I wrote this tweet yesterday:

The 2009 financial crisis was made in London. #GERS makes clear that it's Scotland that's been subsidising the cost of that crisis for the last decade, through additional costs, austerity, a lack of investment and a stalled economy. The Scottish subsidy to London should stop now.

— Richard Murphy (@RichardJMurphy) August 27, 2020

It was, of course, meant to be provocative. There is nothing wrong with being provocative. Unless people are willing to be so then nothing changes. All progress is, as a result, dependent upon those willing to be provocative.

That said, I am not willing to be provocative without good reason, or within the boundaries of suggesting what is reasonable. This tweet was posted with both constraints in mind.

If the ongoing debate on the Scottish economy proves three things it is these: that first of all, Scotland is willing to have that debate when others are not; that second this debate is now backfiring on Unionists in Scotland because their continual attempts to undermine Scotland are now being used by people in rUK to ask why they should supposedly subsidise Scotland for any longer; and, third, that those in Scotland who want independence must reject the efforts of those who want independence based on a neoliberal agenda and must instead offer truly radical alternatives.

Part of that radical alternative is to understand why Scotland is where it is, and that this is not inevitable, or appropriate to its needs, and that it is not as a result the basis for extrapolation into the future.

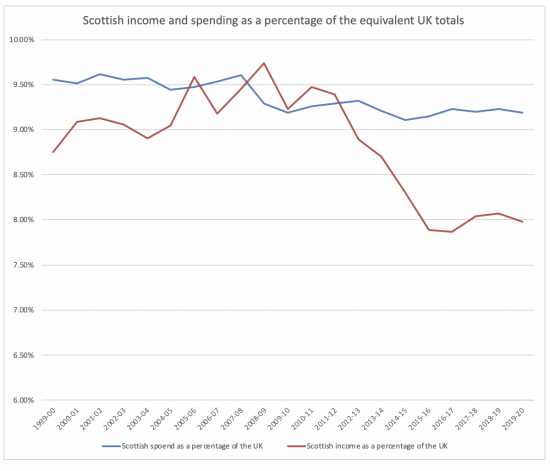

My tweet says that the last decade has seen Scotland suffer as a result of choices imposed on Scotland and not made by it. That draws on evidence from this chart:

I created that chart from GERS data published this year.

Scotland's spend has fallen slightly over the last decade. But, as we know, that figure for spending is in any case wrong because it includes a great many costs Scotland would not choose to incur for itself or which it would not need to incur. The former includes many defence costs: based on an Irish model of defence spending Scotland might incur only one-third of the cost incurred now. The latter includes interest costs, which now largely relate to the UK crash, which as I note in my tweet, was not made in Scotland, and which was severe in its impact, as this chart shows:

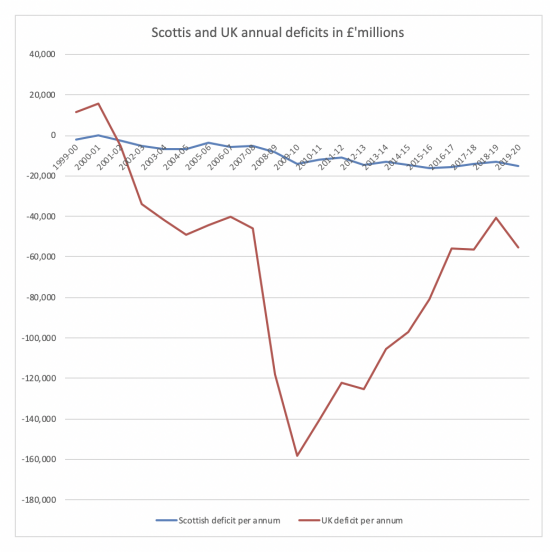

Again, that is based on GERS data, plotted by me.

It's a matter of fact that the bank failure that delivered the recession that the chart evidences did so as a consequence of US banking failure and UK banking regulation failure, and that these events were not, in any way, Scotland's fault. But Scotland has paid a heavy price for them.

That is most especially seen in the size UK deficit that has been sharted with Scotland and, as importantly, in the quantitative easing figures. Not only was Scotland burdened with a heavy cost for bailing out the south-east of England and its failed main commercial activity, but that same sector got, in effect, the whole benefit of the Bank of England's quantitative easing programme that created more than £400 billion during the period from 2010 to late 2019, which was intended to, and did, shore up those banks' balance sheets. It coincidentally boosted almost all asset prices, including property values in the south-east of England, but the spillover effect, most especially to Scotland, was remarkably limited.

So just as Scotland was always going to have an issue with a decline in oil revenues and needed investment it was hit by:

- a recession not of its own making for which it had to pay;

- a lack of investment whilst money was literally poured into the south-east of England, and

- all its tax bases were undermined (including oil revenues) by decisions in London, which was doing all it could to boost the tax bases of England for which devolved powers for Scotland have never been considered because it is considered that they are not even relevant to its needs.

And that does mean that in that case that Scotland suffered downturn constructed in London, whose aim it has been over the last decade to show that Scotland cannot, supposedly, be independent. A different government, with a different policy (and maybe no such thing is plausible within the Union now) might have delivered a very different policy for Scotland, but that government did not exist. Instead we have one that gloats like this:

I am proud that we have protected more than 900,000 jobs and tens of thousands of businesses in Scotland.

Year after year, Scotland also benefits from levels of public spending substantially above the United Kingdom average, with a Union dividend of £1,941 per person. https://t.co/jxqBIecXb1

— Rishi Sunak (@RishiSunak) August 27, 2020

This is London saying to Scotland that it should learn its place and be quietly grateful when, as a matter of fact, the figures used to make this claim are wrong and Scotland need not be grateful because London has in fact generated £400 billion or more for investment in the rest of the UK using quantitative easing from which Scotland has seen no benefit whatsoever, with the unsurprising consequence that its tax revenues have been suppressed whilst those of the rest of the UK have been less so.

My tweet was intended to call this out. London has created what is alone describes the Scottish deficit when the Scottish government actually does not have one. And that is deliberate and part of the whole policy of English exceptionalism that underpins the whole English nationalist agenda that this government pursues, which amongst other things assumes that the rest of the world are idiots who will not notice that such an agenda is being pursued (just look to Brexit for the evidence).

I will call them out. Their claims are wrong. Scotland has problems because London has made them by diverting resources to the south-east of England and yet still charges Scotland for their use whilst denying Scotland any significant revenue-generating investment opportunities or support. My suggestion is that this will continue until Scotland says no to it doing so by declaring itself independent.

And I should add, Wales should also take note.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

[…] always be true that investment spending – so long denied to Scotland as the south-east of England has secured so much of government support – is the best way to go to secure this goal. It always has the best so-called 'multiplier effects' […]

Richard, Have you driven into Edinburgh from the airport, past “Fred’s Folly”? The lasting monument to “Fred the Shred”? You could argue that the Royal Bank of Scotland was not really Scotland. It was simply out of its depth in 2008, trying to play with the big boys in London.

There is a lot of agonising over the rewards Fred Goodwin and others made and kept. But what I find depressing is how tiny they are in comparison to the destruction and misery they caused.

I’d argue that the HQ was already in London by then

Making the vanity project even more farcical

Nonsense.RBS has always been headquartered in Edinburgh, and remains so to this day.

And run from London….where NatWest is

Mr Michael G?,

Independent Scottish banking; almost three hundred years of experience that established the Scottish Banks as highly regarded, albeit small; with equity cross-holdings that protected thei independence and probity was something worth respecting. The Scottish banking industry was detroyed by Big Bang in 1986. Such is the nature of the Union. Survival from being eaten by the wolves, turned them into predators; but it turned them into London banks; London culture; London standards, with recruitment suited to London, neoliberal deregulation: the rest is history. The Result inevitable. The very names disappear. You are welcome to it all, sir.

Spot on

“It’s a matter of fact that the bank failure that delivered the recession that the chart evidences did so as a consequence of US banking failure and UK banking regulation failure, and that these events were not, in any way, Scotland’s fault. But Scotland has paid a heavy price for them.”

Excellent! There is the reality of Britain’s “broad shoulders”: ten years of ill-judged austerity compounding and extending the blunders of British Government that induced the world that created the crash – and then made sure it was the poor and diabled that paid for it.

Well another blooper – but it is diabolical that the disabled in the UK were made to pay for the failure of banks to do their job, and of government to regulate the banks.

The last couple of paragraphs should be changed a little. Not just Scotland and Wales that are being “Subsidised”. London and the South East “subsidise” almost every region of England also. It’s almost as if getting a relatively huge amount of domestic “Investment” in comparison to everywhere else has resulted in better performance when compared to other areas. Who’d have thought it?

You have not followed my argument

What “investment”? The meaning of the word is solely in the inverted commas; for there is no investment. The figures spent “for” Scotland, not “in” Scotland are largely just accounting entries; transfers of costs – journal entries, if you will. Trnasfers of marks on a screen. They do nothing whatever in Scotland. Nothing ever leaves London; London is Britain’s personal Black Hole. Nothing of the smallest monetary value escapes London; no light escapes London.

Precisely

Exactly the point I was trying to make. The UK is broken in far more ways than just the relationships between constituent countries. England within itself suffers huge inequality in resource generation and distribution. GERS also does a handy job for Westminster in taking attention away from the mess it has made of large parts of England.

Has a year passed already since we last did this Tango ?

We know this story off by heart, yet somehow when asked in interview by ITV Border, Kate Forbes MSP our finance minister, responded with the standard response ‘every country runs a deficit’ etc etc. rather than using the ‘free to use’ questions and rebuttals that have been provided by this blog and it’s readers over the years. The SNP’s validation of these figures is still bewildering to me.

One thing I have noted on this year’s media responses, is the determination from journalists to say these figures describe an Independent Scotland’s future finances, when all they ever do is provide an insight into what is happening now. Even that point of simple logic is lost on the SNP media responses.

To Richard and readers like John Warren, I tip my hat and raise a glass – it takes a certain resilience to put up with this every year and to continue fighting the good fight.

Same time next year ?

I suspect so….

Hi, unionists are indeed in a quandary – stop telling us Scots about how much we’re supposedly bailed out by London/SE every year and risk us not getting that delightful message, or risk the “wrong” people getting the message too (those in London/SE doing all the “pooling”) and perhaps wondering why they’re doing so.

Because logically there’s only 2 explanations they should accept this policy; quite incredible altruism, or stupidity.

Those in London/SE who aren’t stupid will know that far from UK economic policy ensuring they are continually impoverished, it actually does the opposite. Hence the very obvious proof that they are always better off of course.

When all roads lead to Rome, Rome gets richer.

Constant immersion in Unionism’s bigger fibs makes me wonder if How No?’s “subsidised” isn’t a Celt using that word ironically.

What you say rings true (here in Aberdeenshire) and I wish there were a way for it to be heard where it needs to be. The local truth, as around Scotland, is laid down by media deeply invested in the Westminster narrative. This week, we’ve had K. Hague on BBC Radio Scotland for GERS and grotesquely worded presentations of the “Union dividend” across the board. All to be expected, but what has been disheartening is the half-hearted of push-back from Holyrood – though the media may have been soft-peddling there. The promised alternative reading of Scotland’s finances is promised no longer. “Don’t frighten the Unionists,” appears to be the watchword.

To be honest, I sometime wonder if the most effective response isn’t to goad southern Brexit cultists with their government implying we Northerners are ungrateful spongeing Scots best ejected.

Why Kevin Hague gets airtime defeats me…

It was entirely ironic. I too often forget that irony and sarcasm do not come over very well on this sort of forum!

I’m puzzled. We’re often told that much of the ‘largesse’ that comes to Scotland is made in London and the SE via financial services (e.g.Banks, Insurance, PFI profits). However, surely much of this profit is earned throughout the UK and simply accounted for in London (where the HQs mostly reside), so a sleight of hand. When the Banking crash of 2008 occurred, the resultant fallout was shared around the UK when, using the same methodology adopted for allocating profit to HQs, the debt should followed the same route?

You are right

More on this tomorrow

But in essence, London’s just doing the standard rentier capitalist ‘creaming it off the top’ thing whilst adding no value at all

Two details I genuinely do not understand in this balance of payments and expenditure. As the Social Security budget is managed and funded for the whole of the U.K. from Westminster, are not these inward payments into the Scottish economy from the Treasury in London; and how is the value to Scotland of nuclear support services from two UK wide bodies ( Ministry if Defence; Office for Nuclear Regulation) Factored into inward investment; how is the monetary value of nuclear submarines and nuclear inspectors and other regulators factored in?

The value of trident is debatable. Militarily it is of course utterly pointless like the new carriers, but as you say there are economic considerations. According to Conservative and Labour assertions, Faslane ‘gives’ Scotland more than 15,000 jobs, but according to the Commons Library it’s about 450…..so they take our money and make our choice…….

[…] to my blog yesterday on whether London subsidises Scotland or, as I think likely, the flow is actually in the other […]