Before deciding to publish the research that I had undertaken on the amount paid by the Bank of England to the UK's commercial banks on their central bank reserve accounts that were, in effect, gifted to them by the government as a consequence of new money creation by the Bank of England between 2008 and 2021, as a Twitter thread I had considered issuing that research as a press release. This is what that press release was going to say:

The Bank of England increased its base rate for the fourteenth consecutive time since 2021 when it met on 3 August 2023. One consequence that is not being discussed is the impact that this decision has on the profits of the UK's major commercial banks (Barclays, HSBC, Lloyds, NatWest and Santander)[1].

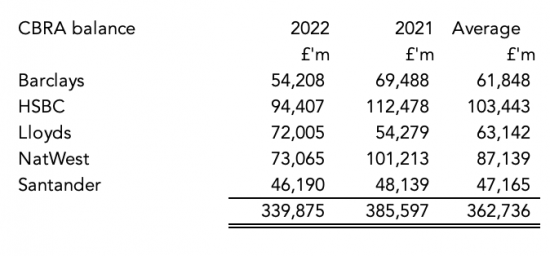

These banks all hold massive sums on deposit with the Bank of England on what are called central bank reserve accounts (CBRAs). This is not because they choose to do so. It is because the balances in question were created during the government's quantitative easing programmes from 2009 to 2021. Those programmes created new money. That money was spent into the economy via the commercial banks. The consequence is that they end up with these deposits that they did not create as a result of their own trading activity: they were effectively gifted to them as a result of government policy. Those balances as noted in their accounts for 2022 were as follows:

Source: The accounts of each of the UK banking operations of these banking groups and author's calculations.

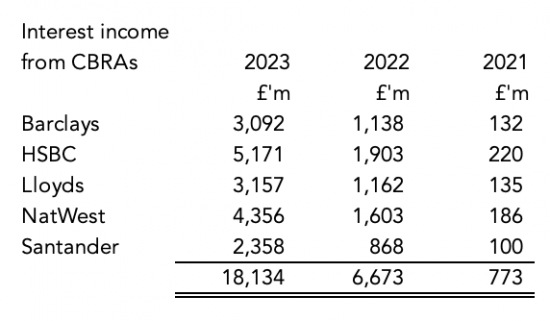

Perversely, the Bank of England insists that it must pay its base rate of intertest on these balances, suggesting that unless it does so its interest rate policy will not be communicated into the economy. The result is that whilst these balances enjoyed an average interest rate of 0.21 per cent in 2021 and an average rate of 1.84 per cent in 2022, they are likely to enjoy an average rate of 4.99 per cent or more in 2023[2].

The result is that the banks are likely to have enjoyed the following levels of interest income from the Bank of England in each of the years in question, assuming that they held the average balance for 2021 and 2022 for the whole period:

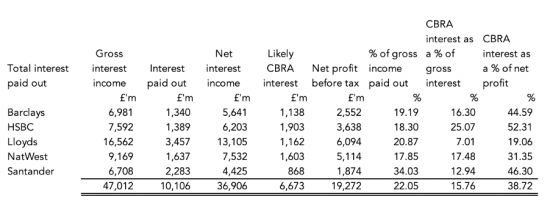

To put these figures in context the following table summarises key financial data relating to intertest earned, paid on deposits and net profitability, plus interest earned on the central bank reserve accounts of these banks based on their accounts for 2022:

It is clear that income earned by banks on the central bank reserve accounts is not being used to make payment of interest to bank customers.

On average 15.8% of the interest income of these banks comes from their central bank reserve accounts, but in the case of HSBC the figure reaches 25%.

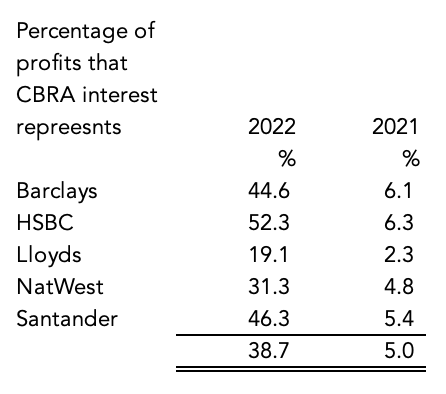

On average 43.8% of the net profit of these banks before tax is represented by payments on their central bank reserve accounts:

Since there is no evidence that any of this interest income from the Bank of England was paid on to any customer of these banks it is reasonable to conclude that the money went straight to each of these bank's bottom line profits.

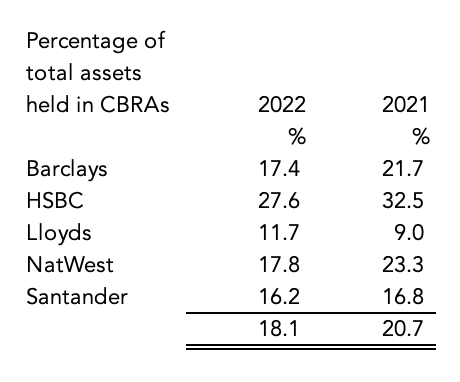

The disproportionate impact of these balances on the income of these banks is also reflected in the disproportionate share of the assets of these banks that their balances with the Bank of England on central bank reserve accounts represents. In proportion to gross assets (i.e. all assets, ignoring liabilities) the ratios are as follows:

On average 18% of the total assets of these banks is represented by a balance held with the Bank of England. That is quite exceptional and shows the impact of this activity on the UK banking sector.

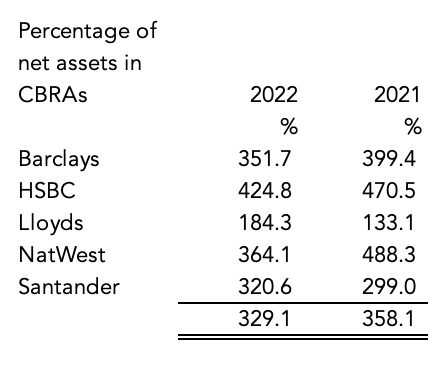

In proportion to net assets (i.e. the total shareholder funds in these banks) the ratios are even more significant:

These disproportionate sums puts in question the whole of the Bank of England's quantitative tightening policy which presumes that the programme is possible without impact arising on the banking sector.

These disproportionate sums puts in question the whole of the Bank of England's quantitative tightening policy which presumes that the programme is possible without impact arising on the banking sector.

Perhaps as significant is the impact of this dependence of UK banks on the government for income and profitability. This dependence may be at the heart of the poor valuations and relative underperformance of this sector in stock market terms.

As important is the impact of this cost on the government. These banks are likely to enjoy subsidies from the government amounting to £18 billion in 2023. They are not, however, the only entities to have central bank reserve accounts. The total balances on such accounts from all banks and financial institutions that have them now amount, on average, to approximately £800 billion at any point in time, meaning that the total interest paid by the Bank of England in subsidising the financial services sector might now come to almost exactly £40 billion in 2023. The Bank of England is indemnified for this cost by HM Treasury. At a time when austerity is threatened the necessity of making this payment has to be questioned.

The Bank of Japan does not make interest payments on all central bank reserve accounts held with it. It only pays the official interest rate on part of that sum and lower rates on the rest. A broadly similar policy exists at the European Central bank. It is important to note that there is no legal obligation to pay this interest in full: the Bank of England does so by its own choice. The rates paid could be changed by it if it so decided. It is suggested that up to £30 billion a year in interest costs could be saved at this moment by reducing the amount of interest paid over all on these accounts.

Richard Murphy, Professor of Accounting Practice, Sheffield University Management School, said:

This analysis shows that the UK's commercial banks are being unduly and unnecessarily enriched by the payment of interest to them on their central bank reserve account balances held at the Bank of England on which full base rate interest is being paid. They are not passing this sum on to their customers in interest payments. They are instead profiting from them.

He added:

This is particularly inappropriate when the UK's commercial banks did nothing to create the funds on which they are being paid interest. The money in question was created by the government and effectively gifted to the commercial banks, in no small part to save them in the aftermath of the 2008 financial crisis and to prevent a crash in 2020. Now they are profiting considerably from both events. That is inappropriate.

He concluded:

The country cannot afford to enrich our bankers and bankers by £40 billion a year when we are in the middle of a cost-of-living crisis and public services are failing for a lack of money. If interest was paid on just one quarter of these deposits that would still be generous, Bank of England policy goals would be achieved, and large parts of the economy might be saved from devastation as a result of £30 billion being available for use elsewhere. It is time for a policy change. It is time to end this grotesque and inappropriate policy that unjustly enriches our banks.

ENDS

Note: The relevant accounts used to support this analysis are of the operating UK banks of the groups in question, not the parent entities. These are as follows:

- Barclays Bank UK Plc - Company number 09740322

- HSBC UK Bank Plc - Company number 09928412

- Lloyds Bank plc - Company number 00002065

- National Westminster Bank Public Limited Company - Company number 00929027

- Santander UK PLC - Company number 02294747

[1] An attempt to include the Nationwide Building Society in this analysis was made but their accounts were insufficiently detailed to do so on a reliable basis.

[2] The rate has been calculated on a daily basis using Bank of England data for 2021, 2022 and 2023 to date. It has been assumed that the average base rate for the remainder of 2023 will be 5.5%.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

All I would add is that to use sovereign money in this way is totally undemocratic in a supposedly democratic country.

And as such, we have no right whatsoever to point our finger at anyone else for their democratic failings when money is being so badly used as this at the moment in England.

This is the pits I’m telling you. Have we now reached the end of the line? What other horrors does capital’s worshippers have for in store for us?

Excellent, Richard; ‘on the moaney’ is the appropriate expression. I never thought of H S B C as your average UK Hugh Street retail bank, and there it is; highest net ratios. Good work. Incidentally, is it not reasonable to consider CBRAs as basic collateral,from a UK Government perspective (it was sovereign money, our money provided in a crisis).

You were quoted in the Guardian.

I saw….

I am not suprised about the banks pocketing the extra interest as this will increase income. I remenber when maggi increase the interest rate to 15% the best I could get on my savings was 4%.

Richard, Please excuse my ignorance. I have no training in economics, being formerly a chartered engineer now in my mid-seventies, but enjoy your writings immensely. I am puzzled by the concept alluded to in your previous thread and subsequently in this one regarding the payment of interest by the Treasury on the CBRAs.

If the banks are substantially prevented from using the funds held in their CBRAs for purposes other than transferring balances between themselves, why is the interest paid on them apparently being treated differently? And, if the banks are allowed to siphon off these interest payments for their own purposes and not retain them in these accounts, will this not inevitably lead to a diminution of their relative value? Just as the value of my small savings is eroded by the very inflation the rise in interest rates is supposed to reduce? Logically, this will require the Treasury to “top up” the value of these accounts at some time in the future. A Double whammy (at least) for the Treasury.

The money held in those accounts is unimaginable for the layman. What is to prevent a UK government from appropriating all that money and using it to transform our public services which have been grossly underfunded for decades. Does the money belong to us.?

The money was created by the UK govermment

It serves a purpose where it is

BUT there is no need to pay interest on it