The Taxing Wealth Report 2024 suggests that wealth in the UK might be undertaxed by up to £170 billion a year when compared to income in a new report published this morning:

This suggestion is explained in a report of 5,300 words. The brief summary says:

Brief summary

This note suggests that, based on a review of taxes paid, UK national income and changes in UK wealth from 2011 to 2020:

- The UK has a tax system on income that is regressive at the lowest levels of income, broadly flat over the middle range of UK incomes, and is only slightly progressive at the upper end, without however replicating on highest incomes the tax rates paid by those on lowest income.

- Has a very generous system of taxation on wealth that means that whereas income was on average taxed at 32.9 per cent over this period, increases in wealth were only taxed at 4.1 per cent.

- The combined average tax rate on income and increases in wealth over this period amounted to 25.6 per cent per annum.

- Because of the way in which wealth is distributed in the UK, with most being owned by the top ten per cent of the population, this differential in tax rates means that the UK actually has a deeply regressive tax system.

- Those with lowest income in the UK were likely to have a combined tax rate on income and increases in wealth of approximately 44 per cent per annum during this period whilst those in the highest decile of earners in the UK were likely to pay no more than 21.5 per cent per annum on their combined income and increase in wealth.

- If the tax rates on income and increases in wealth were equalised then additional tax revenue of £170 billion a year might be raised in the UK as a result.

What this suggests is that:

- There is significant additional capacity to tax in the UK, although only from those with most income and wealth.

- A strong case for reducing the tax paid by those on lowest incomes can be made.

- On balance, so long as additional sources of tax revenue are charged only (or almost entirely) on those with the highest income in the UK then there is no reason for any UK government or political party seeking power to suggest that there is no additional capacity to tax in the UK: that capacity very clearly exists.

The Taxing Wealth Report 2024 will explore about thirty ways in which this additional revenue might be raised in ways consistent with these findings.

The unfair UK tax system

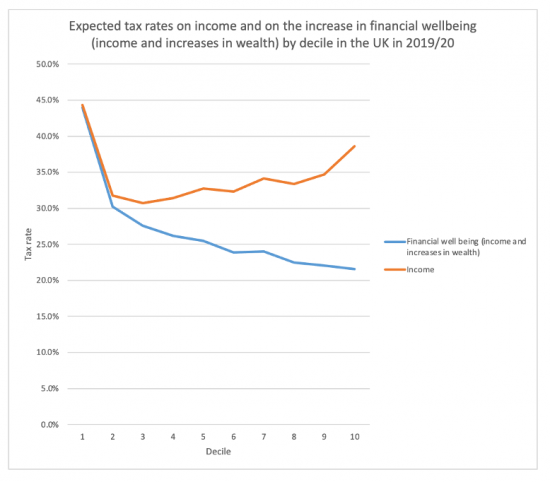

The following chart suggests the true scale of the regressivity of the UK's tax system:

Those in the lowest decile of income earners in the UK pay tax at around 44% on their income and gains in financial wellbeing, whilst those in the top decile pay at 21.5%, less than half that rate. That is why there is capacity to raise more tax from wealth in the UK.

The full report that supports this note is available here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I would suggest if you could summarise this in one of your tweets by taking 1,2,5 and 6 and presenting them separately as the core big message; the Big Picture (with the supporting links for everything else). And then, if possible send it as an e-mail to every single MP, MSP, Welsh and Irish devolved representatives.

This has all the makings of real tour de force on the tax debate.

I think you are one of our most valuable public intellectuals Richard.

Let’s see how our cowardly politicians respond to this.

Congratulations Richard.

Thanks

Thanks for the Blog Richard, a couple of interesting articles on The Conversation this week:

https://theconversation.com/poverty-in-britain-is-firmly-linked-to-the-countrys-mountain-of-private-wealth-labour-must-address-this-growing-inequality-212741

https://theconversation.com/london-is-a-major-reason-for-the-uks-inequality-problem-unfortunately-city-leaders-dont-want-to-talk-about-it-212762

Thanks

I will take a look

This is excellent work. In an ideal world the BBC would be featuring this on their main news, and/or R4’s Today & PM, or even on BBC2 under Kirsty (Snappy-interuptus) Wark.

ITV Nws@10 has been developing a line of well researched journalism, might consider a focus on this.

Easy for me to suggest, when you already do so much, but maybe James O’Brien would be receptive to having a slot on this with you.

Sadly, this truth needs broadcasting on MSM to stand a chance of getting into people’s heads, because the majority – inc. people like Rachel Reeves – do not do their homework before drinking up dogma and, perhaps, stirring themselves to vote.

Am I mis-remembering, or was the top rate of tax under Harold Macmillan at 95% ?

I will be pushing harder when the whole report is out

How are you assessing the wealth of the top decile? Are you taking into account wealth hidden abroad (legally or illegally).

I don’t need to assess wealth

I am not taxing it as such

And I will get to offshore, but these days it is nothing like the issue it was