I posted this thread on Twitter this morning. I admit that at 2,000 words it is rather long. However, what I am suggesting is that the government is giving just five UK banks a bonus of around £18 billion this year as a result of unnecessary interest payments and that overall next year, that cost could easily exceed £40 billion for the whole financial sector.

These sums represent the payment of interest on the new money created by the Bank of England to bail out the UK banking system in 2008 and to pay for Covid. Almost none of the deposits on which this interest is being paid were ever created by the banks that are benefitting from these payments. They were, instead, in effect, gifted the balances in question.

Extraordinarily, not one of the five banks whose accounts I reviewed for 2022 and 2021 passed on a single pound of the additional income that they earned from these payments to a customer by way of additional interest paid. Instead, every single such pound went straight to the bank's bottom line, although I am quite sure that some might have been used to justify the payment of some massive bonuses to those who heartily congratulated themselves on the negotiation of this wheeze.

As I explain in the thread, these payments are not necessary, at least in anything like the current amount. They could be reduced by three quarters, at least, with the Bank of England still having ample opportunity to transmit its interest rate policy into the economy.

As a consequence, what this thread highlights is the fact that we have an economy being run for the benefit of bankers and not to supply public services, or to meet the reasonable pay demands of those who provide us with essential services, or to deliver support to those in need.

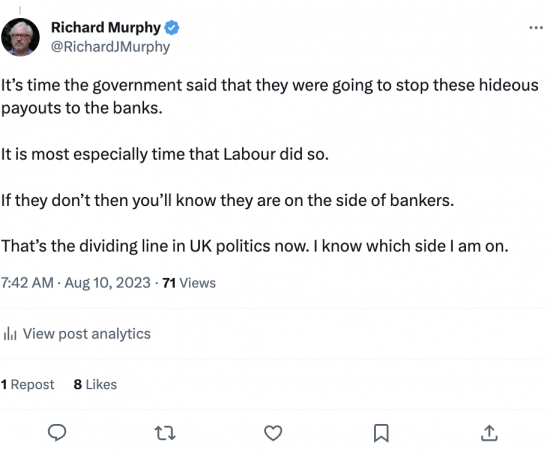

My conclusion to the thread was contained in four paragraphs, but all were in just one tweet, which was as follows:

This is what I had to say:

There is what might be described as an unfortunate side effect to the Bank of England's policy of raising interest rates. It is that the UK's main High Street banks might be paid £18 billion this year for sitting on money that the government quite literally gave them. A thread….

Way back in 2008 you might recall that there was a banking crisis. Without government intervention most of the UK's banks would have failed. As it was many, including Lloyds and the Royal Bank of Scotland (now NatWest), plus others now long forgotten, did.

The whole UK commercial banking system was saved by the UK government injecting more than £400 billion (that's 400 thousand million pounds) into the banking system.

That was new money. It was electronically created out of nothing by the Bank of England (which governments can do whenever they like, even though most politicians deny it). The process involved was called quantitative easing (or QE) but the name does not matter much.

What does matter is that new money ended up in a special type of bank deposit account that only commercial banks, some other financial institutions and some foreign governments can have with the Bank of England.

These accounts are special because they include what is called ‘base money'.

All base money is government created.

There are two types of base money. One is notes and coins, now worth around £80 billion in total. The rest is these special deposit accounts.

These special deposit accounts - also called central bank reserve accounts - exist for two reasons. One is to let money flow from and too the government via the commercial banks. The other is to let the commercial banks pay each other.

Looking at that first purpose, it should come as no great surprise that ultimately all our money is government created. Notes and coin obviously are. But in essence, so too is all the money recorded in commercial bank accounts.

That is because our money is either guaranteed directly by the government, which is what the £85,000 bank deposit guarantee scheme that so many people rely upon to have any confidence to save money with their banks is all about.

Or it's because of the fact that since 2008 the UK's commercial banks have been able to pay each other because the Bank of England created these special deposit accounts to make sure that they could do so.

What this means is that the money that we have in our bank accounts has value that we can rely on precisely because the government created the mechanism to ensure that the banks could always make payment to each other by gifting to them the means to ensure that they could do so.

When that ability of the banks to pay each other was threatened during the Covid crisis - as it was in March 2020 - the Bank of England stepped in again. It created more than £450 billion of extra cash as a result, at least partly for that reason.

Of course, that paid furlough and much else. But because new money was used to pay for those things and it has never been cancelled that money is still there in the banking system, sitting in the special deposit accounts that the commercial banks have with the Bank of England.

There are, incidentally, only two ways to cancel this money. One is for the government to run a surplus, which means it taxes more than it spends. This almost never happens and certainly will not be happening any time soon, so we can ignore that option.

The other is for the government to sell more bonds into financial markets than it needs to do to cover its deficits. The Bank of England has tried to do this over the last year or so, but whether that will be possible in the next year or so is currently unknown.

What this means is that these special deposit accounts - or central bank reserve accounts - are going to continue in existence for some considerable time to come. That's good news because they keep the banking system stable and in operation. They are vital, in my opinion.

I would go a little further than that. Given that we have had inflation and so need more money supply simply to allow for the fact that the pound is not worth as much as it was we might, if anything, need more of these deposits to keep the system functioning now.

Instead, the Bank of England is trying to reduce them by seeking to reverse quantitative easing - a programme they call quantitative tightening - which I think inherently deeply risky because it reduces the amount of money available to the banks to make payment to each other.

So, we need these central bank reserve accounts or special bank deposit accounts that the commercial banks have that were gifted to them by the Bank of England.

But what we do not need to do is pay anything like the Bank of England base rate of interest on these accounts, which is what the Bank of England is also doing, a direct cost to the government, who funds these payments.

The Bank of England has justified this policy by saying that if the Bank base rate of interest was not paid on these deposits then the commercial banks could swap these special deposit balances into something like government bonds instead and still get risk-free interest.

This is not true. That would imply that these deposits can be switched into another form of asset at the commercial bank's choice, but to a very large degree that is not true: unless they can persuade another commercial bank to take their deposit then any bank is stuck with them.

I stress that is because they are base money. That's not normal money. Base money of this sort's s uses are limited and in essence only permit inter-bank payments, and so to claim that the money can be used for any other purpose, as the Bank of England is doing, is just wrong.

In that case the Bank of England's claim that these deposits could be swapped into gilts makes no sense at all because technically that simply cannot happen.

There is another reason why the Bank of England might claim that their base rate of interest must be paid, and that is to reinforce their interest rate policy. It is accepted that this might be true for some of these balances. But there is no reason to pay this rate on them all.

Importantly, other central banks do not pay their base rate of interest on all the central bank reserve account balances that they have created for commercial banks working in their currency. The is most especially true in Japan, but it's also true for the European Central Bank.

Instead, those banks pay tiered rates of interest. They pay in full on the first part of the deposit and then the rate fades away. I suggest that the Bank of England pay in full on 25% of the balance and then pay at 0.1% on the rest - the last being the rate paid for most of 2021.

Why get so worked up about this, meaning that I have already written a long thread just to get to this point? That is because the sums involved in making these interest payments to commercial banks on the special deposits that were gifted to them are enormous.

There are now about £800 billion in these accounts. And the Bank or England's base interest rate is 5.25% per annum - and is still expected to rise. But just multiply those two together and the result is an interest cost of to the government of £42 billion a year.

Let me just put that in context. That's enough to provide the NHS with all the money that it needs.

It would have permitted all the quite reasonable pay claims made by teachers, academics, doctors, nurses, and so many others to have been settled.

It could have reduced poverty.

But, instead, it is being out by way of interest. So, the question is, who gets it? I did a bit of research to find out who some of the big recipients are.

To do that I read the accounts of the UK banking operations of the following five banks, covering 2022 and 2021:

- Barclays

- HSBC

- Lloyds

- NatWest (formerly Royal Bank of Scotland), and

- Santander.

I wanted to include Nationwide, but their accounts were not good enough.

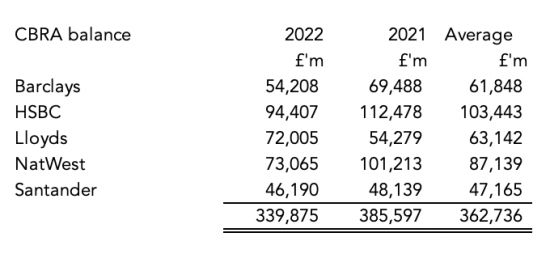

Then I created a summary of the average balance that they held on these special deposit accounts with the Bank of England in 2022 by simply averaging their opening and closing balances on these accounts for the year, and got this data:

These banks are likely to have around £360 billion in these accounts right now.

Then I assumed that their average balance held on these accounts will not change much in 2023, which is most likely to be a reasonable forecast.

After that I then multiplied these balances with the average interest rate likely to be paid on these special deposit accounts in 2023, calculated on a daily basis.

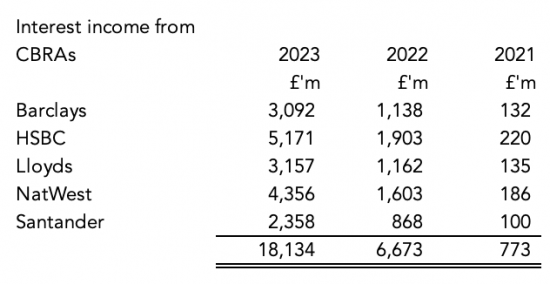

The result was that this year these banks are likely to be paid, or have been paid, these amounts on these special deposit accounts that they hold with the Bank of England:

Note by how much these payments have increased whilst the rest of the country has been having a cost of living crisis.

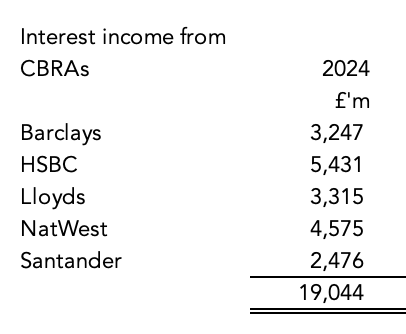

Assuming that the balances stay the same in 2024 and that Bank of England base rate is 5.25% for that whole year, on average, the amount goes up. They will get:

And this is how the Bank of England wants to keep things: they want to keep interest rates high and for so long as they do the UK's commercial banks will continue to be paid these massive additional sums each and every year unless something changes.

Now remember that the banks did not earn the money that is held on deposit in these accounts. They only have these sums because the Bank of England created new money to bail the banks out and to manage the Covid crisis.

If anything you would expect as a result that the commercial banks should be paying the Bank of England, and so the government, for the favour that they were given by being saved in 2008 and again in 2020.

That, though, in the crazy world of banking, is not how things work. Instead, our commercial banks are now being paid for having had the privilege of being saved by us.

And, to add to the offensive nature of these payments, not one penny of these sums paid to the banks by our government is being passed on by them to bank customers by way of extra interest on their accounts. The banks are, instead, keeping it all for themselves.

As my research shows, quite literally every single penny of this bung (I can't think what else to call it) from our government is going straight to the bank's bottom line, where it is recorded as extra profit to benefit their shareholders.

This money is being used to make the richest people in the country richer whilst everyone else suffers. There is no other way of putting it.

That's because as a result of the vast sums that these banks are being paid we must suffer austerity and our public services must be trashed whilst some of those who work in them have to use food banks to feed their children.

What is even more offensive is that this is not necessary. We could reduce these payments by at least three quarters, and maybe more. It would be legal to do that. The Bank of England would operate just as effectively as now. The banking system would still be safe.

In fact, it might be safer than now because the inequality that payments of this sort are creating is fueling a private debt crisis that might cost the banks a great deal when loans cannot be repaid.

So, why is that deeply offensive interest payment still being made? The answer is simple. We have outsourced government economic policy wholesale from the Treasury to the Bank of England and they run that policy in the interests of their mates in the City of London, and not us.

So, Barclays, HSBC, Lloyds, NatWest and Santander win, as do their bosses - who take home millions as a result of this for making massive profits that they say prove how clever they are when they've simply fleeced us all - and we all suffer.

It's time the government said that they were going to stop these hideous payouts to the banks.

It is most especially time that Labour did so.

If they don't then you'll know they are on the side of bankers.

That's the dividing line in UK politics now. I know which side I am on.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thanks Richard

One thing I don’t think is right. “£400 billion (that’s 400 *hundred* thousand million pounds)”

Surely £400 billion is 400 thousand million pounds, not 400 *hundred* thousand million pounds.

Since a billion is a thousand million, then:

➡️ £400 billion is four hundred thousand million pounds

➡️ _ £40 billion is forty thousand million pounds

➡️ __ £4 billion is four thousand million pounds

So great that you are keeping busy and trying to grasp these things. Even in SEN system one should never give up trying to learn.

A fine post – long – but with loads of really good points.

I would sum it up by saying that we value sovereign money in itself too much, and not what it can do for a country. Money is a utility to solve problems – instead here it’s production and storage is being misused in a most evil and self-interested way.

Money is being created to hoard and save at the top of society – in particular I think to serve rentier needs, and of course it’s going to keep those political donations coming in isn’t it – whether Tory or Laboured?

It is almost as if the money supply has been privatised Richard – that is what it feels like to me.

This is an appropriation and negation of sovereign money by private banks aided and abetted by bent politicians.

It is a key issue and should be more widely known – thank you for your hard work.

Thanks

I have made it my mission to try and get to grips with economics. I bunked off my economics lectures at Liverpool Uni in the early 90s, because the graphs had no numbers on – and have decided to make amends.

Thanks for these threads. They make sense when I read them, but I still struggle to try and understand / remember..

It takes time

As I say, one of these threads takes a couple of hours plus forty five year’s pratcie to write

I don’t think that Richard has a recommended book list (but perhaps should?). Here is what I found useful to read:

➡️ A Field Guide to Lies and Statistics – Daniel Levitin (2017)

➡️ The Deficit Myth – Stephanie Kelton (2020)

➡️ The Microeconomics anti-textbook – Tony Myatt (2021)

➡️ Making Money Work for Us – L. Randall Wray (2022)

I have a longer book list on my own web site, which focuses on Modern Money Theory (MMT) here: https://www.mmt.works/books-on-modern-money-theory/

Thanks Ian

Important to keep this in the public eye, this won’t go away. If you collect “windfall taxes” on a regular basis they cease to be “windfall” so we must find a way to deal justly with this (justly for the banks, too, as a windfall tax on profits is a blunt instrument)

A few things,

First, let’s be clear, whether this interest is paid or not SHOULD have no bearing on whether we can “afford” the NHS…. but in our current politics it DOES matter (as we have not moved beyond Household analogies). Much as I hate to say it, it may be a good chance to say “we will reduce the money we pay to banks in order to look after the NHS and its staff”. Labour should do this.

Second, I hear it said “It has always been done this way, why the fuss now?” Well, “Back in the day” before QE the CBRA balances were small and this was not an issue – the sums today are truly staggering as you point out.

Third, there ARE ways (and you touch on them) to reduce interest paid but still have an effective monetary policy. The challenge is to create a framework that is fair between banks…. but it can be done.

Fourth, when you say “not a penny” has been passed on to savers I think you exaggerate. My clearer now pays 1.75% on savings accounts (still zero on current accounts) so it is poor but not zero.

There are two routes one can go…

Either (a) reduce the payments to the banks or (b) redistribute those payments once they have been made…. or a combination of the two.

The first thing to do is to get NS&I to pay competitive rates (base -1% ?); better still if we be if we still had “Giro bank” but Nat West (yes, we still own a chunk and when it suits, government CAN direct it to do certain things as we saw over the Farage debacle) could be directed to pay higher rates to savers. At least these interest rate payments would be passed on to savers – although this then begs the question of how do we tax savings fairly.

The next thing is to look at average reserve balances (over the last year) for all account holders at BoE and pick a number (low at first, say 10% or 20%) for each institution that must be held as unremunerated reserves… and see how it goes. The banks will howl but the world will carry on. Then raise the number until we get to a level that does not hamper monetary policy transmission, does not lead banks to hold too few reserves etc..

Finally, there are taxes that are charged only to banks (not other corporations) that could be raised/tweaked to alleviate the problem.

So, a bit of movement on all these fronts would help, all are eminently do-able in a very short timeframe, they would not threaten the broad “status quo” of our banking system (yes, I know that perhaps we should challenge the status quo… but the sake of swift action on this issue it is best not to in this case).

This is a policy “open goal” for anyone wishing to step up. (I can’t help visualising the Monty Python Philosophers Football match where the whistle goes and nobody kicks the ball for ages).

Much to agree with

Wouldn’t it be more to the point (Emperor’s clothes…), simply to say that the system set up to save a failed system (the 2007-8 Crash); that pays interest of estimated £37Bn to commercial banks for CBRAs in two years has itself badly failed(unintended consequences – it wasn’t thought through to a high interest period arising!). Notice that even if the trickle-down interest you propose trickles down a little further to those with deposits; it doesn’t really trickle down to those most in need. Haven’t we lost something here, just trying to keep the ropy system slapped together after 2007 going; the bit where QE was supposed to spread through the economy didn’t happen then, and doesn’t happen now. Well, the irony is that years later, the banks have managed not just to gorge themselves on QE (save and prosper after ruining the system); but are now feeding off the carcase, into the far future: and it still is siphoned off by those already hooked into the system. So much for everybody left out: again. Is this really how we want to use £19Bn of public money every year – feeding Banks, and keeping the money in the banking system? All just for short-term aim; and whatever we do, don’t challenge the status quo. Sounds fatally similar to …..

Really? That is the best we can do?

May I just emphasise this point about ‘collateral’ that exercises me. I mean collateral as a pledge in the form of security, given by a borrower to a lender. Here is what you wrote about QE, Richard (slightly abridged): “Way back in 2008 you might recall that there was a banking crisis. Without government intervention most of the UK’s banks would have failed. As it was many, including Lloyds and the Royal Bank of Scotland (now NatWest), plus others now long forgotten, did. The whole UK commercial banking system was saved by the UK government injecting more than £400 billion into the banking system …. (or QE).

What does matter is that new money ended up in a special type of bank deposit account that only commercial banks, some other financial institutions and some foreign governments can have with the Bank of England”.

My point is that QE, must be considered as commercial bank collateral for the provision of a security (QE), provided to save the banking system; which was made available by the Government’s owned central bank to the commercial banks, effectively as a gift because they could not pay for it. It is surely quite absurd to consider that interest is now due on a gift, that is now being paid to the receiver by the donor (!) ; when the security is held in the central bank as collateral to ensure the commercial banks can pay each other. It was not set up to provide a substantial source of profit to the commercial banks, at public expense and at zero risk. It is surely absurd, and I cannot understand why that is considered tolerable, in any circumstances.

I think that is a very good point John and one I am accepting into my thinking.

I fully accept that major reform of banking is required. But realistically that cannot happen in a matter of months – it will be years (if at all). My proposals are not intended to substitute for reform, merely an attempt to offer a practical, short term fix that could realistically form a part of any political party’s manifesto.

I also think we need to be careful about calling QE a gift to the banking sector.

In 2008/09 banks were bailed out by direct equity injection by the government – a clear “bailout” (gift). They also received lending when the markets froze…… although paid back, this is also a “bailout” (gift). Lower interest rates and QE were positive for banks but really because it maintained the asset quality (ie. loans got serviced)… and this is different. One could argue that banks were merely beneficiaries (as we all were) of attempts to support the economy. To me, this is not a “bailout”.

QE allows government to spend without draining cash so, inevitably, it will sit in CBRAs at the BoE (it can’t go anywhere else). CBRA balances are not “their” money – it is ours (well, sort of). Whilst rates were very low this was not a problem….. now they are not it is. Money given to the banks when it doesn’t have to be (interest in CBRAs) fits my definition of a “gift”.

Indeed, this gift (interest on CBRAs) is the worst of all. One can argue that preventing major bank failures and losses for depositors did benefit ordinary people (as well as bankers) – but £40bn interest on CBRAs? Really? No possible justification.

I am niot at all sure I agree with all your logic or claims

“I fully accept that major reform of banking is required. But realistically that cannot happen in a matter of months – it will be years (if at all). My proposals are not intended to substitute for reform, merely an attempt to offer a practical, short term fix that could realistically form a part of any political party’s manifesto.”

The problem here is that this short-term manifesto wheeze is exactly what is on the Labour tin; short term, a manifesto pledge that will either be worded by the Oracle at Delphi, or or is outside the planning horizon, and simply ignored. All to produce a real solution that will take unknown years or decades, or never. I am struggling to see the attraction, apart from the perspective of here today, gone tomorrow politicians, that ever affects a negative opinion poll tomorrow, and are selected by the Party because it has no intention of doing anything ‘challenging’, and the Party has done its best to choose clones who will do what they are told; either difficult of well. They just want to win an election, and keep the paranoid-aggressive neoliberal media out of their hair (the electorate can whistle for four years; they had their chance, and were suckered again). This is why we are where we are; short-termism, running amok, and now permeating absolutely everything. This is just self-destructive.

Three “gifts” out of four. I think that makes my case; and candidly, I am unconvinced by your argument about the fourth; but I will rest it there.

Sorry Clive, all this would be really depressing – if I hadn’t already decided Britain is a hopeless basket case, whatever happens.