I am expecting some modern monetary theory (MMT) directed criticism for having signed and posted the letter from a wide range of activists, practitioners and economists to the G7 on the need for a financial transaction tax to help fund vaccine programmes in developing countries. This blog post is an explanation for why I have done so.

There are a number of important framings for this argument. The first is that I think there are six reasons for tax:

1) To ratify the value of the currency: this means that by demanding payment of tax in the currency it has to be used for transactions in a jurisdiction;

2) To reclaim the money the government has spent into the economy in fulfilment of its democratic mandate;

3) To redistribute income and wealth;

4) To reprice goods and services;

5) To raise democratic representation - people who pay tax vote;

6) To reorganise the economy i.e. fiscal policy.

At best most people who support MMT only recognise 1,2 and 6 here. That is a shame. It puts many who support MMT in a very unfortunate policy arena. To deny that tax plays these other roles, and that they are important, is a simple mistake: there is no other way to describe it.

Second, we need to consider the role of tax in government funding. I have published on this a number of times. This article in the Real World Economic Review is readily accessible so I will use that as my reference point. As I argue there:

As Mitchell et al (2019, 333) suggest, within MMT the macroeconomic identity describing the monetary funding of government expenditure (G) can be summarised as follows, presuming T is the sum total of taxes raised in cash during a period, B is government borrowing and M is government created money, with ∆ representing the change in a total during a period:

G = ∆B+ ∆M + T

That, I suggest is an identity: it must hold true in a country that does not receive development aid. In that case, if D is spending on development aid in a country and R is non-development spending (so that D+R = G) then in a country spending on development aid:

D =∆B+ ∆M + T - R

D here is, of course, a spend.

The first noted identity is changed in countries in receipt of this aid. It becomes:

G = ∆B+ ∆M + T +D

Here D is income.

So the question is why might development spend need to be funded by tax?

One is simple refusal to increase borrowing or increasing money creation. Another is refusal to reduce other spend. Although glaringly obviously not true a government may argue that ∆B, ∆M and R are at their limits. This is not true in any developed country at present. It does not mean that the argument will not be used.

There is another reason. That is that the economy is at full employment. Additional spend does require that space be created within the economy to permit additional government spending on a productive activity, on this occasion vaccine manufacture, if inflation is to be avoided. This is an MMT consistent argument as to why tax must be used. Again, this not true in any developed economy right now. But that does not matter in political terms: the argument is being made that there is an inflation risk at present and in that case this issue kicks into play.

So although MMT says there are other options for developed countries when funding development spending, politically they are not feasible.

The developing country that is in receipt of aid also needs to be considered. Remember that for MMT to work there are pre-conditions:

- The jurisdiction's own currency is mainly in use in the country;

- There is a functioning central bank;

- There is no borrowing in foreign currencies;

- There is a functioning (and not corrupt) tax system;

- The tax take is big enough to have an influence on economic policy: if the yield is too small the impact is too low.

These conditions are rarely met in developing countries.

So, turning to the formula for these countries:

G = ∆B+ ∆M + T +D

Borrowing imposes burdens, often expressed in US dollars. That is undesirable when no additional capacity to pay is being created.

There is no effective mechanism to recover additional money creation from the economy. This, then, would be inflationary. When there might be a second currency in use that is particularly undesirable.

Taxes are inefficient.

So, most especially in a crisis when there is little chance of any of these issues being addressed development aid makes sense. This is such a situation: the world needs vaccines. There is no MMT argument against this.

So what additional tax? This is where tax gap theory comes into play. I have written on this. As I note in the linked chapter, there are five tax gaps:

- The tax base gap, which refers to the cost of tax bases not taxed by choice e.g. wealth;

- The tax rate gap, which refers to the costs (both positive and negative) of granting higher and lower rates of tax that vary from the norm or standard rate as well as the cost of all allowances and reliefs granted to taxpayers, for whatever the reason;

- The cost of tax evasion;

- The cost of tax avoidance;

- The cost of bad debt i.e. declared sums owing but not actually paid.

These can be linked to the identity noted above for a country not relying on aid as part of its income, which is:

G = ∆B+ ∆M + T

In particular, in this equation T is tax actually collected i.e. it is a measure of cash flow. However, as the IMF has argued, this net cash sum collected is stated after two tax gaps have been deducted from total potential tax yields i.e.

T = Tt- Tf- Tc

where Tt is the total potential tax due on the tax base, Tf is the net tax foregone as a result of policy decisions and Tc is the tax compliance gap.

It is important to note that these expressions can, in turn, be expanded, so that in the normative typology of the tax base that the IMF suggests be used for estimation of tax policy gaps:

Tt=(Tb×Tr)

where Tb is the tax base for a particular tax and Tr the standard tax rate for that tax base, and:

Tf=Tp+Ts

where Tp represents the value of tax bases not taxed as a matter of policy (e.g. wealth) and Ts represents the value of allowances, reliefs, and varying tax rates granted within bases that are taxed to encourage varying taxpayer behaviours by way of tax spends, and:

Tc=Te+Ta+Tu

where Te is the part of the tax compliance gap resulting from tax evasion; Ta is the part resulting from tax avoidance and Tu is the part of the tax compliance gap resulting from non-payment of tax debts, or unpaid taxes.

Substituting this understanding in the equation for G:

G=ΔB+ΔM+((Tb×Tr)-Tp-Ts-Te-Ta-Tu)

This expanded explanation for the financing of government spending (G) offers new bases for interpretation of both the tax gap and the role of fiscal policy within the macro-prudential regulatory framework by making clear the relationship between borrowing, changes in the government created money supply and the tax gap in all its aspects.

The implication is that if there is an aim to increase revenues then there are many choices available, by no means all of which involve additional taxes from the tax bases that we are all familiar with. In this case I, and others, are suggesting the use of a tax base effectively untouched at present. That is, a tax on financial transactions (and I do of course know about the UK's stamp duty, but it has limited scope). We are putting the additional revenue claim into the first tax gap i.e. we are using a base not previously subject to claim.

Is that reasonable? The incidence of this tax can be argued. Some say because it hits pensions funds it hits those on low income who have pension investments hard: I do not agree because the answer there is to simply reduce the churn of investments within the fund, which is usually advantageous to decision making in any event.

What I do suggest is that this tax is actually beneficial in addressing another of those purposes of taxation, which is to address inequality. As I showed a little over a year ago, in the period 2011 — 18 the national income of the UK was £13.1 trillion, and in that same period the increase in net wealth was £5.1 trillion. It is stressed, that this figure is not for total wealth, but the increase in the value of that net wealth in that period. In that same period the overall effective tax rates on income during this period were unlikely to have averaged more than 29.4%, but those on wealth increases did not exceed 3.4%. In that case, if these rates had been equalised it would, at least in principle, have been possible to raise an additional £174 billion in tax revenue per annum from the owners of wealth.

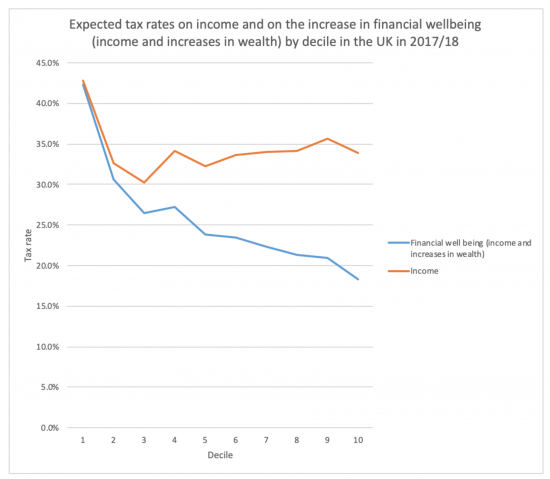

Moreover, because there had been no attempt at equalisation and because the distribution of the ownership of wealth varies substantially across the UK, which variation is reinforced by factors such as age and gender where substantial inequalities exist, the effective tax rate of the 10% of those in the UK who were in the lowest-earning group of taxpayers exceeded 42% of their combined income and wealth gains in a year, but the equivalent effective tax rate for those in the highest ten per cent of UK taxpayers ranked by earnings was less than half that at just over 18 per cent. This is summarised in this chart:

As a result I suggested that there was considerable additional capacity for tax to be raised from those who own most of the wealth in the UK, many of whom are in that top ten per cent of income earners. I am now suggesting that a financial transactions tax would help achieve that goal. It would prevent ministers saying there is no capacity to tax, because there is. And the incidence would be on those with the greatest capacity to pay, whose savings have, we know, been considerably increased by quantitative easing used to address Covid related economic issues.

It would also prevent ministers from saying we must spend on other things, because we can.

It will stop ministers saying that this tax will hit ordinary people who cannot pay, because it will not.

And it will not hit borrowing or money creation if they refuse to consider either. Nor is there likely to be a spillover impact into other taxes.

The result is that this is the currently political possible way to fund what is desperately need, which is a vaccination programme for the world.

That programme is technically possible. It can be funded. The arguments against doing so are virtually impossible to find using this logic.

Will it happen? That is another question, altogether. But ministers can be held to account for their failure.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

As far as I am concerned, the rich – being more likely to be rentiers in order to preserve the value of their wealth – use common means and parts of society and its infrastructure to create and maintain their wealth.

Look at Amazon – now capitalising on the work Government did in developing the internet.

As things stand they increasingly want to use ‘common wheal’ infrastructure for free and claim all rights to ‘innovation’. Tax corrects that anomaly because it re connects these mega rich beings to the society that enabled them in the first place. Sorry – but you have to put something back.

If the same amount of money that had been put into developing the web or putting Bezos into space or some other pet vanity project had been put into the fight against cancer or anti-biotics – where would we be now?

So tax also re-orders society’s priorities for the greater good.

Those are my views prompted by your excellent post.

Thank you

Most disappointed by your comments re vaccination needing to be paid for by taxation.

You put forward arguments and gobbledegook backed by unintelligible formula and obfuscation of the TRUTH. you know that countries with their own Fiat currency never tax to spend!! In fact the opposite is true they spend before they can tax since as Professor L Randall Wray states “TAX is for REDEMPTION” More TAXATION at this point will only remove spending power from the economy when we need more spending power to boost economic activity. Shame on you!!! insinuating that we are any where near causing Inflation is also nonsense. We have thousands of our citizens unemployed and even people in work having to depend on foodbanks to feed their families.

Typical accountant who knows the cost of everything and the Value of Nothing.

So you would for the sake of your MJT purity rather the world died?

First, you missed the whole point of the argument

Second you’re indifferent to inequality and the need to tackle it

Third you’re politically clueless

And fourth you’re obviously utterly indifferent to people dying

That is unforgivable

Shame on you and your pretence that is about MMT

It isn’t . It’s just plain straight forward indifference to humanity

Thankfully there are people who understand MMT

You don’t

So this week tax funds spending? I find it hard to keep up, as it keeps changing depending on the point you are trying to make.

In developing countries tax funds spending

I have never said otherwise

[…] situation happened over the weekend. On Saturday I publicised a letter I had co-signed calling for a financial transactions tax to fund Covid vaccines. The aim was […]

[…] situation happened over the weekend. On Saturday I publicised a letter I had co-signed calling for a financial transactions tax to fund Covid vaccines. The aim was […]

But surely if we raise taxes, we suppress inflationary pressure ? And, according to your post from last Friday, you already believe we are unlikely to get anything more than transitory inflation (Whilst saying ‘some is no bad thing’). So can your argument therefore be summarised as ‘we should accept Western Deflation to assist developing nations fight against the virus ?

Could you please also explain, in layman’s terms, why Western countries can’t just print the necessary funding ? Or is there some other constraint your are not actually missing, such as capacity or resources ?

I’m sure you can understand how some people are getting confused by your constant ‘reimaginings’ of what MMT is and how it can be used.

They could print the funding

But we know they won’t

And that does not solve the vaccine problem

So I am suggesting something else

How hard is it to work that out?

Would you rather I say I don’t care because the world won’t use MMT?

Why? That would be crass

It would also be callous

So if I can’t get my answer one way I try another

That’s an interesting defence, the ends justify the means ?

I think in reality government’s could either tax or print, the ability to provide vaccinations would still be reliant upon raw material and other ‘real world’ constraints rather than being purely reliant on the type of funding

Wow, this is moving into the world of the surreal

First, MMT always makes the point on physical constraints

Second, you apparently think the ethics of choice on the choice means to pay for vaccines more important than the ethics of supplying vaccines

It takes a very strange world view to get to that position

Expect to be deleted from now on

–––

PS Having now found you seem to have many identities you are blocked