As has been widely reported in the media, Rishi Sunak's tax return for 2022/23 was published yesterday.

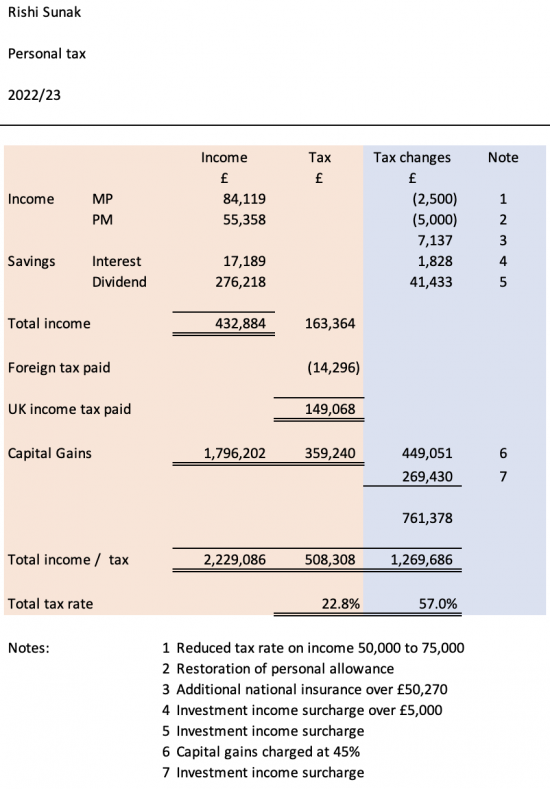

The data as published by his accountants has the pink background in this table:

As is apparent, Sunak's overall tax rate was just 22.8 per cent, mainly because he paid exactly 20 per cent tax on his considerable capital gains.

I thought that reworking this data on the basis of the Taxing Wealth Report 2024 recommendations would be a worthwhile case study. The adjustments and resulting additional tax liabilities are shown on a blue background. The notes explaining the reason for the changes are at the bottom of the table.

As will be seen, the latest recommendations, suggesting reduced tax rates on income from £50,000 to £75,000 a year and restoring the personal allowance over £100,000, are made in this table.

The other changes reflect:

- national insurance being charged on all earned income;

- investment income surcharges at 15 per cent being charged on all but the first £5,000 of investment income, including capital gains;

- capital gains being charged at his top income tax rate (45%).

Without knowing his pension contributions, no adjustment for reduced pension contribution allowances has been made.

The additional tax owing would be £761,378. This is a tax rate of 57%. This is unsurprising: this is, in effect, a 45% tax charge on almost all income from all sources plus an investment income surcharge to compensate for the lack of employers' and employees' national insurance otherwise being paid on investment income.

The resulting tax liability is fair. What Rishi Sunak paid in 2022/23 was not and was instead an insult to all people who worked for a living and paid much higher rates of tax than the prime minister.

I would suggest that the Taxing Wealth Report 2024 achieves its goals if it delivers this outcome.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Looks fair to me.

How would this affect capital gains from startups EMI stocks or the like.

I have CSOP shares and EMI which I hope one day will be worth something. Also had shares from another large startup which I sold when they IPOd. I paid 20% in those but did pay 45% in my RSUs.

If I’m hit with 45% tax I don’t see much incentive for taking a risk with a startup and I would expect the same for people wanting to start tech businesses.

No entrepreneur was ever put off by tax

I know that for a fact

I wonder why you are trolled?

Worth pointuing out that if you are on Universal Credit you lose every pennhy of income you have other than earnings, ie a 100% tax rate

How about Jeremy Hunt, he has quite a lot of rental and other income?> See yesterday’s Guardian.

Let’s stick with this one for this morning

I found the reporting strange. None of the articles I read covering this quoted the percentage tax paid, bit odd the reader was left to work it out for themselves.

Brilliant, looks good and shows the vile behind the smile – thank you

I simply repeat the points I made last year. https://www.taxresearch.org.uk/Blog/2023/03/23/sunaks-tax-disclosures-were-half-hearted-he-needs-to-do-better/

Despite much of the press misleadingly describing it as such, this one page summary is not a tax return.

It is not clear the nature of the blind investment fund that delivers significant dividends and consistent capital gains to him on an annual basis.

It is said that none of the returns from the fund were distributed to him. So how did he pay the tax?

I’ll add, as someone in the lucky position to earn enough that I pay significant amounts of income tax and NICs each year, I find it unacceptable that his annual income and gains (not just one off gains, but repeated year after year – so why is this not taxed as income?) are over £2m but he pays little more than 20% tax.

Does Sunak think it is fair that his overall tax rate is about half the general population? That a millionaire like him is in effect a basic rate taxpayer?

All entirely fair points

(Half the tax rate of the general population, if they were to earn similar amounts, that is – most of the population pay no income tax or capital gains tax, or only pay at the basic rate.)

The question for Sunak is I think whether he believes in a progressive tax system, where each contributes according to their means, and the heaviest burden falls on those with the greatest ability to pay. And if so, why does someone with annual income (and repeated gains) of over £2m pay less than 23% tax?

If a self-employed person earned as much as him in 2022/23 – and some people do – they would have paid income tax of about £976,000 and NICs of about £62.000.

Spot on

Dan Neidle has pointed out that there is no evidence of any gift aid being claimed for charitable donations that Sunak has made.

Perhaps Sunak does not support any charities, or perhaps he does not claim the tax relief.

It is a little peculiar, because there were reports in 2022 that he and his wife had given a donation of £100,000 to his old school. Perhaps his wife provided the funds and claimed the tax relief. Or perhaps £40,000 (the difference between basic rate relief given at source, and higher rate tax relief claimed through the tax return) is a trifling matter for them, not worth claiming.

There is a similar question about how Sunak manages to pay the tax on all of the income and gains that are not distributed to him.

It also appears that he makes no contributions to pension funds, or at least claims no tax relief.

Disclosure of a full income tax return – rather than a one-page summary – might make some of this a little clearer.

Indeed

All very odd

Sorry. I need to correct an awful typo. I mean to write £20k not £40k.

Assuming the gross amount of a donation paid though gift aid was £100,000 then basic rate relief at source would be £20k and higher rate relief would be another £20k (probably an underestimate, as I expect some relief would be at the 45% additional rate, less the 20% basic rate relief already given).

His basic rate band would take been extended…..

Excellent idea to show a concrete example. Thank you.

A fantastic opportunity to illustrate the points you have been been making for so long.

I’m also struck by how much he is still left with after your much fairer exercise. I’d be happy with that. And how a man earning so much money seems totally at ease with setting about reducing the income of everyone else!

And the other thing that strikes me is how addictive money is – the accumulation of it?

I go back to my observation about how money changes people’s perception of themselves , indeed their attitudes to everything. In the documentary film Inside Job, one commentator puts forward research that suggests that making money actually stimulates that part of the brain that is also stimulated by taking drugs like cocaine!

In some countries, alcohol is taxed highly to make it deliberately expensive to curb abuse – like they do with cigarettes now.

Perhaps taxing the huge incomes of our rich is due in order to save them from themselves, save us from them and save the planet too.

Also, before the trolls come in and start talking about having ‘independent means’ to look after one’s self let us be clear: a lot of the means by which the rich get rich is by taking MORE than their fair share of money from economic output.

In plain English therefore, those seeking ‘independent means’ can quite often be robbing others of the means to do the same thing.

That is not progressive, fair or even rational. It’s called greed and our Prime Minister is fine example of it and it is only because of the rather twisted times we live in, him and his party get away with it.

Great idea! A comparison with a taxpayer on average pay, modest savings and no capital gains would provide an eloquent comparison.

Thank you, an interesting illustration. For comparison I worked out my own average rate, on an income nearly two orders of magnitude smaller. It was 15%.

My only confusion is that my recollection hadn’t been that your reports proposed tax rates over 50% since you were largely concentrating on tidying up anomalies and injustices, rather than proposing a totally new set of tax rates (for example aligning interest/dividend and rental income taxation with that for salaried income including NI). In which case the overall tax rate couldn’t exceed 50%. I assume I must have missed, or at least failed to appreciate, some of your instalments. I look forward to you finalising the entire report, so that we can better appreciate how all your suggestions fit together.

I have never proposed an income tax rate over 45%. But with proper NIC and quasi-nic charges the rate goes above that. And remember, for a student earning 60,000 with three children marginal rates can reach 80% now. I am being very fair.

It seems to me perfectly fair. It is comparisons with people on much lower incomes that matter, however when the real underlying inequities of taxation are examined.

From the calculation, Sunak is paying an average tax rate of 34.4% on his UK income, excluding the capital gains (which, I submit are a special case). What really matter here, however is the post-tax income; £284,000.

In the case of someone on £20,000 income, and an average 12.3% tax rate, he/she will have around £17,500 post-tax to spend.

The inequity between them only strikes home when the low income person spends money, with indirect taxes (e.g. VAT @ 20%) being very regressive taxes, compounding the cost disadvantage the lowest paid person purchasing the same (say) £1,000 vattable item actually faces. The £200 VAT in such an example leaves the low paid person paying a price that has a relatively higher adverse impact on his/her remaining spending resources . For someone with £284,000, the £200 VT is immaterial; 0.00007% of total post-tax income.

The £200 for the low pay example accounts for 1.1% of post-tax income.

If it was all salary, according to The Salary Calculator he would have paid £989291 in Income Tax & £47346 in NI making a total of £1036637 or just under 50% of his total income

But I have suggested other changes, including increased NIC

Why has the personal allowance been restored, surely earnings exceed the level he where that applies?

Why not read the Taxing Wealth Report? I suggest it should be given the other rate increases I propose.

I made clear the source of the changes in the post.

Thanks for the reply, it was a genuine question and in no way a criticism of anything nor trolling.

I deleted the trolling bit

See https://www.taxresearch.org.uk/Blog/2024/02/08/the-taxing-wealth-report-removing-existing-anomalies-within-the-uk-system-that-prevent-the-delivery-of-tax-justice-might-cost-19-1-billion-per-annum/

As I recall when I did my Professional Exams pre Thatcher, the top marginal rate of tax was 83% with a 15% investment surcharge – 98%!

Taxing Wealth recommendations seem gentle by comparison!

True

Richard, I certainly hope this format is shared widely.

Richard, I certainly hope this format is shared widely. Twitter, Linkedin, Facebook …