I have been sent the accounts of Deloitte Limited to 31 May 2012 this evening. As the accounts say:

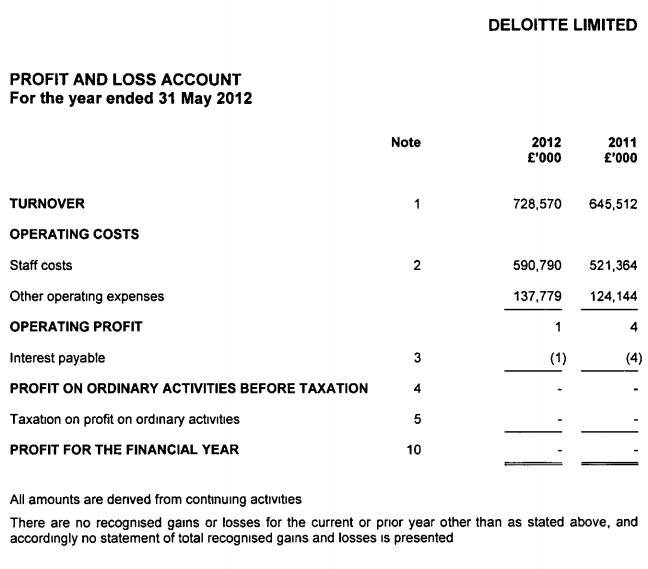

Seems fair enough. So what does the profit and loss account say?

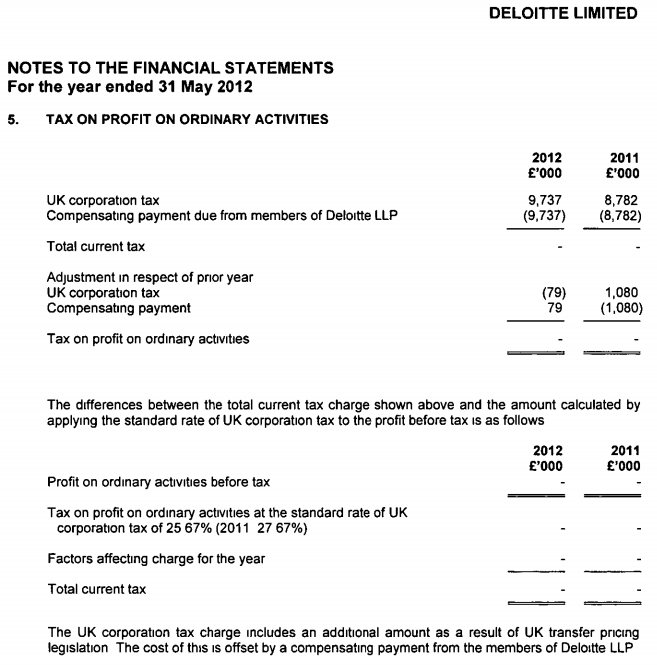

Hang on? £728 million of turnover and not a penny of profit or tax due? It would seem like it, but not quite: This is the tax note:

So, here we have a company employing Deloitte's staff, giving them no legal protection because there are no reserves to ensure that if they pursue a claim it will necessarily be paid since the balance sheet reveals that this company has just £2 of share capital and no reserves, whilst we also learn that the whole arrangement is considered even by the normally laid back HMRC to be so odd they charged £9.7 million of tax for failing to transfer price properly, which cost the Deloitte partners paid.

Now please don't tell me Deloitte don't structure their affairs for tax and almost certainly regulatory avoidance purposes. Because of you do I won't believe you.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Needs a bit more explanation for me, I am afraid. This company provides services for its parent, if I read it right. So in a sane world it would be part of that company and would not make profit but rather it would presumably be a cost of that parent: or just possibly a contributor to profit, if only by saving costs otherwise due to outside companies performing those same tasks

What are the transfer pricing elements which gave rise to the charge, and why did the parent company pay them?

I agree – it is an exercise in opacity and obfuscation

That is why I thought it worth highlighting

Richard

we’ve recently seen the case of HP buying a UK Co & then their board implying they were “sold a pup”. Presumably HP are going to purue action both against the auditors of “PupCo” & against whoever did Due Diligence.

Are you really saying that, faced with that kind of action, a huge accountancy firm like this could just close down & disappear leaving angry creditors without redress ?

No

The audit was done by the LLP

This company seems to be a subcontract employer of staff so that the partners are not liable to them

What a confidence builder that must be!

The implication is that the staff would be left without a penny if anything went wrong though

It’s not that opaque is it? The LLP accounts are public record. I’ve just looked at them. What’s wrong with an LLP having a subsidiary? They are both UK companies and overall the profits are subject to UK tax at 50% under this arrangement.

HMRC clearly did not agree

Although it only seems to say they have followed the UK transfer pricing rules (which is an obligation) not that HMRC forced them to do so. So they are just complying and paying tax at 50%.

This is smoke without fire.Simplify the tax system to 100 pages,not 8,700.

Impossible

Let’s not be silly….

Er, and Deloitte provide lots and lots of HM Treasury staff.

Parent is the llp so surely all the partners are getting taxed at 50pc on the tp income?

Yes

But that does not mean that this is not a ruse

So in your opinion it would be better for this company to make a profit which is subject to corporation tax at just over 26% rather than the current situtation where the partners are personally paying income tax at 50% on the same profit?

I’d like Deloitte to ensure it’s staff are paid by a company with reserves

Protection of creditors is vital in limited liability situations

To think tax alone is always narrow minded

I suspect the Limited Company is actually just there to limit liability of the UK operation and to prevent any liability in the UK spreading to the international parent LLP.

An LLP is a partnership. [Isn’t it actually a requirement of the professional bodies that accountants work through a partnership rather than a limited company?] As a partnership it should be transparent for tax purposes, so the profits that are made at that level (and there clearly must be some) should be subject to income tax and NICs in the hands of the UK resident partners as they arise. This isn’t particularly tax efficient compared to dividends from a UK limited company that makes a profit.

The most obvious issue may be leakage where non-UK resident partners receive a share of the profit, but I know nothing about how a non-UK resident is taxed on the profits of a non-UK partnership that has UK source income. I suspect that even if there is a general rule there will be treaty protections somewhere along the line. In any event I would tend to assume that the UK resident partners would actually want their fair share of the profit, unless we know any really good reason why they wouldn’t?

To really know what the true position is you would need to be able to see what is going on at the LLP level. In particular how the amount distributed to UK resident partners compares to the amount of profit generated in the UK. If the two amounts are pretty similar then there is little to be concerned about.

Given this is Deloitte UK, the number of non-UK partners will be minimal.

The level of “retained” profit will also be minimal – the general theory is that profits each year are distributed (else you favour the younger partners over the older ones if you hang on to significant amounts – as the older ones will retire without ever seeing their share, and they helped to earn it).

I doubt there is any tax avoidance here (as the partners are all paying 50% tax plus NI), but I think RM’s point about limited liability in the employee company is probably a valid one (albeit a common structure for professional services firms).

That last point is my concern here

We only have the profit & loss accounts here, no sign of the balance sheet, so it isn’t obvious what reserves the company has. I am assuming from the line of discussion here that the balance sheet shows basically nothing.

I would agree that if all the clients have contracts with the LLP it is strange to put only the employees under a Limited Company.

In practical terms I don’t really see how this subsidiary company could be easily dropped by the parent if it holds all the contracts for all the employees.

Ultimately I would hope that employees of Deloitte would be clued up enough to know what they are signing up to. I appreciate that not every employee will be an accountant, but there should be plenty accountants amongst their numbers that could explain the position to them.

@Anthony. Commonly the contracts pass on the full cost of employment to the LLP. Even if the contracts didn’t pass it on there is no evidence that Deloitte are not meeting their employment obligations and to avoid them they would have to let the company go into liquidation which wouldn’t be very smart for an audit firm.

This is not HMRC making a transfer pricing adjustment, this is Deloitte imposing a transfer pricing adjustment on themselves.

The company gets taxed at say 26% on the transfer pricing adjustment. However the partners of the LLP will be entitled to a compensating adjustment under the UK:UK transfer pricing rules which will save tax at their marginal rate say 45%. The partners then use part of their tax saving to compensate the company and keep the remaining 19%. (This would be a £7m benefit to the partners in 2012 based on the aforementioned rates).

The reason why the company does not actually charge a mark up is that this would put cash and reserves into the company and when this is distributed to the shareholders (which I assume are the partners) it will be subject to income tax at their marginal rates.

Entities not companies.

RM – I wonder whether you had any comments on the PwC tax disclosure in their latest accounts. They seem to have deliberately given full disclosure of how much tax they have paid which seems unusual.