In 2018, I wrote a blog post making clear that I profoundly disagreed with the fiscal rule that was proposed at that time by John McDonnell, when he was shadow Labour Chancellor.

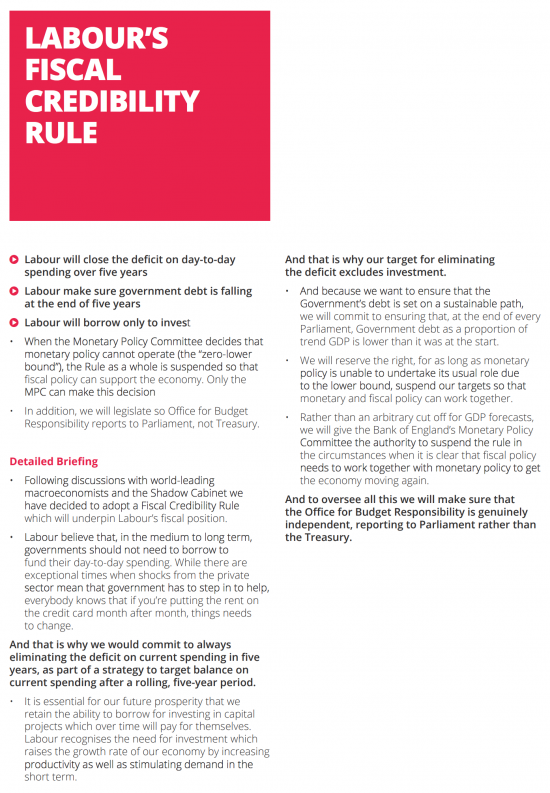

You will not find that fiscal rule on a Labour website anymore, but I happened to screenshot it . This is what it said:

A few sensible, and admittedly sensible, words on what happens in a crisis and when interest rates are at the zero bound apart, you literally could not put a fag paper between what is said there and what Rachel Reeves is saying now or, come to that, what Jeremy Hunt says. The commitment is to:

- Match current expenditure with taxation revenue.

- Borrow only to fund investment.

- Cut the deficit as a proportion of GDP over a five year period.

These three commitments are exactly what Rachael Reeves is saying now, which guarantee us austerity.

I stress, they also offered austerity when John McDonnell endorsed these words in 2018, when he even referred to a crass credit card analogy in the process of doing so.

Why make the point now? There are three good reasons for doing so.

First, this shows that John MacDonnell was nothing like the left-winger that he claimed to be. He was as captured by neoliberal thinking on these issues as Hunt and Reeves are. That is why I could never have worked with him.

Second, this shows that Labour has really not changed, and will not when in office. Austerity is its core belief. It is a fundamentally neoliberal party, and has been for thirty years now. Nothing is going to change.

Third, what that makes clear is that there is no viable political option now being offered by the two main political parties to the vast majority of people in this country who want the needs of the people of this country to be met above all else. None of the politicians leading those parties think that is the job that they will ever be asked to do. They see their role as being to deliver growth even if, as we know, that almost entirely benefits the already wealthy. They are, as a consequence, of no use to our our society and we have to now look elsewhere for answers.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

In 1965 tax revenues were £10bn (£200bn in 2022 money).

In 2022 UK spending was £1,200bn.

Clearly taxes do not pay for spending otherwise we’d have had a paltry £10bn to spend in 2022.

Closing the deficit is a nonsense.

The Conservative Party

The Labour Party

Dumb and Dumber (because Labour should know better).

Best to stop calling it the Labour Party and call it the Starmer Party!

You may be right

I agree with the critique.

One question: did any of them (obvs not Hunt) ever step back and ask: am I looking at gov finance in the right way? What do I know? Why do I know it? (epistemology).

Second question: who was/is advising them – What & why again apply.

My guess is that they unquestioningly just go with the neo-liberal flow (ditto their advisers) – which makes them wholly unfit to be politicos or any sort.

In turn, this shows they focus on detail (balance the budget) not the big picture – get the UK out of the hole it is in (they conflate detail with big picture).

A vote for the 3 main (English) parties is thus a vote for mental pygmies.

I fear so

The SNP gets dangerously close sometimes too – and was there under Sturgeon

I see no evidence that the SNP is still anything other than neo-liberal.

I’d agree that Shona Robison is making many more sensible noises fiscally than Forbes (who is/was a down the line neoliberal, and irredeemably so) but she is hamstrung by Barnet as well as the narrowing of flexibility that the Tories have imposed in their interpretation of the current Scotland Act.

I’d still like to see the SNP outline the MMT options both you and Bill Mitchell have outlined prominently during and post Indyref 1, but I am amazed that Lorna Slater and the Scottish Greens have not hammered this issue at every opportunity, though I’ve been unconvinced by her unpersuasive advocacy on other simpler policies.

The arguments need winning long before Indyref2, and there has been some online discussion, but nowhere near enough.

Agreed

Including on the Scottish Greens

Resonding to both Richard & Tony ref Scotland & the SNP. The Scottish gov has a way out of the current fiscal impasse. Renewables.

“The primary purpose of Crown Estate Scotland is to invest in property, natural resources, and places to create lasting value for the people of Scotland. Surplus revenue (i.e. revenue profit after maintaining and enhancing the value of the estate, as per the Scottish Crown Estate Act 2019) does not belong to the monarch, but is paid to the Scottish Consolidated Fund which in turn helps finance the Scottish Government”

The Scottish gov could thus – for example – develop lots of near-shore wind farms . One example: Firth of Clyde coastline running past Turnberry – shallow – very windy & the old nuke station at Hunterston – with its unused double circuit 400kV line – as the termination point. Cheap a chips (I’d use suction buckets for the foundations) couple of GWs of wind – with the benfit that if Trump visits he’d have some nice wind turbines to look at. The trick would be for the gov to set up its own off-shore wind company – & develop in its own right. Nothing to stop it doing that. Would generate plenty of revs. Could even set up a gov owned company to develop community energy.

I’m somewhet surprised that they don’t. Politicians eh!

Bizarre

Have you told the SNP?

Or would you do an article for The National?

I wouldn’t mind betting that the prospects of the SNP reviving their 2017 plans for a publicly owned Scottish renewable energy company, or even for rejigging the failed “Our Power” supply company with a bolted on generating arm, are close to zero.

I’d also be very surprised if the Westminster government, either light or dark blue, did not either halt or mire such a proposal with qualifications (from the Scotland Act post Brexit on UK competition), as jealousy and spite have been the MO of the Scottish Office for some time.

I can also see a Scottish Power Renewables legal challenge, on competition grounds

As for having the ability, let alone the capacity, to raise the capital funds for such capital investments, plus their related and highly expensive grid connections, I cannot say how the current rules on Scotgov borrowing might work.

Notwithstanding being a nice little earner for Scotgov, it would be great if there were a much larger direct public benefit from renewables, especially for those remoter rural areas with smaller local communities which have problems getting investment funding and actually bear the burdens of externalities. The current provisions for community grants are risible.

Interesting. I extracted Note 9 from the Scottish Consolidated Fund Accounts to 31st March, 2023:

“Under the provisions of Section 36 of the Scotland Act 2016, the Crown Estate Transfer Scheme 2017 transferred the existing Scottish functions of the Crown Estate Commissioners to Scottish Ministers. A new body, Crown Estate Scotland, was established to manage those functions. All revenue surpluses generated by Crown Estate Scotland are paid into the Scottish Consolidated Fund with effect from 2017-18. The surplus paid into the Fund in 2022-23 amounted to £121 million (2021-22: £13 million). Compared to 2021-22, additional surplus of £103 million paid in 2022-23 relates to net ScotWind revenues”.

There is definitely something interesting here to explore and develop.

Mike – we need you in The National…….

I have written an article back in 2017 – it was a bit of a spoof – but at the core it was 100% correct. Near shore wind turbines, Firth of Clyde, very windy, existing large-scale network (Hunterston 400kV lines). Scot gov could start a company to sub-contract the design and then the EPC (engineering, procurement, construction). If it was me, I would partner with one of the big guys (Orsted, Vattenfall or SSE) and do a 51/49 split. Totally normal – already happens in the industry (it’s called “down-farming). & now for the amusing part: Orsted & Vatt are both majority gove owned (Denmark and Sweden).

From my perspective none of this is very hard – but I guess I make the mistake of looking at this through an engineering prism – not a political one. Sigh.

I will mail you Mike – later

Mr Parr,

Help us out here! I should just mention that the problem the British Government may use to try to bury it, is Faslane. Sources of viable continuous revenue independent of Whitehall or tax will make the UK Government very nervous. A defence issue is easy to spin, and costs nothing to use, whether or not it is piffle; and it can be buried in the mystique of official secrecy.

Mr Warren – yes I am sure the Wezzie gov will find all sorts of excuses to stop the Scottish gov taking a DiY approach to wind in general & off-shore wind in particular. In the case of the Clyde – the WTs would sit in shallow water – @ +/- 2kms off-shore the water is +/- 40 feet deep – indeed the whole of the firth is pretty shallow. I don’t have many details of the nukes – but I’m guessing that they chug down the Clyde on the surface? an off-shore WT is easy to see and easy to avoid. But of course I’m using rationale arguments. Silly me.

I have limited insight on the matter, but I seem to recall that in the 1980s the Clyde estuary was thought to have some potential for oil development (George Younger was the Conservative Secretary of State for Scotland), and it was rumoured BP had an interest in exploration; but the Ministry of Defence killed it because of the risk to nuclear submarine movements. I do not know whether the rumours were well founded.

In response to John S Warren’s post at 11:59am today:

You are right about the Ministry of Defence’s interference. The Clyde Estuary was extensively surveyed for oil & gas in the 1980s but the very positive findings were kept secret by the Tory government (shades of the McCrone Report). Despite this secrecy, George Younger, the then Scottish Secretary of State, in a letter to The Times newspaper in 1983, stated, “The oil companies are playing their cards pretty close to their chests, but they are expecting something exploitable (in the Firth of Clyde area)”. The topic was widely known in the West of Scotland at the time and, when no developments were started, the press carried items referring to the MoD’s refusal to permit rigs in the Firth, citing the danger to the nuclear subs in transit to & from Faslane. In 2014 Professor John Howell of the University of Aberdeen analysed the seismic data from the 1980s (previously thought to have been lost) and confirms that “there is a large geological structure there that would be a good target for exploration”. He also states that “there is certainly potential for oil and gas in the Clyde.”

If rigs were deemed to be a great risk to navy submarines, it’s nothing compared to the risk to inshore fishing boats that submarines pose. In 1990 local fishing boat from Carradale in Kintyre, the Antares, was dragged down with the loss of its crew of 4 by Navy sub HMS Trenchant, which was on a training course in the area and had snagged the Antares’ nets. This wasn’t an infrequent occurrence. Per Wikipedia 15 previous incidents involving submarines and trawlers in the 10 year period 1980-90, including one in 1982 that caused the foundering of the Irish trawler Sheralga in the Irish Sea after it was dragged for two miles before sinking. If you were to ask just about anyone from the West of Scotland to choose between nuclear subs and oil/gas rigs in the Firth of Clyde, my guess is most would prefer to see the back of the subs.

That would be my choice and I am no fan of oil.

Mr Flynn of the SNP was making a similar point.

Sunak of course, made his usual sneering reply about tax cuts from him (not true) and Labour/SNP extra taxes falling on ‘working people”.

What about taxes on rich people? Labour could have an open goal.

Happy birthday Richard, welcome to the pensioner world. I have enjoyed ‘retirement’ but I took on another profession and did a lot of reading, and even given some talks.

My great fear is not being able to learn any more

The Scottish Crown Estate revenues seem to be mostly a rentier operation in charging for mooring rights, fish farming and offshore wind turbine ground rents, as well as all their other property income. I had to pay them an annual rental for my boat mooring, for which they did absolutely nothing except send out an invoice. Very much passive capitalism..

It is not the same kind of revenue stream as those that may be generated from an active Scotgov renewables developer and production company, and I’d be interested to know if the sums generated are then offset against any other grant in aid settlements from Westminster.. You know …. the left hand giveth but the right hand taketh away strategy… .

“I had to pay them an annual rental for my boat mooring, for which they did absolutely nothing except send out an invoice. Very much passive capitalism”

It reminds me a little of the UK domestic energy market. The “energy supplier” does not necessarily provide your energy, which is provided by large “energy network providers” (and the energy supplier probably doesn’t supply any energy in very many cases). So what do energy suppliers do? Supply invoices, and nothing else.

I know this from personal experience after Storm Arwen. When I inquired about compensation with my supplier (a major energy company), for the deprivation of energy for five days in winter during and after the storm. I was politely but firmly told the whole problem (return of service, compensation – the lot) was nothing to do with them. I pointed out my contract was with them; and a contract is fundamental in law. I was breezily told that in this case, the Act was relieved them of the responsibility and passed it to the energy provider. I was told to approach my energy network provider; and my suppler couldn’t even tell me who it was. I had never had any contact with the provider, or even knew the specific provider was directly involved. I found out, and they duly stumped up compensation. It has all been fixed by Government and Parliament, in order to create a phoney market out of a monopoly; that collapses as soon as there are any problems; and provides the customer with a supplier, that only produces invoices.

That is Britain today; a living Freedonia, but without the gags.

Spot on

Guess what – all the major parties and their (credible) economic advisors think differently to you – it’s probably time to think that you might be wrong, rather than everyone else.

And it’s working really well, isn’t it?

Have you heard of the Emporor’s new clothes?

The major Parties have “credible” economic advisors?

The current fiscal rules (set in November 2022) are the ninth set of fiscal rules since they were established in 1997. The nine sets of fiscal rules have comprised 26 different rules in total. See Institute of Government, ‘Fiscal rules in the UK since 1997’.

There is a technical term for this form of selective reiteration; making it up as you go along to make it look like you are in control of matters that you ill understand. Credible? Nice joke; i presume that was a joke?

Economics is nothing if not a moral science but under the UK’s political parties it’s become a maudlin science. “Sorry about the tears but you know we have no alternative to inflicting austerity!”

Ironically, the fiscal rules are notable for the target often being missed. This is the kind of credibility we are talking about. They choose them, set the target, and miss them. The Conservatives have proved best at meeting the fiscal rule target, for the Welfare Cap they introduced.

Anyone who has actually dealt with real economic problems can see this kind of methodology, and how it works. In business there are three basic ways management often tackle the desire to improve profitability; innovate, improve sales, or cut costs. The first two are the two difficult ones; the last, cutting costs is typically the ‘go to’ for quick management success. Why? Costs are both relatively easier to achieve, and in the direct control of management. Even if cutting costs is a bad idea, management can usually spin something that at least seems to demonstrate a level of success – because they casn achieve it by decree. Everything else takes either talent, effort, or risk of failure; and all kinds of unknowns most executives wish to avoid.

You are confusing economics with politics. Economics is agnostic of politics.

Politely, don’t be stupid

John, your 2 statements – re ‘selective reiteration’ and ‘fiscal rules are notable for the target often being missed’ – not only accurately describe the pointlessness of following dogma rather the workings of the real world, but also neatly confirm Einstein’s definition that “insanity is doing the same thing over and over again and expecting different results”.

Time for a rethink on just about everything: the UK Constitution, the concept of the UK, the Monarchy, the electoral system, the parliamentary system, the role & composition of the Lords, education, the NHS, the tax system, the rights and powers of the devolved nations, the rights of the individual, a properly representative MSM, the role and effectiveness of the military, and on and on… The rethinking of the UK to make it fit for the 21st century could, in itself, take centuries, given the prevailing tendency to muddle through rather than address problems head-on. I suspect the quickest way to initiate effective change might be for the devolved nations to secede from the UK and that’ll take for ever if they play by current UK rules. Radical action by the devolved nations is probably the best way to waken England up from its slumbers and improve life prospects for ALL the citizens of the UK. Maybe it’s time for the 4 nations of the UK to study how Estonia recovered so rapidly after the Russians left abruptly and left them with no currency, no legal system, no functioning government, education and industry on their knees etc.

I wish that might happen

Sara Browne,

Far more important than a trivial deflection of the issue to me (who cares?); would you care to explain and justify the nine sets of fiscal rules and twenty-six different rules; most of which miss their targets (except if they just eliminate the problem altogether by simply cutting the cost stone dead); all produced with the help of “credible” economists, who were taking no account of political assumptions? How does that work?

The problem with economists is that they can’t do predictions; which is the only real point of any discipline that aspires to be a science. You were slightly closer your the reference to agnosticism; it presumably represents your unconscious recognition that economics is far, far closer to theology than the claim to science it has failed so badly.

Thank you, Neil.

Please explain what makes them credible.

I deal with the shadow Treasury and Business teams regularly as I represent my City employer at a trade body working with Labour and am aware of the banksters and vulture capitalists assembled by Blair and Mandelson to do the thinking for Starmer and Reeves.

I have in front of me Ha-Joon Chang’s Little Blue Book.

Five things they don’t tell you about economics:

1. 95% of economics is common sense

2. Economics is not a science

3. Economics is politics

4. Never trust an economist

5. Economics is too important to be left to the economists.

That’s it.

At least the phrase “will only borrow to invest” allows pretty wide interpretation.

As you wrote the other day (evidence to House of Lords) “… there is an obvious need for increased state investment in the UK, which could only be funded by debt. Social housing, the NHS, education, flood defences, transport, energy transformation as a result of climate change, and much else demand funding and no business would pay for this out of revenue: they would borrow. So should the government”.

But I doubt whether Labour are brave enough to make those investments, given the way they constantly harp on about their (imaginary) fiscal rules.

With incisive elucidation and visible emotion, Owen Jones lists the 1001 reasons why, after 24 years, he has just left the lab. party and is starting a fundraiser to try to get alternative candidates elected at the forthcoming election.

https://www.youtube.com/watch?v=fxBEaJWJNJk

Just a thought. I wonder if Owen Jones could be prevailed upon to grant Richard an in depth interview on his YouTube channel, assuming, of course, that Richard was willing to do it. It would reach a lot of people as would interviews on Novara Media or Labour Social, although they might baulk at the idea.

I have been on with him

I will drop him a note, but I suspect he is quite busy right now

It becomes increasingly clear that there is something deeply negative in the modern British psyche. We punish ourselves with austerity, with Brexit, with disdain for local opinion, and probably in numerous other more subtle ways too. Could this simply be guilt for our colonial past? For the way we behaved whilst members of the EU? And yet at the same time we still persist with outdated colonialist rhetoric, for example over Gaza. Isn’t it time we learned how to be a successful nation in the modern world? To be proud, but not too proud? Richard’s tax changes would certainly be a great start.

Fiscal rules is fiscal fools, the lot of them.

Understanding Sectoral Balances Accounting’s effect on the workings of the UK monetary system means you can only view all the UK’s political parties as being fundamentally undemocratic and therefore morally not worth voting for. They cannot adequately respond to the people’s needs if they don’t understand the effects of Sectoral Balances Accounting. Instead they mindlessly, or deliberately deploy Neoliberal/Neoclassical fiscal rules, that primarily benefit the wealthy. Here are those SBA effects explained in two ways:-

“Notwithstanding the extreme simplicity of this model we are already able to reach a supremely important policy conclusion which will survive throughout this book. Given the level of activity, the quantity of private wealth and the rate at which it accumulates are determined entirely by the propensities of the private sector, which the government cannot change. But this is to imply (again given the level of activity) that government deficits and debts (being identically equal to, respectively, private saving and wealth) are endogenous variables which cannot be controlled by governments. This conclusion totally contradicts many influential, or even statutory, proposals regarding the regulation of fiscal policy which are made in abstraction from any consideration of how economies actually work – for instance the European Maastricht rules, Gordon Brown’s Golden Rule in the United Kingdom and, most important, the view widely held by ignorant politicians and members of the public that government budgets should be balanced.”

Page 142:-

http://ndl.ethernet.edu.et/bitstream/123456789/8726/1/53%20.%20Wynne_Godley.pdf

This Godley and Lavoie statement is reinforced again in the GIMM’s submission document to the House of Lords National Debt Committee:-

Section 2.3.2:-

“It’s important to understand that although the government can control how much it spends, the amount of tax collected depends on the number of taxable transactions happening in the economy, as tax is generally a percentage of the transaction amount. Therefore, the total amount of tax collected in any given period is primarily determined by the spending and saving decisions of the non-government sector and not by government policy. If the non-government sector decides to increase its net savings or import even more than it exports, only a portion of the money spent by the government will recirculate within the domestic economy. The tax collected will be less, and the budget deficit will increase. Net saving and net importing are typical behaviours of the UK domestic private sector, which is why the government has a deficit financial position in most years.”

https://committees.parliament.uk/writtenevidence/128254/pdf/

Thanks

So the Scottish might create “Money out of Wind” whilst the English go about trying to stop the government from creating it from nothing!

To meet the needs of all people within the means of the planet. This is Donut Economics as articulated by Kate Rowath. It has been adopted by the Green Party. They want to rejoin EU and have huge spending plans. Why not give their economic policies a shout out!

What are you asking?

(not the same Colin..!)

It’s rather that the Greens need to grasp Richard’s economic and tax proposals!

And deal with poverty and broken public services ASAP (if they have any chance to do so); not wait around for a few closed loopholes to bring in a bit more tax (very little, in Labour’s schema) and certainly not wait for growth to appear by magic after private investment, so ‘we can afford it’.

(I’m a GPEW member, btw. Not with much traction myself on effecting the above, though; at least not yet…)

The narrative that many Labour supporters online seem to believe on economic policy is that Hunt is on the right, McDonnell is so far left as to be out of sight and Rachael Reeves is somewhere midway between the two, when the reality is that there is hardly enough room to insert a cigarette paper between Hunt’s and McDonnell’s positions. I am prepared to believe that McDonnell comes with more goodwill than the other two and that maybe Reeves comes with more goodwill than Hunt, but goodwill does not put food on the table.

It seems to me that discussions of economics in the media is dominated by psychological attitudes associated with the language used. Thus debt is associated with bad things so it must be good to reduce the national debt, growth is associated with good things so economic growth must be good and, finally, prudent people follow the rules and so it must be right to keep to the fiscal rules. But without first knowing what entities “national debt”, “economic growth” and “fiscal rules” refer to there is no way of knowing whether these judgements are reasonable. I would say that all three notions are problematic.

One way the government could reduce the national debt is by indulging in QT. But there is something fishy going on here because what is being sold is itself part of the national debt. It strikes me that there is no rational notion of debt in which government issued bonds can be considered part of the national debt when they are owned by the BofE, but apparently they are. If they are sold then it would be reasonable to include them in the national debt again. In fact, if they are sold on the open market then what from the conventional point of view is seen as a decrease in the national debt could well end up, from a more reasonable point of view, as being an increase.

When it comes to economic growth the standard narrative in the media seems to be that it is needed in order for the government to afford to spend more. The logic of that assumption would seem to imply that it is fortunate for the Japanese that they always have rapid economic growth after a major earthquake because otherwise they would not be able to afford to clear up the mess. Economic growth, as a an aim, would not be such a bad idea if GDP were defined in a way that related it to the well being of society, but GDP strikes me as truly bizarre, for while it includes what I pay myself to have the right to live in my own house, for some unaccountable reason it does not include what I pay myself to do the washing up. But, joking aside, the precise definition has political consequences because a government can engineer a certain amount of economic growth merely by encouraging activities that are included in the definition and discouraging ones that are not.

When it comes to following fiscal rules, it has to be asked what is he purpose of these rules, whether they achieve that purpose, and whether that purpose is worth achieving. If the purpose of the fiscal rules is to sound reasonable to those who can’t or won’t think deeply about their consequences then I suppose fiscal rules, as commonly understood, achieve that purpose. Those who take this to be their purpose and still promote them are deceiving the public and those who think following these rules can achieve some more noble purpose are deceiving themselves.

Here’s a very simple YouTube video that even British politicians ought to be able to understand! It should make very clear that if you don’t understand it you’re going to be in no position to democratically respond to all the needs of the nation. Politicians will in fact be operating a very indifferent authoritarian government if they gain power like the prospects of a Starmer Party administration, or the return of a Tory one, or even a coalition:-

https://www.youtube.com/watch?v=128NAbDcsLA

What does it mean to say that ‘our target for eliminating the deficit excludes inflation’.

The deficit is the difference between government spending and taxation.

Were Labour proposing in 2018 that the deficit that they proposed to eliminate was government spending less government investment spending less taxation?

What does it mean to say that ‘our target for eliminating the deficit excludes investment’.

The deficit is the difference between government spending and taxation.

Were Labour proposing in 2018 that the deficit that they proposed to eliminate was government spending less government investment spending less taxation?

It was all nonsense

I do think there was some difference between how McDonnell and Reeves aimed/aim to meet these rules. I am not defending McDonnell as I agree with you that these are bad rules, but I do think he would have been much more progressive within the confines of the rules than Reeves plans to be.

Reeves claims she can meet the rules through growth which will come from three things: (1) stability (i.e. fiscal rules, i.e. austerity), (2) investment – mostly business investment (which will increase thanks to a strategic and selective modern industrial policy that will identify market failures and other barriers to investment and remove them) with some government investment (Green Prosperity Plan, National Wealth Fund, and Great British Energy), and (3) reform (of the planning system, public services, labour market, and government).

The current budget rule is determined by Spend (Current) – Tax

The debt / % GDP rule is determined by GDP and Spend (Current + Investment) – Tax

The current budget rule can be met by decreasing current spend or increasing tax

The debt / % GDP rule can be met by increasing GDP, decreasing spend (current or investment) or increasing tax

Again, I’m not defending McDonnell’s adoption of the rules, but given that he did adopt them I think he would have had much more beneficial balance than Reeves for these. Reeves approach is based on lower tax, lower government investment, and lower current spending, and helping business to grow GDP by providing austerity and removing barriers to business investment (she doesn’t seem to have noticed that Osborne has already tried this and it didn’t work). McDonnell would have had much higher levels of current spend and investment spend that would be covered by (a) higher taxes on the rich / corporations and (b) a bigger increase in GDP from government investment. He would have aimed for the combination of all these to mean that austerity wasn’t required.

Obviously you can have unlimited investment spending and not have this increase the current budget, which leaves the second rule of falling debt as a % of GDP. The investment spending would need to help grow the economy by more than the increase in debt. Would this be possible? Maybe over the longer term, but over one parliament, perhaps not. I think that McDonnell was confident the combination of increased GDP from government investment and higher taxes on the wealthy/business would have been enough – at least it would have been better than Reeves’ combination of austerity and relying on business investment to grow GDP.

In the end I believe he wouldn’t have delivered austerity but would have failed to come close to meeting the rules, which in my view is a good thing. I agree that these are bad rules and he would have been much better off not taking them up, but I still believe what he would have given would have been much better than what we will get under Reeves.

Fair comment

I still think McDonnell should never have gone near somthing so unwise, and I did note it included some sensible exceptions, but thank you

Will Hutton seems to think she’s had a damascene conversion

https://www.theguardian.com/commentisfree/2024/mar/24/for-the-birds-rachel-reeves-has-outlined-a-plan-to-give-britain-liftoff

Dont hold your breath

I think he wants a job

Very hard to explain that nonsense otherwise

I will cover it, maybe not today