I have this morning published the latest note in my series that will make up the Taxing Wealth Report 2024.

This latest note suggests that if an overall just system of taxation is to be delivered by the Taxing Wealth Report 2024 then some existing tax charges and reliefs of allowances for those on higher incomes will have to be withdrawn.

In particular, the High Income Child Benefit Charge and the ending of the personal allowance for those on incomes over £100,000 per annum will have to end, and revised income tax rates for those with earnings between £50,000 and £75,000 per annum will be required if penal tax charges are to be avoided. These changes come at a combined cost to tax revenue of in excess of £19 billion, but without them, the other revenue-raising proposals in the Taxing Wealth Report 2024 would not be appropriate.

The summary of this report says:

Brief Summary

This note suggests that:

- Although the Taxing Wealth Report 2024 has identified many anomalous tax rates reliefs and allowances within the UK tax system that are in need of correction where doing so will raise significant extra tax revenues, there are other tax allowances and reliefs that would also need to be addressed if the recommendations within the Taxing Wealth Report 2024 are adopted so that a tax system that is in overall terms just might be created in the UK.

- In the three cases highlighted in this note, correcting anomalous tax rates reliefs and allowances within the UK tax system might reduce overall tax revenues because those in use do, at present, create tax injustice at cost to those with higher income and wealth. It is not possible to promote tax justice without taking these issues into account, presuming that the other recommendations within the Taxing Wealth Report 2024 are adopted.

- The first of these issues relates to the High Income Child Benefit Charge (HICBC). This withdraws a claim for child benefit from any person living in the same household as the child in respect of which that claim is made if that person is earning between £50,000 and £60,000. The tax collected as a result is estimated to be £1 billion a year, but marginal tax rates exceeding 70 per cent can arise as a result, and in combination with the changes in the Taxing Wealth Report 2024 these would be unacceptable and as such this charge needs to be abolished.

- The second charge relates to the phasing out of the personal income tax allowance for persons earning between £100,000 and £125,140 a year, meaning that in that range an additional 20 per cent tax charge arises. On top of the other changes recommended in the Taxing Wealth Report 2024 that would result in unacceptable tax rates that also defeat the desired steady progressiveness of the tax system and as such this charge should be abolished, but only if the other recommendations in the Taxing Wealth Report 2024 are accepted. The cost would be approximately £5.6 billion per annum.

- The third change would be to the income tax rate on earnings and gains totalling between £50,000 and £75,000. Again, this change is only recommended if the changes suggested in the Taxing Wealth Report 2024 are accepted as otherwise there would be no need to do so. If the tax rates on national insurance, capital gains and investment income recommended in the Taxing Wealth Report 2024 were accepted the overall tax rate on people earning between £50,000 and £75,000 would become too high if sufficient overall steady progressivity is to be achieved within the tax system. Subject in that case to those other recommended changes taking place it is suggested that the income tax rate in this range be reduced to 30 per cent from the current 40 per cent rate. This would have a cost of approximately £12.5 billion per annum.

- Without these changes it is likely that the Taxing Wealth Report 2024 would be inappropriately targeted: it is meant to target those with higher income and wealth and should not penalise most of those with earnings of between £50,000 and £75,000 a year as a result unless that income comes from capital gains or other unearned sources.

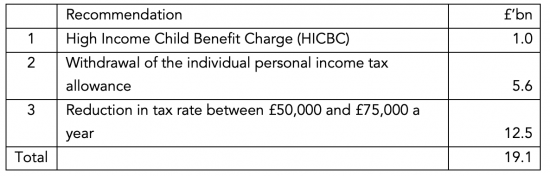

- The overall cost of recommendations made in this note is:

Of these recommendations, the first should happen irrespective of the other changes suggested in the Taxing Wealth Report 2024.

The other two suggestions are conditional on the other reforms proposed in the Taxing Wealth Report 2024 being made or tax injustice would result.

Discussion

There is a discussion of these proposals in the note that supports these suggestions, which is available here.

Cumulative value of recommendations made

The recommendations now made as part of the Taxing Wealth Report 2024 would, taking this latest proposal into account, raise total additional tax revenues or release sums available for alternative spending of approximately £92 billion per annum, on top of which an additional £35 billion from pension savings and £70 billion from ISA savings might be released for investment in social and green infrastructure projects. Total sums released might amount to approximately £200 billion per annum as a result.

It is stressed that this proposal creates a cost and does not deliver additional revenue, but that is the price of creating tax justice and ensuring the proper delivery of the other recommendations in the Taxing Wealth Report 2024.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This seems an eminently sensible suggestion. Tax justice should mean tax justice for all.

Am I alone in worrying that, given that no-one expects all your suggestions to be implemented, this may well be the first to be accepted?!

Hence the many times I say this is only appropriate if the other changes are made….