I posted this thread on Twitter this morning. The report to which the thread relates is here.

There has been much discussion about the likely failure of Thames Water in the last day or so. I've been looking at the accounts of England's water companies for the last twenty years. My conclusion is that they are all environmentally insolvent. So, a thread…..

[Please note this is a long thread. If it appears to stop midway just hit ‘See more replies' and the rest should appear.]

There are nine companies in England that take away sewage. There are more that supply water alone. But the crisis that the English water companies face largely relates to sewage so my work has looked at the ones that take our waste away.

Thames Water is one of those sewage companies. The others are Anglian Water, Northumbrian Water, Severn Trent, South West Water, Southern Water, United Utilities, Wessex Water and Yorkshire Water.

It's important to say that although I used the accounts of each of these companies in my work, the results I am talking about here or for the industry as a whole. To get a proper picture of the water and sewage industry I combined their accounts into one single set.

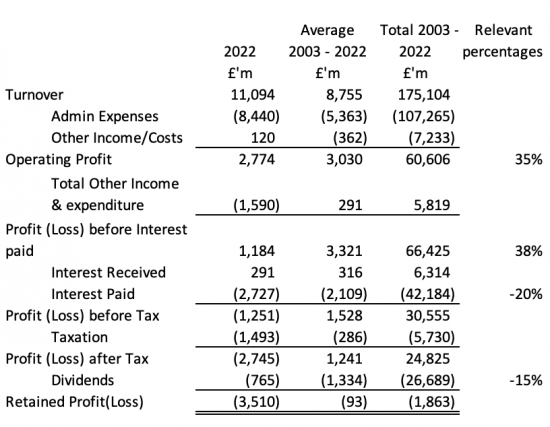

Doing so produced some quite astonishing data. This is what the profit and loss accounts of the combined water and sewage companies of the UK looks like for 2022 in isolation, for 2003 to 2022 in total, and on average over that period:

There is a lot of data there. There are, however, some straightforward facts to concentrate on.

Firstly, the operating profit margin in this industry is 35%. That is staggeringly high, and it goes up to 38% when other income is taken into account. 38p in every pound you pay for water is operating profit i.e. profit before the cost of borrowing.

Second, note the cost of borrowing. I have generously offset interest received against interest paid. That still leaves interest costs representing an average 20% of income. 20p in every pound paid to these companies, on average, goes on interest.

That still leaves them profitable though. And they do pay tax. The average tax rate is 19%, but that is way below the expected tax rate for this period when the tax rate was as high as 30% for some of it. And much of that tax has not been paid: more than £8bn has been deferred.

Finally, of the almost £25 billion they have made in profit over the years they have paid out every penny, and more, in dividends. In other words, the shareholders have taken 15p in every pound paid for water. There was nothing left for reinvestment, at all.

No wonder the water industry is in trouble. The income statement shows that the public is being fleeced by these companies who are simply treating the fact that the English consumer has had no choice as to who to buy water from as a means to extract profit from them.

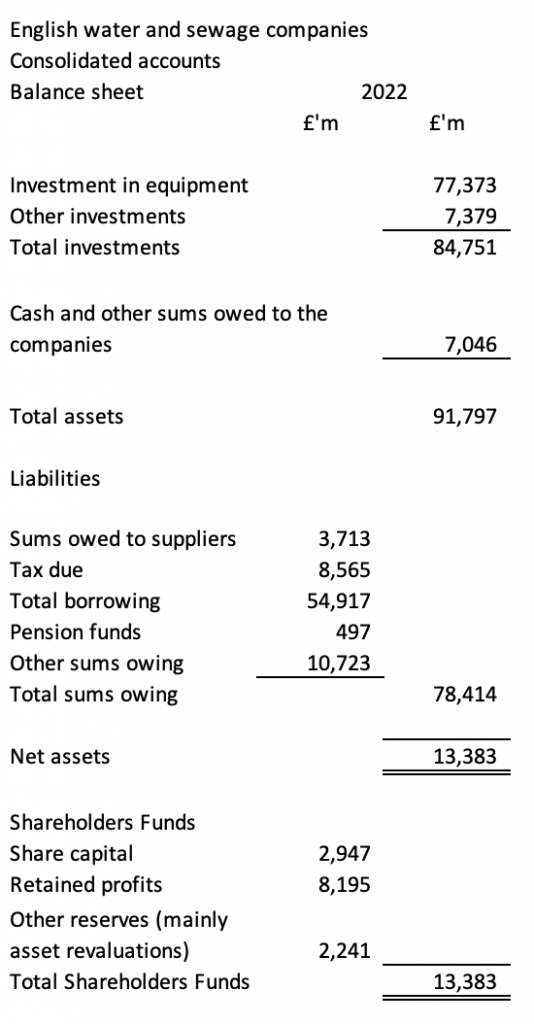

Things are if anything worse if I look at the balance sheets. Now I know these scare most people, so I will talk through the detail. This is a very summarised balance sheet for the industry in 2022:

The industry has £77 billion invested in equipment. The rest of its assets are some financial investments, a bit of cash and sums owing to it from customers. So far, so good.

What is scary is what the industry owes. The £77 billion of equipment is financed, in the main by borrowings of almost £55 billion, or more. It's also funded by the tax not yet due of more than £8.5 billion, which brings down the cash-paid tax rate of the industry considerably.

Even the pension funds of those working for the industry are contributing to the funding, and there is more borrowing of various sorts in the other sums owing totalling more than £10.7 billion.

What this means is that of the total near enough £91 billion invested in the sector more than £78 billion is funded by borrowing or sums owing of some sort and only just over £13 billion is funded by the shareholders.

What that also means is that the shareholders provide less than 15% of the overall funding for this industry. So much for the idea that private capital would fund water after privatisation. The reality is that borrowing is doing so.

When I began to look at the data in more depth things only began to get worse. What I was really interested in knowing was how much the water companies had invested in equipment over the twenty years reviewed.

The answer was, in my best estimate, that sum was £89.8 billion. Of course, some of that has now worn out and has long gone from the accounts. Assets like vans and computers do not last that long in use.

Then I worked out how that investment was funded. There were just two ways. One was out of operating income. For the technically minded this is possible using what is called the depreciation charge in the accounts. This sum amounted to £38.9 billion. Customers provide this money

The rest of the funding came from the increase in borrowing over the period. That amounted to £40.5 billion. Other long-term liabilities, which are again mainly borrowing or pension fund liabilities, increased over the same period by £10.4 billion.

The net result is that of the £89.8bn invested, customers or borrowing of various sorts provided £89.8bn of the funding meaning the shareholders effectively made no investment in the assets of these businesses, at all.

This matters for one very good reason. As we all know these businesses are now routinely polluting England's rivers and beaches with sewage. That sewage comes from what are called storm overflows, although that's a misnomer now, as many release sewage even after modest rainfall.

That pollution cannot persist. Unless it is stopped we will end up without reliable clean water in England. The estimated costs of ending this pollution do, however, vary considerably.

The industry has offered to invest £10 billion over seven years, or £1.4 billion a year. The government has decided that £56 billion is required over 27 years, or just over £2 billion a year. The trouble is neither sum will come close to getting rid of the crap in England's water.

The House of Lords looked at this issue based on independent analysis and concluded that the most likely estimate of the cost of getting rid of all the pollution in our water was £260 billion. And that needs to be done as soon as possible. I suggest ten years.

If that investment of £260 billion was made, we might have clean water in ten years.

What the industry is offering is something quite different. Even if they meet the government's demand of them, at best I estimate that based on officially published data they might cut the crap in water by two-thirds, at best, by 2050.

So why has the government set such a low investment target that still leaves us with polluted water? The only possible answer is that they wanted to make sure that the private water companies would not go bust by having to spend too much.

Let me put that another way. The government thinks that saving the private water companies is more important than them polluting our water, rivers and beaches with all the costs that will create.

The government has made the wrong decision. But if the required £260 billion was spent (with more required to become net zero compliant) then the water companies would go bust. What that means is that they are environmentally insolvent.

The concept of environmental insolvency applies to any business that cannot adapt to make its business environmentally friendly – as climate change and ending pollution requires – and still make a profit. What it means is that its business model is bankrupt.

That is where the English water industry is now. Thames Water might be facing environmental bankruptcy, but this industry as a whole is in my opinion incapable of funding the investment required to deliver clean water and be profitable.

The government might be making noises about taking Thames Water into temporary public ownership, but that is meaningless when Thames Water can never be profitable and deliver clean water. There is only one answer for this industry now, and that is nationalisation.

I would suggest that this nationalisation should be without any compensation to shareholders. That is because their businesses are environmentally insolvent. Providers of loans might also have to take a hit too: they made a bad decision lending to these companies.

The government will then have to support the industry using borrowed funds. I suggest it should issue water bonds via ISAs to the public to do this. Wouldn't you want to save in a way that ensures we all get clean water in the future? I would.

And the way in which water is charged for might have to change. The idea that we all pay the same price per unit irrespective of the amount of water used seems absurd now and might need reconsideration.

But my essential point is that the water industry has to now be nationalised because it is not only failing us already but on the basis of current plans will probably do so forever, and that is not only not good enough, but is really dangerous to our wellbeing.

Our politicians have to now say it is time to end the shit in our water and take control of this industry to make sure that we get clean water. After all, if they cannot guarantee clean water – an absolute essential for life – what are they for?

Finally, a few technical notes. First, this analysis is based on the activities of the companies actually supplying both water and sewage services in England. It is not based on the groups of which they are members.

Second, the conclusions are based on aggregate data. They cannot be applied to any one company.

Third, the data used is extracted from databases but is correct to the best of my belief based on that limitation.

And, if you want to see the report on which this thread is based it is here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Your analysis appears to focus on the cost of improvements to the sewerage network only and does not include costs for improved sewage treatment?

True

More importantly, it does not address climate change either

The costs are, therefore, even bigger than I note

Agree with most of your analysis / especially in regard to the financial assessment. However you start of the assessment by rightly differentiated drainage and water supply, then you state “That pollution cannot persist. Unless it is stopped we will end up without reliable clean water in England”.

You seem to be confusing drainage and water supply here, CSO spills have next to no impact on water supply, CSO spills are not even the biggest cause of poor river health, they come behind phosphorous from Treated sewage and agriculture. If that is your basis that £260 billion needs spending on stopping every CSO spill i think you are mis-guided.

Agree in general though that they should be nationalised at the shareholders expense.

Excellent but damning.

We can’t get anything out of this but the overwhelming sense that we live in an economy manufactured by vested interests. There is no comfort to be had at all. We all know what is going to happen next.

They interviewed a visiting professor on R4 this morning on my drive to work who is saying exactly what you point out here.

None of the pension funds or sovereign wealth funds who own Thames Water and others know anything about the water and waste industry. All the money has been taken out. They are just sitting there like cuckoos with their gobs wide open to eat up revenue, and then leave the company with the debt!!

When will people understand that privatisation merely creates another mouth to feed – the investor – who comes first and will soak up profit and walk away with it leaving the investment side to do what exactly? Be debt funded?

I think that this model of privatisation – similar to me at least as to what happened at Railtrack – has gone beyond stupid.

To call it stupid is to hide the deliberate intent to create what were nothing but get rich quick schemes for the already wealthy and income for poorly managed and defined pension funds (which is another obscenity that needs dealing with – funds that rapaciously take money from one generation to support another literally contribute to running their ‘investment’ into the ground depriving its workers of the same comforts their retired members get).

Surely we can do better than this?

But we won’t be allowed to will we!

Also this morning I heard that the gerrymandering scum at the Boundary Commission had been at work again – reducing seats in Wales and Scotland (any thoughts as to why?) and creating new ones in England.

And if we don’t like it we’ve got to lump it because we are not going to be allowed to protest about it either.

Democracy? You’re joking aren’t you? It’s all wrapped up and neatly packaged, signed, sealed and delivered.

Thatcher’s biggest gift and our future:- the exploitation economy (we don’t need a fancy word like ‘rentier’ to describe what it really is, let’s not mince words).

We are here to do nothing but to funnel our money towards the rich. That’s it!

The Capitalist Nirvana Age is here.

Agreed

PSR, 2 seats disappearing in North East England. Mine, North West Durham, is being shared out between North Durham, Durham, Bishop Auckland and Hexham.

The other one disappearing is Wansbeck, to be shared among Hexham, Berwick and Cramlington. The county town of Northumberland is Morpeth, but it’s never had a parliamentary constituency named after it since 1983.

One of those new seats in England is earmarked, I understand, for Rupert Harrison, who plans to enter politics proper after long being economics advisor to George Osborne, the power behind the smirk, if you will. He’s tipped, I gather, as a future PM, thus one wonders what fresh Hell etc. etc….

Bill, the seat for Harrison is Bicester and Woodstock. Apparently he is from the area, even though he works in the treasury at the moment. At least that’s better than labour who parachute people in anywhere they want to.

“We are here to do nothing but to funnel our money towards the rich. That’s it!”

Here to be leached on! Succinct!

Thank you for such a clear financial picture. It would be fascinating to see which investors cashed out over the years. Brett Christopher excellent recently published book, Our Lives in Their Portfolios, Why Asset Managers Own the World, is fascinating background reading to this scandal.

Thanks for providing that shocking analysis Richard. Note that there don’t appear to be any links to the source report.

There is now

Very fine post, perhaps one of your best. It is tempting to say that this was all planned (by the vile-tories) but this would be to attribute to them a level of intelligence that events show they do not have. Given Vile-Libeore are likely to win the next election, the open question is: what do they plan to do? 30 years of regulation via Ofwat & the EA has been shown not to work.

A failure to propose substantive action by vile-Liebore will show that, like vile-tories, they are happy for UK serfs to swim in shit filled rivers and the sea. I look forward to a stream of nonsense (shit?) from vile-Liebore on this subject.

This failure to invest in core infrastructure is emblematic of the long term decline of the UK. The current body politic is incapable of either understanding the core problem or recognising what needs to be done. Vile-tory – failure after failure after failure, a failed party. Vile-Liebore, cowardly liars, for nearly 30 years, puppets dancing to Thatchers tune.

I am genuinely flattered

A Trenchant, forensic deconstruction. 35% Operating profit, and around circa 17.5% pre-tax profit margin? For a monopoly. Good heavens, that is so easy. I spent my life in business; but I was obviously in the wrong sector (what a mug). Debt/equity I make from your data: 4.1. I mischeviously tried to check Apple’s D/E (slightly conflicting figures from different sources, although not entirely clear on consistency of definitions), for a reminder of a genuine blue-chip global player that is not a monopoly; it seems to be <2.

Water: too critical to fail. Good grief. Bail-out coming …..

"So much for the idea that private capital would fund water after privatisation. The reality is that borrowing is doing so." That is just modern capitalism. Capitalism doesn't use capital if it can possibly avoid it; especially its own. Borrow, or pass the buck to Government. Then claim you are the hard-pressed hero of the modern world, entitled to special privileges. Clearly, it works.

It is sovereign funds and pension funds that have piled in. Understandable, for a natural monopoly, with 35% operating profit, and soft regulation. They clearly think the water companies are too critical to fail. But it does raise an issue about how pension funds are approaching risk in the modern world. I can no longer remove the LDI crisis from the back of my mind.

Much to agree with John

Good job we’ve got Ofwat to make sure this doesn’t happen……….

Yeah right. I’m not convinced any of the government regulators acts in the public interest. Their brief seems to be to protect the industry from interference in its profitability. You’d think a Labour government/opposition would be severely critical of this, but it doesn’t seem so.

Thank you, Richard, as ever for your diligence and commitment to exposing this. I’m going to spend some more time going through the numbers and detail later in the day (sermon to prep, etc. to be done!)

The point that jumped off the page is that “Even the pension funds of those working for the industry are contributing to the funding.” I’m assuming, but may be wrong, that those are the water companies’ own pension funds. If so, it looks like a plain case of not only alongside screwing the customers and the environment but also prejudicing the future pension rights of the people working for the companies.

I recall from days when both my father and I worked for the Birmingham Small Arms Group (of late and blessed memory) that the chairman asked the pension fund to put in money to support the company when it was heading towards the graveyard. The company secretary, who ran the fund, very politely said that would not happen.

This whole matter raises so many questions about corporate governance.

Indeed

If we look at the bigger picture (the “hollowing out”of Thames Water being a mere signifier) the UK is in real trouble it has a political system that makes it easy for individuals who are incompetent managerially, or morally, or both to gain high political office and perpetrate potential serious disasters such as unclean water for thousands if not millions. Just this alone is quite literally taking the country back to Third World status.

As your water report suggests the only “safe water” way forward is renationalisation of the water and sewage treatment industry. Clearly we know where the Tories stand morally on this but what about the Labour Party? There have been so many broken pledges and u-turns under Starmer you can’t really argue managerial competence and therefore that the necessary water renationalisation will take place or indeed other badly needed renationalisations.

This all I’m afraid leaves the country seeking to vote in the hope of a coalition government and the chance that managerial competence and a moral compass will become available.

As a comparison if the Chinese government can pump large amounts of money into its economy to help decarbonise its electric power supply then so can the UK government to help sort out the country’s failed water and sewage treatment industry by renationalising it. Industrialised human economies have now become heavily dependent on reliable clean electricity and water supply as fundamental basics have they not?

“The report attributed China’s remarkable progress in expanding its non-fossil energy sources to the range of policies its government has implemented, including generous subsidies to incentivise developers as well as regulations to put pressure on provincial governments and generating companies.”

https://www.theguardian.com/world/2023/jun/29/china-wind-solar-power-global-renewable-energy-leader

No hysterics about how China can afford it either, I note.

China owns part of Thames Water. Obviously been taking money out of it, presumably to put in its own renewables.

The Times has a exasperating quote in their editorial;

“Its (Thames Water) debts cannot simply be written off wholesale on nationalisation because that would destroy Britain’s credibility as a safe destination for overseas investment. And there would be casualties closer to home. The second biggest investor in Thames Water is the Universities Superannuation Scheme, providing pensions to 400,000 active and retired academics.”

The ever increasing financialisation of our world has become a real problem. It has infected all of our economies and we seem helpless to unravel it all in any fair or sensible way. The Tories will not allow Thames Water to be nationalised permanently for the above reason and I very much doubt Labour will do it either.

https://www.thetimes.co.uk/article/the-times-view-on-water-crisis-drowning-in-debt-pf70mvxww?shareToken=f07ddfee59448ae7957b56cab3a5919d

That is total nonsense

It effectively says that these companies are state agents – and they are not

Thank you for your time and effort in putting this together and I agree totally with your conclusion.

From what I have been able to find out, here are the political options.

Tories – Free market. Temporary nationalisation if necessary, no doubt funded by the magic money tree that they say doesn’t exist. Ultimately, privatise the profits, nationalise the debt. Then give it back to the market to carry on as before. Ultimately, the rest of us will pay the polluting b*stards.

Labour – Greater regulation. Don’t mention nationalisation, Rachel “iron clad” Reeves is listening.

LibDems – ‘public benefit companies’ New one on me. Probably better than what we have got, but still easy to manipulate.

https://www.bbc.co.uk/news/uk-politics-66043763

Green Party – Public ownership.

“Ultimately, to end leaks, stop sewage discharges and cut bills we need to take the water supply back into public ownership, which is what the Green Party believes must be done at the earliest practicable opportunity.”

https://www.greenparty.org.uk/news/2022/08/09/greens-call-for-action-on-water-companies-as-england-faces-heat-health-alert-and-drought/

Reform UK – A bit of government ownership with a hint of racism.

End foreign ownership of utilities, says Reform UK

Under the proposal, set out by leader Richard Tice, companies supplying and distributing energy and water would continue to be run by private firms.

But 50% would be owned by the government and 50% by “British pension funds”.

https://www.bbc.co.uk/news/uk-politics-64464933

So, that’s the choice. In my book the Green Party win by a country mile, but that little matter of FPTP stuffs our future yet again. We will probably get Rachel “iron clad ” Reeves.

The LibDem when is odd….and cannot work IMO

One good thing about seeing the articles on Thames Water is that hopefully people will realise who exactly owns their water companies.

“The existing shareholders are large Canadian and UK pension funds, and investment vehicles for state money from China and Abu Dhabi, which could now be at risk of losing at least some of their investment.”

From an article in the Guardian.

It’s the same for all other English water companies.

It will hopefully make people realise that we need to renationalise our water companies.

weownit are getting more signatures to their campaign again.

https://weownit.org.uk/act-now/stop-sewage-taking-back-our-water

Richard

Did you look at all at who these companies owe money to? In 2022, looks roughly that they were paying 5% on borrowings, which is fairly modest, but on the other hand borrowings are more than four times shareholders’ capital, so I would guess a lot of the borrowings are to overseas affiliates, which apart being another way of taking value out of the UK, also has a significant effect on tax paid.

Prem Sikka has looked at that issue and a lot of the interest – but not all – is being paid to affiliates

He and I discussed this last night

I started working for Southern Water in late 1987. My recollection is that the first attempt at privatisation had recently failed because it was intended that the private companies would also continue to police the monitoring of the rivers. Privatisation was finally achieved in late 1989, after the setting up of the National Rivers Authority (NRA) was included in the legislation. The NRA was later absorbed into the Environment Agency (EA).

During the transition period to privatisation we were given legal guidance on how this would affect our work and what the risks were to the company. On a few occasions’ lawyers warned that sewage works failing to provide adequate treatment could be served with an injunction to stop discharges. At the time this seemed to be considered a likely occurrence and the consequences would be dramatic. Even a small rural works discharges several hundred of cubic metres of final effluent each day and the task of tankering this to another site for treatment would be impractical, leaving the company facing unlimited fines. Unfortunately, it never happened, it was either a too pessimistic reading of the new rules or the NRA/EA have not deemed the problems sufficiently dire to require this action. Had even one small works been faced with closure by this means, I think the industry would have really taken notice!

Although I don’t agree with privatisation, something had to happen to improve sewage treatment. Successive governments and local authorities had failed to provide the financing to improve sewage works – apparently there are no votes in sewage. I think a lot of work was completed after 1974 when the management of sewage treatment was taken away from local councils and given to the new Water Authorities. By 1987 the systems were still quite primitive. I believe the Water Authorities were very constrained by public sector borrowing rules and had to finance improvements out of their charges and occasional financing from government. After privatisation a lot of new technology arrived, and improvements were made, mostly because of EU directives.

A point that is often missed is that few sewage treatment works are designed to treat or positively remove pathogens (eg E Coli) from the final effluent. Some pathogens are removed in the sludge that must be treated before use on land. Some plants use UV and disinfectants to kill pathogens in the final effluent, but this is very unusual (at least it was up until 2007, when I retired). The system relies on dispersal within receiving waters and sterilisation by sunlight. Personally, I wouldn’t recommend bathing in any section of river that is downstream of a sewage outfall, which rules out most rivers in the UK. For coastal sites, the discharge point should be a couple of kilometres offshore and the beaches should be safe. Of course, this only applies if the treatment processes are working as they should and there are no uncontrolled discharges!

Thanks

A very good post. In summary: total & systemic failure at all levels from…….the 1960s? onwards (nearly 70 years?). Sticking plaster stuff and indeed – no votes in sewage treatment – although this seems to be changing. A metaphore for a failing UK – as a country it can’t even handle its own shit.

Just had lunch with weownit and Cat, and mentioned your Cut the Crap report. They will be reading it now, I would think.

This is their Thames Water public ownership petition.

https://weownit.org.uk/act-now/bring-thames-water-into-public-ownership

They have found out from all the NHS stuff and buses and trains that they do that people respond more to piecemeal change rather than the system as a whole.

Thames Water in the news now. Which company will be next.

Love your photo of the Tyne, by the way. Most people forget how rivers running through cities start.

Thanks

I am a big fan of what Cat does

Thye North Tyne was stunning

There was a pair of common sandpiper there to add to the appeal – but they aren’t in the photo

So it seems to me that all this is deliberate. The water companies go broke, to be bailed out by the government, who will also have to clean up the rives, enabling them to be re-privatised later without the baggage. The same small group will make billions, and the cycle continues.

Is there any company on the planet which is environmentally solvent under your sustainable accounting criteria?

Prbably not

But very large numbers could be – th science has shown it

Jon, shouldn’t it be up to us to try and make sure that the ones we support can be? I am thinking of companies like Ethical Superstore, Ecotricity, and what used to be Tradecraft but now has another name. Triodos bank?

That’s the problem with capitalism, financial profit is the only measure of success. There is no consideration for the environment or health, or just doing the right thing.

I like the term ‘environmentally insolvent’. I hope you are going to charge one pence per use of it. I owe you a penny.

“this industry as a whole is in my opinion incapable of funding the investment required to deliver clean water and be profitable”

Is it incapable or is it allowed to be incapable? Former suggests impossible to make sufficient profits to fund investment; latter suggests a failure of government to ensure investment.

Surely the industry could be made profitable (enough to then invest sufficiently for clean discharges) by increasing prices for the customer? If it’s for clean drinking water, they’ll wear it. If it’s for environmental protection, there’ll be massive pushback from the politically ‘right’.

As a quick aside, poor sewerage isn’t the only polluter of our waterways, of course. Agricultural run-off will be a big part of the estimated £260bn clean-up cost. Farmers/consumers to pay.

Back to the water companies, it’s quite extraordinary, and damning, that every penny of distributable profit has been distributed, and they even appear to have tipped into illegal dividends, when these companies are supposed to be operating for the greater public good. The only conclusion to be drawn from that is that these entities operate for the benefit of the shareholders, not the public.

I’m intrigued by the fact – according to my understanding of the above – that the shareholders have (or have ‘effectively’?) contributed precisely £0 to investment.

Does that mean that the £2.947bn has been unchanged for 20 years? Just the initial tranche of paid-up share capital? The shareholders just sit there waiting for their next (dividend) hit, like an addict waiting for his next prescription of methadone?

If so that’s a damning indictment of private investment, in fact it could be argued that this company or these companies are simply masquerading as private companies, if the shareholders provide no further capital investment beyond the initial tranche? It’s not really capitalism, is it, just setting up a company and then financing it (investing for future profits) from borrowings. Not in my book. It’s an incredibly lazy form of capitalism, though I guess sustained periods of near-zero interest rates do mean borrowings are attractive compared to shareholder funding.

There have been no rights issues in the entire period?

You say shareholders have provided £13bn of funding, and I completely understand why you give that figure, due to accounting convention (asset revaluations are not investment by shareholders in essence), but it could also be argued that they have only actually put in the initial £2.947bn, which obviously makes their contribution even more meagre compared to borrowings. I mean, £3bn out of £58bn (i.e. £3bn + £55bn) is about 5% shareholder funding. What’s the point? You might as well take it all ‘in house’ (privatised) if 95% of your funding is from borrowings. It’s kind of Capitalism In Name Only isn’t it, 5% shareholder funding.

If there are financial wobbles, currently, I presume this our old friend rising interest rates again? Companies have been apathetic for the last 20 years, thinking interest rates would remain historically low, ignoring the possibility of ‘rainy days’ ahead, and have now been found out?

The concept of bondholder investment seems very attractive. The Green Party gain remarkably little power in the UK compared to the likes of Germany (probably Germany is a huge outlier) but green investment bonds in public utilities would at least allow supporters to vote with their wallets, even if those voters have no chance of taking over e.g. the Greater London Authority.

What price Greenium Bonds?

Or King Charles could make himself useful by suing the polluters. He owns the water in Britain’s rivers (doncherknow). Come on, you’re the king, act like one. Even just for a day. Would Henry VIII allow someone to pollute his rivers? No he damn well wouldn’t.

Sorry it took time to address this

The industry is profitable but now addled by unserviceable debt and unrealised debt expectations

I made clear there have been capital injections in the report. They have funded dividends and now losses.

The £13.4 billion is a composite. The report adds more detail

This link was in an Evening Standard article two hours ago.

https://weownit.org.uk/public-ownership/water

Some years ago I found myself in a role effectively arbitrating between Thames Water and the supplier of their outsourced IT services, a large and respected organisation. What we learned was that Thames were a ruthless and utterly untrustworthy organisation who treated all their suppliers badly. I ended up quietly agreeing with the MD of the supplier that the plan would be to lose Thames as a customer over a few years. This was a non trivial contract but some organisations are not worth having as customers. (I can tell a similar story about RBS).

It is no surprise to find that Thames are a truly rotten organisation. When organisations have lost all sense of values or morality, no amount of regulation will work. They merely game the system. Banking is much the same.

I put £10 on a horse yesterday – it came in last. To my utter dismay, the bookmaker refused to give me a refund (compensation). I wonder why the very idea of “compensating” shareholders is given publicity. Whatever happened to the concept of risk? This is a theme repeatedly mentioned by Mick Lynch when he correctly asserts that operators who take on rail franchises are not accepting or taking any risk at all….

Well said

Great blog entry again. I wonder what a similar analysis of the energy and supermarket sectors would look like or a more general treatment of FTSE 100 versus FTSE 250 versus non-publicly traded firms would look like?

I would like t9 do it….

[…] Water seems to be more than a local political difficulty. The accountant Richard Murphy has a post on his blog which looks beyond the detail of the failure of Thames Water to the wider issue of the […]

Richard, what do you say to the argument that pensioners would lose out if Thames Water shareholders were not compensated in the event of it going bust? Well done on the publicity you are generating on this issue.

If their funds made bad decisions, so be it

I am exposed to Thames in this way