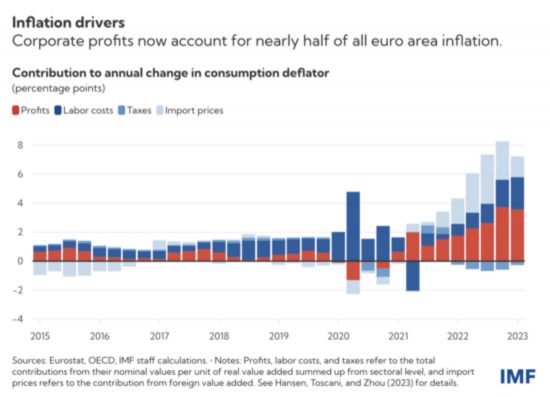

As the IMF has just reported:

Rising corporate profits account for almost half the increase in Europe's inflation over the past two years as companies increased prices by more than spiking costs of imported energy. Now that workers are pushing for pay rises to recoup lost purchasing power, companies may have to accept a smaller profit share if inflation is to remain on track to reach the European Central Bank's 2-percent target in 2025, as projected in our most recent World Economic Outlook.

I stress, this is the euro area. It does not change my suggestion on the role of interest rates, which are a peculiarly UK phenomenon. But this chart is still telling:

Wages have driven only a small part of inflation in Europe. I also suspect that is true here too.

Wages have driven only a small part of inflation in Europe. I also suspect that is true here too.

I also note that the IMF say:

Europe's businesses have so far been shielded more than workers from the adverse cost shock. Profits (adjusted for inflation) were about 1 percent above their pre-pandemic level in the first quarter of this year. Meanwhile, compensation of employees (also adjusted) was about 2 percent below trend.

This does not necessarily mean profits have risen, but there has been a major shift in the distribution of rewards.

As they also note:

Assuming that nominal wages rise at a pace of around 4.5 percent over the next two years (slightly below the growth rate seen in the first quarter of 2023) and labor productivity stays broadly flat in the next couple of years, businesses' profit share would have to fall back to pre-pandemic levels for inflation to reach the ECB's target by mid-2025. Our calculations assume that commodity prices continue to decline, as projected in April's World Economic Outlook.

Should wages increase more significantly—by, say, the 5.5 percent rate needed to guide real wages back to their pre-pandemic level by end-2024—the profit share would have to drop to the lowest level since the mid-1990s (barring any unexpected increase in productivity) for inflation to return to target.

In other words, the correct call for those now wanting to maintain purchasing power in the economy whilst controlling inflation (which together are a totally reasonable goal) is for profits to be sacrificed now to restore appropriate wage rates.

Very oddly we are hearing nothing like that from the Bank of England, politicians or supposed economists in the UK. You would think they all agree wage-earners should suffer instead. But at least their agenda is becoming increasingly clear.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

You might think the public may begin to work out that the two Parties in the hegemonic two-Party British Parliamentary system could work out the fairly obvious implications of that, and realise that the Parties are not operating in their interests, and take the required action, by putting enormous pressure on their MPs; but they don’t. The corporate vested interests do, however apply the required pressure on the two Parties that are transparently serving their interests first, and last; and this works because ‘Party’ is inevitably the creature of deeply embedded, well resourced, highly organised vested interests. The public isn’t. The public is the proverbial ‘sitting duck’.

And there is the reason we are where we are.

“Very oddly we are hearing nothing like that from the Bank of England, politicians or supposed economists in the UK. You would think they all agree wage-earners should suffer instead. But at least their agenda is becoming increasingly clear.”

In the Neoliberal Death Cult state (formerly the UK) getting money by any dubious means would now appear a central agenda of many UK politicians to fund either themselves personally or their political objectives:-

https://www.theguardian.com/politics/2023/jun/26/italy-was-monitoring-lebedev-villa-at-time-of-boris-johnson-visit-documentary-claims

“Profits are driving inflation. When will politicians and the Bank of England admit it?”

Not when you’re accepting an invitation to party with Rupert Murdoch!

https://voxpoliticalonline.com/2023/06/26/is-this-the-reason-a-labour-leader-has-attended-a-party-by-rupert-murdoch/

Right at the end, the IMF say –

“macroeconomic policies thus need to remain tight to anchor expectations and maintain subdued demand. This would coax firms to accept a compression of the profit share and real wages could recover at a measured pace.”

So punish the workers in order to coax the firms. Does coaxing work? How long would it take?

I think the mainstream/IMF believes there is a long lag on further tightening, so how long do they wish workers to suffer?

Why not push for price controls, which would have an immediate effect?

They seem to apply there is a two year adjustment period

Two simple questions. Do the “markets” believe that profits will “fall back”; ie., that the effect of the current policy is ‘priced in’? If it isn’t priced in, why not?

The public are very infuriating for sure – I had to sit there the other day and have someone tell me that Rachel Reeves is a genius and we are all saved – but it has to be said that they might be able to come to their senses if the media helped them to see what is going on.

But it doesn’t. What the media does is obfuscate and offer more choice in what issues deserve the public’s attention and a market for what we should be angry about is created that taps into pre-existing bias’s (fascism). The media populizes these distractions whilst academia legitimises many of them.

We have been ruled like this for years but it is worse now because our rulers can mislead and obfuscate on a scale never dreamt of in medieval or Victorian times.

I came to this blog totally by accident on a path I’d been on since I was made redundant the second time at 27 years old wondering what the hell was going on. I’d worked hard all my life until then to see my efforts come to nought.

Others might have got on with it but this time I was quite angry and decided to go on a big sulk and find out what was going on because I resented being made to feel that it was my fault.

So out went the American self-help books and in came developing a critical consciousness – big-time. I see more people going that way than ever before – why is it that they are clamping down on public dissent for example? So, the public might be changing, awareness might be growing – it’s going to be a very interesting time.

Agreed

Spot on @ PSR

As supertanskiii: https://twitter.com/supertanskiii

would say, being poor is actually a character defect.

And that seems to be the government view….

Inflation is, by definition, a result of companies putting them up.

Companies raise prices whenever they can.

Finally, the IMF have pointed out the bl***ing obvious.

Can we know move on from the nonsense that a 5٪ pay rise is driving inflation in a 10% inflation world?

Had you seen the similar data from, IIRC the sanFrancisco Fed?

Hardly left wing radicals!

I had a quick look at their website but could not find what I was looking for.

Perhaps someone else here will be able to provide a link.

It may have been as long ago as January, but, again IIRC l think that they said that price rises were:

20% import cost rises

30% wage cost rises

50% Companies Profit increases.

‘apply’? Could you be intending ‘imply’?

I am struggling to find this

I believe this refers to your 06:42 reply to George S Gordon, Richard.

There seems to be a counter factual here.:

https://coppolacomment.substack.com/p/corporate-profits-dont-cause-inflation

Treating “corporates” as homogeneous is, in my view, unwise. The oil n gas mafia made monster profits, other sector not so much (although supermarkets????). Makes an interesting point about the rich accumulating much of the gains and the poor being the target for inflation reduction.

Politely, Frances Coppola is utterly useless. I have thought so for a very long time.

There is no proof that right now there is excessive aggregate demand. Economic activity is lower than last year.