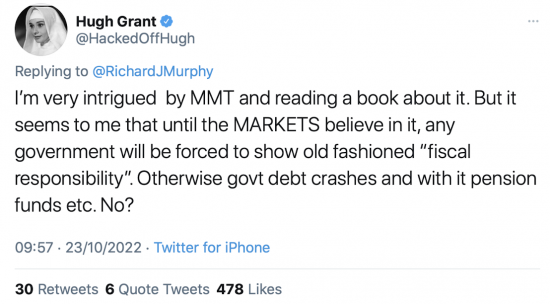

I just posted this thread on Twitter:

You raise an important issue @HackedOffHugh. You're reading the right book. @stephaniekelton is great and we talk often but this is a brief thread in response to your question.

MMT is not a policy: it is a description of how money actually works in the economy. I believe that description is right: the choice as to whether you follow all the policy prescriptions like the job guarantee is for you to decide on . There are three key issues though, I think.

First, people are taught markets rule. They don't. But we've had politicians so incompetent and chaotic that they have abandoned decision making to the markets, and especially central banks. The result is going to be a crash due to interest rate rises that are totally unnecessary.

Second, politicians of all parties seem to think that shrinking the state is the goal of public life. Most of economics is designed to confirm that. MMT says that's not necessary. It lays out the conditions where politicians can decide what size of state they think is needed.

Third, MMT challenges Thatcher's household analogy that suggested the economy is like home. Thatcher forgot government's create money, households don't, so they're totally different. MMT says managing like a household is a disaster for a country: the opposite of what is needed.

The problem is not with the markets. The power to control markets exists, as Japan shows. Just because the Fed wants to trash the US economy and that of developing countries we don't have to follow suit and raise rates, for example.

The problem is with governments who think they cannot stand up to markets in the public interest. As a result they let bad things happen because some in the City abuse market power for their own interests: you're more than familiar with that.

What we need are courageous politicians to stand up to the financial markets, to put central bankers (most especially, as they are particularly harmful) back in their boxes and to manage the economy as if finance is the servant of people, not its master.

A government that realises it ultimately creates all the money could do that: it just has to believe that it must do so in the public interest, whilst leaving space for private business that actually makes things with room to operate whilst constraining the rule of bankers.

Happy to discuss further. There is more from me on my blog and in this free ebook, although its inflation chapter needs updating https://www.taxresearch.org.uk/Blog/wp-content/uploads/2021/04/Money-for-nothing-and-my-Tweets-for-free.pdf

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

given the political will. how easy/ practical would it be to repay the loans borrowed from the markets by creating govt. money/ spending ?

Why repay them?

They gave a due date

Settle then then by rolling them over, as ever

Or how about just reporting government money for what it is?

Investment.

Market creating investment.

Government money into policy streams are the headwaters of the economy.

And you are right to say that until our cowed politicians realise this (or something else better expressed) there will not be much change.

i was thinking along the lines public money for public projects —–no private sector involvement

& let the markets provide for private sector investment

wouldnt this avoid market involement in sovereign domestic politics ?

If you roll them over… let’s assume holders want their money back and not gilts in lieu. Assuming new buyers can’t be found then it is Government money. Then repayment or rollover becomes the same thing. New buyers will obviously only buy if interest rates are high and attractive.

Look at 320 years of experience and stop being silly

And rates will be falling soon the world over soon – even markets have priced that

“Look at 320 years of experience and stop being silly”

That’s not an answer. Out of those 320 years how many years have bond yields been manipulated by central banks through QE. More so how many years have we had yield suppression together with inflation? It is dangerous to share your arrogance that demand will exist in any material size for Govt bonds offering big negative real rates of interest.

1) you are a troll

2) you clearly do not understand open market operations

Bill, can you explain the difference between “money” and gilts? Apart from coupon and timing? You do know the government creates the “money”? And both are forms of public debt? A £10 note is just like a small zero coupon gilt with no repayment date (or repayable on demand, if you prefer, by giving you another £10 note). A holding of £1000 10 year gilts just represents an entitlement to 100 of those £10 notes ten years in the future (or more realistically an electronic record showing entitlement to them).

Public debt rarely falls in absolute terms. More “money” and more gilts are issued year on year. If people want to hold them as investments, is that a bad thing? The level of public debt may fall as a percentage of GDP, but usually because GDP rises rather than because the amount of debt falls. (Assuming you think a comparison of those two numbers is particularly meaningful of course.)

Absolutely. MMT is just a description of the way money works and is politically neutral.

Money is added to the system by government spending and buying gilts; money is drained by taxation and sale (issuance) of gilts. This is a fact and, at its most basic, all MMT says.

Adding/draining money can control inflation – indeed, current policy using interest rates and gilt sales is a subset of policy possibilities available under MMT.

It has become political because it adds more tools to the policy tool kit that the rich/powerful would rather remain unused (as they tend to be redistributive) and they prefer to rubbish the “theory” to avoid having the policy debate that might mean sharing their wealth a bit more widely. The “theory” that they rubbish is almost always a strawman that fails to engage with the serious issues.

The position of markets (Interest rates but also FX) and how they dictate policy is an interesting one.

You are entirely correct that government has the power to control interest rate markets – the BoE could be a gilt buyer/seller “of last resort” to impose any pricing it deemed fit. They have done this for short term rates for ages and for long term rates (through QE) for a decade or more, on and off. (As you know, I prefer this approach to QE/QT).

FX is more difficult as market intervention is limited by the size of FX reserves but, in theory, could be fixed by currency controls etc.

So, it CAN be done – but should it? We currently live in a regime where free markets are the default and any intervention is seen as bad but occasionally necessary… but it does not have to be this way if markets are preventing delivery of sensible outcomes.

In my view, FX intervention should be rare and only to prevent disorderly markets. Interest rate intervention should be more common in order to get yields across the curve to levels that promote policy objectives. However, if the BoE is forced to buy (or sell) excessively it should make policy makers think carefully as to whether they are pursuing the correct policy.

Whilst we don’t want to have markets bully elected politicians they were pretty effective in reversing Kwarteng’s recent “fiscal event”. In short DO listen to what markets are telling you DON’T think this means you always have to do what they say.

Thanks

‘In short DO listen to what markets are telling you: DON’T think this means you always have to do what they say’.

In a word – yep!

Hi Richard, I love reading your insights and explanation of MMT. I can’t say I have got to grips with it and not sure I ever will. But what would be helpful is an example of a country that has used MMT as part of its fiscal policy.

It is not policy

It is the reality of government money creation

USA

UK

Japan

The eurozone

Sweden

Switzerland

Do for starters?

I’d leave the eurozone out as it is somewhat different from your other examples. Individual countries of the eorozone have replaced their own sovereign currencies with what is effectively a foreign currency. The eurozone is, so far, an incomplete system; it has a central bank but no central treasury. Hence, not quite like the others.

Mervyn King appeared on the Laura Kuensberg programme this morning. He said two things of note, paraphrased as follows; that the current National debt was a terrible legacy to leave our children and grandchildren and that recent Governments had been in thrall to those economists who advocate that printing money will not increase inflation.

Oh and that the QE of 2010, when he was Governor of the Bank of England was oK because… I forget why he said it was OK

He did

See my tweet responses

I also noted his belief in hard Brexit amongst his other callous insanities

For some reason, few people (then or now) complain about the massive pile of debt incurred in fighting two world wars or describe that as a terrible legacy to leave to the children and grandchildren of the generations that fought and died. Yet in the aftermath of the world wars, the UK created its welfare state, founded the NHS and built thousands of homes. Meanwhile, most of the time, the UK continued to run budget deficits, but public debt as a percentage of GDP fell from its peak of over 250%. Perhaps investment in infrastructure and people is important – more important indeed than paying down the debt – and pays dividends.

At the end of the day, debt is just numbers on a spreadsheet. The important thing is what you do with it. And how it is distributed.

And actually, money is just a number on a bank statement

Tha is how real it is

“And actually, money is just a number on a bank statement..that’s is how real it is”

Well i can use that money to buy a car or take my kids on holiday.. that’s real

Indisputable

But it’s still just a number

@George Groves. Yes, you can buy a car or pay for a holiday with money.

These are facts but are what philosophers call “institutional facts”. There is nothing about any of the various manifestations of money — notes, coins, magnetic patterns on a computer disc, etc — from which you could deduce these facts without taking into account the rôle these manifestations play in the institution of money.

I am surprised that Mr King had the time to appear, since I understand that “resident village idiot” is a full time occupation.

I suppose that we can class the appearance as part of main-stream-media/Kuensberg’s actions to preserve the corner-shop narrative.

Supposedly “serious people” talking toy-town economics.

As Baldwin remarked in the 1930s (modest edit) “the media have power without responsibility, the prerogative of the harlot throughout the ages”

The corner shop narrative was alive and well

The objections to MMT exposes Neo-liberal Economics as being much more like a religious belief system than the scientific system that it so desperately wants to be.

Although as Jesus Christ pointed out in the parable of the Good Samaritan the supposed believers are much more interested in the perks of the religion rather than putting their beliefs into practice.

Too often true

‘The power to control markets exists, as Japan shows’. Could you expand on this Richard, or point us in the right direction. I can see how control of interest rates and money supply can help but are there other less obvious ways in addition?

See Clive Parry comment for starters

It’s too late to expand on that

Have you read Neil Wilson’s criticism of using interest rate to stabilize economy:

https://new-wayland.com/blog/interest-price-spiral/

Interesting read.

Hi Richard

The discovery of MMT has been a revelation for me and a liberation. Your writing has provided the clearest explanation of it that I have read . I remain concerned however that currency traders may decide to cause a ‘ run on the pound’ if the UK government expounded it as an explanation of a money creation policy. They may do this out of ignorance, malice or both. In any event a substantial fall in the value of the pound is likely to cause a degree of panic among commentators, politicians and voters. How to counter this ? I understand the Japanese government have had some success in doing so but I have not read a clear account of what this has involved ( Bill Mitchell has written about it but I have found his account hard to follow)

You can’t have a run on a currency that can always pay

You can devalue it by reducing the E bionic capacity of the place that issues it

But that is something quite different

The rest is, literally, just speculation

Hi Richard

Sorry I don’t understand your response to my comment, and what the practical consequences are in relation to the current crisis. If (say) a new Labour led government declared its acceptance of MMT principles and advised that it was going to maintain/ increase spending without ‘ covering’ it by either borrowing or taxation and foreign exchange traders decided to sell sterling in response, driving down the value of it, how should such a government respond and how should it explain its response ?

The should be no response because without a response they cannot make a profit

A response is what they want

Not giving them a response means they lose

And the attack would all be over in a day or two in that case

Surely the market acts in its own interests. If the government borrows then they earn interest and because the system favours the creditor the return (interest) is guaranteed. Money for nothing. If the government creates money the market gets nothing (so the market regards it as bad). No wonder PFI was seen as a good wheeze – we are still paying. This part of the debate is the hegemony of an idea in action (still worth looking at Gramsci – but could also look at modern theories like Overton windows)

However underneath the idea we come back to the political in political economy. It’s always about power, how it is wielded and on whose behalf. My concern is that with international markets and large corporations much power has moved away from the nation state and exists in what effectively a regulation free zone.

If the GB takes back control back over its central bank how long could it be kept in line if the US, EU and others acted differently?

Ultimately I am still undecided on MMT, money is just a substitute for barter and has to have some basis in the real world that gives it value. Making money from money shouldn’t be possible. Too many layers of abstraction and all you have is financial engineering and derivatives of all kinds. For the life of me I cannot see why we shouldn’t separate retail and investment banking, just protect retail depositors and let the rest collapse if they make bad decisions – its what they preach. We only have to bailout the ones who have been taking risks with other people money – thats ultimately the only bit what we should protect.

If this view is wrong or over simplistic please explain?

Read David Graeber on the barter argument

There is no credibility to it

“money is just a substitute for barter and has to have some basis in the real world that gives it value”

I might have known this would become a stumbling block, because a definition of money turns out to be contentious. In an earlier part of this discussion you say “money is just a number on a bank statement”.

Perhaps I should have started the sentence “in my view it would be better if” and used “means of exchange” instead of barter.

I am familiar with “Debt the First 5000 years”, indeed I’m a bit of a Graber fan (The Dawn of Everything was hugely enjoyable). I note that debt pre-dates money and debt can be “denominated” in other ways. Perhaps we should have periodic write offs (as in Mesopotamia) and stricter rules on usury (as in the Abrahamic traditions).

What I take from anthropology is that conventional stories about human history and development are often wrong and that we need to be much more open to possibilities for change – what we invent we can change.

The case of money is difficult, its not just a useful invention it is also symbolic, its an abstraction. Because it is symbolic we project meaning onto it through our cultural beliefs. I have no doubt that money enables trade, that alone makes it more than just a number on a bank statement, and what is trade if not an exchange, or barter.

Right now we have and explosion of money M0 through M3, and whilst I’m not suggesting a return to the gold standard I do think we need to consider money having “some basis in the real world that gives it value”. In the US they talk about the difference between Wall Street and Main Street.

Pure speculation; maybe one of the reasons we haven’t seen massive inflation with the massive increase in money supply is because so much of it is hoarded that its not actually in circulation. As climatic change bites the hoarders will find their money worth much less than they think (they will have to resort to specie and private armies). I am sure that in 2-300 years time the people who are left (if they are not enslaved) will look at the idea of endless money supply simply as the adjunct to the equally fallacious idea of endless growth. To quote Shelly “there is no wealth except through the labour of man”

So not only is it political economy, it also depends on your values (philosophy) as well.

Sorry a bit long, I felt the need to explain, I do get the complexity of starting from here. I think we should liberate the hoard rather than printing more – so windfall taxes followed by deep financial reforms and redistribution, rather than QE.

You are right about narratives

But re increases in M3 etc, don’t ignore velocity of circulation

And as to value, that is rooted in the quality of the tax system

“I have no doubt that money enables trade, that alone makes it more than just a number on a bank statement, and what is trade if not an exchange, or barter.”

No, barter only fixes a single ‘exchange’; money is essentially a group, not an individual contrivance, that is created, in Desan’s words: “to measure, collect and redistribute resources”. It is therefore most typically associated with the governance of a group; in a 1605 text (before economists fell for the barter fable), money was exquisitely described as, “inhering in the bones of princes”.

Thus, there is nothing ‘barterish’ about this, with money as the mere convention, disguising a barter; as Desan describes money’s complexity, both pre-and-post a modern commercial economy: “The obligations that support a money can take many forms – tributes, rents, fees, tithes or penalties. But given that taxes most powerfully anchor modern monetary regimes, we can for simplicity calll the material referent of a token its ‘fiscal value'” (Desan, Ch.1, p.44).

I would add that I cannot easily see how ‘barter’ could produce the dynamic property of the ‘time value of money’; which, for example allowed the first ever application of a mathematicised ‘Present Value’ in a Treaty (or indeed any transaction), in order to calculate the ‘Equivalent’, for England to pay Scotland a calculated sum to adopt its share of England’s National Debt in the Union Treaty of 1707 ( by a committee, but principally calculated by the Scots mathematician David Gregory, Savilian Professor of Astronomy, Oxford University, closely advised by the founder of the Bank of England, William Paterson). Without the Equivalent there is no Treaty; without money, and only barter, it is hard to conceive how the world in which the Equivalent was calculated could even have existed.

‘Money’ remains an elusive concept, but it is characteristic of its enigmatic nature – both powerful in its effects, yet hardly noticed – that it is easy to overlook the facility with which even early applications of its range and power, once closlely examined may prove complex, or sophisticated; and not simple, or crude.

Mr Fish,

The very opposite is the case. Classical economics made the fundamental mistake of believeing a ‘creation theory’ in barter. Adam Smith fell into it; everyone followed. Richard mentioned Graeber (‘Debt: the first five thousand years’ is the text). I would suggest Christine Desan ‘Making Money’; she specifically addresses the ‘Creation Stories’ in Ch.1. I will quote from one paragraph as a ‘taster’ you may wish to follow.

“Rather than emerging from trade, money enables trade. Put more accurately, rather than a generic (money), produced by a generic (exchange), money arises as a particular initiative that creates exchanges of particular kinds” (Desan, Ch.1, p.38).

Money enables trade neatly fixes on ‘what’ is driving ‘what’. Take the money out, and the trade propulsion fails; put it in and it flows. I would also suggest Felix Martin, ‘Money, The Unauthorised Biography’. Not everyone has fallen for the myth.

Sadly the money/barter creation myth of classical economics still prevails. The mess we are in is partly because the public education system on economics is so bad. It is not, as far as I know taught very much in schools at all. Economics and accountancy should be as important as mathematics, but the economics mainstream has failed grossly as a discipline to produce a sufficiently coherent subject.

Thanks

Christine Desan sounds interesting. I’ll add that to my growing library of economics books.

In support of Mr Warren, Christine Desan’s ‘Making Money’ (Oxford University Press, 2014) is a must read. The introduction is well worth reading alone (pp.1-22). More than anything though, Desan’s research reveals that money is a legal entity and a concern of the state, which is something Stephanie Kelton has reminded us of more recently. A fact that urgently needs to be remembered, given the market worshipping going on at the moment!!

David Graeber’s work ‘ Debt: The First 5000 Years’ is from the viewpoint of an anthropologist and looks at debt as it was at first – our obligations to each other as human beings mixing in a society, before (in my view anyway) moving on to deal with the creation of money and how money (and its impersonality, it’s utility as a token system, an avatar of favours owed) effectively weaponised debt.

The creation of money has brought untold advantages to human society, but Graeber bravely points that since its inception, the inherent weakness with money is that its mal distribution has the tendency to cause huge problems and imbalances of power and justice too and we are still grappling with this even now, and probably always will!

He also traces our willingness to accept money debt to the human fact that we are designed/hard wired to meet our obligations/what we owe to each other. It’s just that money debt monopolises and abuses this natural sense of obligation and has meant that rentier markets have found it easy to exploit us as our incomes drop, services are cut, and we pay out more through the nose. And that increasingly money debt is pushing out more fundamental human obligations out of societies.

It’s a fascinating read, it really is.

MMT certainly forces you to rethink what you knew. On the question of debt I asked myself a hypothetical question. How would you get rid of all debt? In thinking this through, I started from the premise that the debt must have been created by the central bank at some point. It represents the amount of money still in the economy that has accumulated over time. If you could count up every bit of money in that currency in the world, wherever you could find it, you should end up with a number equal to the national debt. That was my assumption. The problem is, how would you reduce this debt to zero? The only way I could see would be to take that money, wherever you found it in the world, and destroy it! You would be left with no currency. I’m fairly sure this proves that debt itself, no matter how large, is really a problem. Without it, you would have no money.

If this is true, the debt to GDP ratio, which seems to preoccupy some economists, is also not a problem.

A thread is coming on this – written already this morning and now in edit

Be sure to edit out the typos, Richard. 🙂

Which ones?

I understand an HMRC response to an FOI request was to observe that they thought £850Bn was held in offshore accounts. Offshore really means tax havens, and that represents 34% of the total national debt, following your hypothesis. It neatly takes the money beyond reach of UK authority, unless the law changes here to make life difficult; and who is going to do that? Sunak? Think about that for a few minutes, with his background. Starmer? I leave that one to others more interested and knowledgeable abour Starmer.

Thanks John.

So according to my hypothesis, a third of money still in existence could not be destroyed because it is untraceable. Extraordinary. I suppose it could be argued, given what else is written above, that since money derives its value from the obligation to pay tax, it should no value. If only that were true.

More seriously, the figure you provide is mind-blowing. With money comes power. In this case, wholly unaccountable power.

There is no untraceable money – even in tax havens now

I think we are heading for a world where those in banking know about MMT and make decisions based on MMT knowledge but politicians are reluctant to acknowledge it.

We know from experience what can happen with this kind of asymmetric information. Knowledge of the Austrian business cycle made financial investors less willing to invest when interest rates low. Financial markets in the past were far more conservative with their spending than governments.

This time we might be heading for a reversal in attitudes towards spending. Though I find it hard to believe that investors will keep spending while governments are putting the breaks on everyone; simply because it is government policy which regulates the financial system.

Second, politicians of all parties seem to think that shrinking the state is the goal of public life

If we were all equal that might be necessary but we are not equal in brains, health and other attributes. A society like Denmark prefers high taxes and high welfare.

One of the different things about Demarks is it never had the thousand of grand houses such as those in the care of the NT. Maybe that shows how equal Denmark became and is

1. Money is another term for credit

2. Credit is based on Trust

3. Before it is extended the financier has to believe you can pay it back.

4. The UK can afford to extend its credit because it has trillions of net assets, and a future measured in at least hundreds of years. Debts are passed on to future generations. Plus as a last resort it can ask its Central Bank to issue credit to itself.

5. The biggest risks to the UK are in banks or government not investing in long term public assets because it mistakenly has been led to believe it is not more worthwhile to invest in public infrastructure compared to bidding up the price of domestic property in a credit fuelled property boom; or in investing in profitable businesses to keep them more competitive because of the risks involved compared to domestic property. As investment is the biggest driver of competition and productivity the UK has been shooting itself in the foot for generations.

6. The biggest risk to our grandchildren (if we have any) is in not handing over a thriving economy but in handing over a shrunken husk of an economy.

7. Sophisticated markets know this.

8. What they are good at spotting however is the flaws in the story’s government tell their populations that may cause governments to create financial opportunities for speculators. For example the conservative Government in 1992 had made it an issue of credibility that they would shadow the deutschmark in currency markets, when it became obvious this was financially unsustainable.

9. Most recently opportunities for speculators emerged when it became clear that the BOE and the Chancellor of the Exchequer were not talking to one another and had conflicting policies. This enabled sellers to short UK gilts knowing there would be intervention later.

10. Speculators are also looking for governments in crisis. It provides opportunities for asset purchases at bargain prices (nationalised utilities and the NHS) and for an excuse to raise the risk premium on loans provided to governments (even when the government has never defaulted).

11. There are a number of rational ways of going about a high growth, high spending strategy. But it helps if the strategy is agreed amongst the people on the government team, it is credible, and is deliverable. Kwarteng had none of those.

12. The tragedy would be if his clumsiness discouraged any future government of Sunak and/or Starmer rejecting plans for future growth and public investment on the basis of a misunderstanding of sound money economics.

13. A sound economy and economic policies generate sound money not the other way round.

I agree with 5. at Roger above – that’s it in a nutshell, govt in thrall to finance sector – at least Mervyn King got THAT right (his “unlevel playig field” late-2007 “Today” Interview BBC.. And knew about the 30-times property -price multiple “growth” 1976-2006 most of it virtual, commercial-bank created without a sensible charge

Roger’s comment above is spot on: “The biggest risks to the UK are in banks or government not investing in long term public assets because it mistakenly has been led to believe it is not more worthwhile to invest in public infrastructure compared to [allowing] bidding up the price of domestic property in a credit fuelled property boom; [n]or in investing in profitable businesses to keep them more competitive [discount rates, not necessarily gov “borrowing”] because of the risks involved compared to domestic property.”

The First Opportunity is the Eco-Fit thorough enveloping via GreenER Deal ushered in first by interest-only commercial money (charged for at one-third – of fixed 1.5%) – we suggest it could end after 20-years like implied (but not real “cancellation” only from the account) on Bank of England Modern Money explanation. Then [could be extended to the much bigger correction needed] on Free Money (alluded to by Congdon’s August 2022 speech ) from Mortgages. Such a bigger similar step (charging a third) could be towards slowing further-declining LA budgets, but in directed fashion towards the Huge Eco Challenge, education and change of life-styles part of it. the 0.5% off the 1.5% as a first ‘demonstrator’ charge coud be to school liteature on green subjects and real economics.

Another opportunity is to slice global tade to build the barrages (Reliable-Tidal, connected lagoons first) to fill the gap in Solar and in dwell periods ie Windless periods (not from free money) [but] from a charge justifiable on imports resold (Tesco, etc.). A start being employment designing and building Bristol Channel Connection on caissons and renewables by tidal lagoons below. Money no object once the flow is corrected, ring-fenced and accumulated.

Richard, i hope you don’t see this following as irrelevant:

All money worries disappear when you use the bloody stuff instead of let the Trolls free reign that buy and sell shares for profit (see Tim Waterstones “Swimming against the Stream” an excellent treat on basic business) and speculators cream vast amounts away. Why not a slice of the profit to the company as well As Tim W suggests – i.e. Split the Transaction Tax? That would be my point number 3 today. As an accountant/activist, could you agree with that, Richard? PS – you wouldnt want to be PM would you..

My ideas are simpler for now

Mr Greenwood,

It goes unnoticed that considerable infrastructure spend is allowed; but just not spent north of London. HS2 is unaffordable because at least half the total cost is spent, just to connect it to London (because the Conservative nimbies insist it must be underground through their leafy shires), and that half, the first half is already spent in London first. It will proably reach Birmingham, but that is just to turn Brimingham into a London suburb, because the nimbies don’t want houses built either. Then HS2 is effectively abandoned, because it is too expensive to bother; nobody cares; the old saying was – brown shoes north of Watford. There is nothing there for the Conservatives. London already secures 80%+ of investment (the 80/20 rule applies!). There is no advantage to London for anything else; after all, people might realise London’s success is soley at the expense of everyone else.

You need another mega-example? Crossrail 1 and 2 is a spectacular public investment in London, the Red Wall will also never, ever see spent there. Take any single Crossrail new station. Draw a tight circle of a few blocks round the station. You will see an exponential explosion of property values for property owners, gifted by the public sector, to property owners – for doing precisely nothing (one station will produce £1Bn+ property gain in a few weeks). They have just spent £600m+ on a single, gold-plated station; Bond Street. Why do you think? That is why London (outside the square mile) is successful; by shovelling public investment into private asset bubbles. You do not seriously believe the Conservatives are ever going to change it. They have been doing it for decades. It is such a free gift, in case anyone notices, they have used neoliberal ideology that all the money they are making isn’t public money; it is their money. Its a miracle! Public money for doing nothing is now the definition of “hard work” with your own money. Neoliberalism, eh?

Levelling Up is a slogan. It is a political scam, and the proof of that is that the appointment of the Conservative’s ace trickster, the CEO of snakeoil salesmen as the Levelling Up Minister – Michael Gove. now you see it; now you won’t. What the Red Wall will receive is the Trump treatment; give everything the smell of fresh paint; people think something fresh and new has been done. Maybe a few cheap, shoddy, flashy new buildings, some here-today-gone-tomorrow gig jobs; but soon the ‘vacant’ sign will be up on the buildings, and the paint? It will be flaking.

“ The power to control markets exists, as Japan shows”

Please tell us more about what has happened in Japan, or sign post us to an accessible account of what the ( right wing) government has done there

I keep saying I am not expert on this issue

Fair enough but presumably it is something you are interested in and can recommend another source

Not right now, I can’t

So no point trolling on it any more

Thanks for the mention of Stephanie Kelton as I had not taken note of her book. I want to read a book on MMT so that I understand the details and your recommendation is just what was needed.

It seems to me that that there is a serious obstacle to promoting MMT – calling it a ‘theory’. This allows opponents to dismiss it as a fringe, unproven, even bonkers, economic theory, unworthy of serious consideration. As you and Stephanie Kelton have said on many occasions, it is not a ‘theory’ at all: it is simply an accurate, unarguable description of the mechanism of monetary economics. It might help to get MMT into economic and public discourse to remove the problematic word ‘theory’. ‘Modern Monetary Economics’ might be sufficent. Others might find a better alternative. But to continue to be precious about Modern Monetary ‘Theory’ is likely to continue to allow ignorant, often malign economists, politicians and media to perpetuate the current nonsense peddled as fact.

I wish we could rename it….

Of course it is a theory. It is a paradigm case of a theory along with such things as General Relativity Theory, the Theory of Evolution etc. In the scientific literature such things as Newtonian Mechanics, or Thermodynamics are regularly called theories even though they do not have the word in their name.

You say of MMT “it is simply an accurate, unarguable description of the mechanism of monetary economics” but that is precisely what makes it a theory.

I can’t see any reason for changing its name.

happy to discuss further”

The power to control markets exists, as Japan shows”

Is there a financial services tax in Japan?

I am still convinced we need mechanisms, starting national.. Sorry to harp on

(thanks again by the way