I am continuing to work on data from HM Revenue & Customs on its accounts, the tax gap and other issues related to its management of the UK's tax system.

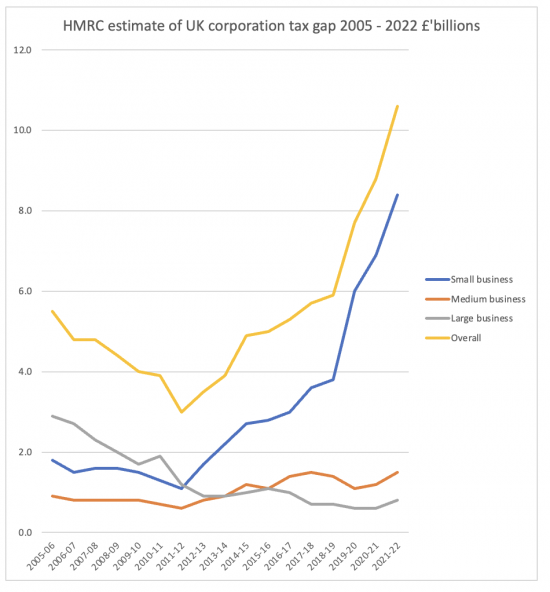

When doing so, I created this chart based on data in section five of the data files on the 2023 tax gap report, downloadable from the HMRC website:

The tax gap is the difference between the tax that HMRC think should be collected each year and they amount that they actually get.

As will be apparent, since I and others began work on tax justice the large company corporation tax gap has fallen from about 8 per cent of revenues to around 2 per cent of revenues. There are, of course, issues I would disagree with on both estimates, but that this trend is correct is, I am sure, correct.

We brought pressure to bear on the government on the large company tax gap from 2005. I created country-by-country reporting that is now in use in about 80 countries, including the UK, to tackle this issue. Large company tax abuse is no longer the issue it was. Investing further effort in it is no longer a priority in the UK and many other countries. It really is time that the current misguided tax justice movement took note: they are barking up the wrong tree when this is just about the only issue that they are still willing to talk about.

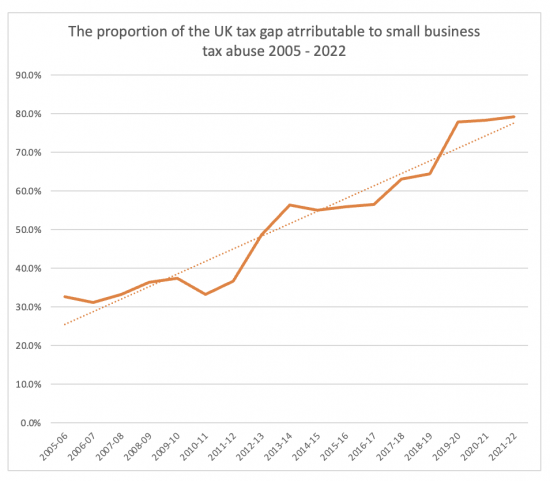

The chart does, in itself, prove why. The small business tax gap has gone through the roof. As a proportion of the total UK corporate tax gap it has changed like this:

Small company non-payment of tax is now the issue in the UK corporate tax arena. HM Revenue & Customs do, I think, still seriously underestimate this tax gap and its ramifications by suggesting that it might be £8.4 billion a year. The large business tax gap is, in their estimate, just ten per cent of that.

But the question is, why is this? I am musing on there being one very obvious cause. Look at the inflexion point in the top chart. It is 2011/12. That is when HM Revenue & Customs began to close local tax offices, end on-site PAYE inspection, and, most especially, began the process of ending almost all on-site VAT inspections of small businesses.

If VAT is not paid, sales go unrecorded. If sales go unrecorded, so too does profit. So, too, incidentally, does PAYE on the money illicitly taken from the companies involved. The small business corporation tax losses since 2012 arising as a result might have amounted to £25 billion in my estimate. The other losses will have exceeded that sum, easily. And that is all because HMRC tried to save £1 billion, maybe, a year.

We are paying an enormous price for HM Revenue & Customs mismanagement in that case. They took HM Revenue & Customs out of the community and the price we are paying for that is very high.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting research.

How does the HMRC tax gap compare with other tax authorities right here in the UK such as Councils, TV Licensing, even collection of road tolls or DVLA. My guess is that they are about similar and certainly I know of one council that massages figures to make the gap appear lower than it really is. But with you being a tax expert you may have the data to hand.

I have no idea

I have not researched the issue and I do not think they are directly comparable

Really interesting piece of correlation and research – are there comparable figures with other countries?

No other country does tax gaps in these areas in the same detail

Don’t know how much my small business experience is common or part the issue. In the 1990s and noughties I remembered on premises tax inspections, requested at short notice. Occasionally, but not infrequent. VAT seemed to be the focus. A particularly diligent accounts manager swore they had a minimum collection figure and would stay until they found enough to pay for the visit! Long correspondence with the inspector often followed and small changes in accounting practice made. Then the local tax office was closed. Inspections stopped.

Thanks

Those visits were a massive force for good: no one enjoyed them but they knew they had to keep good records as a result

As with much of this country, we don’t seem serious anymore about these matters and all I see is increasing centralisation that enables rich funders to get their hands on state apparatus and make it ‘disappear’.

Thank you, PSR.

You should hear what Labour is proposing to the City: Ownership of infrastructure, delivery of public services, seats on central and local government bodies tasked with planning permission, economic development and training, secondment of banksters to all levels of governments, greater independence for the Bank of England, more influence for the OBR etc. There seems no point voting.

My only quibble with your comment is the word any more. In my lifetime, far too often, I have had the impression that people are not serious here. I sat near techies working on Y2K at NatWest and HSBC and often heard and hear outsiders say it was a nothing burger. So often, things and experts are demeaned. Brexit was just the latest example. That’s what leads to leaders like Johnson.

Thank you, Richard.

I temped at the local tax office. A decade later, under New Labour, the office and others in the Thames Valley closed. The building was empty for a years and then converted into flats.

You are right about the price. I would add employing locals, often the foundation for a career. This said, it was understaffed and, compared to the insurer opposite, the late and unlamented Equitable Life, paid about two thirds of what Equitable paid for a junior.

Speaking of New Labour, New New Labour’s business and trade team, led by Jonathan Reynolds and Tan Dhesi, were hosted by my former colleagues at the banking trade body yesterday. Labour seems to think that banksters are the only businesses that exist / contribute. I can’t think of a Labourite who has set up and / or run a business, especially a small one, which part explains the misguided infatuation. This also sends a signal to regulators. This happened under New Labour and ended in disaster, a disaster that this country has yet to recover from.

I think this absence of business experience in Labour is very worrying

Thank you, Richard.

I agree and add that they don’t appear interested. They seem to think the world or their world revolves around finance, PR, technology, NGOs and media, London and satellites like Oxbridge.

This lack of curiosity and limits, which manifested itself like the Chipping Norton set, quickly became apparent when I began working on regulatory and trade policy, late noughties.

You again hit a raw nerve today because I am trying to set up a personal Government Gateway Account which I have not needed before because I always operated within a company as a tax advisor. I believe that I will start paying tax for the first time in years this April because of the increase in the state pension without any commensurate increase in the personal allowance. As you have pointed out, this is like;y to affect a large number of pensioners, and we need to check that our tax codes are correct. So I attempted to create a new gateway account but the system was unable to verify my identity from the answers I gave to be checked against my TransUnion records. I have double checked that those records are correct, but still it wont verify my identity. I then tried to phone HMRC and was given the usual runaround where they try to get you to do it online (which I can’t because I don’t have an account) and after several minutes I got a message saying there is a technical fault and to try later. Like someone else has said I greatly lament the loss of local HMRC offices where there were actual human beings who were always very helpful.

End of rant. But can anyone suggest a way of fooling the system?

This is a system that has a horrible inclination to say no.

It has done it to me using all the right data before now.

I can’t help with the access issue, however I do have a word of advice about self assessment as a state pensioner. Do not trust HMRC and DWP figures.

DWP tells HMRC how much state pension you receive weekly. HMRC converts that into annual income by multiplying by 52. However, unless your state pension is paid to you on 5 April, your annual state pension is not the weekly amount * 52. Your first 4 weekly payment will include 1 week at last year’s rate. DWP does not send you a payslip. Unless you are as obsessive as I am you will assume that the amount DWP and HMRC claim you received as state pension is accurate. For me, this year, my actual state pension income is more than £20 less than HMRC believes it to be. Unless I send a self assessment, declaring my accurate state pension income and then respond when I am asked to explain why it is different from the figure they have, I will pay £4.00 too much tax.

I accept that £4.00 is not a lot in the scheme of things, but it is MY £4.00 It does not belong to HMRC. I calculate this could affect 10 Million pensioners every year. Why should HMRC steal £4,000,000 from pensioners?

Exactly at the point that I retired from tax inspecting. Never realised I was that good!

I bet you were!

This from a friend who works in HMRC:

‘There is an element of truth in what he says that there was a shift of emphasis away from face to face interactions as they are expensive in relation to the amount of return. However, what his analysis overlooks is 3 factors

1) For the last 3 years, a huge amount of resources have been diverted to creating,maintaining, and policing Covid relief schemes. The government ignored our suggested balances and checks, and so widespread fraud ensued

2) This government is he’ll bent on reducing the size and cost of the Civil Service. Consequently, we don’t have the human resources or tools to do the job properly. Our team, for example, is currently operating on 20 full-time equivalent staff less than we require to do the job. Our basic analysis tools are nearly 20 years old and held together with sticky tape and string

3) The government also have created a light touch governance regime. Companies no longer need to submit detailed accounts to Companies House and subsequently to us. Without the detail needed to spot obvious patterns as we were used to be able to do we are struggling. It was easy to spot underdeclaration of profits where we could compare returns that shared the same data points. Those are now non-existent, so it is like looking for a needle in a haystack.’

I buy (1) but it does not udnerkine my point: additional resources should hgave been supplied.

I buy (2) but it makes my point.

(3) is wrong. HMRC still get full accounts.