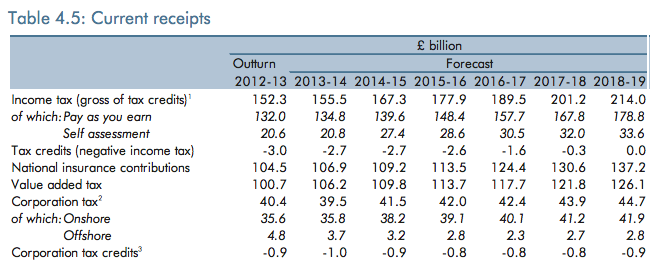

As I have noted here, time and again, George Osborne has always made the most extraordinary assumptions about the growth in self assess income tax revenue over the period from 2014-15 onwards. Take this forecast from the December 2013 autumn statement:

Note that line on self assessment and the jump in 2014-15 which I always said was implausible.

Now note the actual data for income tax for 2013/14 and 2014/15 in HMRC's accounts just published:

Income in 2013-14 beat all expectations, but only because of income deferred from the previous year as a result of the announced cut in higher rate taxes from 50% to 45% which deferred dividend payments. And then it fell again to a figure 16% less than Osborne predicted less than eighteen months ago.

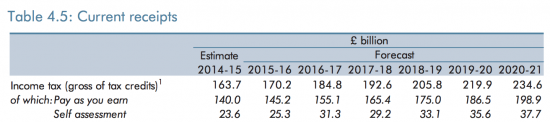

Now let's look at the same table for current receipts published by the OBR this July:

There are two things to say. The first is that the estimated out-turn for 2014-15 is overstated. And that the massive leap in 2016-17 looks just as implausible as that forecast for 2014-15 did in December 2013.

There's a hole in the OBRs forecasting here and three questions arise.

The first is why don't they learn the lessons from getting it wrong?

The second is how much else was wrong?

The third is why don't they highlight these errors?

Could it be that this would make clear just how unlikely it is that George Osborne will meet its tax revenue targets and that this would be too embarrassing to say?

For my broader opinion on the July figures, see here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

the point about total revenue forecasts is that they are really just balancing figures designed to bridge the gap between expenditure and borrowing. the role of the obr is to give these figures credibility and would do the same for any government. everyone in government knows this, hence why the tsc is so uninterested.