Davos is full of calls for the super-rich to be taxed more. The Patriotic Millionaires are at it. As the Guardian notes:

More than 250 billionaires and millionaires are demanding that the political elite meeting for the World Economic Forum in Davos introduce wealth taxes to help pay for better public services around the world.

The Guardian adds:

A “modest” 1.7% wealth tax on the richest 140,000 people in the UK could raise more than £10bn to help pay for public services, the Trades Union Congress (TUC) suggested last year.

Oxfam is also making the demand. Again, the Guardian notes:

Calling for a wealth tax to redress the balance between workers and super-rich company bosses and owners, [Oxfam's] report says such a levy on British millionaires and billionaires could bring in £22bn for the exchequer each year, if applied at a rate of between 1% to 2% on net wealth above £10m.

I wish I did not have to disagree with the demands of these organisations, but I do.

As I have shown in the Taxing Wealth Report 2024, wealth taxes are not only not required, but they really would be an impediment to progress.

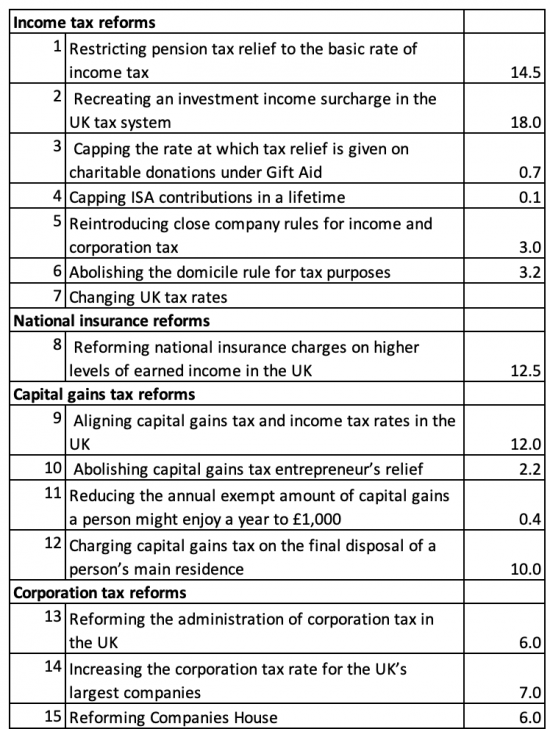

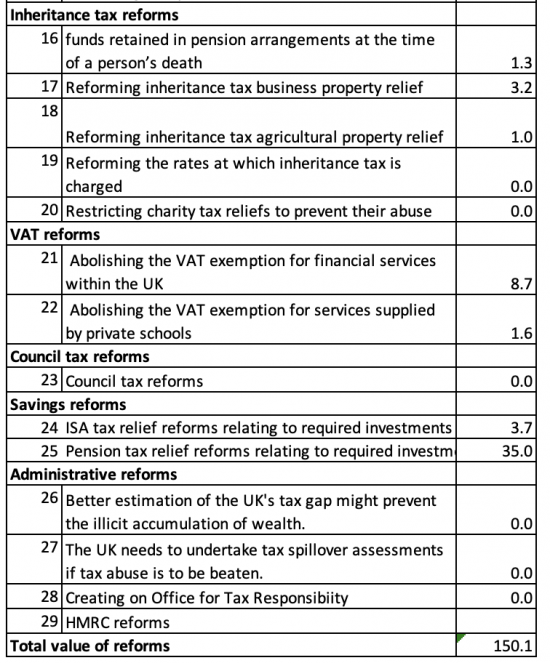

But, even more pragmatically, if we want to tax wealth, there are so many much easier ways to do it that would encounter none of the massive organisational, logistical, accounting and ethical issues that a wealth tax would encounter. For example, take this list, which is my summary of Taxing Wealth Report 2024 reforms right now:

Of course, no one would make all these changes: I am not suggesting that they should.

But if you want to tax wealth, what is better, a few billion in many years' time after a watered-down wealth tax is introduced, or reforms that could be done almost overnight now to existing laws that would undoubtedly raise more money?

The details of the above are to be found via links here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thanks for this interesting list. What would be the effect of implementing these changes to UK tax law beyond the first year? Would the yield continue, or would the changes encourage finding loopholes to avoid paying tax or reduce incentives to generate income or capital gains therefore also reducing tax? Has this been modelled? What are the long-term consequences?

The existing system is abhorrent, what I am asking is how would a system that implemented any or all of these changes look like in practice?

The changes would survive

So wouild the yield

And the whole aim is to close loopholes

My figures are the best you wiull get in the impact of such changes right now

They could be improved

But they are the best you’ll get

While I am sympathetic on a purely emotional level with the idea of a wealth tax together with other taxes reforms Richard proposes, I smell a rat here. The patriotic millionaires have an army of accountants and tax lawyers managing their wealth and are likely quite aware of how difficult it would be to implement and long implementation would take.

If these millionaires are as patriotic as they present themselves to be, what is to stop them voluntarily paying a proportion of their wealth to the state?

Some 2500 years ago Confucius said “It is impossible to be both excessively wealthy and rightious.” This is as true today as it was then.

I’m happy to have both!

If other people want to spend their energy introducing a wealth tax whilst there is a desire from the uber wealthy to start paying one, I would say let them crack on. It might be very helpful in 5-10 years time. Especially the information gathering that would be required.

As long as it doesn’t becoming a distraction from the immediate methods which you show are available. As obviously we shouldn’t be waiting for the billionaires to solve societies problems.

Exactly what I was going to say, KenM, can we not have both?

I see no problem with having a wealth tax if the Patriotic Millionaires are willing to pay, the sooner the better, particularly to save the NHS.

A wealth tax would take many, many years to create, and why bother when it would make the tax system virtually unmanageable because of the number of likely disputes? It really is a policy solution for those who don’t realiybwant things to change, in my opinion.

Good to keep this list in front of people.

Taxing is like plucking a goose; you want the most feathers for the least hiss. (Colbert)

Your diverse list has a small number of “controversial” measures but at least a third could be announced and implemented without a lot of “hiss” (other than in the Daily Mail and Telegraph) in Labour’s first budget. Another third could be delivered in its first Parliament. A few measure you suggest are unlikely to make it through but, as you say, far more realistic than such a fundamental change as a Wealth Tax.

I never claimed anyone would do them all

But, thank you

I think morally the uber wealthy should be taxed hard.. the problem with your proposals are they go too far down the food chain and are hitting the middle classes hard especially those in the SE of England where the cost of just living with a family is astronomically high through house prices. Of course that is why why claim to be able to raise so much more because you capture the middle classes into your net.

So tell me what is wrong with equalising cgt and income tax rates?

Or with chjrghing an invetsment incomne surcharge that means that those with investment income pay the equivalent of NIC?

Or equalising all tax reliefs on pensions?

Or, remocing VAT exemption on fi9nancial services?

Just start with them (worth £50 billion) and tell me wy they are unfair when in fact, right now, each of these subsidise the wealthy?

equalising all tax reliefs on pensions

As Mr Wallace says, this doesn’t hit the really wealthy – who are hardly likely to be limiting their savings for future pensions to the £60k a year allowed anyway. It does hit the middle classes hard and you haven’t thought through the effect on public sector workers. Consider a nurse on £50k a year. The employer ‘equivalent’ amount being for her pension is around £12,000. Currently there’s no tax charge but by limiting tax relief to 20% you’ve now created a 20% tax charge for her on that. You’ve added £2,400 tax to the tax bill of a middle class nurse. Well done. As for doctors, they’d be retiring early in their droves.

remocing VAT exemption on fi9nancial services?

Would effect everyone and put up everyone’s costs, not just ‘the wealthy’.

“what is wrong with equalising cgt and income tax rates?”

Because they are fundamentally different things. £100k earned over 10 years is taxed over 10 years. A £100k capital gain accrued over 10 years is taxed only in the year the gain crystallises. You don’t even consider indexation.

And because when you invest you risk losing what you invest. If you’re going to be taxed the same as if you just stick it in the bank and earn interest, why bother taking the risk? You said you want to encourage investment, this wouldn’t do that.

Most of your measures would impact the lives of ambitious aspiring young people far more than the already super wealthy. You’d be telling them there was no point in trying to better themselves by taking away all the tax breaks you’ve had the chance to benefit from throughout your life.

Politely, of course there are tax reliefs on a nurse’s own pension contribution

We are not talking employer contributions here

And as for financial services, whi do you think buys them?

And as for CGT, a pound in the pocket is a pound in the pocket and should be taxed the same irrespestive of source.

And – none of what I am suggestinmg will have almost any imapct at all on 90+% of people, whilst not a single person I ever met in my years as an accountant ever said tax was a disincentive to work

So you are talking dogmatic nonsense. Or drivel, if you prefer.

I would like to point out that a nurse earning £50000 a year would be in band 8 which is the most senior manager role. I haven’t been able to find out how many nurses are in band 8, but it is certainly a small percentage. I would not like readers of this blog to think that £50000 is the usual salary for a nurse. Unfortunately not ( my son is a nurse).

A nurse on this salary would pay pension contributions of around 10% ie about £5000. This is deducted from gross pay (before tax) which brings the taxable pay down to around £45000. The 40% tax band starts at £37,701 at the moment, so the difference between tax relief on pensions contributions at 40% or 20% is about £1600, not £2400 as you suggest, for your hyperthetical nurse. I don’t know how you have done your sums?

The current UK median wage is £28000. Only 11% of UK tax payers pay income tax above the 20% rate, so this change to the pension tax relief arrangements would not affect the majority.

Thanks

Very sorry, my sums are also wrong. The correct figures are that if you pay £5000 into your pension with tax relief at 40p in the pound it will only cost you £3000, because you pay £2000 less tax. When the tax relief is 20p in the pound it will cost you £4000 as you pay £1000 less tax.

Should not attempt this stuff at bedtime….

‘Of course, no one would make all these changes: I am not suggesting that they should’.

Really?

I bloody would!

Or at least I feel like it.

What we need to see more of is how much money gets poured into the Tory party and the Tufton street mob from those with money to burn.

We my not actually need that much, unless that is we get really serious about redistribution

Maybe we do need them all then

Perhaps we should get really serious about redistribution.

Pilgrim Slight Returns

Whilst you might be happy to pay higher pension contributions, I’d wager that many middle income public sector workers would not.

This could act as a further disincentive to attract workers into the NHS, Education etc

Middle income workers in the public sector would not have to pay more into their pensions if tax relief was only allowed at the basic rate. The people who would are in the highest decile of earners.

Your list should be sent to and/or waved in front of , not only the deliberately blind Labour front bench – but every single voter – to show ‘there is money’ after all.

Surely Richard, the Guardian would accept a piece from you on this?

Especially after Caroline Knowles piece on wealth tax today.

I will ask…

But it mught be better to comopete the TWR first – and that is still not done, althohgh I am making good progress.

https://www.theguardian.com/commentisfree/2024/jan/17/rich-think-wealth-tax-labour-party

A later article in The Guardian.

Richard

Have you attempted to contact The Patriotic Millionaires to explain the problem associated with a Wealth Tax?

There is also the point that calling for a Wealth Tax can be seen as a metaphor rather than a policy prescription

Yes

Not much joy though

Same with the NGO community. Tax campaigning seems much more about slogans than reason these days.

[…] By Richard Murphy, part-time Professor of Accounting Practice at Sheffield University Management School, director of the Corporate Accountability Network, member of Finance for the Future LLP, and director of Tax Research LLP. Originally published at Tax Research […]

Money doesn’t trickle down to the productive class in capitalism. The government has to force it though mean testing taxes, and giving the productive class free public goods, like schooling and transportation.

Excellent post Richard!!

You also knocked down the WEF conspiracy theories 🙂

However I have an addition, and it is a wealth tax on something that cannot be hidden offshore – land:

Even the Wall Street Journal agrees with Adam Smith on land value taxes

The Wall Street Journal has a video, ‘The Invisible Role Taxes Play in America’s Housing Shortage’. The land value tax discourages people from hoarding and speculating on land. https://www.youtube.com/watch?v=gJqCaklMv6M

It rediscovers Adam Smith’s less known 250 year old strategy of a land value tax.

Smith said

“A tax upon ground-rents would not raise the rents of houses. It would fall altogether upon the owner of the ground-rent, who acts always as a monopolist, and exacts the greatest rent which can be got for the use of his ground.”

https://en.wikisource.org/wiki/The_Wealth_of_Nations/Book_V/Chapter_2

I suggest the same for commercial land transactions – raise the capital gains on those if not for all capital gains … Both measures would raise a ton of money and lower housing prices

I am sorry – but if you think land valuation would be easy, you are wrong

I can guess the value of my house within 10%, I suspect

But the property portfolio of a billionaire is nothing like that

Land value tax falls at the first hurdle because a) it is hard to value and b) rental value as LV taxes is much harder still to establish

If yout want to undermine the adminitration of tax do an LVT, I suggest

Richard, I know expert assessors who say the reverse. And it is being done in some places.

Furthermore your proposed change to capital gains is the easiest of all. It would capture far more unearned land appreciation income. In fact there could be a surecharge – a higher rate than on labour income.