I am pleased to report that the Global Initiative for Financial Transparency has approved its new Principles for Tax Transparency. In itself, I think this is important, but I also admit to bias as these Principles have been co-authored by my University of Sheffield colleague, Professor Andrew Baker, and me.

The result of five years work, the final document is of just twenty or so pages, but it is supported by the work Andrew and I did in writing Making Tax Work, which was published in 2020. That report still provides the background for these principles.

The Global Initiative for Financial Transparency is an organisation whoseGIFT General Stewards include the IMF, the World Bank, the International Budget Partnership, the Organisation for Economic Cooperation and Development, and expert tax civil society such as INESC (Brazil), ACIJ (Argentina), CIEP (Mexico), ICEFI, Fundar (Mexico), PSAM (South Africa), Social Watch (Benin), Observatorio Fiscal (Chile), Open Contracting Partnership , and others.

The Principles have been subject to extensive review over the past couple of years and comments from many of the above organisations have helped shape them as have those from Institute of Public Finance (Croatia), ICEFI (Central America), national authorities, a number of civil society partners.

The Principles come at a timely moment to fill up a gap in the global architecture of fiscal transparency rules. The new set of global Principles establishes standards for transparency, participation, and accountability of domestic tax systems. The Principles aim to provide a robust but flexible reference point for policymakers and stakeholders to develop their own frameworks for taxation. As such, they could help promote an informed public debate on tax reforms to help tax systems to raise needed revenues more equitably and efficiently.

The introduction to the Principles says:

The Transparency Principles for Tax Policy and Administration contained in this document are intended to help policymakers and a range of civil society stakeholders evaluate and improve the legal, regulatory, and institutional frameworks that comprise national tax systems. A number of pathways and information requirements are set out in the document, which are intended to inform multi-stakeholder evaluations of tax system performance and enhance policy dialogue between governments, civil society and international organizations.

The Principles are intended to be concise, understandable and accessible to a range of interested stakeholders. They provide a basis for assessing the extent to which a given jurisdiction meets each principle, for assessing and improving tax system performance in terms of stated objectives, and how transparency could be enhanced in a jurisdiction by more fully implementing The Principles. The Principles should act as a focal point benchmark for informing discussions about tax system performance and transparency within national jurisdictions and with the international community. The Principles have been written at a sufficient level of generality to enable them to be applied in ways that are sensitive to and take into account country-specific economic, legal, and cultural differences.

The Principles do not aim at detailed prescriptions for national legislation. Rather, they seek to identify objectives and suggest various means for achieving those objectives. The Principles aim to provide a robust but flexible reference point for policy makers and stakeholders to develop their own frameworks for taxation. The Principles should be evolutionary in nature and be reviewed periodically in light of significant changes in circumstances in order to maintain their usefulness as an instrument for policy making in the area of taxation.

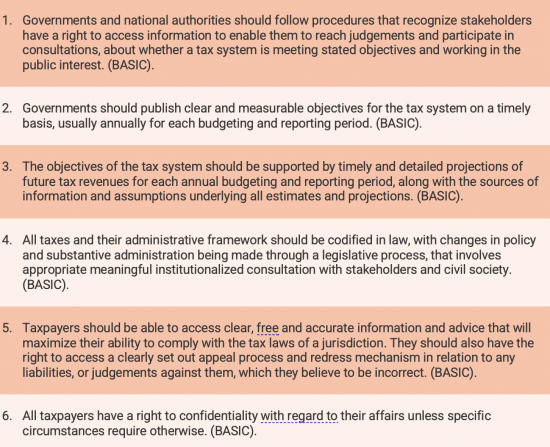

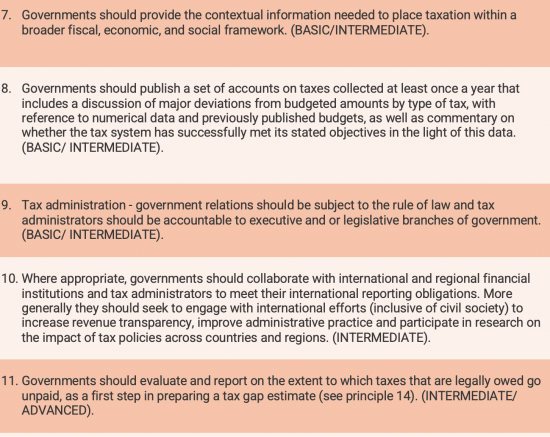

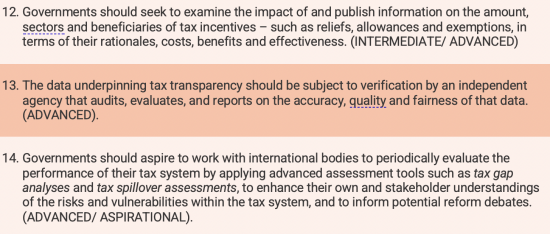

As to the Principles, there are fourteen of them, structured so that they move from basic requirements, through to intermediate and advanced programmes to those that are aspirational. Deliberately written to indicate the scope of the information need that must be addressed, the intention has been to leave as much local room for discretion in the delivery process as possible, recognising that there is no one delivery method that will ever suit all needs. Those principles are:

One of the quite deliberate purposes of this exercise as far as I am concerned has been to seek to alter the focus of tax justice discussion away from that which it has had for nearly twenty years now. The focus on private sector abuse, with particular attention being given to that of large corporations and those wealthy people using tax havens, has been appropriate and will require continuing attention, but cannot now be the sole focus of tax justice debate when so much progress has been made in securing legal frameworks that should, at least in principle, help these issues be addressed.

Instead, we and GIFT have felt it appropriate to look at how government itself works when it comes to tax justice. That reflects our belief that unless strong, enforced, accountable tax systems are put in place then many countries will never achieve the economic independence or economic stability that they rightly deserve. Our focus here is on accountability because we believe taxpayer willingness to comply with demands made of them are critically dependent upon achieving this goal.

In my opinion, these Principles are the biggest innovation in tax justice since John Christensen and I wrote ‘Tax us if you can' in 2005. That publication set out the tax haven and secrecy focussed agenda , underpinned by country-by-country reporting, automatic information exchange from tax havens and corporate beneficial ownership disclosure, that has dominated tax justice reform since then, including at the OECD. What we have now deliberately added (still working with John, who has acted as an adviser to this project) is a critical new dimension on which campaigning can take place with at least two tool kits being available to appraise outcomes. One of those is to appraise outcomes against the Principles, and the other is tax spillover analysis.

It is our belief that these toolkits (and we hope to work to formalise the first, fairly soon) can help international organisations such as the OECD, IMF and World bank appraise the effectiveness of the tax systems of the countries that they assist, with the aim of improving the accountability of those systems, enhancing tax morale and so the willingness of taxpayers to settle the tax liabilities that they owe, and to enhance the macroeconomic management of economies, in which tax is a key component.

In turn the Principles and the toolkits can also assist governments, other politicians and civil society in appraising the effectiveness of domestic tax systems, and so encourage their improvement, which we think vital for all countries since none reaches the standard we suggest to be aspirational as yet.

It has taken some time to get here. I think the effort has been worth it. But now the need is to take this issue forward here in the UK and, we hope, around the world. That is our next objective, because the world is in desperate need of better, more accountable, tax systems. Comments and suggestions on how to do this would be welcome.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

hi I just wanted to say How about getting taxes at point of sale

and recommend triodos bank as they show you what they invest in.

VAT is a tax at the point of sale

And I admit I have always found Triodos hard to deal with

Perhaps I should look again

This will be a big help when evaluating tax systems. I particularly like no 12. Whilst Claiming to have excellent reporting policy in place, there are two areas where the Irish reporting system falls down:

1. The lack of any data on employer contributions to pensions – a tax avoidance option of unknown usage or cost

2. Most data is provided on a “tax case” basis, not on individual taxpayer basis, due to joint assessment returns made by many couples. This shouldn’t preclude individual taxpayer analysis, but that’s the excuse given.

Thanks

Ireland would be a very good case study

Congratulations. Complete tyro myself, but these look sensible and robust.

Thanks