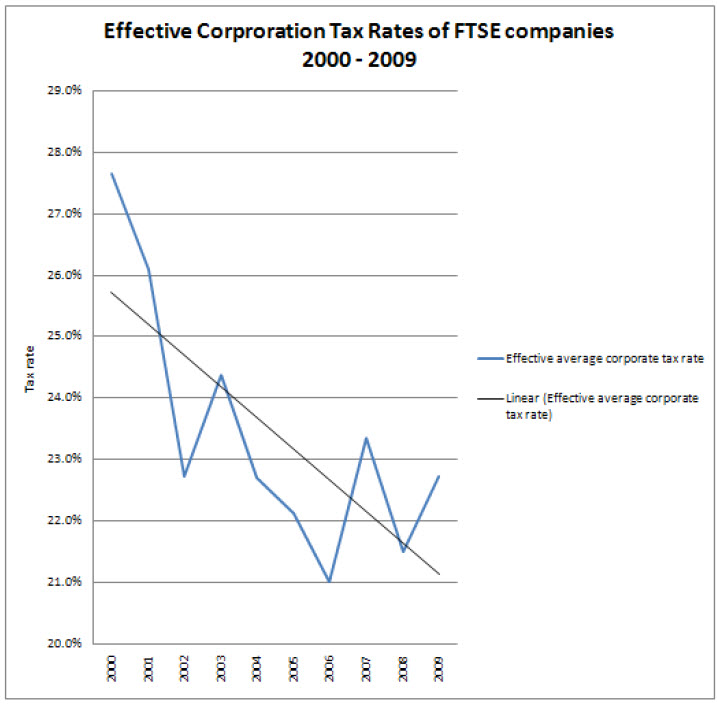

My report on corporate tax, published by the TUC this morning, highlights the continuing fall in the average rate of corporation tax paid by the UK’s largest companies. The trend is clear:

By 2010 the trend suggests the average rate of corporation tax was 21% (and given that for technical reasons the recorded figure for the year was almost certainly inflated by small profits, which tend to result in overstatement of effective corporation tax rates) may well have been lower.

As I say in the report:

Over a decade the trend has been for effective corporation tax rates of major corporations to fall by almost half a per cent a year with the trend rate in 2009 being just 21% - a figure 7% below the headline rate for that year.

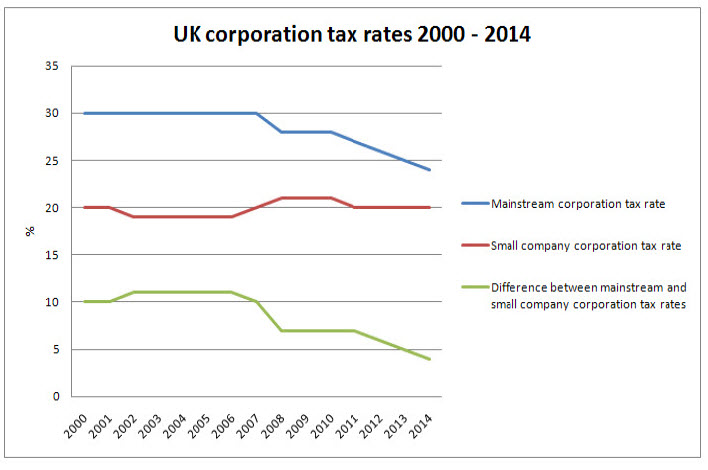

It is, of course, always risky to extrapolate trends, and in the case of this data there is some evidence based on the above graph to suggest that current rates may be flattening — although this issue is returned to below. But even if this is true the trend shown reveals an alarming probability. This arises because of trends in UK corporation tax rates over recent years and those to come, which have been and are predicted to be as follows:

The differential between the large and small company tax rates is closing rapidly. But whereas it is the commonplace experience small companies in the UK (and their accountants) that those smaller companies pay tax at rates in proportion to profit that are often higher than the nominal rate noted on the graph, above, as chart 1 shows large companies are seeing their effective rates of corporation tax fall steadily so that in 2009 on a trend basis they were some 7% less than the headline rate, a situation that replicated the 2006 finding.

Even if large companies’ effective tax rates, using current tax rules were to stabilise at about 21% as Chart 1 suggests possible, which is a figure 7% less than the headline rate, the effective tax rate of those companies will still fall over the next four years as the headline rate of corporation tax for large companies (alone) is cut in the UK, from 28% to 24%14. On this basis the prospect exists that by 2014 large companies will be paying corporation tax at no more than 17% on average whilst small companies will be paying corporation tax at 20%, or more. This means that for the first time in UK corporation tax history small companies will be asked to pay tax on a regular

basis at effective tax rates that are not just higher, but are significantly higher than those paid by large companies. What is more, those large companies will also be paying tax at effective rates lower than the marginal rate applied to the income of a majority of UK households. We will, in other words have a regressive UK corporation tax system.This is important: small business in the UK plays a vital job in creating new employment, often at relatively low cost, and often as the precursor to economic recovery. And of course, most small businesses are run by self employed people paying income tax at the basic rate. We are not necessarily arguing that small business should have its tax rate cut: there are good reasons relating to tax avoidance why the rate of small company corporation tax in the UK should be pitched at least at the same level as the basic rate of income tax (or maybe higher) but we are pointing out that a fundamental inequality is being created in the UK economy which makes no sense at all. The tax system will be favouring large companies over small companies, and large companies over the self employed. It is hard to see how a more unequal and unfair playing field on which small business and its employees have to compete could have been created.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

You have used the consolidated corporation tax charge, adjusted only for outliers, deferred tax and goodwill amortisation.

But this leaves in it all tax paid overseas. So it’s a nonsense to compare a company like Anglo American, which makes most of its money in South Africa and South America, with GlaxoSmithKline which makes the lion’s share of its profits in the US. Both are listed in London, for sure, but they are global businesses with global profit profiles. It’s a fallacy to compare them side by side without taking account of their specific situations.

It’s also amusing to note that you exclude as outliers any company that has reported taxes greater than 50% of profits or has reported taxes when loss-making. Yet, you’d be the first to excoriate any company that reports low taxes compared to corporate profits!

@Vaughn Soanes

All your comments are complete nonsense

Data filtering is a normal part of all academic research – I did no more – and unlike almost all academics have the honesty to publish exactly what I did

And i emphasised as a weakness in the reporting of the companies their trend towards publishing no data for the UK – and sought to draw attention to it

Equally I made clear their desire to record losses here

In othr words the report is the best possible given the appallingly poor data they publish

And that’s a fair basis for drawing the best conclusions possible