Forgive me if what follows is a little technical. It relates to an issue of massively important concern, which is the amount of interest that will be paid by the UK government to our commercial banks because they were the recipients of the money created by the Bank of England to fund the quantitative easing programmes and some other loan programmes e.g. that for SMEs advanced during the Covid crisis.

The bottom line of this blog is that give or take a bit (and all economic forecasting is open to uncertainty) it is likely that those commercial banks will benefit by £136 billion over the next five years as a result of the projected Bank of England base rates included in the latest Office for Budget Responsibility forecast for the UK economy. That is almost enough to pay for the NHS for a year or to pay for education for 2.4 years.

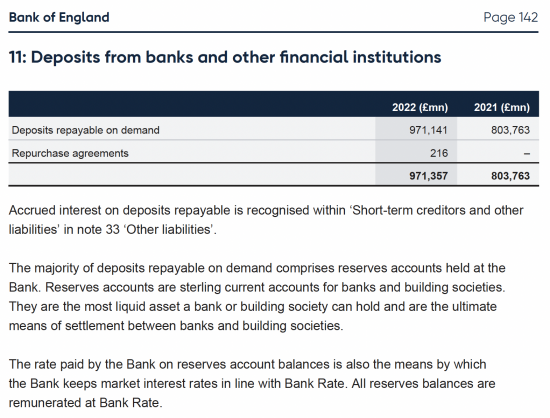

First, let's be clear what we're talking about. It is this sum on the Bank of England's accounts in February this year:

There was £971 billion on deposit with the Bank of England at that time, placed with them by our commercial banks in what are called central bank reserve accounts.

Of this sum approximately £875 billion at that time was due to quantitative easing. The rest was due to additional loan programmes for SMEs and other organisations advanced by the Bank of England to commercial banks for them to lend. I explain how these balances arise here and here and so I will not repeat myself. They are, in summary, the inevitable consequence of the government injecting new money into the economy via the commercial banks using the quantitative easing process. What is absurd is that we pay those banks interest for the privilege of the government doing this.

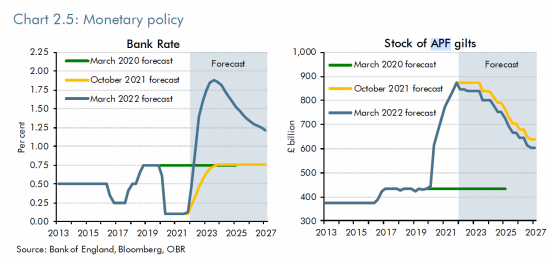

Until mid-2021 that was not an issue of concern: the interest paid was at 0.1%. It was insignificant. And then interest rates began to rise. This was the forecast of rates from the March 2022 Office for Budget Responsibility forecast:

You will note that rates were expected to rise to 1.8% and then fall back to 1.25% over time.

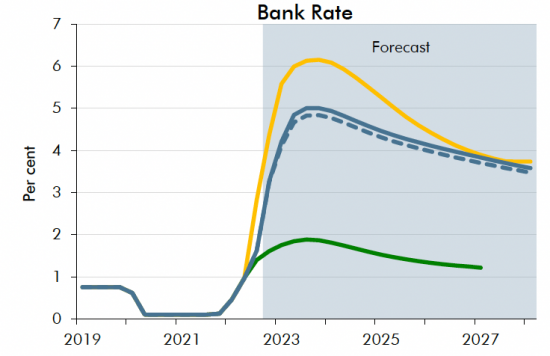

This is the forecast from the latest OBR forecast:

The forecast is for rates to rise to 5% and then fall to maybe 4% by 2027.

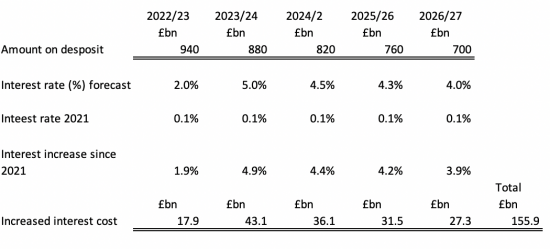

There is no equivalent chart for the APF - which is a shame. The Asset Purchase Facility is the fund maintained to hold the government bonds purchased using QE. This began unwinding in March this year. The net value is now around £835bn and the plan is to reduce it, although how realistic that might be is anyone's guess. I will accept for the purposes of projection, however, that from 2023 until 2027 this facility reduces in stages to £600 billion meaning in turn that the sums held by commercial banks with the Bank of England might fall from £971 billion in February 2022 to maybe £700 billion in 2027.

To look at the additional cost of the extra interest due as a result of forecast increases in bank base rates I prepared the following table. It is, of course, approximate. I assume a steady reduction in the sums on deposit assuming the Bank of England will keep redeeming its bonds as forecast in March. I have taken an average interest rate for each year based on the data supplied by the OBR. This is approximate but more than good enough for illustration purposes:

Let me put this in context. What this calculation shows is that additional interest of £155.9 billion will be paid to these commercial banks over five years.

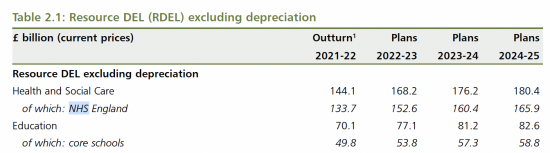

This is from the Autumn Statement and shows the sums given to the NHS to manage the health service. Capital budgets are about £12 billion a year on top:

So, we are, over the next five years, going to give the commercial banks enough to pay for the NHS last year.

I stress: we are giving them this money because the funds they have on deposit were created by the government and not by those banks: the commercial banks did nothing to earn these sums, at all.

And yesterday the tax rate on banks was reduced by 5%.

And let's also be clear that this interest paid on these accounts is paid voluntarily: there is no law that requires it. What is more, it could be cut. For example, a balance of £100 billion would be more than enough to achieve the Bank of England's goal of communicating its base rate into the economy via the commercial banks. 0.1% could then be paid on the rest. Doing this would save £136 billion over five years - and I strongly suspect rather more as I really cannot see the Bank of England successfully selling its bonds over the next few years given the scale of HM Treasury bond sales that are also planned.

In other words, education and the NHS could have an average of £27bn a year more to provide essential services simply by cutting the money paid to UK banks on deposits gifted to them by the government in the first instance.

And note - that is exactly the amount of spending cuts planned next year.

Or the amount of tax increases planned next year.

And what is clear is that these sums are being used to enrich our banks for no good reason.

How important is this issue? I would describe it as vital.

I just hope some politicians pick this up: it is vital that the interest paid on these accounts for no blood reason be changed and that our banks are not enriched unfairly at cost to us all. We cannot afford what the Treasury is planning. We do not need austerity to enrich our banks.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Please publish this – and send to Reeves and co – should be an open goal. Such an obvious point of attack. Also has the merit of opening up the debate on ‘debt’ – what we owe to ourselves and what we owe to others.

Given the less than enthusiastic response of even the Tory press to Hunt’s measures, might they be receptive to this?

I appreciate you don’t have a staff and you are not fully well.

Let’s see

It is out on Twitter

Hi Richard, interesting, I’d be happy to write to my MP but as always it raises more questions that I have to get my head around first. Why did the UK govt start paying interest on reserves held by commercial banks? There must be a reason. How does it communicate its base rate into the economy? If the banks are being paid interest it’s a benefit, they have no costs to pass on to mortgage holders etc.

QE was the reason: that is what changed

They thought this would make QE acceptable and back in 2009 reflating the banks was considered essential

Base rate is communicated by simply upping this rate. It must be the most expensive communication system in history

Thanks Richard. QE was supposed to feed through into the economy, and the pockets of ordinary people and SMEs. What actually happened? The banks and dealers redirected it to the ‘usual suspects’; large financial institutions with privileged access, who invested in asset bubbles. Did all this cheap money at low interest rates stimulate private sector investment into productivity-enhancing economic growth? No. In Britain free enterprise far more typically likes to pass all the risks hastily back to the state, and invest in what it sees as low risk assets like property, that produces easily managed rents; or manipulate financial margins at the edge, with sufficient, persistent incompetence eventually to stimulate a crash (2007-8, still without adequately regulating them even now, as the recent market ‘pension’ crisis too readily demonstrated). Eventually neoliberalism has to pay the price for all the disasters it has served up in the last twenty years, while leaving so many households so often, on the edge, or over the edge, in real comfortless misery; and no way out.

It all has to stop.

I’ve had to read this at least 3 times – like I had to read about the interest on a previous post about CBRA 3 times and then lost my rag.

‘Absurd’ does not even begin to explain this.

It is done to me it look as though the banks are being paid to distribute Government money under duress.

So not only will they be lending this money for profit, they will profit from being issued it by the Government!!

.

You could not make up a system more geared towards your backers and greed than this.

We need to deluge all MPs about this fiscal depravity.

BTW I was watching John Glenn – the Chief Secretary to the treasury the other night on C4. An interesting character, albeit he just trudged out the same old hard line and was a bit defensive – not such a bad loser however than Rees-Mogg.

Perhaps worth adding that the bank tax surcharge of 8% has been cut to 3% (a 5% reduction); apparently to offset the increase in Corporation Tax to be paid. This is extraordinary, when the banks are already receiving a free rent on money they did nothing to create or earn.

Meanwhile, back in the real world, when the Chancellor makes a big issue out of protecting the triple lock; the cost of financing this is significantly offset by freezing personal allowances (fiscal drag), and increasing taxes. Meanwhile, the Government offers banks a free lunch.

In parenthesis the windfall tax on oil and gas is increasing by 10%, but the Government has acted so slowly it has already missed taxing substantial windfall profits already earned before it was implemented, either at 25% or 35%. In addition Shell (UK based) paid no windfall tax at all, because of the very generous terms on which the windfall tax rules were created. IT is typical of Conservatives to puff up taxes or regulations they drag their feet to implement. They typically want the credit for mere sloganising or dragging their feet.

On QE, I should perhaps add this contextual note to BofE thinking, on QE and ‘fiscal dominance’, from BofE Quarterly Bulletin, Q1, 2022 “QE at the Bank of England: a perspective on its functioning and effectiveness”, by Filippo Busetto, Matthieu Chavaz, Maren Froemel, Michael Joyce, Iryna Kaminska (Monetary Analysis Directorate) and Jack Worlidge (Markets Directorate). The emphasis is on Gilt yields, and QE reducing interest rates. Focusing on Para.,6, ‘The impact of the Bank’s corporate bond purchase scheme’ I was struck by this framing of the issues, in the specific context of ‘fiscal dominance’, a term that seemed to me redolent of an inner intellectual tension:

“Fiscal dominance arises when there is a perception that the central bank balance sheet is being used to finance the government in a way that is not compatible with the inflation remit. There are a number of institutional safeguards against the risk that government financing considerations in the UK have an undue influence on monetary policy. The price stability objective – which in the current remit consists of a 2% inflation target – is embedded in primary legislation. Direct accountability of the MPC to Parliament means that monetary policy decisions are free from government influence. In addition, operational mechanisms are in place to ensure that policy decisions are not constrained by the potential implications for the Bank’s balance sheet. For example, the government’s agreement to indemnify the APF makes it explicit that the balance sheet risk associated with these policies is absorbed by the government.

However, even an incorrect perception of fiscal dominance can undermine a central bank’s reputation and credibility, and therefore threaten its ability to meet its inflation target.

An extreme variant of fiscal dominance is when the government simply pays for deficits by ‘printing money’, where the central bank is forced to print more notes or to expand central bank reserve liabilities that bear no interest cost. That description does not apply to QE programmes because the central bank reserves created in exchange for longer-dated gilts bear interest at the central bank policy rate. Therefore, at a practical level, QE is rather akin to a swap between short and longer-dated government liabilities.” (Para.,8, Box C).

The last point is correct and pure MMT

But why do we need to pay BoE base rate on short term money to this extent?

There were two other points that struck me. First, since the BofE views QE as reducing yields and providing the lower bound to interest rates, their policy now is consistent with a priority to reduce inflation, even if the inflation is driven by factors over which they have no control. They control what they can, even if it exacerbates the pain of ordinary people. There is a tension between Government fiscal and Bank monetary policy that, with the independence of the BofE, is a policy that for reasons that escape me, assumed that there were no circumstances of any conceivable kind, in this ‘best of all possible worlds’, when a tension between Government and Central Bank would ever arise; until, as is inevitable in the real world, and those not merely eccentrically imagined by bankers and politicians; we find that it is not just conceivable, but happens – again and again and again.

Second, the BofE’s QE focus on ‘insiders’ (commercial banks, elite corporate institutions and dealers), and its lofty dismissal of notes and coin, had a side effect on the distribution of the benefits of QE, from 2009. It provided a highly managed and restricted circulation of the benefits of QE, which I have long felt never reached those on lowest incomes, where the continuous circulation of hard cash (outside the charmed bankers circle), was the most effective lubricating stimulant of basic economic activity; and, combined with austerity this narrow focus on elite institutions has compounded the appalling problems so many unemployed, disabled or low paid workers face today; and that Government is now scrabbling to correct, or make much of an impression on the serious economic and social problems that have inevitably followed such a long, long period of indifference and neglect.

I was at a BoE citizens panel forum in Bristol on Monday night, and this topic was briefly alluded to. The Comms Director, James Bell, is obviously an intelligent and thoughtful sort of feller, but sadly not one of nature’s public speakers. He said, in rather vague and brief terms, that the interest paid on CBRAs was in order to control other interest rates. ( I didn’t get the chance to query this). As the BoE state in the quote above, from p142, 3rd para, “…keeps market interest rates in line with Bank Rate”. What justification do they have for this, would you say? Is there any validity in it, and how much?

It was not required until 2006

And yes, I see the point on £100 billion

But not on £900 billion – that is what is called ‘having a laugh’

[…] Cross-posted from Richard Murphy’s blog […]

Hi Richard. Thanks for this. What are other countries doing with their QE balances and interest rates?

Broadly as we are – bit as I have noted elsewhere – no one has any experience of actually paying anything but near enough zero on these balances before so no one has a clue what they are doing now – it is pure dogma that is driving the current inclination to pay at base rate and no one has any experience of what happens if you do

But I can tell you, it will be disastrous

In trying to understand this issue further after my earlier comment I came across this NIESR article

https://www.niesr.ac.uk/blog/dont-stop-paying-interest-banks-reserve-balances.

I also read that other central banks use a tiered system of rates.

Unfortunately I found the article’s arguments too technical to follow but got the impression that the financial system has been allowed to develop such that the banking sector calls the tune and has become our master rather than our servant. I recognise my naivety but wondered if any of your contributors, if they have the time, could shed more light on this.

I struggled to find almost any observation in the article that was right

I will try to do a response tomorrow. It is most likely if the weather is bad

I bought bonds from banks and they paid me interest. why does Boe not do the same.very odd

I am sorry, but I do not follow your argument