This tweet was posted over the weekend:

“I'm the Fox Mulder of MMT. I want to believe, but there's a thing called the current account constraint...”@MkBlyth, professor of internatonal economics at @BrownUniversity savages Modern Monetary Theory at #Scotonomics festival. pic.twitter.com/XotdMBZh1Y

— Ian Fraser (@Ian_Fraser) March 23, 2024

The interview was by Karin van Sweeden with Prof Mark Blyth of Brown University in the USA, where he is professor of international political economy.

I happen to know both participants, although not well in either case.

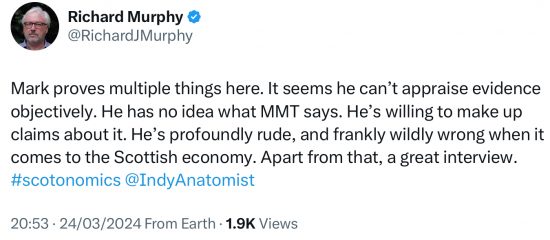

I was infuriated by Mark's comments and posted this last night in response to a typical comment supporting his position:

Mark's claim was that he wants to believe in MMT but can't because of the balance of payments problem that he claims it ignores. He summarised his argument on three ways.

First, he said Argentina has a sovereign government and currency and it has not avoided a debt crisis. This totally ignores that fact that Argentina is a still developing economy and is treated as such by much of the world. It also ignores the fact that it borrows in dollars, when MMT very strongly advises no country should borrow in any currency but its own. And ignores the fact that it has to do so because of its decidedly rocky history of political instability. To suggest that Argentina and Scotland are in the same place is, to be polite, crass in that case. Mark would have told any student of his that, I am quite sure. In that case to make the comparison in a public debate really was unwise.

Then he claimed MMT says a government can default on its debts, print some more money and carry on as before. This suggests Mark has never easy anything written about MMT. Anyone who is serious about it has never said such a thing, although no doubt some uninformed enthusiast on the web has. Mark should really be able to tell the difference, and not make such an absurd claim. It's is unbecoming of a person with some stature to make claims that are very obviously untrue about an opponent's arguments. Why is it that he and others think it acceptable to do so about MMT?

Third, he then utterly belittled Scotland, saying it had nothing to sell the world and as such its currency would be utterly worthless. As such he claimed that no one would accept a Scottish currency and as a consequence, the MMT argument that Scotland should have its own currency had to be wrong. This argument is utterly absurd, and it is easy to demonstrate why.

If, as Mark claims, Scotland would have nothing to sell in the world after independence (and that was his specific claim), then it follows that his claim that Scottish debts would have to be settled in either US dollars or sterling is the most incoherent position that he could adopt. As a matter of fact, if his argument is true, Scotland would have no means of acquiring those currencies after independence as, he claims, it would have nothing to sell in international markets, which is the only way to acquire them. It would, therefore, automatically default on all debts denominated in pounds or dollars because it would not have them.

On the other hand, it would never need to default on debts denominated in Scottish currency because it could always create that. So, rationally, anybody trading with Scotland in this situation would have their risk reduced by trading in a Scottish currency rather than in pounds or dollars, because at least then they were likely to be paid, which is a much better than not being paid at all, which is the position that he would apparently prefer.

Far from being smart, as he obviously thinks he is being, Mark is as a result actually putting forward the worst case argument that he could create for Scotland given the assumptions that he makes by suggesting it use a foreign currency. In the situation he describes only a Scottish currency could work for it.

But let's also be honest and say the argument he makes is crass in any case.

Firstly, Scotland is an old country, with an old democracy, and a competent civil service, backed by a legal system with centuries of history behind it, which system is recognised to be stable and enforceable. It also, quite critically, has a strong and functioning tax system, which would, under an independent government, be capable of collecting even more tax than it does at present, and that is the true basis for the foundation of the value of a currency. In other words, every assumption that he makes about Scotland, which can be summarised by saying that he thinks it would be a failed state, is completely wrong.

It is also, very obviously true that his claim that Scotland will have nothing to sell after independence is quite absurd. Let's ignore the fact that Scotland has, overall, over many recent decades on average run a trade surplus and instead note that Scotland has a greater capacity to create renewable energy in proportion to population than any other country in Europe, and this has to be the strongest foundation for its prosperity that it can have. I should also add that it has a lot of fresh water as well, and that is going to be an incredibly scarce commodity in the world, sometime soon. It also helps that it will have a very near neighbour who will be short of both. In other words, Mark's claim that Scotland would have nothing to sell is ridiculous. There is in fact every reason to think that the Scottish pound will trade at a higher value than the English pound after Independence, for the reasons I note.

So let's leave MMT aside for a moment, because Mark has clearly got no understanding of it. Instead let me just make the obvious point that what Mark said was that he thinks Scotland is too wee, too poor and too stupid to be independent, which is a standard Unionist argument that is both party patronising and downright rude. His claim that Scotland cannot pay is not in that case related to a currency question. It is related to his belief that Scotland will be a failed state.

MMT does not prevent states failing. Nor does it create failed states. All it does is describe how money works, more accurately than any other economic model that I know of. Doing so, it roots itself in reality. Indeed, no model is more rooted in the actual capacity of an economy than MMT because it recognises that physical capacity as the real constraint on activity.

MMT does, in that case, have nothing to do with then argument that Mark Blyth presented, which was based solely on wild comparisons between Scotland and Argentina and the absurd suggestion that Scotland creates nothing of value. Of course if you start from false assumptions, as Mark did, you get to absurd conclusions, as he did. But to then claim MMT had any part in that is absurd. It did not.

If an undergraduate student had offered the analysis Mark Blyth did they would have deserved to fail. It was embarrassing to see him make such a fool of himself. The SNP have appointed him as an adviser in the past. I sincerely hope they do not do so again. Someone who so clearly despises the country he left some time ago quite as much as he does really has no place helping the independence movement, in which he clearly has no belief.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

There must be a chance you become economic advisor to the SNP?

I doubt it. I am not nearly neoliberal enough.

The economics profession appears to have more than its fair share of individuals with an inability to do joined-up thinking – Will Hutton now Mark Blyth!

Thank you.

Further to Richard’s post about Hutton’s neoliberalism yesterday, perhaps the Hutton family property empire and appointments to Oxbridge colleges may explain. These appointments don’t go the likes to Richard or Prem Sikka.

This response of Mark Blyth has perhaps made me review and rethink (again) his description of austerity. Mark Blyth’s assumption about why austerity happened was that policymakers ignored the evidence and expected that austerity would deliver growth. Is that really true?

I remember that public discourse was about necessity, lowering the rate of spending and bringing down potential debt, rather than it being a growth policy. No one talked about economic growth. It was about fixing the roof which labour, and other European socialist governments, had failed to fix while the sun was shining.

Joined up thinking? Hmm the man clearly does not even have his eyes open given this: “Scotland would have nothing to sell in the world after independence”.

Scotland (& Ireland) sit on the greatest (& inexhaustible) energy resource in Europe: wind.

Taken on its own Scotland’s off-shore wind resource is well north of 500GW – or 2,000TWh/year. Expressed another way – 2400TWh is what the EU currently consumes as electricity. Of course, this is just off-shore wind & does not consider: wave, tidal or on-shore wind. Of course we can argue the numbers up and down, but this does not change the big picture. Scotland has a vast energy resource. Which leaves the open question – how come Prof Blyth does not know this? Or perhaps such realities get in the way of a good story?

Agreed

Apologies for adding. £120 billion per year, that is the value of the electricity (based on £60/MWh) that would be generated if 500GW were built.

As was noted by Solar Europe, financing costs i.e. interest rates, account for circa 35% of the levelised cost of electricity from renewables – which means financing costs for renewables are under the control of the unelected bankers in the BoE.

(Thank you to the Brexit people for that “unelected” meme btw).

Thanks Mike

I have lived long enough to be witness to the endless stream of fossil fuel funded academic reports, mass mediated, proving that emissions would not fatally impact upon our environment. And, like too many, suffered at the hands of the UK special forces paid to ‘deal with’ idealistic young female Greenies.

Richard mentioned that Scotland (and Ireland) are well placed to produce what is known in global corporate circles, looking to post fossil fuel damaged earth future profitable projects, as Blue Gold aka fresh water. Whoever owns access to fresh water in the near future, like their predecessors in fossil fuel exploitation, will become very wealthy.

This kind of feverish misinformation designed, in this case, to block Scottish Independence, carries similar hallmarks to the 1970s filthy disinformation wars against social environmentalists.

Perhaps cynicism born of harsh experience has clouded my vision. Perhaps not.

Mark Blyth’s diatribe was a textbook example of a colonised mind. It has long been recognised and is often referred to as the “Scottish Cringe”. It’s one of the results of an essentially abusive relationship. There is usually only one way to deal with such a situation and that is to walk away.

How does Scotland harness all that potential power? Export it via cable, or produce green hydrogen perhaps?

The Right-wing use of the Balance of Payments in economic argument is like the Okey-Kokey. in or out whenever it suits them.

In 1976 Labour Chancellor Denis Healy was told by Treasury civil servants that Britain faced an insurmountable Balance of Payments problem that if not dealt with would destroy the British economy. This turned out to be completely untrue. The real problem was that the Treasury computers had got the numbers wrong.

However, Healy and Labour Prime Minister Jim Callaghan believed what they were told and immediately applied for an IMF loan. The IMF granted the loan but only on condition that Callaghan would change to Neo-Liberal policies. The Labour government agreed and the first step was taken along the road that has lead us to the current disastrous mess.

Back in 1976 Healy soon discovered that he had been completely misled. Within a year it was announced that it had all been caused by some sort of timing issue over payments for aeroplanes, mostly untrue, and the unnecessary IMF loan was paid back in record time.

All of this was reported, but without much prominence, in the serious newspapers of the Day. The only unresolved issue was whether it was a conspiracy or a cock-up.

Despite the truth the Balance of payments problem, 1976 IMF loan and Labour’s change of policy has become one of the great foundation myths for those that support UK Neo-Liberalism.

In complete contrast, ten years later Tory chancellor was told that Britain really did have a Balance of Payments problem. His response was to declare that the balance of payments was no longer important. The financial markets, snouts already deep in the Thatcherite trough, did not stir.

I notice that above I have missed out the name of the Tory Chancellor who declared that the Balance of payments no longer mattered. It was of course the egregious Nigel Lawson.

Thank you, Paul.

Lawson was ahead of Dick Cheney, who said with regard to Iraq, “We make our own reality.” He was also talking about the increasing indebtness of the federal government no longer being important.

Was it a conspiracy?

Wilsion would have thought so

Who knows Richard. There are several interesting theories, see Bernard Hurley below.

One that appealed to my early experiences of programming was related to me by somebody working on the Treasury systems at the time.

It relates to a feature of programming at the time where you had to define the size of any number likely to be the result of a calculation.

Define the number too small and the computer would lose the leading digit. For instance, if the programme had been written for end calculations with 6 digits it would be fine up to 999.999 but if the answer was 1,100,000 it would only show 100,000.

What gave it the ring of truth was that at a time of 25% inflation, if a computer program was not regularly updated this kind of problem was always likely to occur.

It does not need much imagination to see how these two things together could produce the alarmingly misleading results passed on to Denis Healy.

William Keegan the Observer’s ancient Economics correspondent has always maintained that he was told by a very senior Treasury official, “It doesn’t matter if it was a cock-up or a conspiracy, we (note the use of the Royal we) were able to make the Labour Party do the right thing”

I believe the last

About a decade after the crisis my dad was working in the building that housed the mainframe computer that was used to calculate the balance of payments. The story he heard was that at the time there had been road works in the street outside resulting in several power cuts thus causing the computer to malfunction.

This is probably an urban myth especially as power cut would have more likely resulted in the computer spewing out gibberish. However it is a sobering thought that we may have become so dependent on technology that road works could change the direction of the economy of a whole nation.

I have only one complaint about the heading to your post, Richard. I fear that the word “think” is misplaced, as in Mark Blyth’s rant there is zero sign that thought, i.e rational cogitation, was engaged. Indeed, his hectoring tone reveals an irritated polemicist. A poor look for someone in his position as one presumably mainly concerned with the educational development of others less well informed. Perhaps he should seek more appropriate employment.

There are two interesting matters that are important here, that disappear from view, and pass unnoticed.

First, Blyth is a Scot, and most people do not realise that Unionists Scots are by far the most belligerent; the biggest Unionists of all, and have been for generations. Their intellectual forefathers were Imperialists, who never quite came to terms with the loss of Empire; and earlier, with Lord North’s shameful loss of America. They are in fact more committed to ‘Britain’ than the people of England (who are scarcely aware of the difference – as the Unionists Scots know very well, and happily indulge).

The second interesting point is the stress on the balance of payments. The problem for Blyth, is that Scotland has enormous trading advantages, easily and cheaply extracted by Britain (or buried, because they are dangerous to Unionism). Oil is the obvious one; it scared Unionists, so they extracted the value from Scotland to fund London’s financial growth, and redrew the map, and the accounts to avoid it becoming obvious to the population. Oil, renewables, whisky (worth £7Bn+, perhaps £5Bn+ to balance of payments alone – population, 5m), seafood (around £1Bn exports), high quality agricultural produce, potential in small-scale space industry (both for launching rockets, and the ), life sciences and so on.

The British balance of payments deficit is around £17Bn. It is Britain that has the big problem. And it has not fixed it for almost a century, and has no ability to do so. Take Scotland out and it is much worse; and Scotland accounts for around only 8.5% of the British population. Even from Blyth’s brief analysis in the video clip; it is Britain with the big problem, and it is dragging Scotland down, not realising Scotland’s potential.

If Scotland realised its potential, why would it stay in the UK?

The UK used to worry obsessively about the balance of payments, until the neoliberals arrived. They knew they couldn’t fix the problem (save with oil propping up Thatcher’s blunders); so they just changed the narratives. The solution for unionists like Blyth to the British insoluble conundrum? Live in the US.

Thanks John

Appreciated

Mark Blyth was brought up a Catholic.

His father was one of the first, if not the first, Catholics to play football for Glasgow Rangers FC.

Mark told me this himself.

Scottish Catholics are associated with Republicanism not monarchist Unionism.

Apart from that it’s well stated.

Mr Wilson,

The uneasy tension between your second and fourth sentences rather serves my point.

Thank you, John.

Further to the UK’s inability to fix anything, readers and Richard may be interested in https://www.palladiummag.com/2023/04/27/britain-is-dead/.

It’s interesting to note the prevalence of Scots settlers (planters, merchants, ship owners and builders, engineers and police) and administrators over English ones in the (former) colonies, including Mauritius whence hail my parents. Their legacies endure include churches, schools and plantations.

Whisky alone brings over £7bn. Scotland, unlike England, has a largish trade surplus.

Why comparing Scotland with Argentina (a country Scotland has nothing in common whatsoever) – and not for example with countries that became independent in Europe in the 20th century – e.g. Norway, Ireland, Slovenia. How did they survive and thrive – some of them with no other resources than human?

If Slovenia and its economy with then new currency survived 1991-1995 rather well and without any major setbacks (and is now in practically every index that measures quality of life way ahead of the UK) in an extremely hostile environment with most of pre-1991 markets completely cut off (and with, unlike Scotland, no resources other than human), I can always only laugh at all doomsday predictions that are aimed at Scotland.

Will telling Scots that they must be the stupidest people/country in Europe and the only one who can’t sustain independence really save the union?

We can foretell it now.

Some politician will declare that the Scotch Whisky industry adds £7.1bn to the Scottish economy, and they will be utterly wrong. (Source – scotch-whisky.org.uk/insights/facts-figures/ ).

Scotland can still prosper as an independent country of course. Doing some of the things that Slovenia and other comparators has done will help – free markets, universal health care without an NHS, liberal planning.

Without an NHS? Why would they want to do that?

The figure comes from an SWA Report, based on an economic impact study by Oxford Economics and the IWSR (International Wines and Spirits Record) on behalf the World Spirits Alliance (WSA).

Oxford Economics are described by the IFS in these terms: “Oxford Economics was founded in 1981 as a commercial venture with Oxford University’s business college to provide economic forecasting and modelling to UK companies and financial institutions expanding abroad. Since then, we have become one of the world’s foremost independent global advisory firms, providing reports, forecasts and analytical tools on 200 countries, 100 industrial sectors and over 3,000 cities. Our best-of-class global economic and industry models and analytical tools give us an unparalleled ability to forecast external market trends and assess their economic, social and business impact”.

There is the sources, as I understand it; not a politician in sight. Then I turn to the Michael, link; and it goes precisely nowhere at all that I can see. You tell me what looks marginally more plausible?

Replying to John Warren:

The url cited by Michael is correct, so I’m not sure why it doesn’t show as a clickable link. Among the facts and figures on the page are these:

“In 2023, Scotch Whisky exports were worth £5.6bn”; and

“The Scotch Whisky industry provides £7.1bn in gross value added (GVA) to the UK economy (2022)”

Which tallies so well with the figures noted in your comment that I dare say they come from the same original source.

Thanks Therese,

Helpful information.

Unfortunately, the SNP will not commit to creating a central bank parallel to Indy for Indyref2 either, being as corporate liberal as Blairite Labour was, and so will fudge the currency issue completely, just as Salmond did last time around.

I recall his pretty dire under-performance during the televised debate on currency.

I think the currency issue alone lost us the Indyref a decade ago, as only 200,000 more people voting YES would have seen us cross the line, however closely.

My Yes friends were all well able to articulate the Scottish central bank and currency issue, (including some natural SLab supporters) and promote this option, but were undermined by the official SNP take.

Everything positive Richard has written about Scotland is true, we really are resource rich, and both his and Bill Mitchell’s contributions to the macroeconomic debate have made, and will continue to make, a positive difference.

The fundamental problem here is that we are desperately short of a left of centre party in Scotland that is not neoliberal, and is committed to MMT.

If the Labour Branch office ever mature sufficiently then we may see them emerge as this, but they are far too tied to WM and internal Labour neoliberal politicking.

I’m afraid the Scottish Greens, well intentioned though they are, just do not cut it.

I suspect the SNP have abused them as the Tories abused the LDs in power, but their top people have not performed very well as junior ministers.

Blyth really does have a poor take on geography. Scotland is just one small country of around 5m people. Our Nordic neighbours, Finland, Norway,. Sweden and Denmark are all comparatively endowed (excepting Norway’s sovereign wealth fund), yet regularly top both global economic and happiness indices.

Conspicuously these countries are outwith the Eurozone…

I fear you are right

Denmark has few natural resources other than agricultural land and is prosperous. You are right Scotland could be one of that group. The countries you cite are all in the single market as well. Scotland would also want to be, possibly full EU membership.

Just point out Finland uses the euro.

”The fundamental problem here is that we are desperately short of a left of centre party in Scotland that is not neoliberal, and is committed to MMT”.

It’s not just Scotland that suffers from that problem!

True

Did Scotland get paid for producing and exporting Mark Blyth? If so, what currency were they paid in and do they want their money back?

🙂

If I have understood correctly, MB’s view seems to revolve around the idea that only the US (and perhaps China) can achieve monetary sovereignty because international trading wants to use US Dollars. Is there a good rebuttal to his idea?

Yrs

The UK does little trade in the dollar

Then there is the euro, and the yen. Sweden, Denmark and Switzerland do just fine. So dies Australia and sime smaller EU states outside the euro. It is just nonsense.

Confusion. Whose side is he really on, does he even know?

https://www.thenational.scot/politics/20676559.mark-blyth-real-views-economics-scottish-independence/

The confusion is perhaps because Blyth appears to find it easier to mimic the operation of a weathervane, and blow with the wind, than handle problematic facts.

It is a common neoliberal problem. A favourite BBC Scotland source for international affairs is, curiously the University of Buckingham. The BBC today found a ready spokesman on the China problem in Anthony Glees of its Centre for Security and Intelligence Studies, who painted a disastrous picture on security; with a long list of failures. For once the BBC interviewer asked a shrewd question; why then do we allow so much Chinese investment here? The answer was a stuttered and stumbled ramble about “we are on our uppers”, economically in “a parlous position”; we have just allowed them to make things, we “dropped our guard”, we are a peace-loving democracy. Or in short, we are Neoliberals and private contracts for profit trump everything, and do not look beyond the quick profit; and look where that long defended catastrophe has brought us. In short, Neoliberalism unleashed brought us here.

You could sketch a similar argument about Putin. We stood by and did virtually nothing after the Litvinenko murder in Mayfair, under our nose, flaunted in our face, in 2006; similarly did nothing with every Russian attack on a neighbour after that, whether Georgia, the southern Ukraine, 2014; Crimea and on to the full attack on Ukraine, 2022. Putin discovered slowly how weak the West was, and how little it was prepared to do to stop him (indeed would trumpet sanctions that are hopelessly slack); and Putin has become ever more confident he can do what he likes (and let us be clear, Brexit was a big signal to Putin that Europe was weak and divided. The British have a lot to answer for. Brexit was an enormous impetus for his confidence, on his doorstep).

We talked big on sanctions after the 2022 Ukraine invasion, but have not delivered; and now we find Putin is less affected than we are. We have used a Nelson’s eye on sanctions; because the economics affected us politically more than the hardships for Russians affected him. We are still failing badly on sanctions, on oil and it seems a lot more, and having supported Ukraine, we have now left it exposed and short of resources – we have turned the tap off; the worst of all worlds. Sanctions are a sieve that Putin can manipulate. Zelensky thought he was dealing with determined and consistent friends in the West; he finds now he has been dealing with Pangloss; short-termists who give up if the result (or profit) wanted doesn’t arrive quickly enough; while telling him we offer the best of all possible worlds. We should have known, from the history of Ukraine, and from WWII just how difficult, long and complicated a war and politics in Ukraine would be; but we blundered in, talking big; and we have kept on blundering, but not delivering.

This is a very, very bad way to do the business of geopolitics; but it goes with Neoliberalism.

Agreed

Thank you, John.

Glees? China? OMG!

It’s a small world. Glees taught me at Brunel. He left for Buckingham a couple of years or so after I graduated (masters, including dissertation on central bank independence), complaining about the lack of commercial freedom etc.

He’s not a China expert. Neither is he a Middle East and terrorism expert.

Glees’ family fled Germany around the Kristallnacht. He’s a Germany and EU expert, what he taught at Brunel, Oxford and, at first, Buckingham, and speaks German and French fluently. He made his media name on these issues.

Not long after monetary union and around 9/11, he reinvented himself as a Middle East expert, something he had never been interested in in the years I had known him as a tutor, 1990 – 5. Some years later when we caught up, around 2008 if memory serves, he admitted that he did not speak any of the MENA or subcontinent languages, had never been there and knew nothing about their cultures, histories etc.

There’s a lot of this about.

I should have added that the biggest sanctions busters are US commodity traders, investment firms and banks.

If it was not for Russian oil and gas being imported via India, Turkey and even Saudi Arabia, we would not be logged on.

A fine analysis, John. When I first noticed outsourcing – call centres – it was clear it was just an extension of the neoliberal playbook – find cheap labour wherever it’s cheapest and watch your profits grow. So we outsourced as much as we could, manufacturing, computer chips, gas supplies (from Russia), food, merchant seamen – whatever and wherever home grown could be undercut and made expendable.

The unintended consequence was that we became reliant on some very nasty and unpredictable regimes, not to mention colonial-like exploitation. As you say our naive “bedding” of Putin (Bush looked into his eyes etc) has come back to bite us.

Neoliberalism may ultimately result in a real Armageddon because the changes necessary and the amount of investment needed to prevent a disastrous level of global heating are antithetical to the doyens of neoliberalism who see profit in wars, in never ending growth, in ever increasing consumption of useless stuff, in ever larger piles of wealth they can never spend.

The Neros are in charge.

Colonel Smithers, there are plenty of China experts the BBC could have called upon. The one that springs to mind is Steve Tsang.

https://en.m.wikipedia.org/wiki/Steve_Tsang

Lots of questions for Blyth and Reeves to answer in this Pavlina Tcherneva article as to why they’re not just wretched Neoliberals not worth bothering with because they’re blind to the “unparalleled spending firepower” sovereign governments have:-

https://www.postneoliberalism.org/articles/whatever-it-takes-how-neoliberalism-hijacked-the-public-purse/

Excellent article, thanks for sharing.

Pavlina provides two YouTube links in her article of Mario Draghi saying that MMT is of relevance and the ECB cannot run out of money:-

https://www.youtube.com/watch?v=2M1jcnQi8eg

https://www.youtube.com/watch?v=_fF3pNTtmfc&t=40s

(With this last link you may have to hit Replay or drag the red button back to the beginning)

As a cruel and usual punishment Rishi Sunak, Jeremy Hunt, Keir Starmer and Rachel Reeves should be made to watch each link 100 times!

A very very fine article – thank you. I was struck by this:

“This financing regime has created the appearance that the state needs private finance to pursue key policy objectives, whereas it is private finance that needs the assurances and guarantees that only the state and its public financing institutions can provide.”.

One concrete example is the way most medium/large-scale renewables are funded. Gov holds a capacity auction, projects are bid in (based on £/MWh) once the MW or GW capacity is reached – the winners (ordered by price bid) get a guarenteed (by the gov) price for their MWhrs that are produced and sold by the project – based on as bid or as cleared. They then can obtained funding from ………private banks. This is how most renewables in the Uk and the Eu are built. No gov guarantees, no build – cos no private finance. (CfDs are a side issue – they are a crude interface mech’ allowing the project to sell to the market).

Thanks Mike for pointing out this ability of sovereign governments using their power to create money from thin air to put a “safety net” under private sector investment in such an important economic development as sustainable energy. Such a shame Mark Blyth can’t put the two together in his thinking.

Although not myself Scottish, as an innovator, I have tremendous admiration for the very prestigious inventive output that has emanated from Scotland over the years. Their ground-breaking contributions to medicine alone have been really impressive. The Scots deserve the opportunity to build a thriving economy exporting power and water to what will soon become the sad rump of the former United Kingdom.

I had a very busy weekend that started with attending a ‘Think Global’ event in London. John McDonnell was on the opening plenary panel, where I had a chance to ask him, in front of a packed audience, if he reads your blog? He replied that he does. This was a question asked at the end of making a concise point on the necessity not to buy into the insidious propaganda of “no money left”. I countered this lie by elaborating on the ability of the UK Government, as a Fiat currency, to spend money into the economy without first receiving any taxes. I made a pitch for your ‘Taxing Wealth Report’ being capable of significant wealth redistribution and raising far greater revenue to repair the damage of Tory asset stripping. At the break I got a chance to chat with John McDonnell, who said he agrees with you on many issues. He still remains confident that the Labour party will swing back in a Socialist direction… dream on!

On Sunday I joined local Green Party members who had gathered to go out canvassing in West Oxford. Although I don’t do the door to door work, I came to help man the base. We had Natalie Bennett join us for lunch and it was an ideal opportunity to talk to her about Green Party monetary policy. I told her of my concerns over Molly Scott Cato’s unworkable support for something dangerously akin to ‘Positive Money’, relaying your assessment of this “economic illiteracy”. Bennett is a very pragmatic levelheaded party member whose close relationship to Scott Cato means these serious concerns will get discussed, reviewed, clarified and hopefully amended.

I bought a copy of Natalie Bennett’s new book, ‘Change Everything’, which I have not had a chance to start reading yet. However, from our discussion, I think Natalie herself, along with the majority of other Greens, is in support of not just redistribution of wealth, a much fairer taxation system, but also MMT. I hope this intervention makes a real difference, because it’s vitally important for the public to realize that the Green Party policy proposition represents the most comprehensive democratically formulated Socialist agenda on offer to UK voters today. Greens are certainly not a ‘single issue party’ as portrayed by the media. Independents and other breakaway groups can run on a dual platform as ‘Socialist and Green’. This is an important alternative to fragmentation on the left which is easily marginalized by the media.

Natalie does good work with Prem Sikka

Thanks for the comment

Choose a set of smallish countries like Scotland (eg Denmark, Iceland, Austria etc) and compare them against the UK on a wide range of measures. On the vast majority of these the smaller countries have done very well (ie better) compared with the UK – over decades. That seems to indicate pretty definitively that comparable countries around the size of Scotland are not inherently not viable as Blyth basically states. He deserves a straight F and that’s being generous. Any more such nonsense and it’s a straight BS.

https://www.theglobaleconomy.com/compare-countries/

The problem with Scottish independence is the SNP. They just can’t put together a coherrent case for how it would be done.

Projections of wealth on a declining resource was always going to be a hard sell….but renewables, well that’s different. We can harvest many times our own needs and flog the rest to a host of willing buyers (including the English)

….and the currency question in 2014 was a mess. We can do better with energy security at our backs.

I suggest a merger with Norway. We can trade renewable energy and gain Norway’s relationship with the EU. Norway would probably even suggest a tunnel (and get it built!) between the two of us.

Have you asked the Norwegians?

Mark needs to spend more time in Scotland. The country has an abundance of natural wealth.

I followed this discussion with interest. It began with Mark Blyth asserting that an independent Scotland with its own currency would fail because it has nothing worth selling. If this were the case, I suppose he would have a point. Scotland would struggle to import the foreign goods it needs because its currency would be worth so little.

Obviously, the premise is wrong. Scotland does have things worth selling. One of them is energy – as mentioned several times above.

On this particular item I have a question. Is it technically possible for Scotland to sell electricity into foreign markets? You would need some interconnection with their power grids?

It would need interconnectors

But the National Grid already exists and England is going to be desperate for Scottish power

Enjoy your posts and the comments thereon. What do you think of Prof Stephanie Kelton’s interpretation of MMT, in particular her book The Deficit Myth? She visited here (Australia) recently and a lot of shouty ranting ensued. To a non-economist (but retired accountant) it was confusing and a bit dismaying. Thank you. Peter

I have posted a lengthy reply on the blog this morning.

Thank you for your question.

“Figures released by the Office for National Statistics (ONS) show Scotland’s trading performance as the strongest of the UK nations.”

https://www.gov.scot/news/scottish-trade-outperforming-other-uk-nations/

Mark Blyth needs to shove these statistics up his kilt and smoke them to recoin a phrase!

Thing is the support for Scottish independence is diminishing. There will always be a sizeable minority in favour , let’s say 40% and that may or may not be generous , and that will not change as they will always be there. Nothing wrong with that as I don’t mind if others don’t share my view , it’s their democratic right. But I’m fed up with the issue being the only one. Most of us are not interested in purely independence , a semi competent SNP would be a start but they are not even that , just run the country properly and stop blaming Westminster for everything. We’re not interested in being an MMT experiment , we just want things to function properly.

Yoiur first claim is very obviously untrue. Just look at the polls. Pretty much everything else you say is as unevidenced as that claim. I suggest you come back when you have an argument and not falsehoods to offer.

As the time-worn proverb puts it: ‘there are none so blind as those who will not see’.

The vast bulk of the UK’s press is biased to the political right and the BBC now reflects right-wing reporting more than in the past. It’s evident to anyone who cares to think about it. If that’s biased reportage in England, it’s considerably worse in Scotland. There is just one newspaper, The National, which supports independence (and it’s London-owned with an American parent company) and BBC Scotland takes an obvious Unionist stance with constant evidence-free criticism of anything and everything that the Scottish Gov’t does, so about 97% of the MSM news in Scotland represents view akin to John’s. And yet the polls consistently show public support for Independence running at 50% or higher.

Understanding cannot be forced on someone who chooses to be ignorant and John clearly prefers to believe the evidence-free variety so conveniently available here.

Quite so

“…. we just want things to function properly.”

So do we; starting with Westminster. Scotland is not independent, and everything else is your show, so be my guest: tell me how you are going to fix the Westminster mess?

Here are three videos Mark Blyth and for that matter Rachel Reeves and Keir Starmer need to watch to understand sovereign governments do have the power to create money from thin air:-

Just before the 8:00 minute mark in this Scott Pelley interview Ben Bernanke makes clear on behalf of US citizens the Federal Reserve can create money from thin air:-

https://www.google.com/search?q=Scott+Pelley+interview+with+Ben+Bernanke+on+printing+money+March+15th+2009&client=firefox-b-d&sca_esv=65f1f60e92dda291&sxsrf=ACQVn0-3B2eNQ20j–dghkyRQtVXSWYaiA%3A1711426957998&ei=jU0CZp_HPJCGhbIPr8ih4A0&ved=0ahUKEwjfwY-fipGFAxUQQ0EAHS9kCNwQ4dUDCBA&oq=Scott+Pelley+interview+with+Ben+Bernanke+on+printing+money+March+15th+2009&gs_lp=Egxnd3Mtd2l6LXNlcnAiSlNjb3R0IFBlbGxleSBpbnRlcnZpZXcgd2l0aCBCZW4gQmVybmFua2Ugb24gcHJpbnRpbmcgbW9uZXkgTWFyY2ggMTV0aCAyMDA5SABQAFgAcAB4AJABAJgBAKABAKoBALgBDMgBAPgBAZgCAKACAJgDAJIHAKAHAA&sclient=gws-wiz-serp#fpstate=ive&vld=cid:58ff6974,vid:odPfHY4ekHA,st:0

Here again Alan Greenspan makes the same point:-

https://www.youtube.com/watch?v=DNCZHAQnfGU

Then Mario Draghi effectively makes the same point in regard to European Union citizens:-

https://www.youtube.com/watch?v=_fF3pNTtmfc&t=40s

(You may have to press replay or drag the red button back to start to hear this video.)

Thanks

Here’s the shorter YouTube link for the Ben Bernanke comment that the Federal Reserve Bank simply marks up the reserves of private sector licenced banks using a computer:-

https://www.youtube.com/watch?v=odPfHY4ekHA&t=478s

(Start just before the 8:00 minute mark to hear this comment.)

In summary therefore you have two governors of the US central bank and one president of the European Central Bank all effectively saying they can create as much money as necessary to resolve problems by simply entering numbers on their banks computers. Obviously their remit to control both inflation and deflation relative to real resource availability has to be a factor in how much money they create.

Is it that difficult for Britain’s politicians to watch a few videos?

Geejay-didn’t Lenin say that ‘capitalists will sell us the rope with which we will hang them’ ?

I have a question regarding Scotland’s electricity production. My MP, Kenny McAskill had an article about this in the National a couple of weeks ago. https://www.thenational.scot/politics/24191279.kenny-macaskill-uk-took-oil-now-wants-electricity/

A lot of this electricity is produced offshore and so far as I know the infrastructure is privately owned, and profits will therefore accrue to the owners. There are plans for some of it to come ashore in England, bypassing Scotland altogether. In that case what benefit is there to Scotland from these energy banks?

Limited

This has to be renegotiated

Mark Blyth speaks out. Scotonomics has the full video. Maybe he’s been misinterpreted. So easy to jump this way or that.

https://www.thenational.scot/news/24211354.mark-blyth-unionists-taking-words-independence-context/

His reaction that he has been abused by right-wingers is quite amusing.

I guess he is not putting me in that category.

He really should accept that he did a car crash interview, at least in the park that has been quoted.

Update from Scotonomics puts Blyth’s piece in perspective.

https://www.thenational.scot/politics/24212854.unionists-wrong-leap-scotonomics-interview-mark-blyth/

The trade figures you rely on ignore intra-UK trade, which becomes overwhelmingly the most significant part of Scotland’s trade balance if it’s independent. Scotland’s net trade balance in 2022 *if independent* was -£19 billion, or 10% of GDP. Source: table G1 in the spreadsheet ‘Other quarterly national accounts summary tables’ which can be found on the Scot Gov website.

There is literally no way to prove that

What on earth do you mean? Have you looked up the data on the Scot Gov website? It really is there. And it really does show a trade deficit of 10% of GDP, if rUK is considered to be a foreign country. In other words: it shows that an independent Scotland would have a very large trade deficit. Mark Blyth is entirely correct about this.

I am stating the straightforward fact that there is no real data to support that estimate because there is no tax border and do no reason to collect it. That is a fact.

Mr Taylor,

Scotland’s supply to rUK is represented by critical sectors, like energy (renewables, oil) where Scotland has big surpluses, the opposite is less true the other way, i.e., are substitutable by other supply chains which determines the negotiating priorities (you cannot rationalise away the deeper structural balance of payments issues). You are also assuming Scotland as a state is already precisely identifiable as a free-standing state in the current data. This is false, in almost every sector Scotland’s data is entangled within Britain because it has not been a priority to identify Scotland separately in three hundred years. The government data for Scotland is a spatchcock of complex estimates and calculations, bolted on to an integrated UK state system (from company data – Scots companies may have a system location in England, and the same with tax). Anyone who has ever dealt with complex systems knows that the approach is unsatisfactory, and we know the British State is reluctant to face fixing the problem; for obvious political reasons; once you provide the system, you then have the information to do something about solving all kinds of problems (including those Britain does not want to solve, because it is not deemed in Britain’s interests).

There is no data system for a separate Scotland, that is deliberate; and that is just a basic existential fact. That is not a claim the result will be favourable to Scotland, it is just the fact – and that is not favourable to good governance in Scotland, or best for the future prosepects of Scotland, or realising its clear, untapped potential. You are promoting irrationalism in Government.

In Ireland, since independence a century ago, share of total trade value has fallen drastically. Imports have fallen from 98%, to little over 23% in 2020; exports have fallen from 81%, to 10%. Other markets have taken precedence (notably the EU), and the prosperity of Ireland has improved immeasurably. (Source: Economics Observatory, ‘Ireland’s economy since independence: what lessons from the past 100 years?’: Figure 1, Ireland’s trade with the UK, 1924-2020 [Trade and Shipping Statistics of Ireland and Comtrade, courtesy of John O’Brien]).

This is not exceptional for countries freeing themselves from the British State; beginning with the US. There is a more interesting and productive world, beyond the introverted inertia of the British State. A post-imperial British state is meaningless; however uncomfortable it may for many to understand, imperialism, frankly was its raison d’être.

Thanks

I am afraid I may be guilty of MMT apostacy.

I think Mark Blyth is partly right and that currency exchange is a bit of an MMT blind spot.

An independent Scotland could not buy more US $s by simply creating more Scottish £s. He is right that there would have to be a reason to sell $s to buy those £s and that the best reason would be to be selling goods and services priced in Scottish £s.

Where Blyth goes haywire is in suggesting that Scotland has no goods or services to sell. Of course it does. But the real work will be put structures in place to get proper value from selling those goods and services. That is the horse that has to go before the independent currency cart.

This whole debate raises a point which I have not seen mentioned. When the Bank of England raises interest rates, I would expect it to affect exchange rates. Higher interest rates will encourage foreign investors to buy UK bonds, thus maintaining or increasing the value of the £. In the short term this may or may not be a benefit, but in the longer term I see it as nothing but a harm. Higher interest rates are likely to discourage the investment UK exporters need to make in order to remain competitive. And in the longer run, more £s will have to be exchanged for $s to repatriate the interest to foreign investors.

MG asks

“How does Scotland harness all that potential power? Export it via cable, or produce green hydrogen perhaps?”

The existing National Grid would be a great place to start?

Agreed