As recently noted, discussion of the UK tax gap has recently taken place in the House of Commons. The Exchequer secretary, David Gauke MP, robustly defended the HMRC estimate of the Tax Gap, which he compared to mine.

HMC estimate the tax gap at £40 billion. I estimate it at £120 billion.

I have now robustly defended my estimate. but in doing so had a curious ally in George Osborne who in the budget speech flatly contradicted the HMRC tax gap estimates when he said :

Some of the richest people in this country have been able to pay less tax than the people who clean for them.

That is not fair — and it stems from the avoidance activity that has exploited the wider gap between the rate of capital gains tax and the top rates of income tax.

These practices are costing other taxpayers over £1 billion every year.

This estimate of tax avoidance by the Chancellor from the Despatch Box needs comparison with the HMRC estimate of December 2009 and that if the TUC, prepared for them by Richard Murphy of Tax Research UK.

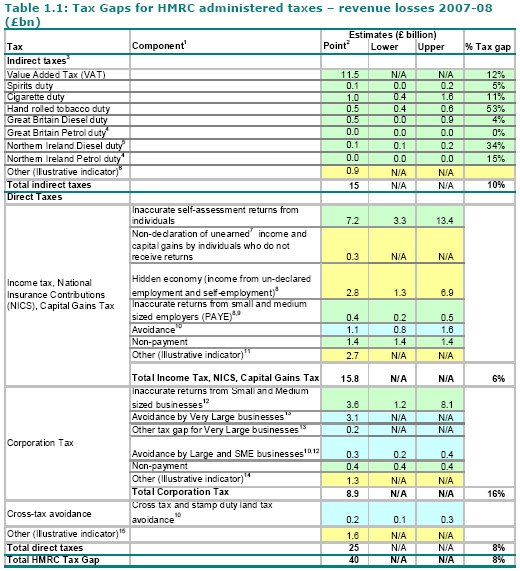

The HMRC estimate of December 2009 (table below) says that total tax avoidance for income tax, national insurance and capital gains tax amounts to £1.1 billion a year. Since £1.1 billion amounts to more than £1 billion it seems that the Chancellor might be saying, if the HMRC figure is correct, that all tax avoidance for all these three taxes, of which the smallest by a massive margin is capital gains tax (it representing £2.5bn of tax collected in 2009-10 as opposed to £229bn for the other two taxes) might relate to Capital Gains Tax alone. None, it would seem, could have related to income tax or national insurance at all if the December 2009 HMRC estimate is correct. That, of course, is very obviously unlikely.

The Missing Billions made that fact clear. In that report it was suggested by Richard Murphy that Capital Gains Tax avoidance could take place in two ways. The first was shifting income into gains and the second arose by shifting income from higher rate taxpayers to lower rate tax payers so that the overall rate of tax within married couples and civil partnerships was reduced — both being practices the Chancellor alluded to in his speech. The Missing Billions estimated the former cost £0.5bn and the latter cost £0.6bn. In other words, it estimated a total of £1.1 billion of tax avoidance arising from this tax — or a figure of more than £1 billion a year, exactly as the Chancellor has confirmed has occurred.

There appear two possible explanations for these disparities: the first is the Chancellor has been relying too heavily on the TUC’s work although his Minister and HM Revenue & Customs claim it is wrong, in which case he needs to offer explanation to parliament. The alternative is that the TUC estimate is right and accords with official estimates but the data published by HMRC in December 2009 is very seriously wrong.

This, however, has further consequences. If the TUC estimates are right (as seems very likely — or the Chancellor would not have produced remarkably similar estimates in his budget speech) then it is very obvious that tax avoidance is also much higher than HMRC has admitted — as David Gauke in his earlier speech had already implied by saying it was at least £7bn when HM Revenue & Customs state it to be only £4.7bn.

In the absence of evidence to the contrary the derailed and specific calculations of tax avoidance, all prepared on similar bases to that confirmed to be correct for Capital Gains Tax by the Chancellor, are presumed to be true. These suggest a tax gap on taxes charged ion individuals and trusts of at least £13 billion a year and suggest HM Revenue & Customs have seriously underestimated this gap.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: