Clive Parry posted this comment on the blog this morning:

As you know, I support all your suggestions in the Taxing Wealth Report.

However, I don't understand the chart. Maybe I am just not understanding because I can't get my head around the fact that tax in the UK does not reduce inequality. I assumed it might not be doing enough but surely it does something… except the data say no. I am confused.

The comment was made in response to my posting this chart from the Office for National Statistics / House of Commons Library on the UK Gini coefficient:

Let me offer an explanation. It comes from the Taxing Wealth Report 2024. In a summary post on its website I noted that:

This reporet suggests that, based on a review of taxes paid, UK national income and changes in UK wealth from 2011 to 2020:

- The UK has a tax system on income that is regressive at the lowest levels of income, broadly flat over the middle range of UK incomes, and is only slightly progressive at the upper end, without however replicating on highest incomes the tax rates paid by those on lowest income.

- Has a very generous system of taxation on wealth that means that whereas income was on average taxed at 32.9 per cent over this period, increases in wealth were only taxed at 4.1 per cent.

- The combined average tax rate on income and increases in wealth over this period amounted to 25.6 per cent per annum.

- Because of the way in which wealth is distributed in the UK, with most being owned by the top ten per cent of the population, this differential in tax rates means that the UK actually has a deeply regressive tax system.

- Those with lowest income in the UK were likely to have a combined tax rate on income and increases in wealth of approximately 44 per cent per annum during this period whilst those in the highest decile of earners in the UK were likely to pay no more than 21.5 per cent per annum on their combined income and increase in wealth.

- If the tax rates on income and increases in wealth were equalised then additional tax revenue of £170 billion a year might be raised in the UK as a result.

What this suggests is that:

- There is significant additional capacity to tax in the UK, although only from those with most income and wealth.

- A strong case for reducing the tax paid by those on lowest incomes can be made.

- On balance, so long as additional sources of tax revenue are charged only (or almost entirely) on those with the highest income in the UK then there is no reason for any UK government or political party seeking power to suggest that there is no additional capacity to tax in the UK: that capacity very clearly exists.

The Taxing Wealth Report will explore about thirty ways in which this additional revenue might be raised in ways consistent with these findings.

The unfair UK tax system

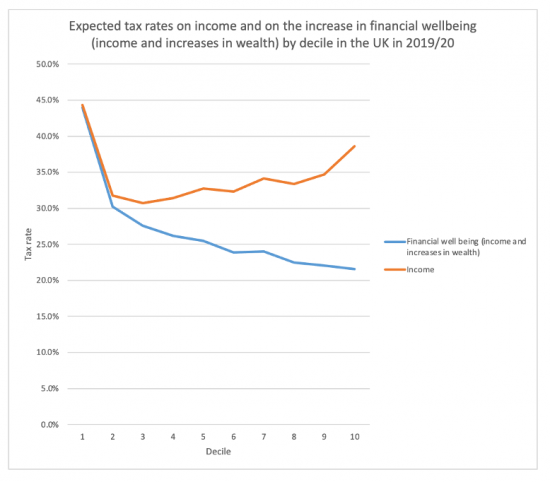

The following chart suggests the true scale of the regressivity of the UK's tax system:

Those in the lowest decile of income earners in the UK pay tax at around 44% on their income and gains in financial wellbeing, whilst those in the top decile pay at 21.5%, less than half that rate. That is why there is capacity to raise more tax from wealth in the UK.

The full report that supports this note is available here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Good explanation.

In another blog, one of the commenters suggested that a salami-slicing approach to wealth & taxes could be taken, a bit here, a bit there, not enough to cause the usual suspects in the UK media to get into a froth, but enough to start taxing wealth in a meaningful way – taxing wealth by stealth as it were. I made a couple of suggestions (safety insepction of swimming pools bigger than e.g. 60m2 £500/yr etc). Large-scale actions won’t work because of aforementioned media.

That’s why my approach works

I don’t know if this helps but Monbiot stated that poorer people tend to spend more on sales taxes as part of their living costs because of their lower income – the tax eats into buying power because there is less money as buying power. Since wages and benefits seem to have been contracting, this makes perfect sense to me.

That seemed quite a salient issue to me, as you Richard and even Nick Hanauer have pointed that out before. The rich can afford VAT better than the poor or less wealthy. The Tory VAT rise to 20% from 2010 is one of the reasons why I hate their (Tory) guts. Awful.

Agreed

Tax systems for the last 40 years have been designed intentionally as not to distort the outcome of markets. This is the current prevailing ideology. The idea that tax systems are meant to reduce inequality is rather old fashioned. If we hold this to be the intention of our governments, sadly we are swimming against the current and no matter what we do, you will find ourselves lost at sea unable to explain where we are. Successive governments have decided that such outcome is socially desirable and have taken action to not interfere. More than that, they have taken effective action to prevent interference from happening. They have turned the concept of greed on its head and call those who seek social equality as entitled, selfish and greedy individuals who against the common good. The ”common good” being regressive tax.

Here’s to old fashioned.

Thanks. That is really useful….. and a really swift response.

Everyday is a school day on this blog.

🙂

The picture is complex. People in the lowest deciles – indeed, most deciles but the top one or two – get most of their annual increases in financial wellbeing through income and benefits. Those sources are by and large subject to income tax. They also pay VAT on much of their spending, excise duties if they dare to buy alcohol or tobacco, and fuel duties if they can afford to run a car. Council tax is regressive in sense that it has a high floor e a then is only very loosely based on the value of houses.

But the picture at the upper end is also very mixed. There are many in the top 10% or 1% or 0.1% who pay lots of income tax and NICs on earned income and who have very small amounts of other income or annual capital gains. Footballers say. Or bankers. But there is also a sizeable fraction of people with dividends or capital gains each year taxed at very low rates. They consume goods or services that do not bear VAT. Etc.

I think we can look at this in terms of tax on income alone. The Conservatives and Labour always argue that those with most income pay the most tax; but what is not ever sufficiently revealed is the effect of a tax system that leads all Governments disproportionately to tax most thoroughly the least wealthy, and the least able to bear the burden. If we look at the issue from the perspective of income and discretionary spend, not as a %age, but a quantum (money left after tax and essential goods/services such as housing, food), then this provides a better insight into the economic resilience and wellbeing (let us call this ‘survivability in survivability’); for example, in a cost of living crisis.

This means establishing a range of discretionary spend a person/family would require as some reasonable minimum. I do not have the facts (because we do not think this way!), but I suspect such analysis would show many millions of people are being grossly overtaxed; and millions are being undertaxed (who can survive a longstanding cost of living crisis without even noticing, and no material changes to their standard of living). It is not a minimum wage that is required (and taxed back!), but a minimum discretionary spend for a very basic, but decently livable life.

You are right

The ONS data does try to look at this.

So too do Hargeaves Lansdown, oddly.

This. Exactly this. The richest can afford to pay more without a substantial impact on their lifestyle and wellbeing. (Just one Range Rover, and skiing holidays every other year.) The poorest can’t.

That’s it

Yes indeed – gini measures of inequality – deals with relativities between groups – which increased massively under Thatcher and has wobbled this way and that ever since.

But as you suggest JW and as Richard has I think accepted , the ‘absolutes’ the ‘necessities’ of food warmth and shelter etc., might well be affordable to the poorest 30% even if the relative gini was high – and yet unaffordable at a lower relative gini – depending on the overall absolute levels of income compared to the price of the basics.

Agreed

Survivability of survivability?

The Measure of Survivability.

I like this explanation of why taxes are unfair. It is based on Sweden, but I’m sure there are comparisons with the UK.

“Why taxes are unfair… (using Lego to explain)”

https://youtu.be/vxpq-xMo4-M

Very good

Thanks

I would do it differently, but it’s good.

We’ll likely hear how the rich can’t afford to have their increases in wealth taxed.

The only exception I’d say is pension pots. These are mostly taxed (or taxable) when income is taken from them so should probably be exempt from wealth tax. Given how badly moist are saving for retirement it’s probably best not to discourage people further.

An exemption could only apply if limits in value were imposed. Too easy to abuse otherwise.

There are limits, although they are arguably too high.

There is a limit on how much you can save in a pension in a given year and a lifetime limit on what you can take tax free from a pot.

You know that has changed, don’t you?

First can I thank you for doing what you are doing which I think is trying to help people understand. There is so much talk about taxation.

I thought MMT had established that taxes do not fund public spending?

Can you help me understand the fascination with taking money away from people and out of the economy (taxation) and eroding peoples dosposable income?

I understand that new money is created by a government spending thus adding money to the economy and that taxes have the oposite effect in draining money from the economy. I also think I understand inflation where the price of goods and services increases over time for a whole host of reasons often counter intuitively.

Setting prices or the role of governments in setting prices is not overly discussed but is incredibly important in balancing an economy both nationally and globally.

How will increasing taxation give any of us more disposable income? Surely the opposite is true?

It appears to me that a total rethink on the understanding and function of money is required both nationally and globally?

Might you read chaoter 16.5 (I think it is) on the role of money and taxation in here? https://taxingwealth.uk/wp-content/uploads/2024/04/Taxing-Wealth-Report-2024-Full.pdf

Alsi try this. Then come back to me. https://taxingwealth.uk/2023/09/08/the-taxing-wealth-report-2024-and-modern-monetary-theory/