The following is an edited extract from the report that Danny Blanchflower and I have submitted to the House of Commons Treasury Committee on quantitative easing (QE), quantitative tightening (QT) and the Bank of England Asset Purchase Facility.

The aim of this part of the report is to show that the level of band sales planned by HM Treasury and the Bank of England in combination over the next few years is utterly unsustainable without pushing interest levels to unprecedentedly high levels that will be deeply damaging to the economy, which is why we recommend that QT be abandoned.

The submission is especially important now. A wave of banking stress in the USA and Europe is already proving us to be right, as is the new credit line required by banks to restore market solvency. It is glaringly apparent that the forecasts we have made in the report showing the danger of cancelling QE, implementing QE and the resulting high real interest rate policy is absolutely right. So too then is court policy prescription, which is rate cuts, cancelling QT altogether and a new round of QE.

The data sources used for the research that follows has been published by the government or its agencies:

- HM Treasury's Debt Management Office

- The Bank of England

- The Bank of England Monetary Policy Committee

- The House of Commons Library

- The Office for National Statistics

- The Office for Budget Responsibility

Where interpretation has been required this is noted in the relevant section below, but nothing but official sources have been used in the production of this report. A detailed bibliography of sources is attached.

Specially, data has been extracted to show:

- The gross value of government bonds (gilts) issued by year. The Debt Management Office published this data for all years to 2021/22 covered by this review. Thereafter the figured has been computed by comparing the forecast public sector borrowing requirement for 2022 – 2028 as published by the Office for Budget Responsibility in November 2022 and the forecast gilt redemptions forecast by the Debt Management Office in March 2022.

- The government bonds (gilts) redeemed each year. As all UK government bonds are now issued for a finite period some fall due to be repaid to those persons or institutions owning them every year. The figures for planned redemptions for April 2022 onwards were taken from Debt Management Office forecasts published in March 2022. Figures for earlier years were estimated by comparing the total figure for gilts in issue at the end of each such year as published by the Office for National Statistics in October 2022 with the value of bonds notified as issued by the DMO for each such year as advised by the Debt Management Office in its annual report to March 2022, the difference being assumed to be redemptions.

- Net UK government bonds issued have been calculated as the net of gross bonds issued less bonds redeemed in a year.

- Quantitative easing data is based on publications by the Bank of England website in December 2022 with allocation to years prior to 2020 being based on data published by the House of Commons Library in 2016.

- Quantitative tightening data has been based on Bank of England forward guidance statements. They have said that they wish to reduce the size of their gilt holdings and set a target of an £80 billion reduction in that total holding in the year from September 2023. It has been assumed that this level of quantitative tightening will continue per annum thereafter, but as noted below this assumption is varied in the discussions that follow.

GDP until March 2022 data has been imputed from data in the Office for National Statistics public finances release for October 2022 to ensure consistency with other data used in this exercise. Forecast data from thereon from the Office for Budget Responsibility forecasts issued in November.

CPI data to 2022 is that published by the ONS whilst forecast CPI thereafter has been taken from the OBR forecast of November 2022.

Bank of England base rate data has been extracted from its website.

Except as noted no other data sources are used in the work.

Estimates are not adjusted for inflation as cash flows are being discussed.

It is assumed throughout the workings that follow that all gilt redemptions are reinvested in alternative gilt offerings, excepting from 2022 when QT operations change this assumption. The assumption is considered reasonable in London's financial markets.

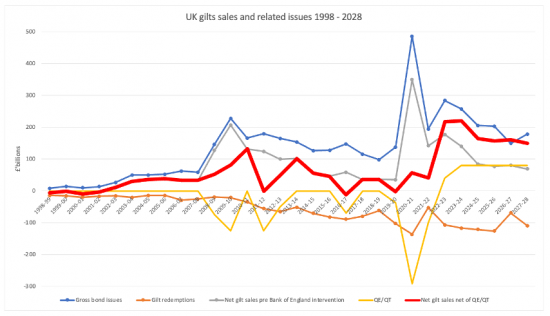

Based upon this date the core finding of the analysis that follows is summarised in Chart 3:

UK gilt sales and related issues 1998 - 2028

The data that supports this chart is available in appendix 1 to the report.

This chart suggests that until 2008 modest gilt sales and steady gilt redemptions led to very low levels of net gilt sales from 1998 until 2002, with only a modest increase thereafter. Given that there were no QE or QT operations in this period net sales before and after such operations were the same and are highlighted by the bold red line on the chart.

From 2008 onwards gross gilt sales increased significantly over levels seen before the financial crisis of that year. However, quantitative easing had a significant impact from 2009 onwards and significantly reduced net gilt sales after taking redemptions into account. The result was that in two years (2011-12, and again in 2016-17 when a post-Brexit round of QE took place) there were net negative bond sales in the year.

The Covid pandemic changed government finances considerably. Despite the claims made by the government that taxpayers paid for this crisis that was not true: gross bond sales did, at previously exceptional levels. However, QE also reached previously unanticipated levels and the net result was that actual borrowing in the two crisis years of 2020-21 and 2021-22 was an average of £49.2bn per annum, which compared favourably with the average net borrowing of £48.1 billion per annum from 2008 to 2020.

The exceptional period on the chart is the data for the period from April 2022 onwards. Driven by exceptional costs arising from government financial support to consumers and businesses resulting from the energy price crisis that developed as a consequence of the war in Ukraine that began in February 2022 the UK government deficit was forecast to increase in 2022-23 to £177bn, which is also assumed to be the value of net gilt sales in that year.

That deficit is forecast to fall after 2020-23, but average gilt redemptions from 2022 to 2028 at £108.2bn per annum are expected to be much higher than the average of £61.1 billion per annum from 2008 to 2020.

On top of the resulting higher than historically experienced levels of net gilt sales, the impact of QE is expected to disappear in this period (an odd exception to support solvency in financial markets in October 2022 being noted). That is because the Bank of England has announced its intention to commence active quantitative tightening operations. Passive quantitative tightening began in February 2022 when the proceeds of gilt redemptions in the portfolio held by the Bank of England ceased to be reinvested in gilts as they occurred. These combined quantitative tightening impacts are forecast by the Bank of England to be at the rate of £80 billion in the first year of that exercise and have been forecast for this exercise at the same rate each year thereafter. If that happens, then average bond sales that the financial markets will be expected to fund from 2022 until 2028 will average £178 billion per annum, which is an unprecedented sum.

Only in the years 2010-11 and 2013-14 have financial markets been expected to fund more than £100 billion in a year in net bond issues, and the first was almost immediately followed by significant quantitative easing. From 2022 onwards anticipated net gilt sales exceed £200 billion in some years and are £178 billion on average in the period 2022 - 2028.

As a result, what this data makes clear is that the current government is forecasting that it will borrow, before either QE or QT are considered, at unprecedented rates over the next few years, which period will include almost the entire lifetime of the next parliament and whichever government is then in office. Average borrowing over this period before QE or QT are taken into account is likely to exceed £100 billion a year and is greater than in any past period. Even allowing for the impact of inflation, which the OBR forecasts suggest will be close to zero by 2024 and modest thereafter (see below), the result will be an unprecedented demand for government borrowing from financial markets during this period unless action is taken to address this issue.

That impact will likely include these effects:

- Sustained, higher than otherwise required levels of Bank of England base rate to maintain a sufficiently high interest rate environment to attract foreign funds into UK government bonds;

- Loosening of financial regulations to allow London to become (once again) the epicentre for ‘hot' funds of questionable origin, cementing its reputation as a tax haven and creating conditions potentially similar to those that existed prior to the 2008 financial crash;

- Significant and continuing downward pressure on government spending plans to try to keep borrowing within indicated levels whatever the resulting impact on society. Austerity will become endemic, in other words.

If the Bank of England were to pursue its plan for quantitative tightening these problems would become very much worse. This is exacerbated by the fact that there is, based on the data noted, no apparent capacity for the Bank of England to seek to sell further bonds into a financial market when those markets' net willingness to provide funding to the government at interest rates that are sustainable for the rest of the economy may be limited.

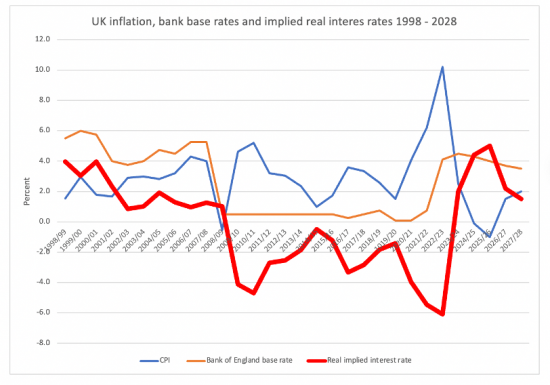

This last point might explain the extraordinarily high net positive real rates of interest forecast by the Office for Budget Responsibility at present, which are as shown in this chart which compares forecast Bank of England base rates with forecast CPI inflation rates:

Sources as noted in text, author calculations

These movements in interest rates, showing 2022 – 23 in isolation because of the exceptional inflation in that single year can be summarised as follows:

Table – Real interest rates

| CPI | Base rate | Real interest rate | |

| Average 1998 - 2008 | 2.8 | 4.9 | 2.1 |

| Average 2008 - 2020 | 2.6 | 0.5 | -2.2 |

| Average 2020 - 2022 | 5.1 | 0.4 | -4.7 |

| 2022-23 | 10.2 | 4.1 | -6.1 |

| Average 2022 - 2028 | 1.0 | 4.0 | 3.0 |

Sources, as noted in text

Whilst not stated, the assumption behind this projection must be that the only way in which the exceptional rate of gilt sales, noted previously, can be sustained is by paying exceptional real interest rates to those who might acquire those bonds, many of whom will come from outside the UK.

The impact of these rates on households with high levels of personal debt, and most especially on households with mortgages, are impossible to overstate: in many cases these households will have unaffordable borrowing if persistent high net positive real interest rates persist at, or above, the rates noted in Chart 6, which data is summarised in appendix 2 to this note. As a consequence, high levels of personal bankruptcy might result. This in turn might lead to mortgage default and a potential banking crisis. Those seeking to rent domestic accommodation as an alternative will not find matters any better: many landlords borrow heavily to buy their property portfolios and consequently they tend to pass on rising interest costs to their tenants by way of increased rents. Those living in rental accommodation are likely to face crises of affordability as a result.

The impact of these high interest rate costs is likely to be seen beyond the housing market:

- Indebted households will have little or no capacity to spend on consumer goods beyond those required to sustain themselves, with significant recessionary impact on the rest of the economy, and most especially the retail, leisure and hospitality sectors.

- The cost of business investment will be high. Overall rates of UK business investment were low even when interest rates were maintained at low levels from 2009 to 2021. They are now likely to fall further still, also contributing to a recessionary environment.

- In a recessionary environment the likelihood that government taxation revenues can be maintained at the levels forecast by the Office for Budget Responsibility in November 2022 is reduced.

- If governments seek to equate current (i.e. non-investment related) expenditure with taxation revenues either in a financial year or over a limited number of years, as is the currently stated aim of both the UK's leading political parties, then significant downward pressure on government expenditure will result.

- The consequence is likely to be a sustained recession in a situation where public services are failing.

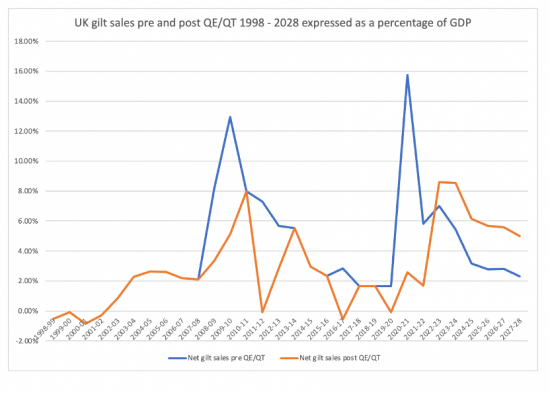

The aberrational nature of what is forecast is emphasised by this Chart:

Sources: as noted in text

Sources: as noted in text

The persistent level of gilt sales forecast for 2022-23 onwards is unlike anything previously noted when expressed as a percentage of GDP. There is no evidence that this level of sales is sustainable if QT takes place as currently planned, and maybe in any case given the state of the economy

There are several ways in which the potential economic crises that the noted planned level of gilt sales might give rise to can be averted.

Firstly, and most obviously, the Bank of England could be instructed to end its quantitative tightening programme, whose sole purpose would appears to be to support high interest rates when the economy has no need of these and they are, instead, economically destructive. This however, may be seen as impacting the Bank's independence. There are major issues though of groupthink which need to be overcome (Blanchflower, D. and A. Levin, (2023) 'Fostering diversity of views in monetary policymaking', Finance & Development, IMF, March.

Secondly, the Bank of England could be instructed to reduce its bank base rates at the first possible opportunity[2]. Given that the increased interest rates now being promoted by the Bank of England are not required to address the inflation we are suffering, whose origins are in Covid supply chain disruption and energy and food price disruption created by war in Ukraine, both of which have occurred wholly outside the UK, this decrease would have little or no impact on UK inflation rates. These rates are, in any case, forecast by the OBR to fall to around zero or below by early 2024 as a likely consequence of the mathematical methods used to calculate inflation indices.

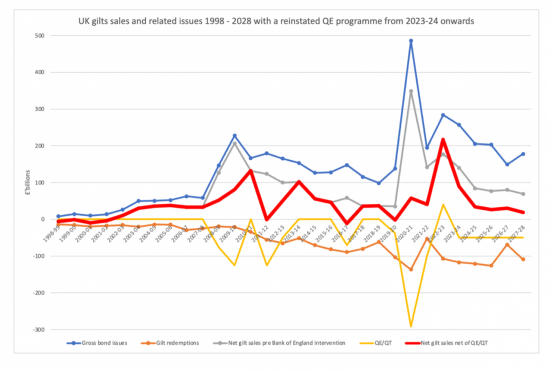

Third, given that the situation now faced by the UK has been created by war, and as a result the likely impact of some energy price increases will continue for some time, the current economic situation should be considered as aberrant as were the conditions in 2008 and 2020 and the use of QE to support government spending whilst simultaneously keeping interest rates low must be considered. A QE programme of £50bn a year could transform the borrowing outlook of the UK government and leave averaging anticipated borrowing at rates broadly consistent with those of the last fourteen years. The following chart demonstrates the impact of replacing the QT programme with a QE programme of £50 billion per annum, from 2023-24 onwards.

Sources as noted in text, with a QE programme of £50 billion pa substituted for the Bank of England proposed QT programme of £80bn pa from 2023-24 onwards

As is clear from the highlighted red line, net gilt sales to financial markets fall to the levels with which they are familiar if this QE programme is put in place. As a result interest rates could also be reduced, considerably, and most of the stresses in the UK economy could be removed as a result, with a stable economic environment being created, all as a result of this single change in policy.

In summary, there is compelling evidence that QT will create significant upward pressure on UK interest rates that will as a result move well out of the range to which the UK economy is used over the last decade or more with potential significant adverse consequences that we suggest should be avoided. A renewed programme of QE could achieve this goal and deliver stability for UK financial markets as a result.

[1] https://obr.uk/download/economic-and-fiscal-outlook-march-2022/

[2] The Chancellor has the tacit ability to do this backed by the powers in s19, Bank of England Act 1998 to over-rule the Bank's decisions

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

QE or QT is the wrong way to look at it.

QE as executed was about buying a particular amount of gilts at whatever price was prevailing. This meant that in 2020 and 2021 50 year gilts were traded at yields of 0.5%. These low rates were not having any beneficial impact on the real economy (it certainly was not high rates that was hurting firms)… but as they have returned to more normal levels it has created problems (LDI hedging, SVB failure etc.).

The answer is clear (and was said at the time) – don’t fix the size, fix the price (or more precisely a “corridor” for gilt yields).

So, whilst I hear you about QT, the right response is to say something like…..

“Our inflation target is 2%. Consequently, a neutral range for long maturity gilts is 2% to 3% so the BoE reserves the right to buy or sell gilts in the open market in order to keep yields at levels consistent with monetary policy aims”

Yes, but that only puts gilts in play, and we argue that is too narrow

My view on all this is that it sounds appalling.

Rachel Reeve and Stymied need to see this – this is the Tories bequeathment and their meal ticket to get back in.

I’m not one for conspiracy stories but there is some sort of malignant programme of work at work here that has it all worked out unless Laboured decide to pivot in another direction.

Well done to the both of you,

You are fighting for the likes of this lady,

https://www.bbc.co.uk/news/uk-england-stoke-staffordshire-64983317

You do realise that many of the banking problems we have seen is the consequence of cheap money for best part of 15 years. Do you really believe that continuing down the path will solve everything? It won’t it will will store more problems in the future.

No I don’t realise that because it is not true

The problem is trying to raise rates and reduce liquidity

It’s staggering you cannot see that

Tanvi

The biggest crash of all – 2008 – was not due to interests rate was it? It was because of an under-regulated mortgage market impacting on the the mortgage backed securities derivatives market itself under regulated.

The low interest rates came about as a consequence of trying to get economies back on their feet. That ran into trouble because of other factors (hint – read the news) – not an excess of consumption.

Your response is typically Neo liberal – reductionist, over simplistic and self serving.

Just a thought and suggestion for new entries in glossary.

Is there any merit in including:

Fiscal Policy – The reason for having an explanation of this terms is that its often used by reporters, media, etc. If appropriate you can link it to Fiscal Rules/Fiscal Choices/Fiscal Place.

Monetary Policy – same as above and you could link this to Conventional Monetary Policy

If they aren’t there now they will be very soon

There’s just a banking crisis to deal with this afternoon

Steve Keen’s take on the banking crisis

The Fractured Fairy Tales That Led To Today’s Banking Crisis

In “A Simple Solution to the Banking Crisis That No Country Will Implement” , I argued that The Fed could end the current crisis simply by buying all outstanding Treasury Bonds at face value. After that, in future The Fed should either let Treasury run an overdraft on its account at The Fed, or The Fed should purchase Treasury Bonds directly from Treasury.

more

https://profstevekeen.substack.com/p/the-fractured-fairy-tales-that-led

https://www.patreon.com/posts/simple-solution-80326211

This a very good

Worth reading