I have been suggesting that interest rate rises are fuelling inflation.

That idea might, it seems, shock the Bank of England. They seem to think that inflation is down to excessive pay increases. However, I have some news for them, which is that employees do not set price increases. It is companies that do that. In that case, let me put forward a model of a company that is largely service-based to explore my suggestion.

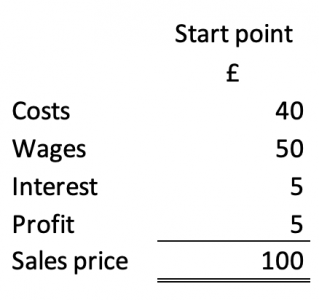

This is the starting point for this model:

The figures have been chosen for purely representational purposes: they are denominated in monetary units (thousands, tens of thousands, or millions: it makes no difference) but also, in effect, indicate the percentage split in the cost base of the company. The proportion of wages suggests it is service orientated, as most companies are.

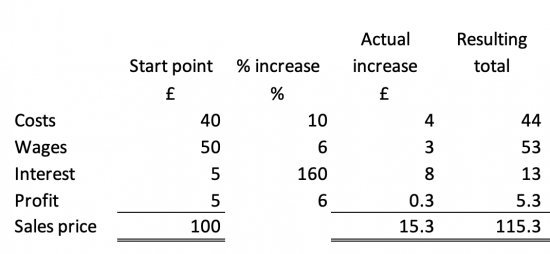

Then I suggest that adjustments for inflation be taken into account, as follows:

Bought-in costs have increased by 10% - roughly the rate of inflation in the last year.

Wage increases have been kept to 6% - which will be tough on many staff.

The big increase is, however, in interest costs. The company pays interest at 3% over bank base rate. So, the rate has grown from near enough 3% to 8%, or a growth of about 160%.

In comparison, profits have only been targeted to increase at the same rate as wages.

The resulting overall cost increase is 15.3%, with more than half of that being due to interest, which imposes a bigger cost increase than external costs and the wage settlement combined.

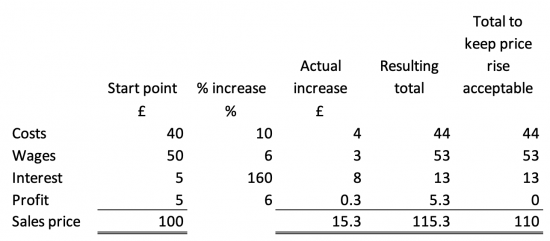

Let's presume the company realises that the market will not accept a 15.3% price increase, and it keeps it to 10%. This is the result:

Profits have now been eliminated. The company's future is, then, in doubt.

I stress that this is a model.

I would add that the assumptions seem fair, as does the cost structure, although these (of course) vary widely.

My points are threefold. First, it is not wages that are driving up inflation.

Second, it is interest rate rises that are driving up prices.

And third, interest rate rises are now so extreme that many businesses will face the threat of failure.

The Bank of England is welcome to use this model and think about the consequences which they have created. Unfortunately, I suspect that they will not. That's because what this model makes clear is that we face a crisis created in Threadneedle Street, but they have no understanding of what they have done and are doing.

And that's why we face desperate economic times.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This is really interesting. To assess the overall impact on the economy, we would presumably need to know the total level of corporate debt. Also, how do companies behave when they have hedged their exposure to higher rates ? Do they still raise prices in anticipation of the cost of servicing their debt increasing after the hedge ends ?

I will see if I can do that next week….

Great! Also, the surge over the last few years in FinTech will have some impact I believe. I used to work one such company which provided “embedded” finance to small businesses such as funding that is repaid from a fixed percentage of their sales, and “instant payouts” for companies that take card payments that would ordinarily take a few days to receive.

In the area where I am interested (renewables) at the level of corporates (e.g. orsted) money raising is via bond issues. Once the bond is issued the rate is locked in. Orsted issued circa Euro900million of bonds quite recently. I’m guessing many corporates follow a similar route.

For the smaller fry, usually bank financing for a given project (as previsouly mentioned RES projects have a 80/20 debt/equity split – with the equity coming from the developer). In both cases (corporates to smaller fry) what they can charge (for the electricity) is usually controlled by auctions – most renewable projects go through a gov controlled auction process which in most cases, leads to tightly controlled costs. We have analysed some and the previous statement is +/- correct. One could argue that this is a somewhat synthetic environment and not reflective of how other sectors function. That said, renewables (and energy efficiency measures) are key growth areas & thus ensuring that there is value for money is very important & in turn raises the question “how to ensure that those biding for projects “sharpen their pencils” – RES seems to have this covered, not so sure about EE.

I believe Asda and Morrisons have recently been bought using borrowed money,

Anecdotally as a regular Asda shopper prices have gone up, and cheaper brands have disappeared. I used to tell my mother Asda was cheaper than Sainsbury’s her normal shop but this is no longer true

As Lidl and Aldi continue their phenomenal growth in the UK it will be very interesting to see how their very different business model continues to compete against the rest of the supermarket sector, particularly Asda and Morrisons debt-fuelled approach.

Although I personally do most of my shopping in Aldi and (some in Lidl), there are certain items which I get from Tesco every week or two. It is very noticeable that they have begun to ‘price match’ Aldi for quite a lot of goods and note it on the shelf edges when they have done so.

No claims of cheapest prices anywhere, but it’s something, I suppose.

Is it perhaps time to think about what ‘inflation’ is? Or what is being measured.

Apparently ‘core inflation’ is rising, although CPI is falling and food price inflation, while still high, is falling slightly. But all those things only look at the price of some things. Is that sensible?

The BoE wants to control ‘inflation’. If the items included in the inflation calculation do not include those things that interest rates have a major effect on, then the BoE may be ‘right’ (although it seems very unlikely on their performance to date). Mortgage payments, for example are not included, I think.

But surely even the BoE must be aware that most businesses have some level of debt which means their prices must be affected by interest rate rises.

I am deliberately allowing for secondary effects in what I am doing

The other huge irony which the Tories and the Bank of England are refusing to talk about is that inflation has also soared in the UK because of Brexit. For example, farmers can’t get the labour they need which previously came from EU member countries. Food prices have soared including dairy products.

https://www.theguardian.com/business/2023/jun/22/uk-dairy-prices-could-keep-rising-unless-staff-shortages-ease-co-op-warns

What is the Leave voters reward? The Tory government and the Bank of England are substantially increasing loan repayment interest amounts including house and car lease ones to dampen inflation! Do Leavers now want Boris Johnson back in office for further financial punishment or indeed any Brexit Tory? Do they even want Keir Starmer in office who won’t even acknowledge the severe negative financial effects of Brexit!

Posted for Leavers:-

https://inews.co.uk/news/world/uk-western-europe-why-highest-inflation-rates-brexit-2426613

“……but they have no understanding of what they have done and are doing.”

They must have. It has to be deliberate doesn’t it?

I think perhaps they have no understanding of the degree of misery they are unleashing, but that’s another matter and they are confident that they will be insulated from that misery and chaos.

I agree; of course the BofE knows what it’s doing. This is an attack primarily on the mortgage-owning middle classes designed to send them back to the peasantry, one taking place as democracy, even the current faux nod in its direction, fades and the age of oligarchy is ushered in. After that will come a Dark Age presaged by complete societal collapse, a collapse itself very evidently already under way and being engineered by the political class.

‘Dear money’ is part and parcel of austerity policy and indeed deliberate – all laid for you by Clara Mattei in ‘The Capital Order’ (2022), look at (for example) p150, p.153 and p.173 when the BoE raised the interest rate to 7% in 1920, with effectively the connivance of the Treasury and its its head Ralph Hawtrey who was a big austerity advocate.

Here’s a conundrum. My household will be relatively (and I stress that) able to cope with this interest rate rise provided it is short enough. Should we continue to spend into our local economy by eating out at our favourite and independent pub: visit our local and equally independent cinema etc? This would keep income coming in to those businesses – particularly if others in our situation carried on the same way – keep people employed etc. But as we continue to pay the higher prices for these things, are we helping fuel inflation – again acknowledging that one household is immaterial, it’s the larger effect?

Don’t worry about inflation if you can afford not to – support real people

58% of Brits now want to re-join the EU bloc!

https://www.theguardian.com/politics/2023/jun/23/britons-who-want-to-rejoin-eu-at-highest-since-2016-survey-finds

Hardly surprising with inflation rates being lower in the EU. Boris Johnson and his Tory cronies now on a hiding to nothing for the purposes of scapegoating by Leave voters to lazy to think consequences through before they voted!

There are multiple factors affecting inflation both in the UK and in Europe. Richard has high-lighted making money expensive as one. Covid has obviously affected production and starving the NHS of funding has resulted in many individuals being off long term sick as they wait for procedures. Climate change is another but a common factor forcing up inflation in the UK is voting Tory of course. They must be the worse party in power since the beginning of Parliamentary representation!

Ah yes the Brexit dividend has finally arrived shovelling more money to bankers with higher interest loan repayments!

Thanks. This is the sort of simplified model I was alluding to yesterday, but you’ve extended it to illustrate the point.

In many sectors, wages and rent and interest are among the main costs. But aggregate wages tend to lag inflation, and eventually catch up, but not lead it or pass it.

You made me think….

The whole raison d e tet for the rise in interest rates is to make the majority of the population, both mortgagees and renters, worried and therefore compliant with the Tory policies of lower wages and subservience to their employers.

People who are worried about keeping a shelter for themselves and their families will accept this outrage but eventually fall victim to it.

Those who challenge the interest rate rises will loose their assets to the banks and the rich which is the whole basis of Tory policy, namely returning land ownership to the rich.

You said, Richard, in your Politics Live slot yestrerday that the BoE don’t understand the transmission mechanism of interest rates. I think they understand only too well – I transmits wealth to 10% of the population from the rest of us.

You may be right

The response of the Tories and BoE is both callous and cruel. They must know all of the above yet they are stuck in TINA mode – there is no alternative. Total rubbish. There are alternatives, they would just rather people didn’t know about them. The only good thing that hopefully will come out of all this is that the Tories will face electoral wipe out. But then we get Labour with a similar TINA blueprint……

Your model is too sensible for the Tories, BoE and I’m afraid, Labour. All three are stuck in a discredited model that has been seen to be wrong and ill equipped to respond to the personal financial crises that many people are now facing. The very fact that their starting point is a wage/price inflation spiral that doesn’t exist is both a lie and shows their approach is of the blunt instrument variety. TINA, the ghost of Maggie Thatcher lives on.

“TINA, the ghost of Maggie Thatcher lives on.”

Indeed it does but after 40 odd years we now know it for what it is the intellectually lazy Neoliberal Death Cult of which Brexit was a part. Of course the only ones getting the Brexit dividend are the bankers with increased interest payments on loans. Who’d have thought it!!!

Off at a tangent and on my theme of inflation drivers I had just renewed my broadband contract with BT. I. Common with most other providers there is contractual price increase mechanism based on CPI plus 3.9%. A large proportion of the provider costs are fixed so it is profit uplift.Selective and targeted price controls would have an immediate impact.

I would imagine that it’s wage inequality that causes inflation. The solution is to pay the least well-off significantly more, and fat-cat CEOs significantly less. It is a stable and predictable economy that keeps inflation low, and if poor pay changes consumer habits, then at the very least their wages must not lose value. Likewise the fat-cat who don’t spend.

I am not convinced that is the cause of inflation

But inequality does need to be tackled

He also said something like – firms should not reprice their products.

Since dramatic increases in bank rate spurs those with portable capital to seek higher returns – selling financial instruments based on historical, now superceded, value assumptions in order to profit from the higher rate- the market value of an issued gilt falls and the yield rises. Government borrowing becomes more expensive.

In the financial sector a wholesale repricing exercise follows.

Should he really have said that all firms apart from those in the financial sector should not reprice their product.

Well spotted

[…] By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK […]

Hi Richard,

That is an interesting and plausible model.

There is also the impact of mortgage/rent payments on workers’ pay bargaining. They are likely to be far more vociferous in their demands for pay rises if they can’t pay their housing costs.

Agreed

But that does not threatened the plausibility of this model

It just reinforces the idea that the BoE does not understand the implications of its actions.

The model needs a lot of development, an awful lot.

And I don’t mean comparisons to companies with low or nil debts who can presumably outcompete those with significant debt and perhaps poach their workers with being able to pay higher wages.

Nor am I thinking about wage inflation not being measured accurately as total compensation for wage earners is different and the difference matters.

I’m thinking double entry: for every entity paying higher interest another one is receiving it. What does that do to prices?

First, the model is micro, not macro. It explains why businesses increase prices

Second, the answer is excess profits are made by banks. The double entry is not hard, s it?

Next question?

Something strange going on.

In their obsession to curb inflation, BoE hawks actually welcome driving people into poverty, and from poverty to destitution.

But under the last vestiges of socialist policies, the Government is still expected to step in to stop large numbers of its citizens dying from cold and hunger.

This will cost money.

Government spending will have to increase

But the Government obsesses over public debt

Not to mention

Companies will become less profitable or fail, so that tax returns will reduce

More private loans will fail and the insurance component of interest on private loans is paid with Government “printed” money.

The BoE’s irrational obsession, is exacerbating the Government’s irrational obsession.

I live in a street where HMO application is no longer required. If the council doesn’t agree then it’s contested at government level. This has been going on for a number of years. Family homes become multiple let and the investment is huge. What is pushing up inflation? Wealth itself! Banks lending and the stupidity of markets in my opinion. Sadly it needs to crash and that was probably it’s purpose. It’s boom and bust again. Sad face!

The current labour and skill shortages are such that recruitment is difficult and expensive. Staff retention has become a business critical issue for many organisations.

In which case it makes business sense to prioritise wage increases ……..and to increase flexibility in working arrangements. Other aspects of the business model are then adjusted as necessary to keep trading.

But businesses are not prioritising wages – they are paying less than inflation on average