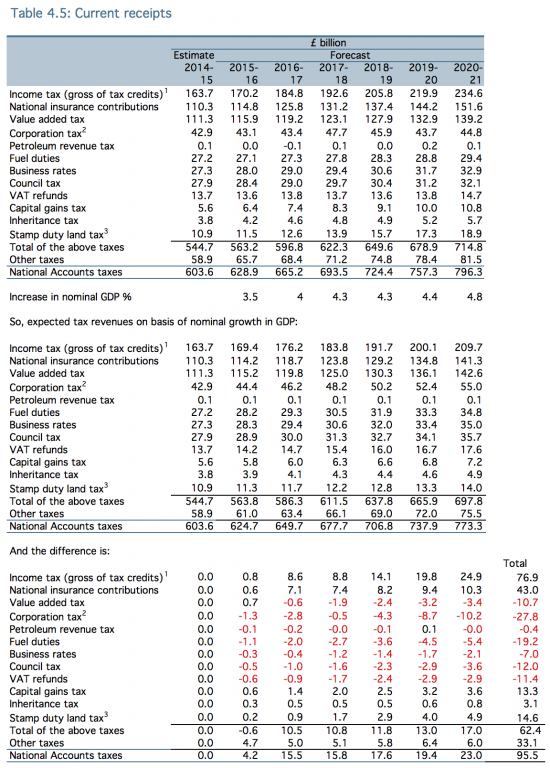

After each budget I have a habit of looking at how the forecast changes in tax revenues for each major tax over the next few years break down. Here's the table based on the Office for Budget Responsibilities analysis in table 4.5 of their report published today, which I then compare with what the revenues of each noted tax would be if they moved in line with nominal GDP (i.e. allowing for inflation, as this forecast data does) and then comparing the two:

The evidence is rather blunt: because George Osborne and the OBR are assuming at least a million more people will be in work in the UK by 2020 (many of whom will be migrants as that many people are not otherwise available) it is assumed that income tax and NIC will rise significantly as sources of tax revenue.

Almost every other tax, including rather oddly VAT (given that growth is assumed) under-perform nominal GDP, but the stand out variance is from corporation tax.

Over the next five years as George Osborne punishes the worst off in our society and imposes the harshest of pay regimes on public servants business will get a tax giveaway of £27.8 billion in cash terms as a result of the tax cuts he is giving to companies.

That's what this budget is very obviously all about, revealed in red and black.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This rather nails the pathetic lie that there is not enough money; that we must tighten our belts and suffer.

We can find this; we will be able to find the likely £4 billion for the next 25 years for Trident.

Nothing is being done about the £120 billion tax lost to evasion and avoidance every year.

Interest rates are at their lowest rates in history and consequently we would have no problem borrowing big for investment and paying it back.

The money is there, but they hand a large part of it to their rich friends. But this is what you get when lobby groups run the country rather than democracy.