As I have already mentioned on this blog, Danny Blanchflower and I have been working together on our vision for the economic policy that the UK needs at present. The following post is by the two of us, and sets out our basis for concern:

We are worried. Today it's been reported that UK retail sales are collapsing and consumer confidence plummeted just as we had expected. The bottom is nowhere in sight.

This suggests to us that the UK is probably headed to – and may already be in recession: this now seems almost certain, driven by tax increases and spending cuts and rate rises by the Bank of England, who we should recall also missed the Great Recession in 2008. Six months after recession started in April 2008 the majority of those at the Bank had no idea about this and just as now were talking about raising rates. Then they had to cut them as inflation plummeted. It is difficult to identify turning points but there are many indicators to watch that are all now flashing red. We are at risk of history repeating itself.

In this post we set out our concerns. When doing so we have, inevitably, had to appraise both the real-world data on what is happening, and the explanations for current policy that are being supplied, most especially by the Bank of England when the Treasury has little meaningful to say to justify its own inaction. This post brings some of that thinking together. It is not policy focussed: that is for another article. The intention is to look at the issues that cause us concern.

In this post we essentially argue three things. The first is that consumer sentiment in the UK suggests that the economy is collapsing. As Danny has shown in his research, this is the most reliable indicator yet found of an oncoming recession.

Second, we argue that interest rate increases are the wrong response to this crisis, offering a number of reasons.

Third we suggest that the Bank of England has also misunderstood the current inflation and is applying its mandate without consideration of the social consequences of doing so.

The analysis offered is not academic: if it were we would use a considerably wider range of sources. The conclusions would, however, be the same. It would just be harder to read.

Danny coined the phrase ‘the economics of walking about', which was the title of a speech he gave when a member of the Bank of England Monetary Policy Committee in 2007. The idea is quite simple and was used by Danny to forecast the 2008 crisis, which the rest of the Bank missed, entirely, but which Richard also forecast using not dissimilar approaches.

As Danny's work has shown, people's sentiments are the best indicator of future levels of economic activity that we have. Asking people what they expect to happen is the best way of finding out what will happen. The sentiment of people you might meet ‘walking about' is simply more reliable than the data and modelling produced by most professional economists in forecasting the future.

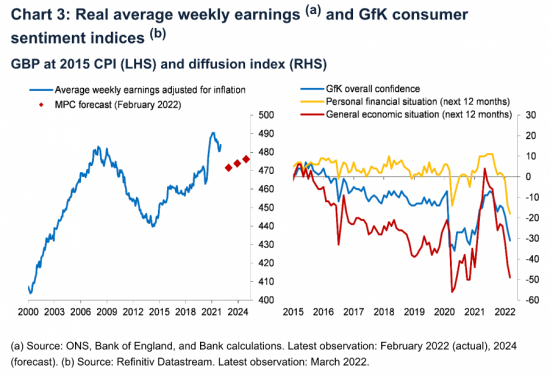

The evidence that people think that there is going to be a recession in the UK (with similar findings being found in other countries) is overwhelming. We note this data in a speech published by Catherine Mann, a Citi bank economist who sits on the Bank of England Monetary Policy Committee this week:

The right-hand chart is the more telling at this moment: the left is one to return to. Interestingly Dr Mann seems to believe that this data is irrelevant and it was time to raise rates at the Bank of England's next meeting in May, and this despite that chart showing that the Bank of England were aware of plummeting consumer sentiment when making their last decision to increase interest rates.

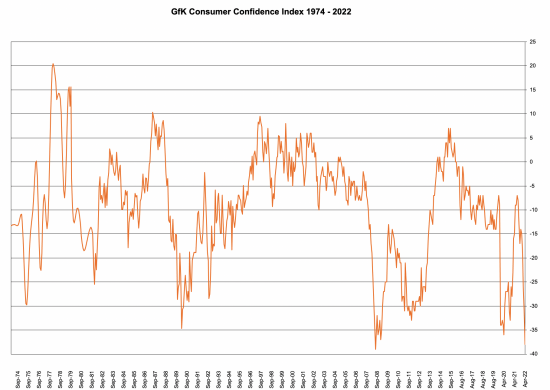

We now know that matters have got much worse. The latest Refinitiv GfK data is now available, having been published today, and shows this:

Consumer confidence has collapsed.

The troughs are in 1975 (inflation crisis as a result of oil price crisis), 1981 (Thatcher crisis, destroying the economy), 1990 (ERM crisis), 2008, Covid and now. The current situation is just about as bad as it gets. On every occasion, consumers knew how bad things were. They do now, we suggest, and matters can only get worse this time. We are moving into uncharted territory. It is our simple suggestion that with things this bad conventional economic thinking is way out of its depth and alternative approaches are required.

We also know that business confidence is collapsing as well. The S&P / Chartered Institute of Supply and Procurement indices for April 2022 show that April data indicated a much weaker speed of recovery across the UK economy, largely due to the slowest rise in new orders so far in 2022. Survey respondents mainly noted that the cost of living crisis and economic uncertainty arising from the war in Ukraine had impacted client demand.

Despite this the only policy response we are seeing to this crisis is coming from the Bank of England, The Treasury recently stood aside and, apart from increasing taxes wholly inappropriately did almost nothing in the Spring Statement. The Bank has now increased interest rates twice. They now stand at 0.75%. Some in financial markets think it is the Bank's aspiration to raise them again, to maybe 1% in May, and that the target is 2.5% by next year. We completely disagree with this policy, for three reasons.

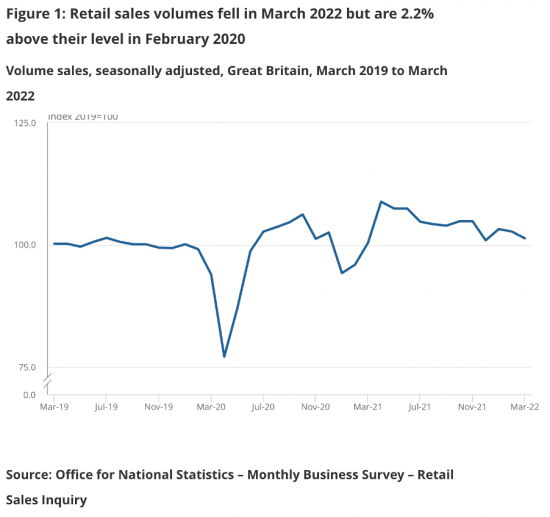

First of all, a policy of increasing interest rates to reduce prices only works to tackle inflation created by excess demand for goods driven by excess incomes within the economy. There is no such excess demand within the economy. This is the chart of retail sales in the UK issued by the Office for National Statistics today:

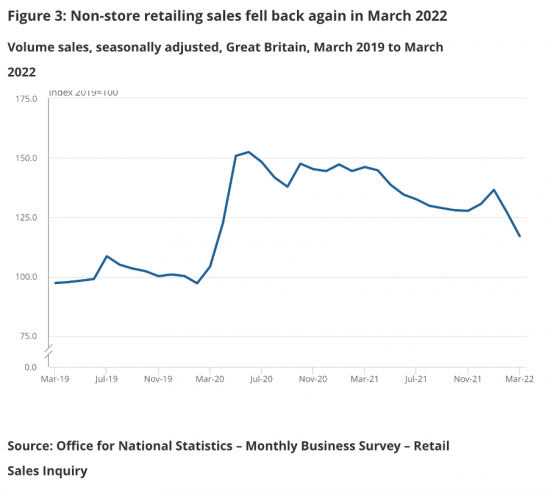

Perhaps as worrying is the chart for online spending, which is likely to better reflect discretionary spending:

Retail sales are already falling, and that is before energy price increases. There is an overall shortage of demand in the economy. Families are now widely expected to be facing a cost-of-living crisis and millions are expected to go into poverty. Despite that the Bank wants to reduce demand still further by crushing the household incomes of those who borrow (who are by definition usually amongst the least well off) still further by increasing interest rates. This can only make matters worse, not least because of the wholly inappropriate social consequences that flow from it. In our opinion rates need to be at or near zero again, and most likely strongly negative. Forcing them upwards makes no sense. The MPC should be cutting rates not raising them.

So why is the Bank of England pursuing such an inappropriate policy – signalling that more rate rises are coming - in the light of the evidence that they know exists, that consumers think we are heading for economic Armageddon in a way not known during the working lifetimes of most of those now involved in economic policy decision making? The two increases we have already had were in error in our view.

As far as we can tell from the recent speech by Catherine Mann the Bank disagrees with the idea that if consumers think the economy is going to slow, it will. Instead they think that if only the Bank can send out a signal to the world that they are going to tackle inflation then the expectation of inflation will go away and all will be well. The belief is that people will drop their expectation of higher wages (which are happening, as noted in the first chart of this post, which comes from this speech) if they believe that the Bank will get inflation under control by increasing interest rates, irrespective of their consequences. That, however, requires the Bank to believe that people think that they believe that the problem causing inflation is that people just have too much money to spend and that if only that excess money is taken away from them then all will be well in the world.

In this context it is worth noting that Bank of England Chief Economist Charlie Bean said in April 2008:

And indeed some commentators have argued that the MPC should have been more aggressive in cutting interest rates in order to head off the risk of the credit crunch turning into something particularly nasty. But that would simultaneously have increased the likelihood of inflation becoming de-anchored, another outcome we want to avoid.

It is as if nothing has been learned. Not only are the priorities as wrong now as they were before the last crisis, as what we have written here shows, what the Bank of England want to believe is not what is actually happening in the real world. Most people have too little money. They have no excess to spend. They cannot save. They have no savings to draw on. Their lines of credit will soon expire. And they have no way of knowing how they can make ends meet without wage rises, which the Bank is determined will not happen. As a result, their confidence has, quite reasonably, crumbled. But Mann thinks consumers are wrong to feel that way and that the Bank is right in their belief that people's confidence should grow because the Bank is seeking to crush their well-being. As such she thinks the policy of increasing rates should continue.

Worse, and our third argument, she appears to think this even if it means that people might remain worse off when inflation is curtailed, which is a point Mann explicitly makes in the speech, where she suggests that this is an issue beyond the mandate of the Bank of England, whatever its ramifications, which we would suggest include long term hardship. .

There is much more we could say on this speech, and others by Bank of England personnel, but what ordinary people have realised is that the Bank is the only agency pursuing economic policy in the UK right now, and it does not care about them. It is actually doing the exact opposite to what it should be doing in a time of a European war

Nothing else really matters after that is appreciated. No wonder consumer confidence has collapsed. No wonder retail sales have collapsed. Economic policy is being run against the best interests of people at a time when people are facing economic poverty, despair and potential very real distress.

What to do about this? That is the subject of another post. The point of this one is to make clear that, firstly, people are rightly concerned; secondly, the Bank of England has its policy response to this crisis wrong and thirdly it does not care about that.

There is, however, a critical comparison to make. The UK actually went into recession in April 2008, and not after Lehman Brothers collapsed in September that year. Danny, alone, on the Monetary Policy Committee at that time realised that. In January 2008 he was already arguing for interest rate cuts. In a Guardian article that month he was noted saying "Worrying about inflation at this time seems like fiddling while Rome burns."

In September that year the minutes of the MPC note that “A case could be made for an increase in Bank Rate. There still remained a significant risk to inflation expectations from the expected short-term rise in CPI inflation.”

In contrast it was noted with regard to Danny's contribution that:

For one member, the prospects for UK demand had clearly worsened over the month, increasing substantially the downside risk to inflation in the medium term. There was no evidence that inflation expectations were pushing up nominal pay growth. The slowdown might be amplified by financial institutions' responses to increased financial fragility. A significant undershooting of the inflation target in the medium term, at a time when output and employment would be well below potential, risked damaging the credibility of the monetary framework.

The reality was that inflation fell by more than 4% over the coming year. It was killed by worried consumers reducing their spending, and not by the interest rate cuts that began a month after Danny made the above point.

We feel we are in the same place now. Whilst the Bank of England fiddles with rates people's livelihoods are failing, and the economy is burning. We are likely to be in recession again, already. But still the Bank does not get the issues, the messages from the data, or the required responses. And that is why we are worried.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It seems to me that Central Banks still have Milton Friedman on their collective shoulders, living by the maxim: “Inflation is always and everywhere a monetary phenomenon”.

You are right. The lessons of the last 60 years — particularly the last 15 years — have not been learned.

Unfortunately, their positions tend to rely on them not learning those lessons — to horribly mangle Upton Sinclair.

Agreed

Sorry to muscle in folks but my better half and I have got tickets to BBC’ ‘Any Questions’ on the 6h May.

We can submit a question for consideration by the panel.

Would anyone like to make any suggestions for a question?

The one that comes to mind is ‘If the Tories (& Labour) say that there is too much Government debt to help and invest in the people of this country , then please tell us who they owe it too and why must it must paid back?’.

Well, if any of these commentators who believe the national debt is too high and they have some sterling bank notes in their wallets, they’re welcome to send them to me

That’s my line….

You and Danny are taking my late fathers idea again!

(These people dont have any money!)

– meant in the nice way

I was out today buying beanpoles near Shaftesbury, while I dont usually go on it during the week, I was surprised at how little traffic there was on the A303, and there isnt anything like as much traffic as there used to be before lockdown in the roads around my house.

Oh and not much demand for beanpoles either it seems.

My middle son and I are off to Swanage tomorrow to ride the railway and its interesting to see the timetable

https://www.swanagerailway.co.uk/calendar

which is only fixed up to the end of June at the moment, with all the uncertainties over Covid, fuel supplies and the economy it seems a wise move.

It doesn’t look good for the economy if you are walking, driving or training around.

Enjoy

I guess it shows I’ve been paying close attention to your wise words Richard. I couldn’t resist stealing your line, sorry! Indeed I can concisely tell other family members what taxes are for (not paying for things) and that funding quality public services is a question of priorities and that austerity is 100% unnecessary

🙂

I suspect I have asked this before – but how much impact do BoE interest rate rises really have? Other than psychological.

For ordinary low-paid folk affected by price rises, the borrowing they have access to is by credit card where another 0.25% isn’t going to be the issue when rates are already over 20%. For businesses they will have seen the way the wind is blowing and hold off any investment for at least the next year regardless of borrowing cost. For those with mortgages the majority have fixed rate deals, though admittedly it is going to be tough on those reaching the end of a rate fixed 5 years ago.

What is needed is not tinkering with interest rates, it is helping the lower paid deal with inflation undermining their budgets. Unfortunately not an interest of our current Chancellor, or within the powers of the BoE.

Jonathan

Let me try tomorrow

There is some material left over from last week on this…

Richard

It can’t just be economic misunderstanding that has led the Bank to pursue their interest rate policy , who benefits from this misguided policy? Are they protecting the asset rich minority at the expense of the majority.

Yes

My fear is that the BoE DOES see a major downturn ahead…. but doesn’t think it could/should do anything.

In 2008/09 the BoE was behind other Central Banks in realising there were problems and moved very slowly…. until the s*** hit the fan and banks started to fail. At that point serious action WAS taken and quickly. It suggests to me that Central Bankers are cautious when choosing policy to support the economy (because they, by and large, the rich/powerful are not hurt by a recession) but care passionately about a banking crisis (because that really does impact the rich/powerful). Of course, that action to bail out the banks had the happy side effect of supporting the real economy but the purpose of the action was to save the banks.

Wind forward to today and we have little risk of a banking collapse (I hope!) so I wonder whether the BoE really cares about the economy?

Having said that, with rates so low (and, despite the BoE) staying quite low, official interest level changes are just rearrangement of the deckchairs – I am afraid it is Rishi Sunak that is on the bridge of the Titanic… and I am not hopeful.

Where Central Banks are taking a risk is in the reversal of QE. The Fed is talking tough and I fear that the wheels will come off on May 10/11/12. Mark your diary – it is the US Quarterly refunding (ie sale of bonds), without the Fed to buy who else will show up?

This is why I have problems with rich well paid people making these decisions. They’re so insulated from reality they have no idea what it’s like. I’ll bet the MPC have no ordinary civillians on it? My own personal GDP sucks.

Might a repeated “error” be an unstated policy?

Might it be the policy of the Bank of England, and those they invisibly represent, to lessen the wealth of the generality of the population?

When the bank rate is raised, to whom does the money go?

Do HMG and the BoE differentiate inflation causes sufficiently?

Interesting idea

I’m serious about the question though if it gets picked – is this an opportunity or not? I promise to be on my best behaviour and not swear.

Is there another question we could put forward? About interest rate rises?

It might be a good idea also to give out some free copies of Richard’s latest (and very cheap) book!!

We listened to Any Questions last night and it was held in a Tory seat I think. Throughout, the Lib-Dem was loudly applauded whereas the Tory incumbent was subjected to heckling, derision and indifference.

John Warren could well be right about Johnson now being seen to be a liability (liar-bility?).

As to the issues raised in this post – I agree with Danny that we have been in recession since 2008 – absolutely we have. My view was that up to that point (but there were warnings) things were not too bad (although in 2003 New Labour reduced public sector pensions from final salary to average salary for no good reason, thus reducing the future retirement income of thousands who have been retiring in this period now – part I bet of the Tory spending plans they had. Labour then gave huge tax breaks to the private pension industry).

As another commentator here said recently, this idea that inflation is just about the supply of money is a load of old rhubarb. Once again the Neo-liberal view that the only idea is that there are no ideas comes into play – at the Bank of England too. So much for the MPC!

I think it comes down to two things for me:

1) The Allegra Stratton affair proved to me that the people in charge of this country are just not like us; they do not know how we live or what affects us. Our rulers live in a bubble of high earning bliss and real privilege (not the artificially constructed ones we see in identity politics). The way Stratton was laughing and giggling about illicit partying was just so indicative of the mindset. How an earth can we have people like that making laws and rules for the rest of us, so cut off from reality that they are?

2) This business about Government money versus taxation is just a lie – a construct – to enable the rich to get their hands on public infrastructure and services in order to make money out of them (schools, railways, roads, NHS anything). There is no question of it in my mind. This is why privatisation has become extractive drilling down on cutting costs and transferring the savings to owners or contractors to give a return on investment. And Labour, the Lib Dems and the Tories all believe in it which is even worse. Even Alan Budd – Thatcher’s economic advisor has acknowledged the extractive downside of it all. And this is why wealth has continued to grow and real wages – sacrificed on the altar of ‘efficiency’ – have been declining.

My father died in 2008 but he wished me to continue my education so that I did not go the same way as him – a manual worker, a tool maker – who was thrown on the scrapheap in his 40’s. I’ve studied up to MBA level whilst at work, I rotated into new roles and avoided redundancy but I still cannot believe that despite that I and many others can never be allowed feel safe and secure; that my wages are 25% less despite studying and doing more than what they were in 2010 because of ……………what exactly? The public sector did not bankrupt the country. The private banks did that! Yet it is working people being made to face the music even now.

My Dad was worried about the future then – I wonder what he’d make of it now.

PSR, as you know, the banks didn’t bankrupt the country either. They bankrupted themselves, and were then saved by the government. Rather than bailing them out, it might have been better to do an FDR and nationalize them all.

Congratulations on your further education, but I am sorry that the system isn’t allowing this to consequently benefit you. This is disgraceful.

“Economic freefall

Just how bad is Britain’s current economic collapse?

One indicator can be found in the monthly registration of new vehicles, which are generally higher in September and March when new registration plates are introduced. Nevertheless, total registrations were down 14.3 percent on this time last year – when the UK was still subject to lockdown. . . . the bigger concern is in the 27.6 percent fall in light commercial vehicle (LCV) registrations.” ?

https://consciousnessofsheep.co.uk/2022/04/06/in-brief-economic-freefall-peak-foodbank-electricity-first-fracking-back-there-were-no-clever-people-after-all/?fbclid=IwAR2MO7RM07XI1cgrkArWM5oK9B70AucIaMYWM58RwIQLWn_nXhFJ9jhYkL0

‘“Individuals borrowed a net £1.5bn on credit cards in February, the highest monthly amount since records began in 1993, according to data published by the Bank of England on Tuesday. The figure was more than three times higher than the average of £400mn borrowed in the previous six months and pushed total consumer credit, which includes personal loans and car dealership finance, to £1.9bn net — the highest level in five years.

“Consumer borrowing is usually considered a measure of spending growth, but with inflation at a 30-year high and falling consumer confidence, some economists have warned that it was increasingly a sign of consumers running into debt to maintain their standard of living.”

The increase in credit card borrowing coincides with a dangerous fall in the rate of M2 currency entering the economy:

While the currency supply is still growing, the slowing rate which, like wages, is not keeping pace with rising prices, is sufficient to trigger a recession later in the year. Indeed, given the supply-side woes which are only just beginning to break over us, we will count ourselves very lucky if all we get to experience is two quarters of negative growth. And remember, all of this was happening before Russia invaded Ukraine.’

https://consciousnessofsheep.co.uk/2022/04/20/this-time-really-is-different/?fbclid=IwAR0DAQhhZjb54P5RhD_5glJk919ybGbuYOuMBufaDopKceKcIjKWicnhxSU

Some interesting ideas by why start by saying that retail sales are collapsing? They have slowed but remain above pre-pandemic levels. Other indicators say the same thing. The extraordinary thing is how consumption has been resilient in the face of obvious headwinds (slowing incomes, higher prices etc)

Because it is trends that matter

If you think retail is going to do just fine you’re nit paying attention

‘In September that year the minutes of the MPC note that “A case could be made for an increase in Bank Rate. There still remained a significant risk to inflation expectations from the expected short-term rise in CPI inflation.” ‘

In the ‘best’ neoclassical tradition!

M. King said in his opening remarks: {Thursday 11 September 2008} :

“In the UK we face a difficult but, temporary, period during which inflation will remain high for a while and output growth at best weak. . . . But provided we do not impede the required adjustment we will come through this temporary period and resume a path of normal economic growth with inflation close to target. . . .

Provided we focus on bringing inflation back to target, our present difficulties will prove to be temporary. Inflation will fall back, and growth will resume.”

https://publications.parliament.uk/pa/cm200708/cmselect/cmtreasy/1033/8091102.htm

He was so very wrong then