As the Guardian has reported this morning:

Cash-short banks have borrowed about $300bn from the Federal Reserve in the past week, the central bank announced on Thursday.

They added:

Nearly half the money – $143bn – went to holding companies for two major banks that failed over the past week, Silicon Valley Bank and Signature Bank, triggering widespread alarm in financial markets. The Fed did not identify the banks that received the other half of the funding or say how many of them did so.

What we do know is that US Treasury bonds owned by the two banks were given as collateral for the loans. So, in effect, the Fed made loans against the security of US Treasuries delisted with it. That is quantitative easing (QE) in all but name.

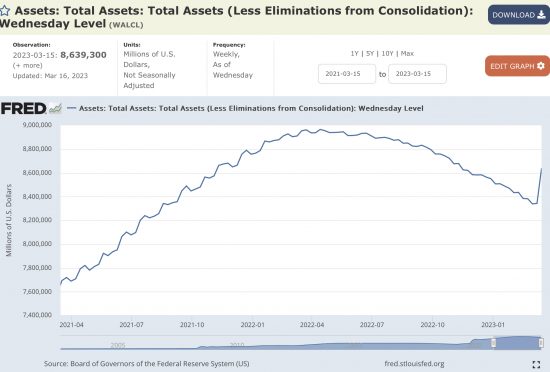

The impact is clear in data issued by the Federal Reserve Bank of St Louis, almost always the best source of US economic data. This chart shows by how much the Fed expanded its lending into the economy last week:

Half of the reduction in the QE programme to date in the US was itself reversed last week. That is his significant this is.

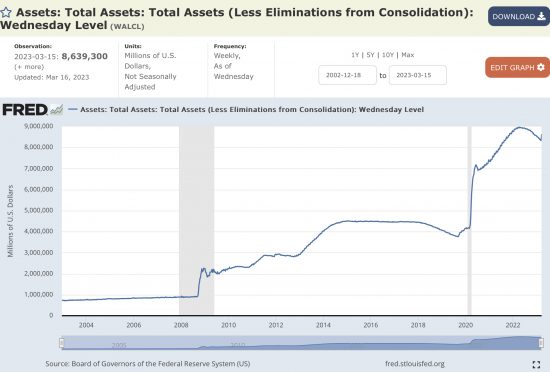

And, to contextualise this, the following is a longer term chart on this issue:

There have been three serious upticks in QE. They were in 2008, 2020 and last week. To pretend that this is not significant is, in that case, to ignore the evidence.

Switzerland is, of course, now doing something similar for Credit Suisse.

Three thoughts. First, let's not pretend we have not got a new banking crisis; we clearly have.

Second, let's note that quantitative tightening is clearly not working and is, in fact, dangerous.

Third, let's start talking instead about how QE can be used by more than bankers to deal with issues of greater public concern. It is absurd that the ability of the state to create money at will is reserved solely for the benefit of bankers.

This story will run, and probably for longer than most think. We have a banking crisis that has reversed policy in days. It will have to do so in the UK as well. What the Bank of England does next week might be an interesting indication as to whether they have truly and properly appraised the risk as yet.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Why aren’t these banks benefitting from increase asset prices, increasing interest rates etc. FTSE regent highs etc.

Even crypto is pumping again.

The money from price levels must be going somewhere?

It is

It is going to the wealthy and to corporate profits

Inequality is growing fast

An increase in interest rates reduces the prices of preexisting long term assets. Banks like SVB held very longterm assets which had very low interest rates, much lower than current rates. This is not a problem if the bank doesn’t have to sell. However SVB had to sell their old assets to meet the demand of the customers cash withdrawals. They found the hard way that their business model wasnt as risk free as they thought.

And this is why banks now arent benefitting from increase in asset prices and increased interest rates. Financial markets are reevaluating their risk. This is the risk that Keynes explained as being different to a business failing due to it being unprofitable. Banks can fail even if they are profitable. The problem is liquidity. The increase in interest rates has reduced the liquidity of older assets.

Today I’m hearing that the Met is in the ‘last chance saloon’ because of a forthcoming report on its culture.

The banks were trusted before 2008. The lessons learnt were ripped up and elected politicians chose to trust them again. And look what has happened?

When will banking & finance be in the ‘last chance saloon’ I wonder?

It’s about time really.

Oh well?

The government must create money, and increase its “debt”, in a growing economy to prevent deflation.

For many years, 80’s, onward, it failed to do so. It relied on, temporary, money creation by commercial banks (loans). To keep money creation happening. Interest rates had to fall, and they did. But you reach a limit as rates approach zero.

So, eventually, there had to be QE, 2008.

QE has been less effective than more direct money creation, government spending, because it led to increasing inequality, which meant money was not in circulation.

Governments continue to resist the necessity of money creation leading to a series of crises, such as now.

This will continue until governments understand macro economics.

Eventually there must be a reduction of inequality, more government spending, and lower interest rates.

The question is how much damage will be done first.

https://www.bbc.co.uk/news/av/uk-politics-64974824?fbclid=IwAR24c94yEVgcGdT5WRIrJ-2hERKCulnc1cTFotSNR9YPcCGRGP0D2TSB2OQ

In the first 26 seconds we hear why Hunt thinks we have to get worse off. The money spent in the pandemic “has to be paid for’.

By which he means ‘paid back’.

Does he not understand …as in the 1930s the bankers didn’t understand Keynes?

Or do they really know but the banking interest is too powerful to resist?

Or something else?

I wish I knew

Hunt talking complete nonsense (surprise!) as the great bulk of the money created and spent into the economy will someday wind up back at the Treasury anyway. Where’s the problem? There isn’t one so he certainly isn’t justifying austerity there.

On a boat at the moment so unable to comment at length (you will be relieved to hear).

I don’t see this as QE. Yes the Fed balance sheet is increased but motivation matters. This is “standard central bank activity” in a crisis – lend freely at market rates against good collateral. The bulk of this is happening at the Discount Window and is required because depositors are changing behaviour and moving their money to bigger banks. The flipside of the Discount Window borrowing will be a huge increase in reserves held by large banks.

This reshuffling of assets and liabilities around the system is painful for some but is being lubricated by the rise in Fed lending… which will be reversed once equilibrium is restored.

The key question is ” is there enough capital in the system to take the losses?”. “Are the vulnerable banks sufficiently liquid?”. We will see….

I have to disagree

I do not see equilibrium being restored

And wasn’t QE always against the collateral of Treasuries (or gilts in the UK)?

I view QE as an extension of open market operations. It is ‘adding reserves to maturity’…. which could be 10 years or more. Discount Window borrowing is short maturity and I would be surprised if DW borrowings are this size a year from now.

All equilibria in banking are unstable… that’s due to maturity transformation. We will reach a new equilibrium at some point as some banks trim assets in response to struggles to raise deposits; others buy those assets. This may involve banks going bust, shareholders losing everything, bond holders getting ‘bailed in’…. and possibly depositors, too. But the questions are ‘how will this impact the real economy?’ Will depositors a lot of money?

We will see. I am concerned…. worried, even…. but not to the extent you are.

That’s a fair compromise

Well, yes motivation does matter; but I have never seen it on a balance sheet.

Agree with Clive – this is not QE.

Some argue that the distinction in unimportant. They are wrong. It’s critical.

It is a mistake to confuse unorthodox monetary policy and the control of inflation with managing financial stability. Why? For the obvious reason that these objectives can and do conflict with each other.

Note the obvious discomfort of Mme Lagarde yesterday when asked about this potential conflict.

We have to disagree

This is a bank bailout using Treasuries under collateral that could result in their acquisition

That is 2008 all over again, with a very fine distinction that is immaterial being applied

I think you are wrong

“It is a mistake to confuse unorthodox monetary policy and the control of inflation with managing financial stability.”

That may be true, but where does it take us? It takes us to something you call “conflict”, but looks to me suspiciously like “confusion”. Do you really think bankers (central or otherwise) are demonstrating a magisterial grasp of the problems, or just shovelling more public money (that ‘down the line’ deprives ordinary people of resources to fix the the cost of living crisis), at a TBTF sector they have not mastered, controlled, or quite understand how it is evolving?

Machine-minding is not problem solving, even if the technical process to keep the machine running proves inventive.

“I think you re wrong”

The accounting treatment by the FED supports Clive and my interpretation. But each to their own. The abuse of this FED data all over social media today has been widespread.

This one comment on the tw@ttersphere was amusingly appropriate

https://twitter.com/DiMartinoBooth/status/1636494923544313863?t=2KEVM0itiwWu3FjW6QADKA&s=08

The accounting treatment for QE is persistently wrong

I would say that makes my case

Well it is all fairly orthodox, and there is little to see here. Move along. Meanwhile there was this minor announcement yesterday:

“JP Morgan Chase (NYSE:JPM) & Co, the financial services company stated on Wednesday that the Federal Reserve’s emergency funding program would administer almost $2 trillion in funds into the US banking system, alleviating the current liquidity crux.”

Well done Richard, I never ever believed we pulled out the 2007-8 banking problems by their disgusting roots. Sticking plasters, fudge and misrepresentation is all neoliberals will ever do. The pirates sail on, with their lockers still full of false flags and swag.

For anyone who hasn’t read Hyman Minsky’s ‘Financial Instability Hypothesis’ please do so; it is about the substance, not the mealy-mouthed, process-obsessed machine-minding that is all you can expect from hopeless politicians, central bankers or frankly inadequate neoliberal economists.

Yes, and this from L. Randall Wray and Stephanie Kelton in her newsletter The Lever:

https://stephaniekelton.substack.com/p/magical-thinking-monetary-thinking?utm_source=substack&utm_medium=email

A concise history of central bank madness in continuing to do what doesn’t work. Again. And again. And again.

Or is it that the few for whom it does work are enjoying their loot while watching the world burn?

It’s good

This is from a briefing I received yesterday from Investec: ‘We continue to believe that the lagged effects of the most aggressive rate increase cycle in living memory are beginning to make themselves felt and that weak players will be exposed.’ Sounds like they are not impressed by the policy?

It seems so

Oops.

The Lens newsletter.