Rumours are spreading in newspapers and email comment columns that Jeremy Hunt thinks he might have 'fiscal headroom' for a tax cut this autumn. The money is on him halving the rate of inheritance tax from 40% to 20%.

I do not agree with the term 'fiscal headroom, which imagines that there is a long-term sustainable level of government spending that must be maintained, which can be compared with current tax receipts to determine whether the latter are appropriate. That there is a 'natural level' of spending is absurd. It ignores need and political choice. It also presumes a government has no ability to change matters, and that makes no sense. Much the same is true of the related ideas on taxation. As measures go, then, this one is hopelessly flawed. But that does not stop it from being much beloved and believed by those who, like the Office for Budget Responsibility, think the government a perpetual victim of circumstance where market needs must always be served first.

But even if the idea of 'fiscal headroom' made sense and there was, maybe, £15 billion to spend this autumn, the last thing that should be done with that money is to use it to cut inheritance tax.

As I have noted in the Taxing Wealth Report 2024:

In the tax year 2020/21, which is the last for which reliable statistical data is available, just 3.73 per cent of all estates in the UK were subject to an inheritance tax charge.

This means that inheritance tax is a tax on the wealthiest households in the UK, payable only when those in them, and most likely the last survivor in them, dies.

It applies to just one in twenty-five households.

It is the only real approximation to a wealth tax that we have.

And, as I have again shown in the Taxing Wealth Report 2024, the wealthy are massively undertaxed in the UK:

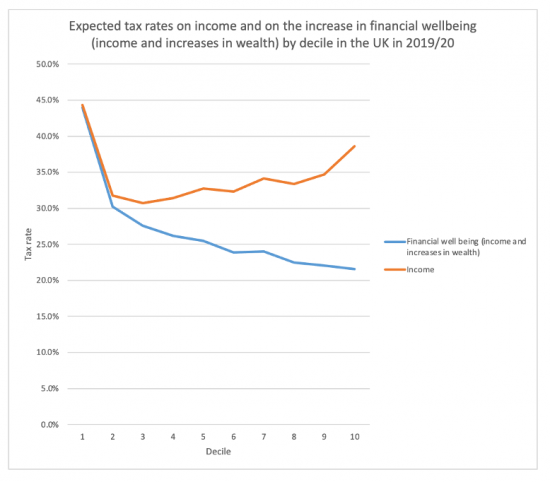

The following chart suggests the true scale of the regressivity of the UK's tax system:

Those in the lowest decile of income earners in the UK pay tax at around 44% on their income and gains in financial wellbeing, whilst those in the top decile pay at 21.5%, less than half that rate. That is why there is capacity to raise more tax from wealth in the UK.

The full report that supports this note is available here.

That data, based solely on information from the Office for National Statistics, shows the overall tax rate by decile of people in the UK when their income and their increases in wealth are considered. Few people take wealth into consideration when looking at the progressivity of tax, but a pound increases well-being from wherever it comes, so it is inappropriate that wealth increases are ignored.

Doing so makes it clear that the wealthy already have a massively favourable tax deal in the UK. And now, when there are pressing needs all around us, a cost of living crisis, and a claim that the country could not afford decent pay rises for doctors, teachers, nurses and other essential public sector staff, Jeremy Hunt might be giving away half of the inheritance tax yield - or £3.5 billion a year - to those who do not need it, who are otherwise called the well off children of already well off parents.

There is, I know, nothing I can do to stop Jeremy Hunt from making a fool of himself, but I can suggest that the evidence shows how stupid this idea really is. But then, maybe, that is its appeal to a party that has lost all touch with reality.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

What sticks in my craw when I read stuff like this is when someone like James Buchanan in his public choice theory accuses politicians of conniving with voters in his portrayal of public sector service funding and here we have a Neo-liberal politician planning on bribing voters with tax cuts that are likely to end up in the Tories bank account.

In the grand scheme of things, inheritance tax is small beer – about £7 billion a year. About a fortieth of income tax.

But it is one of few taxes that directly address extreme inequality, because it is very focused on the wealthiest – only 4% of estates pay IHT. And it is quite salient among Conservative voters, particularly in the south east. There is an irrational fear factor of “death duties”, even if most people are still not paying it.

The IFS recently reported that IHT could be cut to 25% in a revenue neutral manner, if at the same time BPR and APR were capped, pension benefits were taxed, the additional residence nil rate band was abolished in favour of a slightly higher nil rate band for all. Lower rates and a wider base are usually good things, particularly if it is about reallocating the burden among the wealthiest and most estates continue to be exempt.

https://ifs.org.uk/publications/reforming-inheritance-tax

They also recommend removing the CGT uplift on death.

So it will be interesting to see if an IHT rate change, if it occurs, is accompanied by any wider reform, or is just a give away to the wealthiest.

I paid CGT in the UK on assets I disposed of after I Brexited to Ireland. In Ireland I got credit for this but then had to make up the difference to 33% — about double what I’d paid in the UK.

The UK tax system heavily favours those with unearned income.

And anyone who has had any dealings with HMRC can confirm that it is understaffed and has difficulty collecting tax even from people keen to pay (me eg, because I had to report UK income and tax paid in Ireland as well as the UK). The idea of HMRC having the resources to chase people who report inaccurate information seems, well, almost droll. Somehow that doesn’t really seem accidental under the current govt.

Isn’t time that some investigative journalists went undercover into HMRC and reported their findings?

I find the rightwing, and quite widely spread, objection to inheritance tax odd. If you’re allowed to choose when to pay tax on your wealth, `after my death’ seems a pretty good option.

As to the rate of tax, in the interest of simplification, why not just treat inherited money/assets as income of the recipients? They could be allowed to spread it over several years as I think recipients of irregular income are already allowed to do. It would encourage those leaving the money to spread it in smaller sums to more recipients.

And I would continue to allow exemptions for bequests to charities, to encourage wealth being left for public rather than private good – though of course we could tighten up the definition of charities; for example, I don’t regard private schools as charities.

I prefer separate taxes

There is almost no spreading option in U.K. tax law, tiny issues apart

An IHT cut would also be contrary to any ‘levelling up agenda’, since I suppose a lot of the estates taxed IHT are in the southeast, due to the much higher property prices there. The idea that IHT is ‘unfair to hard working people who’ve been careful and saved for their children’ seems mostly spin… along with ‘levelling up’.

Good point