Amongst those on whom the Covid inquiry will shine a spotlight are David Cameron and George Osborne. The question they will be asked is whether the austerity that they introduced to the UK was responsible for leaving the UK ill-prepared for the Covid pandemic.

I considered the austerity that Cameron and Osborne were responsible for and planned in a paper I wrote in 2015 entitled 'Why the UK's Fiscal Charter is Doomed to Fail: An Analysis of Austerity Economics during the First and the Second Cameron Governments'. It is available here.

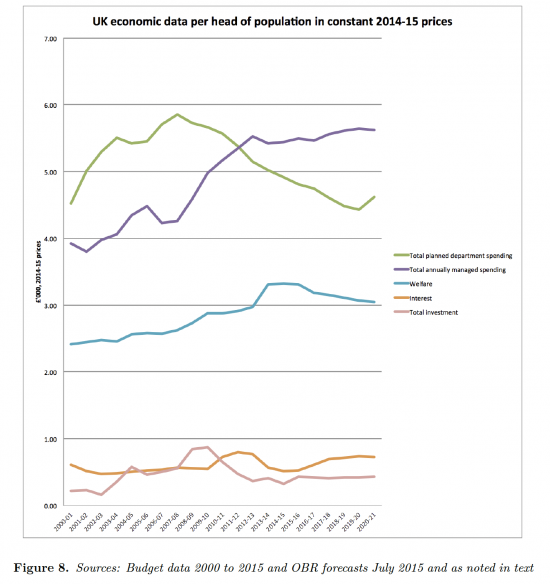

A key chart might be this one:

The split between annually managed spending and planned department spending is explained by the government like this:

In summary, what Osborne and Cameron did then was to:

- Cut all the expenditures that made it seem as if the government could make a difference to well-being;

- Contain essential spending;

- Reduce investment;

- Reduce social security spending, inevitably making people worse off;

- Keep interest rates low to control interest spending.

The scale of the cuts in planned spending was staggering: the intention was that it should be by 25%.

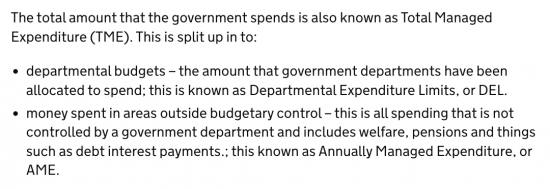

Meanwhile, their plans for tax were moving in the opposite direction:

As total planned spending per capital fell, total planned taxes rose significantly so that a budget balance could be achieved - supposedly.

Their goal was to tax more and spend less. You cannot be more recessionary than that. Only QE kept the economy afloat.

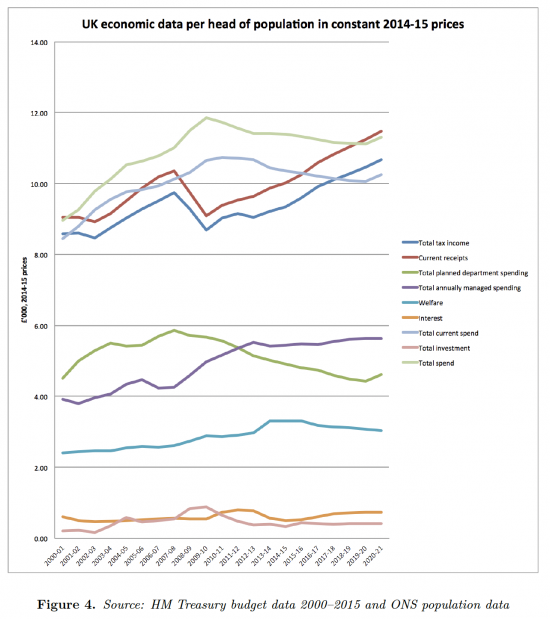

When it came to who paid the tax, this was telling:

Income tax, national insurance and council taxes were to bear the burden. Corporation tax was spared. So too was VAT. In other words, those most suffering from the cuts were to pay for them.

The policy was, I predicted, a disaster in the making (using slightly more moderate language). So it proved to be. We were left hopelessly ill-prepared for Covid and what followed.

Cameron and Osborne were a disaster for the UK economy, and yet Labour is now dedicated to much the same policy. And this time no QE is planned. So far, nothing has been learned from the grim experience of 2010-2019. Maybe Lady Hallett will set the record straight. Maybe she will also be too late.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Despite the mauling I received yesterday I thought I’d risk putting my head above the parapet once more and hope it won’t be shot off.

I can only agree with Richard’s summary of austerity and the dreadful, and unnecessary, affects it had. Labour espouse the same policies leaving many of us political orphans in the first past the post electoral system.

Sadly I doubt Lady Hallett will set the record straight. As you say, and based on past inquiries, this will be far too late. More than that there is no guarantee she will address the right, or even relevant, issues. I remember the Hutton inquiry, which was supposed to address how this country got into the Iraq war. Not only did it exonerate the government, despite their “dodgy dossier” being proved false, but it shot the messenger, the BBC, for having told of the governments disgraceful behaviour.

We might hope this inquiry will provide useful insights and apportion blame appropriately, but I’m not optimistic.

May I widen the perspective? This is all astonishingly short term.

The distribution of wealth within the UK is central to the discussions but I don’t see here reference to other countries – especially the poor of other nations.

More disquieting to me, is the squandering of nature’s gifts in such a very few years – hardly a single generation. What about the needs of the next 20 or 30 generations?

Fossil fuels will not be regenerated on comprehensible human time-scales. Precious materials needed for the more publicised existing schemes of vehicles, solar panels, batteries and wind generators are deployed as though two or three decades are all that need to be considered.

All kinds of pollution problems lack serious remedies; plastics, of course, nuclear and ‘time-bomb’ proposals for captured and liquefied carbon dioxide which, it is pretended, can be safely stored underground for a few thousand years.

What are we about?

Existential failure, it would seem

I have always assumed that the main purpose of the Cameron-Osborne Austerity years was to rebuild the fortunes of the rich lost in the Sub-prime and derivatives Financial wipe-out of 2008-9.

So successful were they that within ten years the rich were richer than ever, everybody else was much poorer and the rigged financial system that had caused all the problems had been substantially buttressed with gigantic amounts of public money.

As Brexit, Johnson, Truss and Sunak have brilliantly demonstrated when it comes to the ability of the Tories to govern wisely on behalf of the nation it is non existent.

It’s greed first, ignorance second and trebles all round.

You may well be right

Difficult to find a word for those who lack critical thinking skills, identifying all the parameters that need to be taken into account before they make a decision or make policy. Certainly as far as the Tories and indeed Labour are concerned in regard to Austerity and Brexit policies it would not seem unfair to say the thinking is “impetuous”. This begs the question whether the UK’s education system badly needs to focus on developing critical thinking skills and set it as a core subject to be examined.

Fiscal policy has maybe always benefited the rich, but now it seems it can do so in plain sight and more so.

And that is supposed to be a good thing, so it appears.

So – rich = good, ordinary or poor = bad.

It seems to me that austerity is being normalised. This has all the markings of an ‘end of days’ scenario. We don’t believe in anything anymore other than what we have got used to, which is not very much!

The labour party must have been informed about, if not read, the Marmot Review, and Ten Years On, by Michael Marmot. The tories will know about it, too, but they will ignore it. Labour shouldn’t ignore it.

Whole chapters on the effect that austerity had on our ability to fund/ cope with the pandemic. This is from page 6.

“Put simply, if health has stopped improving it is a sign that society has stopped

improving. Evidence from around the world shows that health is a good measure

of social and economic progress. When a society is flourishing health tends to

flourish. When a society has large social and economic inequalities there are large

inequalities in health. The health of the population is not just a matter of how well

the health service is funded and functions, important as that is: health is closely

linked to the conditions in which people are born, grow, live, work and age and

inequities in power, money and resources – the social determinants of health.

The damage to the nation’s health need not have happened.

When, in 2015–16, statistics from the Office for National Statistics and Public Health

England first showed that the increase in life expectancy had nearly ground to a

halt, we at the UCL Institute of Health Equity were cautious, in the usual academic

fashion. We were reluctant to attribute the slowdown in health improvement to

years of austerity because of difficulty in establishing cause and effect – we cannot

repeat years without austerity just to test a hypothesis. The fact that austerity was

followed by failure of health to improve and widening health inequalities does not

prove that the one caused the other. That said, the link is entirely plausible, given

what has happened to the determinants of health.

The evidence we compile in this ‘ten years on’ report, commissioned by the Health

Foundation, explores what has happened since the Marmot Review of 2010.

Austerity has taken its toll in all the domains set out in the Marmot Review. From

rising child poverty and the closure of children’s centres, to declines in education

funding, an increase in precarious work and zero hours contracts, to a housing

affordability crisis and a rise in homelessness, to people with insufficient money

to lead a healthy life and resorting to foodbanks in large numbers, to ignored

communities with poor conditions and little reason for hope. And these outcomes,

on the whole, are even worse for minority ethnic population groups and people

with disabilities (1). We cannot say with certainty which of these adverse trends

might be responsible for the worsening health picture in England. Some, such as

the increase in child poverty, will mostly show their effects in the long term. We

can say, though, that austerity has adversely affected the social determinants that

impact on health in the short, medium and long term. Austerity will cast a long

shadow over the lives of the children born and growing up under its effects.”

By the way, on Wednesday at 6.30pm, there is an online event by Arise, the Festival of the Left, for the 75th anniversary of the NHS.

The title is How can we Repair it and Restore it after 13 Years of Austerity.

Do you have a link?

https://www.eventbrite.co.uk/e/635317290117/?keep_tld=1

Sorry, been out for a walk to calm myself down.

Where have all the butterflies gone?

We have a reasonable number – and variety

But I agree, not in the numbers of old

Orange tips are great right now – but nearly over

Only saw 6 in 2.5 hours.

3 orange tip, 2 small white and a brown that was too fast for me to see – probably meadow brown.

All the people I spoke to said the same, they are just not up here this year. Loads of rabbits, though!

Worrying

NHS Spending increased in real terms each and every year between 2008 and 2022, plus an extra £50bn or so in both 20/21 and 21/22 for Covid.

Not really the ‘austerity’ that is being portrayed.

Classic trolling

First you ignore per capita is the right variable

Then you ignore an ageing population

And one more suck because of the actions of big food companies to poison people with sugar / glucose

And you ignore the medical inflation rate

And then you claim it increased

Idiot