The EU Tax Observatory has a new report on tax evasion out this morning.

Or, to be precise, they have a new report on tax evasion by the super-wealthy out this morning because that is what the EU has funded them to look at.

In the Executive Summary, they note:

It is very odd that they ignore country-by-country reporting given no one else does. It is true that if you are considering evasion rather than avoidance country-by-country reporting is not a big deal as it was almost wholly focussed on avoidance, but so too is the global minimum tax rate for multinational corporations, so this makes little sense.

However, as they then note:

The decline in offshore tax evasion is what I would expect. Quite simply, the campaign for automatic information exchange from tax havens, which I and a few others led from 2005 onwards, worked. It took a lot of effort for about a decade but the results are now seen.

The fact that the global minimum tax rate is not working is now down, in no small part, to the active opposition to it from the current leadership of the tax justice movement who, for their own political reasons (mainly aimed at undermining the Organisation for Economic Cooperation and Development) have done all they can to discredit its actions even though the OECD is the only organisation in the world with a chance on delivering on this issue. I am baffled as to why these tax justice campaigners still have any funders left.

Third, there is still tax evasion by the ultra-wealthy.

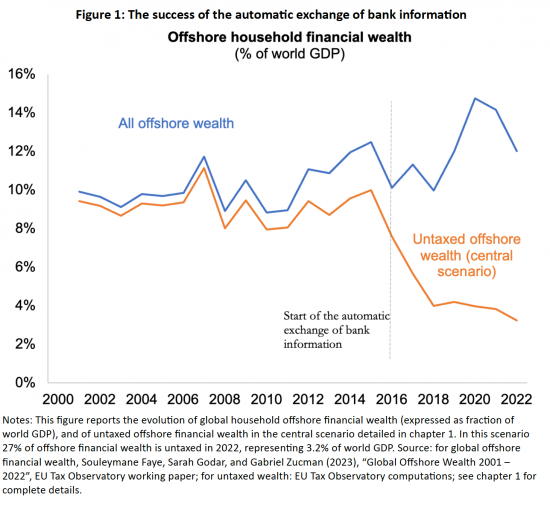

On this last issue, they note that overall the offshore tax problem has fallen, dramatically:

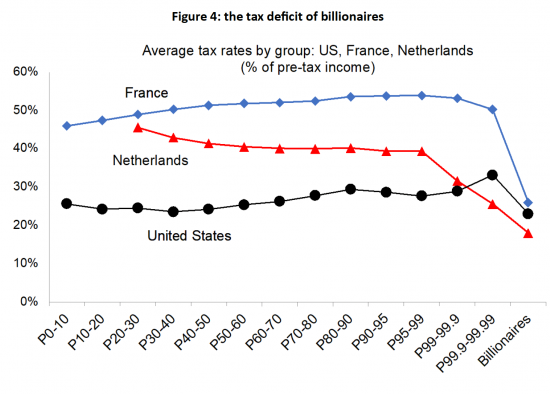

But they add that the problem of taxing billionaires remains:

They argue that this trend is because states still allow the wealthy to hold their assets in personal companies, and that massively reduces their tax rates.

I agree, entirely. This is an issue. Tackling it is a driving force behind the Taxing Wealth Report 2024.

There the similarity ends. I argue that the answer is to impose better taxes on the income from wealth nationally. I have already demonstrated that if there is a £170bn tax shortfall in the UK, as I think likely, more than £100 billion of it can be recovered by actions in the UK targeted at the wealthy. I have more suggestions to make as yet.

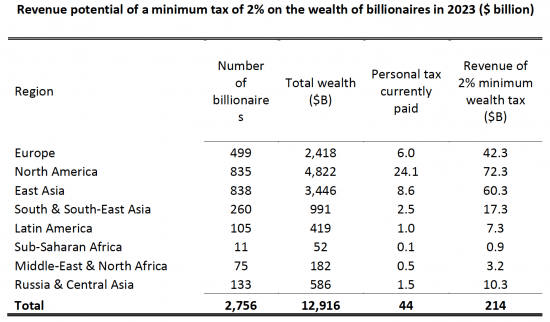

The EU Tax Observatory do not agree. They suggest an international wealth tax, based on the work of Thomas Piketty. They suggest that the revenue to be raised might be:

Three things are worth saying.

The first is that there is no hope of such a tax happening. The international cooperation required to deliver it does not exist, and will not exist. I would like to say otherwise, but I just cannot see it. In an era where tax competition is still the norm the cultural change required for this to happen is not present in most states, let alone between them which is a much further demand to make.

Second, as I have long argued, wealth taxes are nigh on impossible to collect because whilst global and national estimates of aggregate wealth can be prepared in micro detail, every single wealthy person will dispute the value placed on almost every asset that they own, from a work of art, to a racehorse, to land, to jewellery, to the value of the shares in a private company and trying to raise any tax at all will, as a result, be a logistical nightmare that will tie up the court systems of countries for years. This is the problem with all tax proposals by those who have never worked in tax.

Third, there is simply a better way to do this, as I am showing with the Taxing Wealth Report 2024. In the UK alone, I can suggest ways to raise more than half the global total that the EU Observatory is suggesting. In that case, if my methodology - which is based on deliverable tax changes - was extended, then very much more could be raised - including from the super wealthy whose wealth holdings can be shattered open simply by deeming the companies that they own to be transparent for tax purposes under what are called 'close company' rules, which I will write about in the Taxing Wealth Report 2024 as soon as I can get the time to do so.

In summary, this report is useful, but the trajectory of thinking on how to solve this problem that it proposes is, I suggest, wrong. The problem of tax abuse by the wealthy has to be solved locally, not least because that is the place where the incentive to act will exist, if it does at all.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

One suggestion I’ve seen to handle the asset valuation problem is that the owner decides the value of everything for tax purposes, but agrees that the State can buy any item for that price. So you can value your Picasso at £5, but be prepared to say goodbye to it.

I agree with your preference for taxes on the income from wealth, rather than on wealth directly, but would be interested in your thoughts on this valuation idea. Its instinctively appealing, but I suspect would just be a different type of unmanageable in practice.

That breaches human rights

Breaches human rights or not.

What a great idea.

I sympathise with the suggestion that the valuation placed on an object should be the amount the state can buy it off you for, but fair valuation is extremely hard to achieve. Even when a “fair valuation” can be derived from a large and relatively liquid market it often isn’t the amount you would be willing to sell it for.

A good example of it would be the value of your car. Its considered fair market value is very rarely the amount that you would be happy to sell it for. This normally becomes an issue following an accident when the car is written off and the insurance company tells you what they think it is worth based on what they think they could buy a similar car for. How often are people happy with the outcome?

Similarly, unless you want to move, the fair value of a house isn’t necessarily the amount that you would be prepared to let somebody buy it for.

You can’t really use the amount you want to sell something for as a fair basis for taxation because there is often a difference between what you would pay for something and what you would sell it for.

Good points

But ignored by tax which values assets at the price a willing buyer would pay

This is usally agreed by negotiation and rarely by formula

There’s always a difference between how much you’re prepared to accept and how much the buyer will pay.

The price that a buyer is prepared to pay at that moment IS the value.

Perhaps related, is why the UK doesn’t, unlike the USA, levy taxes on world wide earnings/assets. Instead we have non-dom status. Why?

Good question

What surprises me in those statistics is the number of billionaires who are prepared to pay 24.1% tax to retain US citizenship.

Why? What advantage does that give?

Let’s presume that they do not pay…

If you were born in, say, the UK or USA, it was your home and your family lived there. You might be reluctant to give up your citizenship. Especially as you then wouldn’t be able to stay very long. And you have to have citizenship and pay taxes somewhere.

Basically, that’s the deal, you pay taxes and get the benefits of living there and being a citizen.

However, if billionaires wish to leave the UK, and not live here, I’m not too bothered. They might threaten to sell their investments. Why would they do that if they were profitable? And, if they did, someone else would buy them. It doesn’t much matter who owns assets. And, since we know trickle down doesn’t work, selling the assets probably won’t hurt the man in the street. Let reluctant billionaires go.

Didn’t Johnson give up his US citizenship, having been born there, when he realised that he would have to pay their tax?

Yes

Billionaire investors can be foreign domiciled paying low rates of tax & own shares/assets in UK entities e.g. Philip Green’s wife tax domicile Monaco & a UK shareholder

But that is much harder to achieve now

Christina Green, or Lady Green, may be resident in Monaco. But I suspect (I haven’t be able to confirm) that she is a UK citizen. It would be interesting to see what choice she’d make between low taxes and UK citizenship.

Further, is it right that non-UK citizens who are non resident can be directors of UK companies? If that were not the case the Greens might think twice about their tax arrangements. Or perhaps they would leave the UK and sell their UK investments. Which is arguably a good thing.

Try this, Tim

https://www.taxresearch.org.uk/Blog/2014/07/07/time-for-a-passport-tax-2/

I will be discussing this issue on BBC News 24 at 11.30am on 23/10/22

NOW REARRANGED for 14.30….that is the BBC for you

Saw you at 16.30.

My grandson was very impressed, as was I. At least they had you on on the right day!

Thanks

I may be wrong but I doubt Thomas Picketty would consider himself a tax expert. Maybe it would be worth having a conversation with him and then perhaps he could amend his recommendations and put more pressure on the EU / GB to take up your ideas instead.

I think he does…

You cannot build a world wide tax justice framework on poor foundations – you are absolutely right to say that it all starts locally and strategically it is the right approach.

There will be more to come on this