A month ago I suggested that the Office for National Statistics might be overstating the cost of interest in its monthly reports on the UK government's finances. Much discussion ensued, and I suggested that I was writing to the ONS for clarification on their accounting. I duly did so.

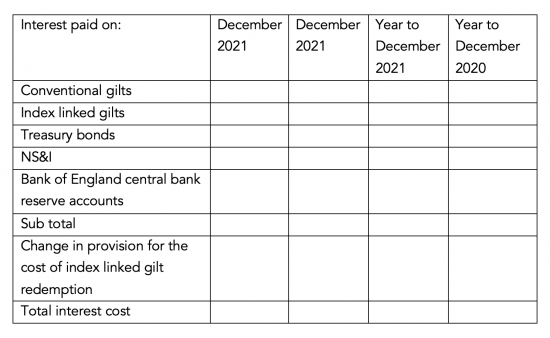

In fairness to the ONS, they have supplied me with a reply to the submission that I made to them, and have welcomed my suggestion that it might be appropriate to summarise the cost of government debt within their publications in a manner that might be consistent with my proposal, which was (dates are for example):

The intention of this suggestion was straightforward. It was to differentiate that part of the cost which is actually going to be settled in cash in a manner that is highly probable and to then identify that part of the cost which relates to the estimated cost of redemption of index-linked gilts, which might best be described as a pretty wild estimate during a period when the retail price increase is increasing aberrationally, which happens to be the case at present.

I have been advised by the ONS that this reconciliation is, in principle, possible using the data at present. However, so far, and try as I might, I have been unable to locate some of the necessary tables to check that this is the case, such is the near impossibility of finding almost any data on the ONS website.

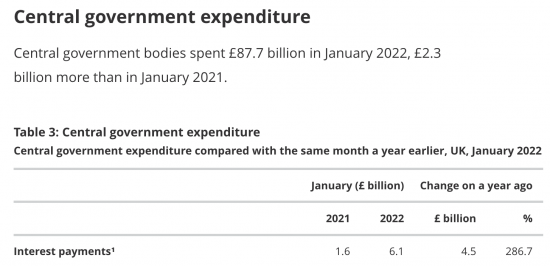

In the meantime, another month has passed and this is the claimed cost of expenditure on interest this month:

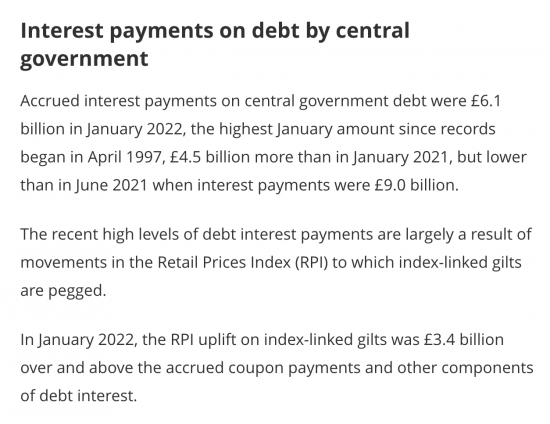

The ONS explain this as follows:

So, at least £3.4 billion of the £6.1 billion charge is made up and assumes that the current rate of inflation p[ersists to the time of redemption of all the index-linked gilts in issue.

Some might think that possible. I consider it to be utterly implausible.

Candidly, what we are looking at are some pretty big reveals of charges sometime soon in this case when RPI drops, as most, for very good reason, think it will.

What to conclude from this? Four things. The accounting should be improved. I think the ONS get that. Second, the ONS website really does need to be improved so that data can be found. Third, this method of estimation is too crude to be useful. Fourth, the claims that costs must be curtailed for this reason make no sense.

There will be more to come on this issue.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The Treasury is paying interest on the index-linked part of the debt held by the Bank Of England of which there is both substantially more and the rate is higher.

They get those interest payments sent back, but that’s not in the ONS remit to exclude this from outgoings.

Like sending money to Brussels and getting some sent back unspent, although the timescale is different.

The BoE does not hold index linked gilts as far as I know

Seems slightly surreal to be commenting on arcane accounting for interest issues as we teeter on the brink of war. But I am not a General, Diplomat or Historian….. so I will confine my thoughts to finance.

There are two separate issues; gilts held by the APF and the “inflation uplift” on I/L Gilts.

I think there should be a footnote to whatever number is calculated for interest that records “interest received” on the APF portfolio. This would, I hope, be a “neutral” way to record the fact that the stated interest cost is, in fact, offset by interest received.

I really do think that the inflation uplift should not be recorded as interest. There are two things we want to know about the government debt; how big is it (and how has this changed over the period in question)? What has it cost us to service it?

To me, it is clear that when accounting for the outstanding amount of I/L debt we must use the inflated principal. So, for example if we have £100 of I/L debt today and inflation is 5% then the “amount (principal) owed” will be £105. I think this is straightforward.

If the real rate on the I/L gilt were 1% then the cash paid as interest will be £1.

I would say that my “economic position” has changed by (a) the interest paid (£1) and (b) the increase in the amount owed (£5) … a total of £6.

If you include the inflation uplift as “interest” you get an interest cost of £6 along with an increase in amount owing of £5 to give an overall cost of £11 – ie. “double counting”.

So, all data related to inflation uplift should be displayed with data about the change in amount of debt outstanding. It most definitely IS a cost but it is not interest.

I am musing on that

The trouble is the ONS only uses accruals occasionally and recognising changes in equity, which you propose, is nowhere near their thinking

“(T)he ONS website really does need to be improved so that data can be found…”

Thank you for pointing this out. I’m surprised there isn’t a national outcry over the poor quality of online official statistics in the UK.

Information is often difficult to find, presented in extremely user-unfriendly formats or made public in huge, unwieldy and undigestible cartloads.

The comparison with many official US government websites is truly embarrassing.

I can’t help feeling that this problem reflects the UK’s lack of genuine democracy and the governing elite’s preference for operating in secret as much as possible.

I think it a scandal…..

What to make of this on the BBC news App?

Inflation sends UK debt interest payments higher https://www.bbc.co.uk/news/business-60431535

or this, which is recycled regularly:

Coronavirus: Where does the government borrow billions from? https://www.bbc.co.uk/news/business-50504151

Deliberate misinformation

Thank you, Richard. That’s what I thought.