The ONS has published a report on the cost of living crisis this morning. They say:

- Around 9 in 10 (87%) adults reported an increase in their cost of living over the previous month in March 2022 (16 to 27 March 2022), an increase of 25 percentage points compared with around 6 in 10 (62%) adults in November 2021 (3 to 14 November 2021).

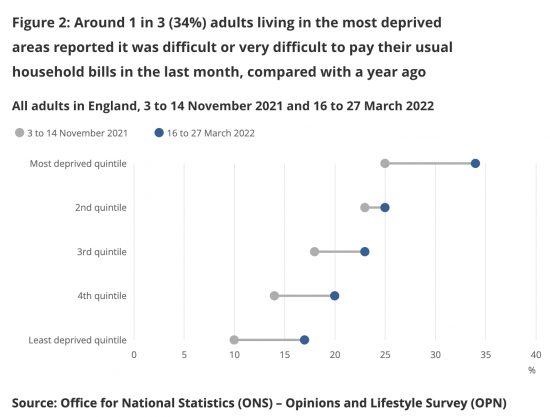

- Nearly a quarter (23%) of adults reported that it was very difficult or difficult to pay their usual household bills in the last month, compared with a year ago, in March 2022 (16 to 27 March 2022); an increase from 17% in November 2021 (3 to 14 November 2021).

- Focusing on the latest period, among those who pay energy bills, around 4 in 10 (43%) reported that it was very or somewhat difficult to afford their energy bills in March 2022 (16 to 27 March 2022).

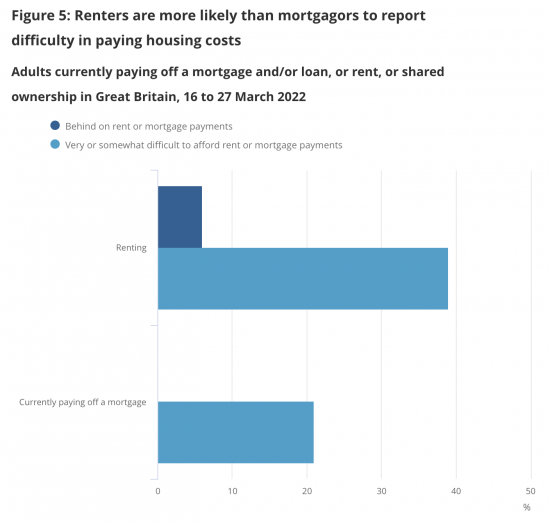

- Of adults currently paying off a mortgage and/or loan, or rent, or shared ownership, 30% reported that it was very or somewhat difficult to afford housing costs, and 3% claimed to be behind on rent or mortgage payments, in March 2022 (16 to 27 March 2022).

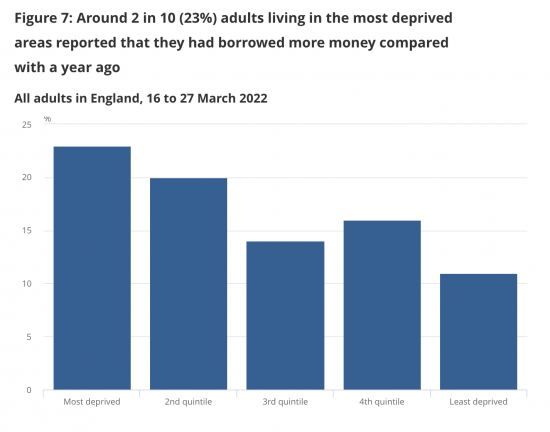

- Among all adults, 17% reported borrowing more money or using more credit than they did a year ago, in March 2022 (16 to 27 March 2022).

- Among all adults, 43% reported that they would not be able to save money in the next 12 months, in March 2022 (16 to 27 March 2022); this is the highest this percentage has been since this question was first asked in March 2020 (27 March to 6 April 2020).

This finding was unsurprising:

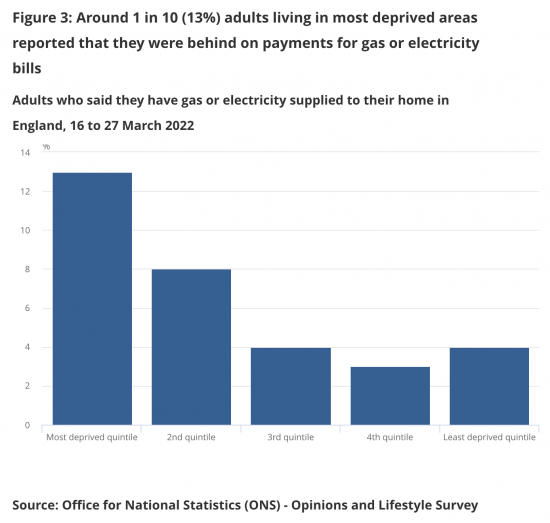

As was this:

The stress of this crisis is already beginning to tell, and quite unevenly.

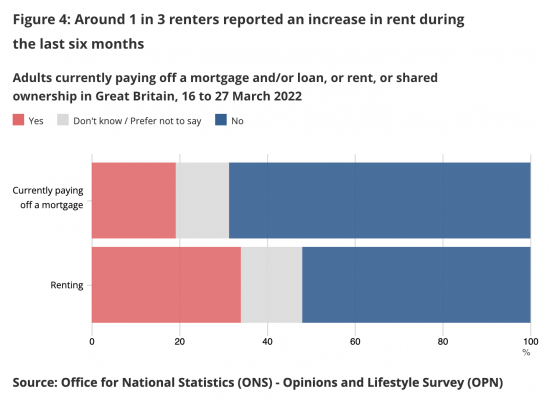

It impacts other costs as well:

The risk of people losing their homes is, as I have kept saying, high.

So too is the chance that we will have a debt crisis growing:

People are borrowing more. But will they be able to repay?

This is a profoundly worrying review. And remember two things.

First, the Treasury made this worse by increasing taxes.

Second, the Bank of England is making this worse by increasing interest rates.

You cannot make up callousness like that in the face of a crisis of this magnitude.

We urgently need an alternative economic policy. Danny Blanchflower and I have offered on.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

With disease and war on our doorstep it is not surprising that things are grim. Economic policy cannot do much about either of them… but it should respond to them.

Fundamentally, the issue is solidarity – do we have it? If we do, your (and Danny’s) policy prescription makes sense… but do we have it?

Clearly, the Tories do not. Labour, historically, does – but it is hardly “front and centre” of their economic policy at the moment. What does that say about us as a nation? I shudder to think.

I wish I knew where Labour was on this….

If it does not speak up now when will it?

It reminds to to some extent of 1997 when Labour campaigned on very similar policies to the Tories (even down to limiting spending commitments to Tory levels in the first couple of years). It worked – in that Labour was elected… but they would have been elected in ANY case at that point. To be fair, Blair/Brown did move later…. but there still remains a “what if” they had campaigned on a more radical policy platform.

Is Keir Starmer following the Blair/Brown 1997 playbook? Will it get him elected? Will he then change tack once in power?

It might be a good strategy but a lot could go wrong!

I wish Labour would give me a reason to vote for them other than just to get rid of the Tory incumbent. Our voting system means that, for our MP, if you don’t want a Tory you have to vote Labour.

Craig

I wish I knew what Labours intentions were.

There seems to be a vacuum where that information should be. This might be strategic, but the what-do-Labour-stand-for problem is widespread.

Two things I long for are PR, and in the meanwhile, a rainbow coalition (of almost any description) between Labour and other viable parties. It’s absurd to think that with the latter, the Tories would have lost every GE since about 1950.

Since that seems unlikely, “Getting rid of the Tories” is sufficient reason to tactically vote for ANY alternative IMO.

Remembering that 1997 was really a protest vote, a vote against the Tories.. cemented by the legacy of the legendary PM who never was, John Smith.

At least in Scotland we do have a choice Craig. Take your pick from four political parties who are all campaigning for an independent Scotland.

Labour is a policy vacuum. Sad. In local meetings I keep raising questions such as:

Social housing?

Local government powers?

Universal credit levels?

Pensions?

Education?

Business development?

Training?

EU relationships?

Green policy?

Answer comes there none, apart from management babble, in which I am an expert.

The answer to all these is the same:

“The important thing is to ensure that going forward we put in place the robust processes that deliver the services that people rightly expect to be of the highest quality and that is why we have taken steps to ensure that our policies are, at the end of the day, responsive to the needs on the ground.”

Phew! Am I glad we paid off our mortgage last year!

This is awful.

But if I look at this through the lens of a Fascist, all I see is opportunity.

That’s what worries me also.

I’ve just seen an article in the Guardian by Nouriel Roubini on stagflation and it sounds doom laden. However, I believe what he is forgetting is that tightening fiscal policy on income from wealth and on high earners, while investing in energy efficiency, walking, cycling, PT and renewables, will surely help mitigate supply shocks. Ditto energy quotas (whether tradable or not). Link here:

https://www.theguardian.com/business/2021/jul/02/1970s-stagflation-2008-debt-crisis-global-economy?CMP=Share_AndroidApp_Other

I do not agree with him

This is very different, IMO

He hasn’t been known as Dr Doom for nothing.