I am now working on the last major section of the Taxing Wealth Report. This refers to the administration of HMRC.

My focus was initially going to be on the lack of funding supplied to HMRC, about which its management gets rather excited because they think that proves their claims that they have improved the organisation's productivity. However, the more that I am getting into this issue, the more I realise that the questions that need to be asked are much more significant. In particular, I am very concerned about the quality of the data that HMRC makes available to let us appraise its performance and so decide whether its funding is appropriate.

I might discuss the problems that I have found with HMRC‘s accounts in another post. In this one, I want to address one of my long-standing bugbears, which is HMRC‘s data on the tax gap.

The tax gap is the difference between the tax that HMRC think should be collected in a tax year, based upon the legislation then in existence, and the amount of tax actually paid in that year. I have, for many years, criticised HMRC data on this issue and the methodologies that they have employed to estimate the tax gap, whilst also giving them due credit for the fact that they are the only major tax authority that does try to publish this information on an annual basis.

My question at this moment is just how useful that annually published data really is. That is because HMRC have a habit of updating their estimates of tax gaps, regularly. In fact, hardly a year goes by without HMRC revising the data that they have previously published on the tax gap for a particular year.

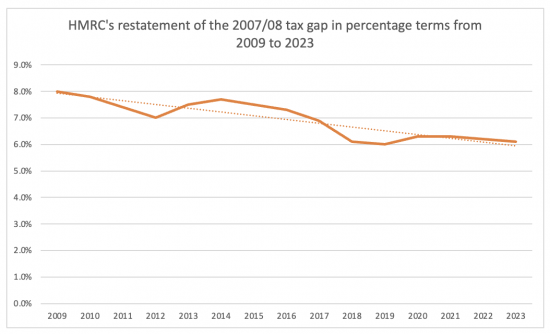

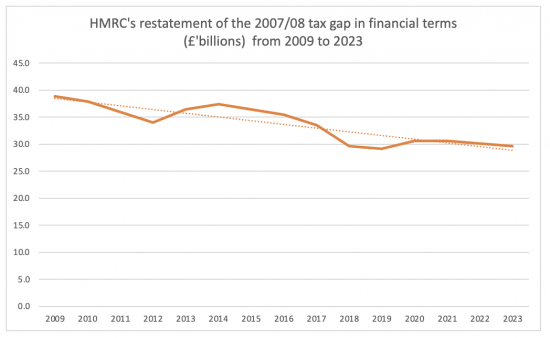

Take as an example the tax gap for the year 2007/08, which is one of the earliest for which data is available. Information for that year was first published in the 2009 tax gap report and was suggested to be £38.8 billion. That was eight per cent of the total tax owing for that year. Since then, that estimate has been revised. That revision has not happened once or twice, which is the most that would ever really happen with regard to commercial financial accounting information before serious questions about the underlying quality of the accounting information of the reporting organisation arose and its auditors became subject to intense scrutiny. It has, in fact happened every year since publication first place. As a result, the percentage tax gap for the years question has been re-stated as follows:

I added a trend line.

Expressed in financial terms, the tax gap for that year has moved as follows:

The data source is the Excel data publication that supports the 2023 tax gap from HMRC.

1.9% of the tax gap for 2007/08 has disappeared since 2009. The sum in question is £9.2 billion. That would be good news if I believed it was true. Actually, I think it simply because re-estimation has taken place.

Think about this for a minute and reflect on how HMRC would react if a taxpayer went back to them every year, saying that they wished to revise the estimates included in their accounts going back well over a decade. That might be tolerated once, subject to a potential tax investigation unless very good reasons were given. Multiple restatements would, most likely, give rise to the tax payer suffering an extraordinary degree of scrutiny, which I think it reasonable to presume they would not enjoy. Restating every year would be utterly unacceptable, but that would be particularly true if, as in this case, the estimate was revised downwards from years year, implying the total overall profit each year rose as a result, with successive tax underpayments arising as a result. All hell would break loose if that were to happen, and rightly so. So why do HMRC think that they can get away with this?

My questions are straightforward. Firstly, why are HMC allowed to do this without sufficiently highlighting what they are doing on an ongoing basis, which is to always (it seems) find errors that suit their management's agenda?

Why, secondly, are they allowed as a result to present this headline data without making it sufficiently clear that the comparisons that they are make are not with the contemporaneous data of the periods to which they refer, but to some moving target that has been in existence ever since? I find it annoying when financial statements are restated, usually for one year at most of the time, and usually for reasons that are made very transparent in the financial statements, but the other thing what is happening with HMRC is that it is very hard to explain why these successive restatements are occurring, and even need to be made. And for the record, I have read the methodology notes.

If HMRC want to provide information that they wish me to believe, then I do really think that they should be subject to the requirement that they impose on others, which is that we use our best effort to get information right the first time that they prepare and submit it. They should not enjoy the opportunity that others do not to continually restate it to suit our own agenda.

Is it too much to ask that HMRC state their opinion and then stick to it?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Keep up the good work. It sounds like that Taxing Wealth Report is building towards a climactic final chapter. It’s certainly got a few people feeling the same way as you do when you hear the Du-Du-Du at the end of Eastenders.

Typo to fix:

That might be might be tolerated once

Thanks

Nice work.

My first reaction to this is that the tax gap surely contributes to inflation?

My second reaction is ‘How convenient for some is the way HMRC works’.

A parliamentary committee anyone?

This may go to the PAC

Agreed. Richard and PSR

But rank has it’s privileges, if you will. Only the little people have to follow the ‘rules’.

You probably have seen this but..

“How much money is the UK government borrowing, and does it matter?”

https://www.bbc.co.uk/news/business-50504151

I have seen it

It’s nonsense

Maybe HMRC should state a margin of error when they estimate the annual tax gap, say plus or minus 2%, 5%? HMRC should do this rather than waste an inordinate amount of time going through all the taxes due and taxes taken again. Time spent on the revision would be better spent chasing up the big tax defaulters ie large corporations and million/billionaires..-_

No, they should publish it once and then, as accoot9ing does, show revisions to0 earlier years plus workings as a separate number in later periods, if necessary.