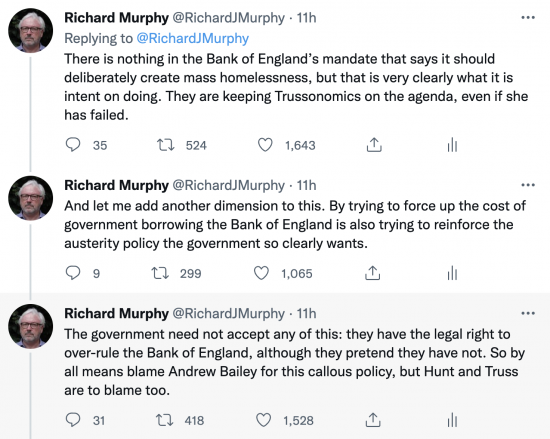

I posted this short thread on Twitter last night:

I hope my anger, disgust and outright fear for the consequences are apparent in what I wrote.

There is class warfare going on in our economy right now. The financial elite is very obviously planning to devastate the well-being of the majority in the UK. I cannot explain this policy in any other way. Why else would quantitative tightening, a policy that can only have the goal of increasing the interest rate, be going on otherwise?

But let's also address that austerity point as well. The government is saying it cannot borrow to pay for pension increases, social care, the MHS or decent education. But apparently, the capacity to sell binds into the market that could fund that does actually exist but is instead to be used to force up interest rates with no social benefits attached.

This is the Bank of England waging economic warfare on this country. I have no other way to describe it.

And worse, the failed Tory party is going to sit by and let this happen.

If Labour says nothing then they too are party to this.

What is happening in UK politics?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It’s not UK politics anymore Richard.

It’s Russian politics circa 1989 onwards, driven by the Chicago Boys.

You’ve got to give the Neo-liberals credit – they are get up and go and take their chances to create their own reality.

They never let a good crisis go to waste.

Remember?

Inflation is ten per cent and bond yields are going up again this morning. The Bank is taking action it pre-announced, and which the mini-budget made essential, surely?

Surely? Why?

The mini budget was a disaster

Why have another one?

You’re of course right that what the Bank has again started to do could end in widespread tragedy.

For as long as the invigilation of inflation and market stability is the job of the Bank, though, it is unsurprising that it is doing what it is doing.

I suppose Gordon Brown thought that the control of inflation was something that could not reliably be left to the politicians. His settlement has given the Bank the pistol it can level at the Chancellor’s head. This can obviously be a bad thing.

The markets are of course uncontrollable though persuadable, and the Bank has been given responsibility for responding in circumstances like these. The markets will be salved, experience has shown, only when orthodoxy has been restored. Having another mini-budget to assert the will of the Government would simply provoke a further response from markets and Bank, would it not?

Ian, you are wrong that the markets are uncontrollable. This is true only in situations where the government chooses to do nothing about them. FDR controlled the markets to a significant extent in the early 1930s. In principle, the government is more powerful than the market. Though probably not this government.

Ian Wood; ” The markets will be salved, experience has shown, only when orthodoxy has been restored. Having another mini-budget to assert the will of the Government would simply provoke a further response from markets and Bank, would it not?”

Now perhaps is a good time to be asking who if anyone elected the markets? What’s the point even in any show of democracy if the real bosses are allowed to be the markets when it demonstrably isn’t necessary? Japan for example, alone among the major powers I believe, is refusing to kowtow to the markets and raise interest rates preferring instead to exercise yield curve control. Their bonds accordingly continue to be in demand, showing this can be done. The Bailey-led BofE, in cahoots with a compliant govt, prefers to condemn the ordinary Briton to destitution. I say in cahoots with govt as no responsible govt would be allowing this. Taking a bad situation and making it far, far worse worse for the average Briton now seems to be govt/BofE policy, deliberately done.

Lamentably, insurrection would seem to be the only rational response.

Hi Bill Kruse

Nobody elects the markets, and nobody can. The markets that affect our daily lives are worldwide. That has produced highly questionable benefits, one of them being the ouster of Kwasi Kwarteng and, as is now being seen, the utter humiliation of Tufton Street. But it obviously provides an unstable basis for governments.

Why don’t we do what the Green Party suggests, and put the UK Government in charge of the printing press and do away with government bonds and retail banks altogether? The Bank of England would remain in charge of interest rates. The Green Party, of which I am a member, is laughed at for its economic policies, which can indeed be laughable – the party doesn’t really think economic matters are of high importance – but I cannot see any reason why we need the present farrago of nonsense involving the ‘extinction’ of debt, the ‘selling’ of bonds, the ‘creation’ of money, and the ‘tightening’ of the money supply, which is what is going to happen (damaging tightening) again shortly.

The mini budget was indeed a disaster both from a moral point of view and an economic one.

Leaving aside the former I am left wondering what would have happened had Kwarteng had simply told the BofE to create any money necessary instead of trying to finance his budget through the sale of bonds. This would have caused inflationary pressure that would eventually have to be dealt with but would it have caused immediate economic collapse?

No

I feared this would be the endgame with the BoE govnr’s record and what he has said in the past. The U.K. now is being demanded austerity from the markets & he is happy to oblige.

They will do anything rather than tax the rich. Which is what should have been done to fund furlough. I mean the money would have got bwck to them anyway. Instead it was a bonanza for the rich.

Titus.

Hi Richard

I am pretty sure you have covered this before, but could you explain simply for a slow learner what is actually going on. I get the disquiet but not sure of cause and effect.

If I get time

It is in short supply..

I appreciate that you must have been extremely busy today, and enjoyed your stint on Scotonomics. 😉

I am not sure that I follow why it must be that the QT will result in interest rate rises?

Could it not be that Andrew Bailey might think or at least say that a rationale

for selling these pre-existing Financial Assets into ‘the markets’ (mostly Banks and Pension Funds, IIUC) is a way to ‘remove excess cash from markets’ or to ‘withdraw excess cash from the economy’ INSTEAD of raising bank base rates, which he must know that the Debt Burdened real economy can hardly sustain, and in the absence of any possibility of the Government doing it via fiscal policy of taxing cash rich businesses or wealthy business owners.

After all people are not always evil, stupid or Machiavellian, sometimes they just have rational-to-them belief systems.

Is that too simplistic a take?

QT increases government demand fur money so markets charge more

It really is that simple, they think

I read that this was still going ahead – and that the BoE had delayed the sale’s start by a day.

The latter is a pretty clear indicator that the BoE is intending to use the threat of the sale on the next day to make sure the new Riechskanzler, aka Hunt (trussed up for markets), slashes and burns to such effect that predators and markets along with the BoE are, for the moment, satisfied.

IF Bailey knows what he is doing – which never looks or sounds likely – I think he may be guilty of what appears to be the most vicious attack on living standards since records began.

This is simply appalling.

[…] The Bank of England has declared economic war on the people of the UK Richard Murphy […]

The Bank of England is doing what it is designed to do as an aristocratic institution inimical to the interests of working people. That the Tories are complicit should come as no surprise.

Why should there be an ‘aftermarket’ for government debt? It simply allows speculators to make money out of movement of guilt prices. Government debt should not be an asset which can be sold on. What objections would there be to this Richard?

You remove the necessary underpinning of the pension market in that case

So, how would you reform pensions?

[…] For instance, Richard Murphy has repeatedly called for its Governor, Andrew Bailey, to be dismissed, which the Government could do at any time. Some detail from an October 19 post: […]