My friend Prem (Lord) Sikka has drawn my attention to this question he asked in the House of Lords:

This is the answer he was provided with:

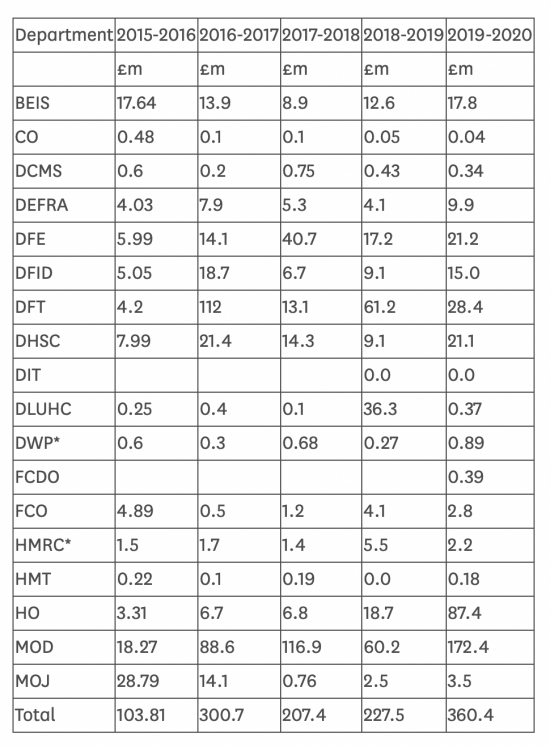

There are so many questions that this poses. First, how are the figures for HMRC so utterly inconsistent with the tax gap?

Second, why is the detection rate so abysmally small, at less than 1%?

Third, what is being to improve this?

Fourth, why isn't this issue, plus the tax gap, the focus of attention if the government really thinks it needs to find £50 billion of savings?

It really does feel that the government has paid too little attention to this issue for far too long, as remains true of the tax gap about which I have been writing for longer than most people given that the issue was virtually unknown in the UK when I first published a report on it, way back in 2006.

It really is time that the government got serious about these issues. There is no evidence that it ever has been.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Agreed – it would help if they got HMRC back to aggressive fraud investigation instead of the “light touch” approach that has been promoted ever since Customs and Excise merger with the Inland Revenue ( speaking as an ex Customs Officer)

£33-£55Bn loss from fraud, excluding Covid fraud. The critical question that arises? What resources are provided to HMRC and other Departments to detect and pursue fraud? How much is actually spent by Government to reduce this scale of loss? With a traget up to £55Bn you can afford to spend a large sum to stop the rate of loss. I return to my proposition, made recently on other threads; there are two ways neoliberal Governments make the inherently wasteful, costly, dysfunctional nature of neoliberalism work; first (and far less important), by removing regulations and the investigation of fraud (neoliberalism requires the frustration of ‘red tape’, for its media and PR to rail against the iniquity); second, and functionally far more important, Neoliberal Government simply deprives its executive of high quality, well resourced regulation and investigation arms; because that would just illuminate how fake most ‘free market’ competition is, and how much neoliberalism leans on a consumer ‘rip-off” culture, for its monopolist vested interests to function profitably.

Monopolists thrive in neoliberalism, even without fraud. The reason the scale of the energy is so severe, and produces a deep recession is because it is effectively a private sector monopoly. The Government refuses to acknowledge the basic fact that energy is a monopoly, and cannot function otherwise, in order to protect the vested monopoly interests it has chosen, exclusively to represent. The phony UK domestic energy market (that collapsed under the strains of its fundamental incoherence); and the failure to apply a serious windfall tax on the UK oil and gas sector, in spite of the sector making exceptional, windfall monopoly profits on an unprecedented scale. Remember the Bloomberg forecast of windfall profits for the UK oil/gas sector (that dictates UK domestic energy prices) of £170Bn over the next eighteen months, and the neglible tax being raised from the monolopy profits that are now driving an economic recession, ruining family lives.

The trivial absurdity of the political debate about thereal nature of the economy, and the real problems is frankly ignorant and farcical. The guitly failures for this are Party and Media.

It seems to me that successive UK Governments dont take fraud seriously, right across the board, with predictable consequences.

The footnote does say that the HMRC and DWP figures are internal fraud error only. Benefit and tax fraud being reported elsewhere. But it is worth asking why they aren’t provided in the answer.

I spotted this one too and concluded that tax and benefit frauds are either omitted altogether or are included in other departments’ totals. The obvious question is why? I suspect it’s because it would be too embarrassing if they were clearly identifiable. As for the MOD figure, MOD contracting and project management has been the subject of critical reports for as long as I can remember, but the figure of £360.4 million still comes as a shock. Benefits fraud can’t be a main driver in that £360m, it has to be fraud, yet the MOD just seems to get more porous year on year. Comparative figures for prior years would be useful here if only to demonstrate whether this is a one-off blip or has been going on for ever without anything being done to control it.

As others have observed, it’s always been bleeding obvious that fraud increases as regulation diminishes and 2008 wasn’t so long ago that UK Gov and everyone else can pretend it was a one-off blip which we can now forget about.

Thanks

Sunak’s wife avoided more than twice as much as the HMRC figure in this chart. Perhaps time for non-dom status to be removed.

Warwick university research shows that only 100 of the 26000 non-doms would leave this country if that happened, and most of them don’t pay tax anyway.

It seems to me it’s a no-brainer.

The reason I think this happens is because the people in government are made up of the same people who benefit from the lax approach.

“When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorises it and a moral code that glorifies it.”

Frédéric Bastiat

Indeed

What is going on at the MoD? I’m sure these figures don’t include things like supplying armoured fighting vehicles that don’t work.

Good question

Neil License , benefit fraud is small in comparison to most in this table and tax fraud is an unknown that can only be guessed because the Westminster government actively lay a pathway for tax fraud in the way they have designed income reporting to HMRC let’s face it we know how easy and common it is for self employed people to declare all and sundry as “expenses” and we know how little investigation is done by HMRC.

The home rental market area is another fraud that the Westminster government encourages because it is happy to get increased votes from landlords in return for lax almost nonexistent regulation of reporting income from rent many landlords don’t even report to HMRC that they own and rent out property and HMRC make no effort to find out, a simple request sent to local authorities asking for details of privately rented addresses in their area together with details of the occupier and owner would allow HMRC to find out who owns these rented properties they could then cross check to see if income from rent has ever been declared , I know many people who own flats and rent them out but have never declared it to HMRC so easy , so many people in the last couple of decades cashed out their pensions and put the money into buying and renting out flats because it’s easy as pie to have income from rent where no tax is applied, the alternative was to keep your work pension lump sum in the bank and get zero interest and keep your monthly pension and see it taxed.

Benefit fraud also gets compounded by benefit errors by issuing offices and claimants alike- an increasing problem given the complexity now of how to apply or qualify for it.

Those figs seem to fluctuate wildly year on year in most cases! Would be interesting to see the relevent ministerial/political appointments relevant to each year, maybe also the senior civil servants in charge.

I’m not sure demanding that the people who have most encouraged (and/or gained from) fraud within UK government should be the ones to investigate and rectify the problem (aka crime) is likely to gain much traction with these are the same people who get to make the decisions on this.

Maybe a public campaign demanding a ‘fall guy’ to be investigated for criminal activity could get the ball rolling though – the MoD is untouchable despite being knowingly open to bribery and corruption for more years than I care to remember, but the Department of Transport should be an open goal (Crossrail, HS2) for gaining wide public – and possibly even, dare I say, media – support.The latterseem always to be up for identifying and pursuing an enemy of the state.

Pile staff and money into better fraud detection .even recruit some captured scammers. the more detection forces the less the loss. Can it be simpler. You spend money to save money.