Martin Wolf wrote an article for the FT that began by saying:

At this stage in the inflationary process, a central bank needs to show moral fibre. Last week's 0.5 percentage point rise in the Bank of England's intervention rate was unquestionably necessary. It may even be that the resulting 5 per cent rate will not be the peak. Nevertheless, doing whatever it takes to bring inflation to target is more than merely desirable, it is the bank's legal duty. Nobody on the Monetary Policy Committee is free to ignore this obligation.

He goes on to demand a recession.

Every now and again Wolf writes something I can agree with. I was beginning to think he got the significance of climate change, for example. He also appreciates the cost of high-interest rates on developing countries. Occasionally, I could almost imagine that there was somewhere deep inside him a human being struggling to get out and even show remorse for his past neoliberal failings. But I was obviously wrong. It takes considerable indifference to human suffering on the altar or monetary orthodoxy to write something as indifferent to human wellbeing as that paragraph.

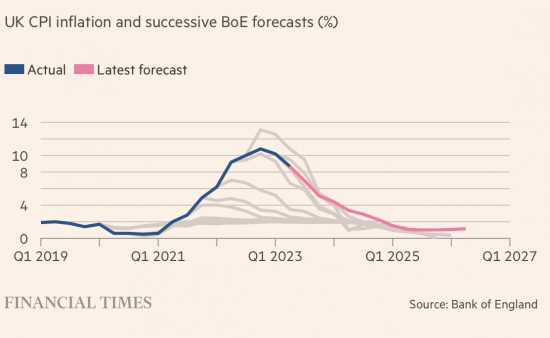

The rest of the article was as bad. I would even accuse it of spreading misinformation. This chart is an example:

I do not hold back in my criticism of the Bank of England, but to include forecasts of inflation from early 2020, when we had no reason to think inflation would rise, in this chart is misleading. It's also misleading to include a forecast of inflation without energy price support when it was known that was going to happen. This chart is disingenuous as a result.

But so is Wolf. His claim that the Bank of England have a legal duty to cut inflation is crass. The government creates vast numbers of legal duties that are in reality no more than statements of objective. Wise people know that. Wise people also know that in the face of changing circumstances, compromise and reappraisal are required, with new objectives being set. To pretend that a law that was itself no more than a whimsy of a passing politician, now losing removed from power, is justification for the imposition of human misery of the type Wolf demands is an indication of what might, if I am being kind, be called intellectual poverty.

And let's be clear about what Wolf's weasel words really mean. He is saying 'there is no alternative'. He's back to his very worst Thatcherism.

But he is wrong, of course. Two members of the Bank of England Monetary Policy Committee last week disagreed with him, or at the very least thought that their legal duty was best exercised by taking no action right now on interest rates.

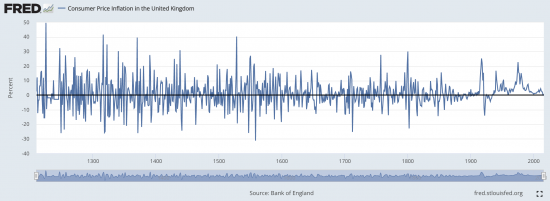

And he is wrong because, as I have noted before, the reality is that inflation always goes away anyway. Take, for example, this St Louis Fed chart which summarises data from the Bank of England on inflation trends in first England and then the Uk over a period of more than 800 years:

After a period of inflation there has, historically, always been deflation, and even if the latter has been rare of late, there is always a return to more normal rates. The simple fact is that despite what politicians and the Bank of England claim, inflation does not persist. The policy measures put in place to supposedly tackle often only make things worse.

But people have been persuaded otherwise by the likes of Martin Wolf and those whose job they think it to be to support the value of the currency in preference to the strength of the economy, the people on whose wellbeing the country rests, and evidence. They are out in force in the FT this morning, demanding a long period of positive real interest rates and a declining central bank balance sheet, both of which will be disastrous for the country, but which will serve the interests of those promoting inequality very nicely.

The reality is that there is a choice available now.

The Bank could, and should, have done nothing last week.

The Bank could, and should, have ended quantitative tightening.

The Bank could, and should, have said it is going to wait and see the impact of previous rate rises.

The Bank could, and should, have said that as inflation falls (as it will) so will rates.

It did none of those things.

It just chose to impose misery, stress, harm and destruction on the economy, in response to which the prime minister said 'we should keep our nerve', without once explaining how a household facing impossible increases in housing cost and a government that is doing all it can to reduce its real net income is meant to 'keep our nerve'. And Wolf has the temerity to suggest that imposing this misery is evidence of 'moral fibre'.

I won't describe my anger about people who write articles of the type Wolf has done. They are wedded to outdated and obviously false dogma (indicated by the fact that it has failed so often) and yet they demand more quite literal human sacrifice to their cult of stable money. To say I despise them for their utter callousness is to understate matters. Hell would be too good for those who will impose so much misery without justification because it is hell on earth that they desire for others, and I think that is unforgivable, most especially when that hell on earth is all to save some cash on the shopping bill which could be more compensated for with fair pay rises that are entirely within the gift of government.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I totally agree with you.

This is economic sadism writ large.

We are told to own you own property but all of a sudden it is wrong to pay a decent wage to enable that or make it affordable. But home ownership for the masses becomes leverage for capital.

We are told by these tossers that you cannot buck the market as it is the best mechanism for setting prices.

Except – apparently – when the market resets and raises the cost of labour for justifiable reasons. Now what the market is screaming at capital it is just too much of an inconvenient truth, because now the market is working in favour of labour.

And capital will just not have it – as usual – rule breakers, not takers. So capital is reduced to lying and doing stuff like this in order to establish the capital order as the social order, just Clara Mattei said Britain and Italy did in the post World War 1 era.

All this is about is social control – nothing more.

Workers must know their place even if the market values their labour higher.

Because the rich say so.

It is as simple as that.

So their argument is that raising interest rates makes money more expensive so people have less of it to spend, which brings down inflation because businesses will innovate to drive their costs down so they can bring down their prices to a level people can afford.

But inflation also reduces the amount of money people have to spend (or rather how much can be bought), so surely it has the same push on businesses to innovate to bring down their costs and therefore the prices they charge. Of course, if you have pots of wealth though, inflation has the extra downside of eating into your wealth, and if you owe money, inflation has the extra benefit of reducing your debt.

Now the people who make these interest rate decisions for inflation purposes – are they wealthy or have lots of debt? I think we know the answer to that one.

I am not in the slightest but convinced pushing up interest rates cuts innovation.

Interest rate rises are meant to reduce investment. Argument goes that it is too much invocation that causes inflation. Companies are trying to innovate beyond the current existing level of resources. Increasing rates is meant to slow down innovation, not speed it up.

Wolf is just another dim Neoliberal Death Cultist. When inflation runs high then yes those with middle to high incomes can reduce demand but Wolf never stops to think a wind-fall tax can simultaneously be imposed on the the banks when base rate moves upwards which can be used to compensate those hardest hit by such upwards movement. Why isn’t Wolf talking about such compensatory methods? Presumably he had a heart lobotomy many years ago, a requirement for his a nice safe well-paying job spouting Neoliberal ideological gibberish!

There was no justification either for imposing Hell on Earth on Peter Johnson, the Libor whistle blower.

I salute Andrew Verity for having the courage to expose what I think is the duplicity of Barclays, the Bank of England and the Treasury.

https://www.bbc.co.uk/news/business-65916892

The justification would be the survival of their (upper class) clan while others will fail. It’s tribal. We’re seeing the limos being formed into a circle here.

Martin Wolf – the Bourbons (forgotten nothing learnt nothing) is there a difference?.

Wolf is a neocon useful idiot, keeping the propaganda going so that the increasingly rackety neocon bus stays on the road/Emperor still has kit on.

Why should Wolf change his tune? Gets to nice gigs, respected by the rich & powerful etc.

On Sunday I spent an hour watching this:

https://twitter.com/igorsushko/status/1669549294515531777?t=Qt35oygFQc3GCNxDDglzHA&s=19

Only when a country faces disaster does some sort of truth start to come out. Prigozhin is vile – but what he says is interesting about Russia, corruption etc.

The UK is not quite in the state of Russia, but is nevertheless riddled with corruption, I’m-alright-jackism, political paralysis, lying/delusional politicos etc.

Unless things change, UK is heading for failed state status – & probably fascism.

June 26th 2023 article by Bill Mitchell on Japan’s stance to keep base rate low during current inflationary period:-

https://billmitchell.org/blog/?p=60938

“Every now and again Wolf writes something I can agree with.” – even a stopped clock is right twice a day!

Please can you put that into Letters to the Editor. Shame you are not an FT or Bloomberg contributor, I get fed up with hearing from Harvard or Yale professors

The issue in a capitalist society resolves itself into this: either poverty will use to democracy to win the struggle against property or property , in fear of poverty, will destroy democracy. Poverty ,great wealth and democracy are ultimately incompatible elements in any society. Aneurin Bevan wrote this in his book In Place of Fear. Bevan in my opinion has left an indelible mark on his country as no other politician has done. I have taken to reading Michael Foots biography of the man since the assassination of Corbyn. Bevan spent 31 years as a Labour MP. Almost all of that time he had to fight for Democratic Socialism in his party. He was under continuous threat of expulsion for his belief that only socialism could make the changes necessary for a better society. The Right used every trick in the book to prevent a social democracy. Just as they are doing today. The language is almost exactly the same. Financial prudence etc. Only when WW2 ended did the Attlee Government surrender and the working class were given real improvements in their lives. I experienced those three decades as a child, a teenager and a young man. Today s Labour Party which I joined in 1956 as a Young Socialist is doing what the Right has generally done. Starmer has eschewed socialism. It is driving out the Left which has always been the moral heart of the party. At the end of a long life I am in despair. All those years of believing Labour were the only organisation which would end fear ,insecurity, equality and poor health for all are but a dream.

Thank you

And I too am a big fan of Bevan and his book