I have this morning published the next in my series of proposals that will together make up the Taxing Wealth Report 2024.

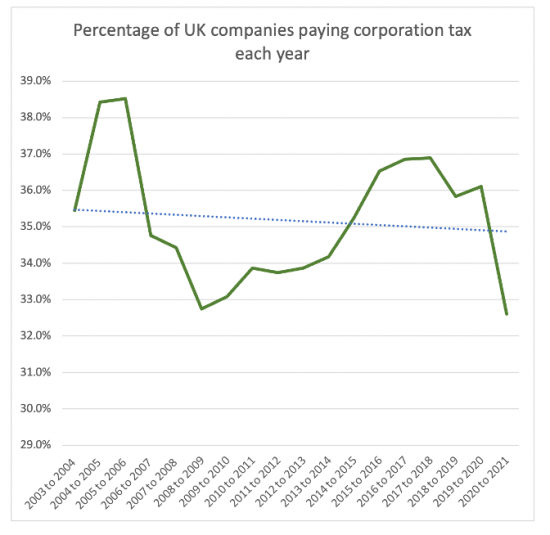

In this note, I suggest that a radical reform of the administration of corporation tax in the UK is required. When only one-third of companies in the UK pay tax, millions do not submit corporation tax returns, and hundreds of thousands disappear each year without questions being asked, there is something seriously wrong with the way in which this tax is being administered at present.

I suggest that on the basis of the radical reforms that I propose that at least £6 billion of additional tax revenue might be raised a year, but it is likely that this is a serious underestimate because these measures should also significantly reduce the scale of fraud on the government each year.

The summary to this note says:

Brief Summary

This note proposes that:

- The administration of corporation tax by HM Revenue & Customs needs to be substantially reformed if the abuse of limited liability companies to illicitly accumulate untaxed wealth is to be prevented.

- The current lax regime for the requesting of a corporation tax return by HM Revenue & Customs should be replaced by a mandatory obligation that a company file such a return with attached accounts each year.

- That the directors and principal shareholders of a company should be required to prove their identities and current address to HM Revenue & Customs and Companies House annually.

- That the directors and principal shareholders of a company failing to supply a corporation tax return should be liable for the penalties due as a result of that failure. The latest available research on this issue suggests that 99 per cent of those penalties are unpaid at present.

- The directors and principal shareholders of a company should be liable for any tax of any sort owing by it if unpaid by the company itself unless they can demonstrate a clear commercial reason for which they were not responsible that explains the inability to pay.

- Any banker, lawyer, accountant or other person in the financial services industry acting on behalf of a company who is required by law to prove the identity of that company's directors and principal shareholders shall be required by law to provide an annual declaration to HM Revenue & Customs and Companies House confirming those identities, or a statement as to why they are unable to do so.

- Any bankers and accountants supplying services to or acting on behalf of any company in a year should be required by law to supply details of the total payments received in that company's bank accounts during each of its financial years within nine months of the end of that period so that in the absence of a corporation tax HM Revenue & Customs can raise an estimated assessment of those taxes that they think it might owe for which the directors and principal shareholders shall be liable unless they can disprove that claim.

- That these proposals should considerably reduce the amount of tax evasion in the UK, which HM Revenue & Customs estimates to be £19 billion per annum, but which might be very much higher, most of which will be undertaken through limited liability companies. A revenue estimate of £6 billion is estimated to arise as a result of these changes.

- These proposals might also considerably reduce the scale of fraud perpetrated on the government each year, which is estimated to be between £33 billion and £58 billion per annum excluding Covid related issues. No revenue estimate is made for the likely gain resulting.

The illicit accumulation of wealth in the UK that contributes significantly to inequality might be reduced as a consequence of these changes.

Discussion

This is one of the longer notes that will make up the Taxing Wealth Report 2024. This is also a complex note which should, however, reward those who take the time to read it. A related note on the need for reform to the operations of Companies House will be published soon.

The core suggestion that this note makes is that HM Revenue & Customs does not know which companies are trading in the UK and appears to be indifferent to its ignorance on this issue and the tax consequences that flow from it.

The suggestion is made that limited liability companies (and related entities) are being seriously abused to assist the evasion of tax in the UK.

Only one in three companies in the UK pay tax and the trend is downward:

As a result, a number of recommendations are made that might appear onerous at first sight but which are, in fact, no more than what is now demanded from tax haven jurisdictions under Organisation for Economic Cooperation and Development automatic information exchange rules. If we can impose such requirements on other places, it seems to be absurd that we cannot do so domestically when the scale of tax losses resulting within the UK economy is likely to be much higher than that arising from the abuse of tax havens.

There would, no doubt, be significant objection to the proposals made, including removing the advantage of limited liability from those directors and principal shareholders (those owning more than ten per cent of a company) who use the ready availability of limited liability companies in the UK to abuse markets and unjustly enrich themselves. Those objections should, however, be ignored. Limited liability is a privilege and not a right, and it is one that cannot be abused. If regulation can be imposed on drivers because they create a risk to society by using their cars, regulation that will cost much less a year for a company to comply with in most cases can also be imposed on all corporate entities registered in the UK to prevent the risk that they create to society.

The estimate of tax yield resulting from this proposal is very likely understated, but since the scale of tax fraud in the UK is unknown because we do not have proper tax gap appraisals, this is something that has to be accepted for now.

Cumulative value of recommendations made

The recommendations now made as part of the Taxing Wealth Report 2024 would, taking this latest proposal into account, raise total additional tax revenues of approximately £76.3 billion per annum.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I am surprised so few companies pay tax, I am shocked that ID confirmation is so lax and outraged that so many penalties go unpaid.

I like the idea of putting the accountants, lawyers and bankers “on the hook” for providing simple ID and cash flow data. They will squeal about the cost of compliance but I see the cost as a key weapon in unravelling complex webs of holding companies that only exist for tax avoidance. Dodgy companies would become “unbanked/unaudited/unlawyered” pretty quickly…. or at least hideously expensive to run. And if you are unbanked then you are effectively out of business (ask Nigel!).

The “big” change you suggest is to make shareholders liable for penalties etc. This strikes at the principle of Limited Liability. It is an entirely legitimate/well deserved strike – after all if you own a company that is breaking the law you should accept some responsibility – but will be tough to get accepted.

Would your suggestions raise costs for “genuine” companies? Not really, I suspect. For a start any plc will be doing all this stuff already, I presume (tell me if I am wrong, Richard).

For other companies it seems pretty simple to track incoming cash and, in the absence of accounts, use it as a basis for tax…. but will the accounts be “true and fair”

For dodgy companies it’s about tracking the “money out” and this will either be to (a) a UK company – which will still be ‘in the system’ (b) a UK individual as wages – should be simple to verify/tax with NI No./PAYE etc. (c) dividends – simple to tax IF ID checks are done properly (d) a foreign company/individual – and this is the tricky bit.

(d) could be a real hassle for import businesses – how would this be dealt with?

Clive

Thanks for al, first half comments

Re the second half, this data would only be used in the absence of accounts. The aim is to force compliance. I think it would work. And why would someone oppose it?

I run a company and would not oppose it. I doubt I would even notice the changes to suggest.

They would be easy to comply with in my case, too

What Richard proposes would be far more effective than the annual audit as a real test of the state of the business. It would totally transform limited liability, and the theory of the firm. This is revolutionary. Think of this. How many board meetings examine the Corporate’s unvarnished bank statements (or anything of this kind not highly simplified and rationalised), do you think?

“Any bankers and accountants supplying services to or acting on behalf of any company in a year should be required by law to supply details of the total payments received in that company’s bank accounts during each of its financial years within nine months of the end of that period so that in the absence of a corporation tax HM Revenue & Customs can raise an estimated assessment of those taxes that they think it might owe for which the directors and principal shareholders shall be liable unless they can disprove that claim”.

Wow! That seems very, very fundamental. That would shake-up the whole business world. I doubt if most Board members are given that information. That really would leave business with “nowhere to hide” (unless they start running two sets of books!). I fear that will just scare all politicians witless! The truth is ‘openness’, and ‘transparency’ are never intended to survive beyond the mission statement. Nobody who is an insider isactually supposed to carry it out.

I see that Sky News have examined all the climate proposals made by Sunak’s latest ‘honesty’ proposal; car-sharing, 7-bins, meat-tax, flying-tax: none of them were announced Government policy. They were ideas floating around Whitehall or media; and had no policy authority whatsoever. He made it all up (Sky News Explainer: ‘Did Rishi Sunak ‘scrap’ net zero measures – or were they not even policies?’)

Sunak made it all up. Remember this, on the steps of 10, Downing Street? “integrity, professionalism and accountability at every level”. Conservatives, eh?

I intend to shake limited liability up

When it is used for criminal activity, why not?

Sorry to come to this late, been on holiday.

The law already permits HMRC to make a “determination” of profits chargeable to Corporation Tax/CT payable, on companies which have failed to submit a Corporation Tax return after having been given notice to do so [there are analogous provisions as regards personal Income Tax]. The effect of this is to put Corporation Tax into charge which is legally collectible, and determinations may not be appealed – they can only be displaced by the submission of a return. The extent to which this works (ie. results in payment of the “correct” amount of CT) is, however, a moot point. It does of course require enforcement on such companies, which are already in default…

My whole point is it does not work because the directors have already abandoned these companies.

So make them personally liable. That is my point.

Worth adding that for HMRC to do its job properly it has to have the staff and systems it needs.

When I semi-retired and wound up my UK company a couple of years ago I had a lot of difficulty even contacting them – at one point having gone through all the usual call-centre shenanigans I finally spoke to a staff member who candidly told me – and the bit in speech marks here is an exact quote – that not only were they short-staffed, but “all our senior people have left”.

OK the pandemic disruption/backlog was obviously a factor then – but now, I understand, they don’t accept telephone calls at all!

The gutting of public services in the UK seems to have cut off the nose to spite the face.

I am working on the data in this one.

“The gutting of public services in the UK seems to have cut off the nose to spite the face”.

Yes, but the gutting was deliberate. You can’t apply laws or regulations that you do not police. This gutting is the essence of neoliberalism. Read Liz Truss’s speech. She is still pushing the no red-tape agenda (‘red-tape’ os tabloid code for doing nothing, stop at nothing).

Paul Johnson of IFS on the r4 ‘Briefing Room’ seems to admit we are taxing less than France and similar countries, but that we tax high income people and bigger companies more than they do – so we would need to tax ‘ordinary people’ more.

It would be interesting to get his response to each of your individual suggestions where a higher tax take is possible.

Clearly your corporation tax proposals embody a pretty revolutionary change on how things are done and could provoke resistance.

An excellent proposition with equally excellent comments.

It does indeed suggest to me that the lax management on display here is simply ideological and of no benefit to society at large at all.

one typo

directors and principal shareholders (those opening (OWNING )more than ten per cent of a company) who use the ready availability of limited liability companies )

Hope that is helpful .

Thanks

Now noted and changed in the final version

This is not about taxes but an example of how to educe PFI costs.

https://www.nakedcapitalism.com/2023/09/mexicos-amlo-rips-up-usurious-public-private-partnership-finance-agreements-for-9-public-hospitals.html

I have no idea how accurate Naked Capitalism’s (NC) research is; but PFI is a way for government to keep investment off the ‘balance sheet’ (the debt quantum obsession), but it means being ripped off by private capital on an industrial scale. As it has been executed in the UK it is a financial disaster. I leave this excerpt from the NC article, because it provides something we have lacked; a quantum of the scale of the shambles no British political party wants to discuss:

“[PFI]…. is also a dangerous way of kicking the can down the road. By early 2017, the UK government had already coughed up £110 billion in fees and interest. Between April 2017 and the 2040s it is expected to pay investors and companies another £199 billion for existing deals. That works out at a total outlay of around £310 billion for 700 projects worth a measly £60 billion.”

I do not know how accurate this is – but if anyone knows, this would be good to know!

The state subsidises inadequate wages with in-work benefits. Originally intended ans a temporary measure, now just routine. I suggest that corporation (some proportion of it) be based on how mush the state pays in benefits to the a firms employees and simply claws back the money.

I think we could derive this information by using payroll data and matching with data on benefits claims.

If your business plan is based on low wages why should we pay a subsidy to support it?

Re. Comments above; I heard the briefing room also, it didn’t del with the preferential treatment of income derived from capital. But the point is we have headroom – if we chose to use it.