I have already drawn attention this morning to an article in the FT and a new report that suggests that in the UK pension funds lost an average of 0.7% of funds invested on behalf of their members from 2000 to 2013.

I thought I would have a quick look at how much this dismal performance cost the UK using HMRC data:

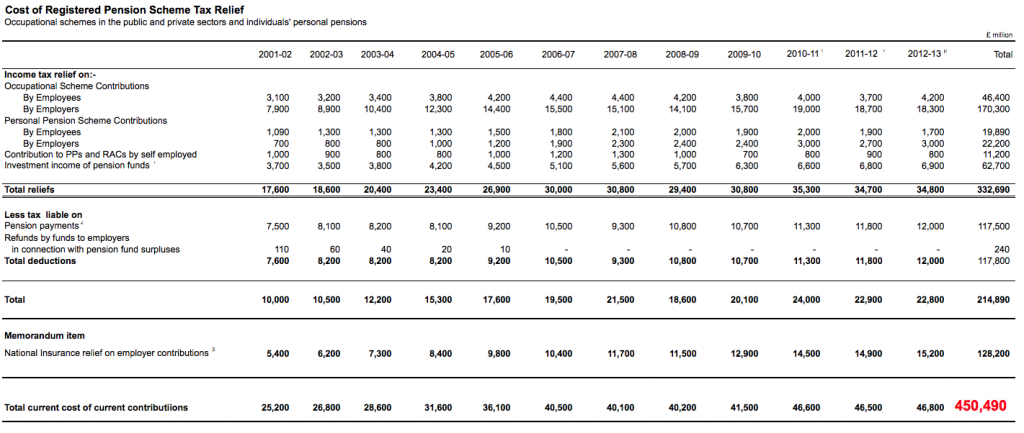

Click on the table for a bigger version to open, and note I added the bottom line which is the total of current tax and NIC costs of pension contributions made.

Over the period when these funds managed to lose the pensioners of the UK money (even though those of many other countries made positive returns) we spend a total of £451 billion subsidising these pension contributions.

Now, I admit that in this time series some of the tax paid by pensioners will need to be deducted from the cost of tax reliefs given, because clearly over time there is a partial matching process going on here. Equally, not all need be matched: much of the tax paid will have been by people who made contributions before the period began, and so you could argue that the next cost was a but lower than £450 billion. I have no way of knowing by how much that might be the case (and nor has anyone else) but it would be very surprising indeed if this was £100 billion, but just in case let's call it that.

That still leaves a net £350 billion investment by the state in pensions and apparently that's all been lost, and more besides.

Shouldn't that give rise to these questions:

1) Why are we investing pensions in this way when there are clearly better options?

2) Why are we structuring pensions this way when it clearly allows the extraction of excessive fees for poor return from the system?

3) Why are we subsidising this failure with so much state money - enough, in fact, to represent a third of our real state debt right now?

4) Why are we tolerating the massive redistribution of wealth from many to a few that this system permits?

5) Why are we allowing so many funds to be put to idle and non-productive use outside the mainstream economy?

6) What can we do better?

7) Why aren't more people asking these questions?

I address the sixth question here but admit that needs updating now.

The seventh is the question that is perhaps the most baffling of all.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

I don’t think 350bn has been lost. Just 0.7% of it. Which isn’t the same.

I don’t agree

First they lost 0.7% every year

And they should have made a return

And other funds without subsidy made positive returns

So your logic is wrong

Ed Note:

Comment deleted: changing name does not mean I necessarily accept comments from you

You say the £350bn has “all been lost”. Has it?

I think it has

In the sense there is no return for it of course it has been lost

In theory get rid of RBS (8Bn a year and no sign of an end), drop all bank and business subsidy and pension subsidy how much of the deficit is left? I assume no Tories or Neo Libs would object to using their precious market?

When you consider 3 Bn can disadvantage 10 Mn and essentially be as relevant to closing the deficit as PFI was to a sensible funding regime it does seem odd things that would close the deficit are ignored.

Flying a Kite

When I was talking to the manager of a retail building soc/bank he said that at the end of business he had to switch all his local funds to “head office” who then reinvested the money in the next time zone. As there are three time zones this means that not only can these banks or “pension management funds” profit x 3, they can actually move 2/3rds off shore or as anybody else would say, steal it.

If this style of transaction is prevalent in the finance industry it means that not only does the Fed & all other Central banks not have the money to back their currencies but all the “safe” investments at retail level are actually only worth 1/3 of their value which in the insane logic of the financial markets would be a relative drop in value due to economic circumstances.