I am presenting to the Green New Deal All-Party Parliamentary Group this morning. I thought that made it a good time to summarise the recommendations made to date and their value:

The Taxing Wealth Report 2024

The Taxing Wealth Report 2024[1] is being published as a joint project between Finance for the Future LLP[2] and Sheffield University Management School[3]. Prof Richard Murphy is the common link between the two[4]. The work has been funded by the Polden Puckham Charitable Foundation[5].

Premise of the report

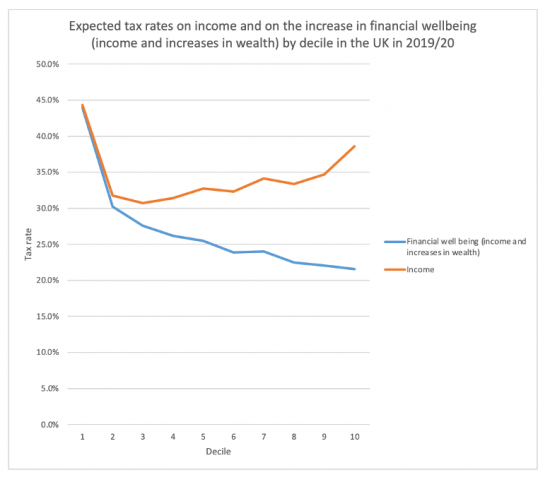

The premise of the Taxing Wealth Report 2024 is that if the combined total of income and wealth increases enjoyed by each decile of income earners in the UK was to be compared with the tax paid on that total, taking into account taxes on both income and wealth, then then it would be apparent that the overall tax system within the UK is deeply regressive. The lowest decile of income earners pay an overall tax rate on their combined increases in financial wellbeing each year, irrespective of its source, of around 44 per cent. In contrast, those in the highest decile pay a combined tax rate of only a little over 20 per cent per annum on their increase in financial well-being in a period. The contrast is shown in this chart:

The data sources and methodology are explained in two notes[6] [7].

Given this evidence, it is suggested in the Taxing Wealth Report 2024 that too little tax is paid on wealth, income and other profits derived from wealth, savings and their accumulation, and those types of expenditure that the wealthy are most likely to partake in.

The approach to making recommendations for reform

The Taxing Wealth Report 2024 has sought to address these issues in a pragmatic manner that could be adopted piecemeal by a government seeking to raise additional revenue as well as to tackle some of the inherent social issues that a regressive tax system creates.

This resulted in the rejection of a wealth tax as a solution to this problem. Agreeing the basis for charging a wealth tax would be a nightmare. To also undertake this exercise on an annual basis would impose excessive costs on both taxpayers and HMRC. That would most especially be the case given the relatively low yield that would be likely to result when most private financial wealth in the UK is held in either pension funds, ISAs or homes, all of which the government has deliberately tax incentivised, meaning that they would, therefore, most likely be taken outside the scope of any such charge.

In that case, a piecemeal approach to this issue was adopted to propose changes to the existing tax system that might achieve at least one of four goals in each case, although with most achieving several of those goals simultaneously.

The first was to increase horizontal tax equity, i.e., to make sure that receipts of funds are taxed equally for persons with overall similar levels of receipt whatever the source of those receipts might be.

The second was to improve vertical tax equity, i.e., to improve the progressivity of the UK tax system.

The third concern was to raise revenue, although it was always accepted that a proposal could have merit without having any significant tax-raising consequence.

The last goal was to improve the administration of tax and related information collection systems in the UK.

Recommendations made to date

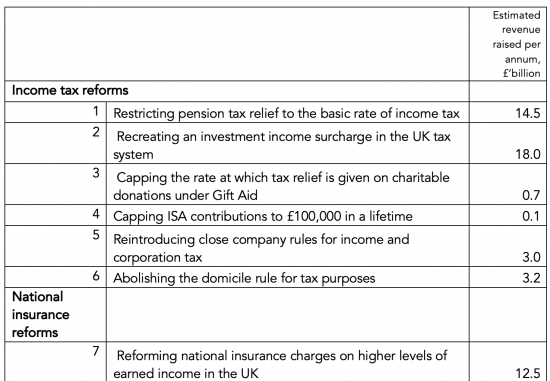

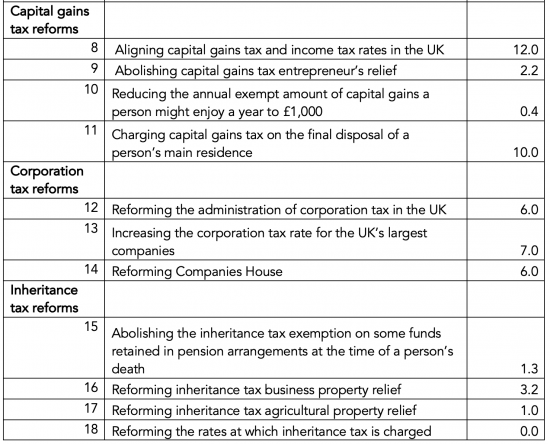

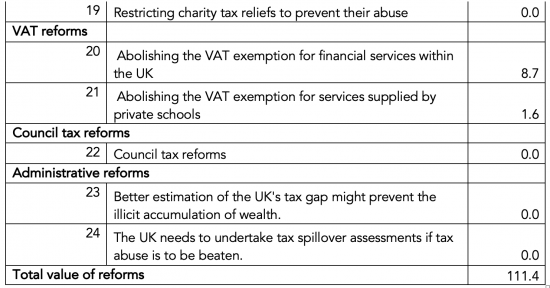

Based on these criteria, the following recommendations for tax reform have been made to date.

A separate blog post and related support note has been published for each recommendation. The recommendations are all summarised on one web page from which links to those blog posts and support notes can all be found[8]

A number more recommendations have yet to be published that will address income tax rates, the use of tax-incentivised savings and potential reforms to the funding and organisation of HM Revenue & Customs. A background notes on the economics of taxation and its relationship to fiscal policy will also be included in the report. None of these notes will materially change the suggested sum that might be raised by way of additional tax by these proposed reforms.

Final thoughts

It is unlikely that any government would want to undertake all these reforms, let alone at one time. The disruption that would cause would be too great. Instead, the proposals are made to suggest three things.

The first is that there is money left to tax.

The second is that the goal of raising that new tax is achievable.

Thirdly, it is possible to tackle the inequality within UK tax system that our current tax system does far too little to address.

Footnotes

[2] https://www.financeforthefuture.com/

[3] https://www.sheffield.ac.uk/management

[4] Richard Murphy's biography is available here https://www.taxresearch.org.uk/Blog/about/richard-murphy/

[5] https://www.polden-puckham.org.uk/

[6] https://taxingwealth.uk/2023/09/06/wealth-is-undertaxed-by-170-billion-a-year-in-the-uk/ and

[7] https://taxingwealth.uk/2023/09/07/the-taxing-wealth-report-2024-methodology/

[8] https://taxingwealth.uk/2023/09/13/the-taxing-wealth-report-2024-recommendations-to-date-and-their-suggested-value/

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Good luck Richard – are you there in person?

Would be good if you could suggest the most low hanging fruit – listing them in order of ease of implentation.

Sitting in Westminster Hall cafe right now…

Surely the “abolition of” ones will be the most easily implemented as they do not require learning new rules, and would actually reduce the amount of administration required.

That’s approximately £15 billion raised as well. But what administratively easy and what is politically easy will produce two different rankings.

Good luck Richard.

Nice to know that the IQ of parliament will be temporarily increased by your visit today.

🙂

Putting the 5p a litre fuel duty cut back on is overdue

Assuming there were a political party interested in picking this up, I wonder if tackling multiple tax changes at one time might be beneficial. Given the level of austerity we’ve faced the past decade plus, spending everywhere seems pretty tight and desperate for something different. That sounds like an opportunity for a radical political voice to say “we could change this”. There would be disruption from any change to the tax system, even minor ones. So might it not be better to get them all out of the way at once, especially if that frees up public spending more quickly?

I hope your presentation goes well.

Thanks

I will do feedback – maybe tomorrow

I just hope the consumption of ethically and intellectually rich ideas will not prove too much for our MPs, existing as they do on the unhealthy pap of ignorance, stupidity and greed.