I heard Liz Truss say to Laura Kuenssberg that she wanted a simpler UK tax system this morning. I immediately tweeted this:

Then I noticed that Simon Clarke, her Levelling Up Secretary had tweeted:

Clarke confirmed what I thought: there is a flat tax agenda amongst the Tories who are now (supposedly) running the UK.

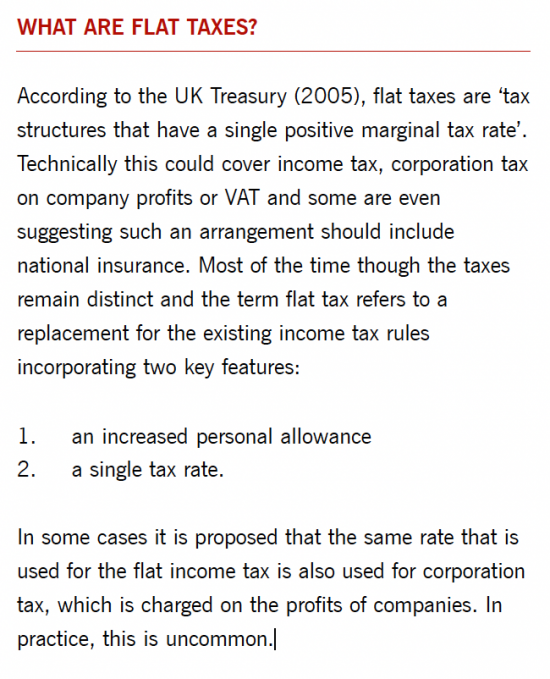

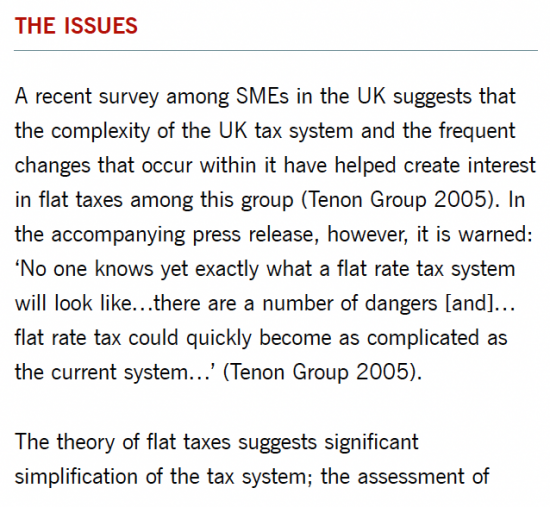

I last write in-depth about the dangers of flat taxes in 2006, when commissioned to do so by the Association of Chartered Certified Accountants - the ACCA. That paper is here. In it I said that flat taxes were:

I concluded:

I was trying to be objective back in those days, reflecting the wishes of those sponsoring my work.

I unpacked my arguments in a separate blogpost, which was one of the first I ever wrote for this site. In it I said:

The report was paid for by ACCA research funds and as such had to meet strict, objective academic research standards, including (as is essential for a professional institute) a neutral approach. But this article is not subject to those constraints, and I can therefore be more straightforward about what the evidence I uncovered when writing the report reveals.

The first conclusion I reached was that there are no "flat tax states". Those countries that claim this title in Eastern Europe have tax systems that are nothing like the flat tax model as laid out by Alvin Rabushka and Steve Forbes in the USA, who are the main political promoters of this idea. At best they have single rate income tax, capital gains tax and corporation tax systems with all the resulting complexity that flow from retention of such structures. In fact, Russia, Lithuania and Serbia even manage multiple rates of income tax, which somewhat negates the claim to have flat tax systems.

Secondly, the tax systems that these states operate are not simple. They all retain complex rules for calculating income, the treatment of capital allowances and the consideration of capital gains. They also have a wide variety of allowances and reliefs available for ordinary citizens to claim against their personal income including, in most cases, relief for pensions, mortgage interest, education costs, home to work travel, union and other dues, charitable contributions and so on, and on (in some cases).

Next, these systems do not appear to reduce the administrative burden on the tax payer, as is claimed. In Estonia 84% of adults submit a tax return each year; in the UK it's 16%. And in the same country details of benefits in kind supplied by an employer to their employees have to be made monthly, which makes the annual P11D routine in the UK seem like a positive panacea in comparison.

These departures from the myth that is promoted around flat taxes might have been acceptable if the claims for their economic performance had been shown to have any support. Unfortunately that was not the case either. It is widely claimed that tax revenues increase when flat taxes are introduced. No evidence was found to support this claim. Income tax revenues fell in countries introducing flat taxes if other obvious factors (such as Russia's oil boom, the creation of which can hardly be attributed to a tax change) are taken into account. Indeed, if tax revenues did increase it was almost entirely of VAT and NIC, as was he case for example in Slovakia and Romania, where income tax revenues fell.

Nor can this increase in indirect tax be attributed to economic growth resulting from the adoption of a flat tax. Indeed, the Estonian Ministry of Finance specifically warned against making an assumption that this was possible. Their spokesman when interviewed for the report said of flat tax "it's a tax; it's not a medicine for the economy."

And the IMF and Institute for Fiscal Studies did not find the rich in Russia were more tax compliant after the introduction of a flat tax, as its proponents claim they should have been. But curiously though those on low pay who actually saw flat taxes increase their tax burden in that country were more tax compliant, counter intuitively to the claims of those who propose such taxes.

Finally, although the UK's leading exponent of flat taxes, Richard Teather of Bournemouth University claimed that his proposals for a flat for the UK would not help the rich in the UK and would only benefit the less off, my work showed that the data he used when coupled with HMRC data could not support that view. In fact, those earning less than £22,000 might save an average of about £200 a year (before NIC changes, which are likely to increase their bills based on the precedent of other flat tax states), those between about £22,000 and £74,000 would see their tax bills rise by up to £2,000 whilst those earning over £74,000 might see their tax bills reduce by over £7,000 an average. This is a clear indication that this system will favour the rich, as all other surveys in the UK and the range of data I reviewed for other countries also showed to be true.

So, the evidence failed to support any of the claims made by the flat tax lobby. In which case I have, outside the framework of the report considered what that lobby want. I conclude that they wish to promote these four things:

1. Reduced taxes for the rich

2. Increased taxes for working people

3. Reduced tax on companies

4. Reducing the role of government.As some indication of this two quotes from Alvin Rabushka, the man who invented flat tax are illuminating. Both come from the interview with me for this research, which he consented to be published. About the redistributional effects he said:

"The only thing that really matters in your country is those 5% of the people who create the jobs that the other 95% do. The truth of the matter is a poor person never gave anyone a job, and a poor person never created a company and a poor person never built a business and an ordinary working class guy never drove economic growth and expansion and it's the top 5% to 10% who generate the growth for the other 90% who pay the taxes to support the 40% in government. So if you don't feed them [i.e. the 5%] and nurture them and care for them at the end of the day over the long run you've got all these other people who have no aspiration for anything more than, you know, having a house and a car and going to the pub. It seems to me that's not the way you want to run a country in the long run so I think that if the price is some readjustment and maybe some people in the middle in the short run pay a little more those people are going to find their children and their grandchildren will be much better off in the long run. The distributional issue is the one everyone worries about but I think it becomes the tail that wags the whole tax reform and economic dog. If all you're going to do is worry about overnight winners and losers in a static view of life you're going to consign yourself to a slow stagnation."

I think that pretty much supports my first two claims, and since the third is part of the same metric, it's covered by the same evidence.

As for the role of government he said:

"I think we should go back to first principles and causes and ask what government should be doing and the answer is "not a whole lot". It certainly does way too much and we could certainly get rid of a lot of it. We shouldn't give people free money. You know, we should get rid of welfare programmes, we need to have purely private pensions and get rid of state sponsored pensions. We need private schools and private hospitals and private roads and private mail delivery and private transportation and private everything else. You know government shouldn't be doing any of that stuff. And if it didn't do any of that stuff it wouldn't need all of that tax money so that's the fundamental position and as long as you're going to have government do all that stuff you're going to have all those high taxes."

As he also made clear, that then let's you have a flat tax. But in that case what I wrote for the Guardian last year is true:

"Flat tax is not a serious attempt at taxation, but is instead an exercise in social engineering. That is why its innocent appeal is so dangerous."

That 'social engineering' process is designed, as Rabushka himself say, to 'take the tax code out of the economy'. In other words, it leaves people wholly dependent upon market forces. The consequence happens to be that politics is neutered on the way because as anyone who follows general elections knows, at the end of the day politics is about the economy. Rabushka and the right wing want to stop that. And if you don't believe me, John Meadowcroft who writes for the Institute of Economic Affairs, a think tank Margaret Thatcher still supports, said recently when asked if he thought democracy a 'market institution' (when undertaking an interview on www.transformingbusiness.net) that :

"Democracies and free societies tend to go hand in hand. Having said that, democracy tends to lead to socialist policies, such as protectionism. If democracy leads to property rights and the rule of law, then yes, you need democracy. But otherwise, democracy is not a prerequisite for a market economy. Democracies tend to create very large states. In most European countries, including the UK, nearly half of GDP goes to the state. This is not good for the creation of free markets."It seems fair to conclude that some in the mainstream the right wing now think democracy can be sacrificed to the market, and I believe that flat tax is part of that process. Which leads to the conclusion that two writers (Hettich and Winer) have put forward that:

"it is possible to have a flat tax, or to have democracy, but not both"

I agree with that. Nothing has made me change my mind since 2006.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Did you notice she couldn’t say Bank of England without preceding it with ‘independent’? A precursor to apportioning blame?

Of course

“these other people who have no aspiration for anything more than, you know, having a house and a car and going to the pub.” Rabushka

He has a very limited idea of aspiration, restricted to running a business for oneself or an employer.

I counselled a number of people whose mental health was being affected by poor management direction and it was their efforts that made things work in the real world.

There are qualitative aspirations, for example, people who run charities which make life better for people. I have volunteered for a few of those. There are those who try to preserve wild life and nature. Those who run Scouts and Guides, sing in choirs or volunteer for the RNLI.

There are those who campaign for a better deal for minorities or seek to confront injustice.

All contribute to society. As someone ! one said, ‘man does not live by bread alone’.

Agreed

So the writer concludes that, ‘in the long run’, unless a person is numbered in the 5%, they have no aspiration to anything more than a car and a job and going to the pub? This is an individual with a cognitive impairment. He cannot see beyond categories; the categories are put in a hierarchy, and connected by a series of simple, but layered, mathematical formulae. This thinking runs through the entire argument. There are no shades of grey and no space for multiplicities, or complex reciprocal interaction, or any kind of feedback process. The process is purely linear and reductive.

People who think in this way are often accused of inhumanity or lack of empathy. It’s more basic than that – it’s the lack of the cognitive ability to process complexity. The outcomes are simple, formulaic, serial reductive processes, projected into a complex world in the register of a black-and-white moral code.

I suspect Ms Truss is the same. The hallmarks are all there.

They would feel very comfortable with each other

As well as reminding me of the quality of reflection and challenge you have been putting out there for years, this post needs to go on Twitter in some way now given how you’ve been using that platform.

Reproducing the so called ‘arguments’ of people like Alvin Rabushka reminds me – and indeed should remind all of us – that their musings are nothing but PERVERSIONS of what we actually know about the emergence and creation of political order and control in human society – including money.

It’s so one sided. He says nothing about what those who benefit from flat taxes ‘tend to do’ as well (steal other people’s wealth with their wealth through markets; use their wealth in politics so that government benefits them etc., etc.). Buchanan was the same – only government departments wanted to increase their budgets and status – not business units or corporations. Complete tosh.

As for John Meadowcroft (what a nice, credible English name for such a tosspot), all he is doing is following the lineage of Carl Schmitt via von Hayek (Mirowski, 2013, pp. 83-88) and Milton Friedmann too – both saw democracy as ‘inconvenient’ to Schmitt’s definition of ‘the sovereign’.

Hayek and Freidman were Fascists and that is a fact, and flat taxes are a populist fascist ruse pretending to make things look fairer to hard pressed and easily won over electorates.

The link is out there today

Groovy – with thanks.

Well that is pretty depressing reading and gives a pretty good insight into the Government’s modus operandi… Singapore on Thames here we come!!

Not directly related, but this incredible & terrifying statement supposedly by the Tory party chair (as reported just now on the Guardian politics live blogs) seems to sum up this dire ‘government’:

“When fuel bills arrive, people can cut consumption or get better job, Tory chair Jake Berry says.

In his interview with Sophy Ridge this morning on Sky, Jake Berry, the Conservative party chair, also said that, if people were having difficulty paying their fuel bills, they could either cut their consumption or get a better job. He was making a point about the need for the government to economise, and he said that was how households worked too. He said:

People know that when their bills arrive, they can either cut their consumption or they can get a higher salary, higher wages, go out there and get that new job.”

Words fail me.

I heard this in a clip that BBC Radio 4 included in its 1pm news, but it demonstrates Truss’s ineptness: She conceded only that ” the presentation (of the “fiscal event”) could have been better.” It wasn’t the presentation that spooked everyone it was the bleeding content. UK appears daily more and more like a rudderless ship crewed by headless chickens.

Agreed

As incompetent as all of this looks, it is in essence the ‘shock doctrine’ in action.

We are about to have something similar perhaps to that which was foisted on post Soviet Russia in the 1990’s – courtesy of a right wing think tank or two.

Forgive this off-thread comment, but this morning, on Sophie Ridge on Sky; Jake Berry MP, Minister without Portfolio was challenged on the Truss claim that public spend could be protected by making “efficiency Savings”: what were the efficieny savings. Berry made reference to the Covid ‘Bounce Back Loan Scheme’ (BBLS), which had total loans drawn of £46.6Bn.

Here is what happened with that scheme (a badly constructed and executed Conservative Government scheme), according to the Department of Business, Energy and & Industrial Strategy (DBE&I):

“It is unfortunate that some have taken the decision to take advantage of this vital intervention by defrauding the scheme for their own financial gain. The government has always been clear that anyone who sought to do so is at risk of prosecution.

Checks were put in place from the outset to reduce the risk of fraudulent applications being successful. Lenders are the first line of defence, and were required to make or maintain know-your-customer and anti-money laundering checks and use a reputable fraud bureau to screen applicants against potential or known fraudsters. Lenders reported preventing over £2.2 billion worth of fraudulent applications as a result of these checks.

The government remains focused on working with the Bank, lenders and law enforcement agencies to tackle fraud in the scheme.” (https://www.gov.uk/government/publications/covid-19-loan-guarantee-schemes-repayment-data/bounce-back-loan-scheme-performance-data-as-at-31-july-2022).

The efficiency savings, it appears will come from clawing back the unpaid or fraudulent BBLS. I will pass over the fact that this clawback has been ongoing for a long time. Indeed the data published on the DBE&I website is dated 31st July, 2022, so there is nothing new about this. Let us look at how the BBLS clawback is progressing:

“£28.3 billion: the Outstanding Balance of total Drawn loans making payments on schedule

£4.7 billion: the amount that has been Fully repaid by borrowers

£3.2 billion: the Outstanding Balance of loans in Arrears that haven’t yet progressed to Defaulted

£1.4 billion: the Outstanding Balance of loans Defaulted that haven’t yet progressed to Claimed

£2.6 billion: the Outstanding Balance of loans Claimed that haven’t yet progressed to Settled

£1.2 billion: the total Settled amount (the amount paid out to lenders under the BBLS Guarantee Agreement)

£1.1 billion: the total Drawn value flagged by lenders as suspected fraud”

(Deconstruct that Gordian knot, if you can – or go to the DBE&I on BBLS website if you wish to acquire a headache and sense of hopelessness).

This comment is not intended as a critical analysis of the state of play of the BBLS (but the data raises more questions than answers, and should be receiving more attention). Does Berry not even think that anyone will inspect the facts behind his extravagantly improbable claims?

The BBLS was a dreadful mess that was created and botched by the Government – as only they can. It was ineffectively managed, because neoliberal Conservatives never invest the required resources in the management, control, regulation or audit of its own expenditure; presumably because that is done in the Public Sector, and adequate investigation expose their folly and irresponsibility to critical scrutiny. They make this mistake endlessly; then follw up the fatal consequences with fatuous, glib, superficial politicians like Berry attempting turn reality upside down, and brazenly take credit for making feeble and failing (under-resourced) attempts to correct the abject blunders of their own Government.

This Government isn’t funny, but it is a contuning, long running Whitehall farce.

It’s not the 5 to 10% who generate the wealth, its the 90 to 95% who buy the stuff.

It is a trivial analysis that completely overlooks the education system that produces people who are able to do the jobs required by the successful entrepreneur, health systems that enable workers to keep working for the entrepreneur despite disabilities and accidents and illnesses, public infrastructure of roads and water and electricity that enables the entrepreneur to bring in raw materials and deliver products, legal and justice systems that enable the entrepreneur to make contracts with third parties confident that they can be enforced and that deters people from stealing their goods. It also overlooks most people’s need and desire to support the old, the young, the disabled, and others, in their families and communities, and the (non-monetary) value of art and literature and everything else that makes life worthwhile. In short, it overlooks the contribution of society to their fortune. All of this is not red tape holding them back – it is the glue that holds us together.

Thank you for re-publishing this, since as someone who discovered your blog a very long time after 2006 I had speculated about how a flat tax would work. Just because it would make it very easy to align tax rates across a range of possible income/wealth sources.

It is helpful to know that it could work, but only in the sort of economy that works against the values of any society that could be considered civilised. So income tax needs to be progessive, and any attempts at alignment of other taxes need to match that somehow.

it’s a flat tax until they start introducing loads of reliefs and exemptions for the wealthy, then it starts to look extremely regressive (that is ignoring the fact that flat taxes are a misnomer as they are inherently regressive to begin with).