocy.

There is even the occasional person who makes money on both sides. E.g. accountants who made money helping clients avoid, then make money on the other side of the fence.Or vice versa. They must be creaming it.

Meanwhile, us poor mugs who have better things to do with our lives but are willing to pay our fair share etc, get shafted.

My point is this: the HMRC figures just confirmed what we already knew — for all the cost, complexity and pain, it still doesn’t collect as much tax as it should. Loads of tax fell through the net.

Your figures also confirm what we already knew — just substantially more so.

Really, we know the system stinks. Have your Tax Gap calculations (and those of HMRC) done anything more than confirm something we already knew? Isn’t the issue of size just skirting around the issue?

Of course, the next question is: what do we do about it? But that presumably is for another day.

I thought one of the interesting points was that 45% of self assessment tax returns either underdeclared income or over egged deductions. Meanwhile in HMRC the number of enquiries continues to fall. i heard that staff numbers in the HNW unit has been cut by 25%. so much for tackling the tax gap.

@Chris in Hastings

Just don’t say flat tax

That’s all – because if you do I won’t bother to let it on

I proved how inefficient it was in 2006 – and now the world is realising I’m right as flat tax regimes begin to collapse

What we do about it is for the HMRC to be more proctive. At the moment the chances of being picked up for an enquiry are very low.People are aware of this and chance their arm knowing it’s never likely to be picked up. As the report states 45% of SA returns underdeclare tax. If HMRC do more enquiries then the message will get through that you have more chance of being picked up so it’s not worth it.

Just curious Richard – have you sent your analyses and views direct to the HMRC staff tasked with updating their tax gap research?

Last year the contact name in HMRC’s publication was Sanchia Bailey re Measuring Tax Gaps – 2009. This year it is Kerry Booth Measuring re Tax Gaps 2010. It may be that they don’t read your blog. Of course one might hope someone would pass your insights onto them….

@Mark Lee

Hartnett reads this blog

A great many in HMRC do

I’ve presented these numbers in HMRC

They’ve been debated in parliament three times since May

I assure you – they know

@bob

I entirely agree with you Bob. I made this point myself to Gus O’Donnell and Dave Hartnett at a meeting in 11 Downing Street in 2004 when they first announced the launch of the DOTAS regime.

[…] that with the £20 billion I estimate could be raised by a concerted effort to close the tax gap — as an initial target — and there […]

[…] is the consequence? First, note the data on this from HMRC’s tax gap, available here. This estimates the maximum error rate on all tax returns to be £6.6 billion — and the NAO say […]