The UK government issued a cross-department report on what they call a Roadmap to Sustainable Investing today. As they said:

The report, entitled Greening Finance: A Roadmap to Sustainable Investing, comes ahead of the UK hosting COP26 next month and is part of the Chancellor's plan for the UK to lead the world in green finance and sustainable investing.

Their claim is:

Around 70 per cent of the UK public want their money to go towards making a positive difference to people or planet. But the lack of common definitions around environmental sustainability is leading to greenwashing, misleading investors and consumers about how green a product really is.

The trouble is that greenwash is exactly what this proposal will deliver.

At the core of the proposal for what the government calls Sustainability Disclosure Requirements is a demand that businesses must start disclosing their environmental impact so that other businesses and consumers will have a better understanding of whether their investments are aligned with net-zero, or not. The aim is to 'help cement UK's status as the best place in the world for green investment'. The proposals will not do that for three reasons.

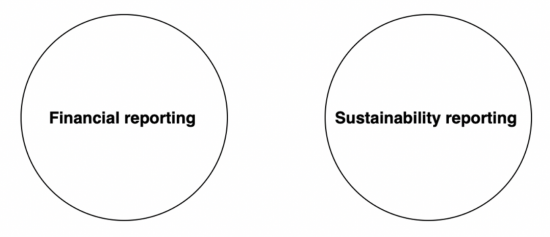

The first is that these proposals are to be based on the accounting standards to be issued by the new International Sustainability Standards Board that is being promoted by the International Financial Reporting Standards Foundation. The problem with this is, as I have made clear many times, is that the IFRS has made it very apparent that they think that there is no read-over between these sustainability standards and International Accounting Standards, which their International Accounting Standards Board produces. They seem to think that the two are related like this:

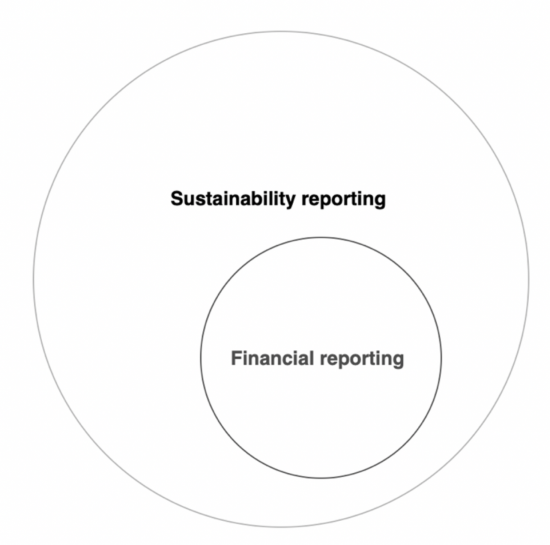

They simply do not think that the two issues relate to each other. That fails to reflect the reality of the world that we now live in, which suggests that this should be the relationship between the two:

The fact is that if any business is to now be a going concern it has to be able to adapt to net-zero and still pay the bills. That is what my Venn diagram suggests. What the IFRS is suggesting is that paying the bills is still the priority and we can tack some financial reporting on the side. It's as if they still think climate change is an externality that is not much of an issue when it is in fact the biggest issue we all, including business, face.

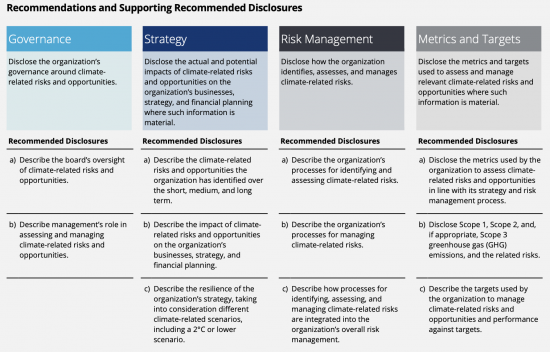

That the government is making clear that what they expect the ISSB to do is to adopt and so endorse Mark Carney's Task Force on Climate-related Financial Disclosures standards is the second reason for thinking that this proposal is greenwash. What Carney had to say in the TCFD might have looked original in 2017. Now it looks hopelessly out of date. In effect the TCFD requires reporting against eleven indicators:

The first three columns all relate to 'soft disclosures' that will be found in the front part of a set of accounts where the management waffle or greenwash might be found. But even when you look at the right-hand column, where the supposed metrics are, you realise that none of these requires that any figure be included in a set of accounts to reflect the impact on the financial position of the company of the supposed climate reporting being made. Just as the ISSB and IFRS assume there is no read-over from climate reporting into financial reporting nor does the TCFD.

Third, the evidence is that despite the existence of the TCFD and some claims of compliance with it the real impact in financial reporting resulting from it has been minimal, at best. Carbon Tracker has done the best work on this. As they noted recently:

Over 70% of some of world's biggest corporate emitters failed to disclose the effects of climate risk in 2020 financial statements. 80% of their auditors showed no evidence of assessing climate risk when reporting

And this is likely to continue because it seems very apparent that what the ISSB is going to propose is something like the Resilience Report suggested by Sir Donald Brydon in his review of the future of auditing, which is a statement outside the actual financial statements and that may be quite separately audited from it. In other words, the accounts of companies are going to be treated as if the world goes on as normal, whilst over to the side the irritation of climate change will get its own mention in a nice glossy publication, expensively produced with lots of charts and pictures of trees and solar panels, plus the odd electric car, but with absolutely no clue being given as to how this data will then impact on the finances of companies.

In that case, how is the finance sector meant to get any real clue as to how to allocate capital in accordance with green principles which is what the government is saying it wants it to do? The IFRS Foundation say in their conceptual framework that:

The objective of general purpose financial reporting1 is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions relating to providing resources to the entity. Those decisions involve decisions about:

|

|

|

|

|

|

But what this new framework from the government, IFRS, ISSB and TCFD will do is make sure that no data on green issues will end up in the financial statements prepared using the IFRS's International Accounting Standards. In other words, just at the very time when investors are saying that they need financial data that is material to their investment decision making from all companies that is exactly not what the government is going to offer them. It will be offering greenwash instead.

What do we need? My answer is, of course, sustainable cost accounting. What this requires is that every company include a provision in their accounts for the cost of eliminating carbon from their systems and that they then indicate how much capital they will need to build the new business model that they must create if they are to survive into the era of sustainability that we must reach. This says exactly what the impact of climate change on companies would be, and how much change will cost so giving investors the clearest possible indication 0f how returns will be impacted by climate change and who will need what additional capital. That is what the IFRS say investors need. That is exactly not what they are going to get under the government's proposals.

For this reason investment companies and pensions funds are going to protest very loudly and very long about what is going to be demanded of them that they cannot deliver because the government is not willing to demand that companies provide the necessary data to do so.

There is going to be a showdown here. And the government is going to have to lose it. Investors of all sorts have to get what they want, and the government will have to give in and demand it from companies. It's just a shame that right now what they are delivering is greenwash and not the real thing. We cannot afford a few wasted years whilst this is resolved. The future of life on this planet is dependent on the government getting this right. And it isn't. It's getting it horribly wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It looks like Johnson will use the offer made by Bill Gates to invest £400 million in the green industry in the UK as his answer to solving climate change when it is unclear what exactly the investment will go into, how much this will be effective when effective investment runs into many billions. Also and what profits will be made from this investment as private investment is no charity?. As for sustainability accounting. with Sunak as Chancellor, this will be the last thing on their minds as they are in hock with the big polluters

“What this requires is that every company include a provision in their accounts for the cost of eliminating carbon from their systems and that they then indicate how much capital they will need to build the new business model that they must create if they are to survive into the era of sustainability that we must reach. ”

Ok.

What does this look like for Tax Research UK? Surely as the inventor of sustainable cost accounting you must have a worked example of how it would operate in practice, and what it would look like for your own company?

Let me look through the obvious fact that you are trolling

My scope 1 emissions relate to travel (invariably train right now ) and II equipment, where I am wholly dependent on Apple to cut their emissions

My scope 2 is kept as low as possible by my power supply tariff

And scope 3 is dependent on power generation becoming carbon neutral

This is why SCA only applies to large companies. It is beyond the control of smaller ones. Which is a complete answer.

[…] spent yesterday afternoon reading the government's dismal proposals for new green corporate reporting – where the thinking simply does not add up to a coherent […]

This is so exactly right: and I suspect it’s far from accidental.

What would it look like, if large companies accurately accounted for the costs of their getting to Net Zero compliance? What if it showed that…they couldn’t, or at least couldn’t do so and remain attractive from an investor perspective?

I imagine the prospect of tumbling share prices, companies dropping out of indices and consequent chaos, falling bonuses and share perk values is more than a little offputting. But: you can’t tackle a problem until you’re truthful about its existence.

I think there needs to be a campaign around this issue – one which makes it comprehensible to those not as financially literate as your usual audience, Richard, and one that makes it unignorable from the perspective of investor governance groups. It’ll be frightening for many, but it has to happen if a just transition is to happen – rather than damaging industries carrying on squeeeeeeezing every last dollar they can from society before it all goes downhill.

How do we do that?

I suspect it’s about having that ‘cognitive dissonance’ explained simply and clearly – that we have 1) an alleged move to net zero and a decarbonised Britain and 2) an accounting, investment and stockmarket system – which affects almost everyone, via their pensions etc – which is sticking its fingers in its ears singing ‘lalala, we can’t hear you’. and so….a) getting that into the mainstream discourse (articles in mainstream media) and engaging with the CSR bodies on the same issue to press for it being part of responsible reporting.

Or, if one was feeling bolshie and could get a good swashbuckling law firm involved, taking someone or other to court for perpetuating a fraud (on whom…investors?). Even with minimal chance of success it might attract the right sort of media attention. I wonder if Good Law Project would be up for it….or Client Earth….

Cat

Let’s discuss offline

Richard

For sure! I’ll see you this evening at the panel event – we can either catch up after that, and/or make a plan in the next few days