There is an interesting thread from Tom Tugendhat MP on Twitter. He is, of course, a Tory and chair of the Foreign Affairs Committee. He is also the only known challenger to Boris Johnson to be Tory leader, as yet. He said as part of this thread:

He then concluded

I have, of course, been saying this for a long time. Offshore, whether located in those places often thought of as tax havens or within the City of London, where the term was actually invented in the 1950s to describe unregulated transactions taking place in the UK between two parties who were not UK resident that did, as a consequence, thereafter deliberately fall outside the scope of UK regulation, which is how the London laundromat came into operation, has always been an exercise intended to undermine democracy.

Whatever the veneer that the offshore service suppliers, whether they be bankers, lawyers or accountants, wish to put on their activities, the intention of the offshore activity has always been to undermine the chosen will of democratically elected governments with regard to the raising of taxation, the operation of regulation and the use of state resources. I suggest that it is really is not possible to be more anti-democratic than that.

For that reason when I was once asked to name the four biggest threats to democracy that I could think of I rather suspect that my questioner thought that I would refer to the likes of North Korea or Iran. I actually named the Big Four firms of accountants - Deloitte, PWC, EY and KPMG. That is because, quite literally, the world of offshore could not exist without them. As my work with Saila Stausholm has shown, they provide the underpinning to all the major tax havens of the world, including London, of course. As we noted:

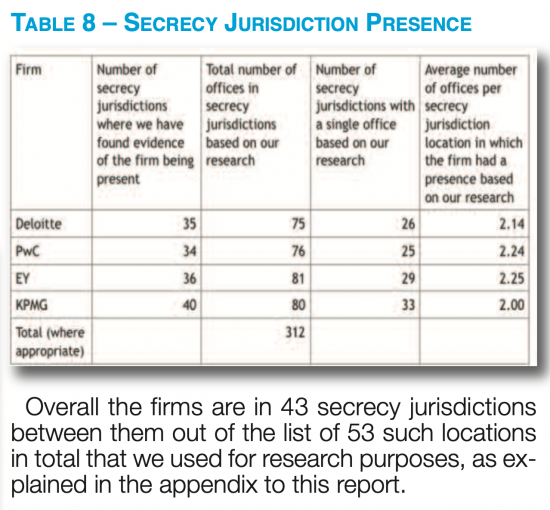

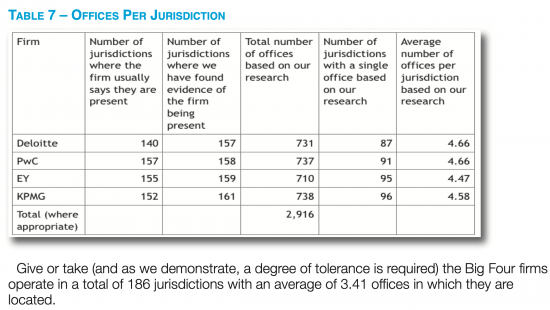

To put this in context this table suggests the total number of locations that these firms have:

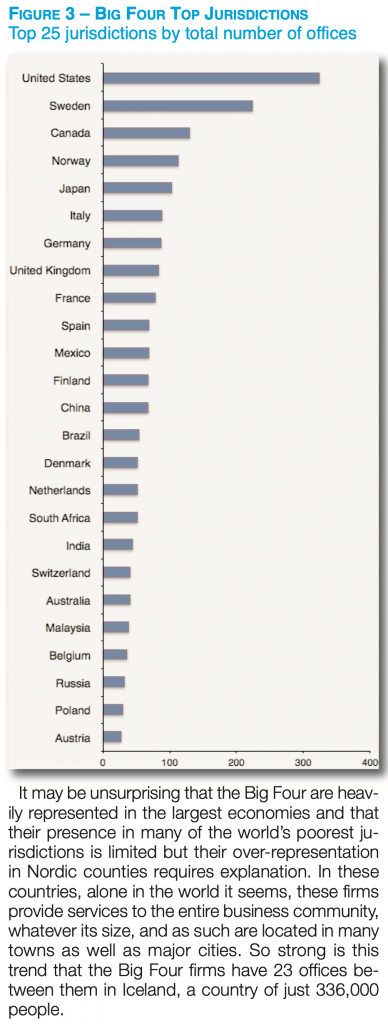

Between 20 and 25% of all locations that the Big 4 serve are tax havens. And they are not there to service local needs. Our work tested this in two ways:

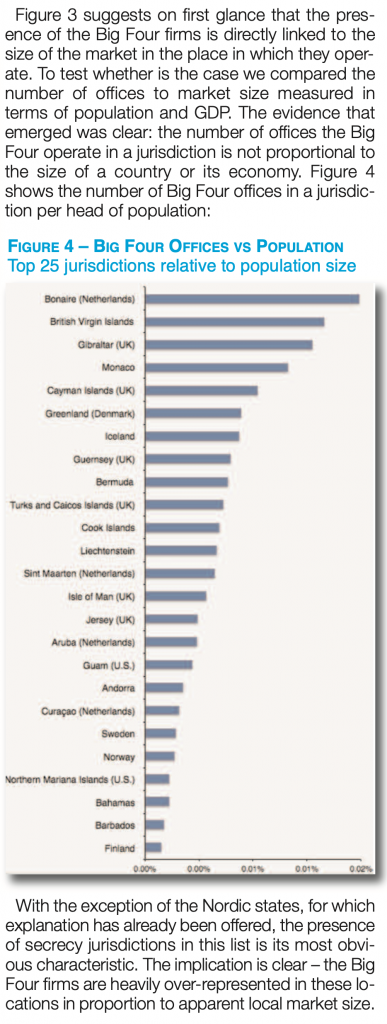

Then we tested again, for the locations with the greatest number of offices proportional to the size of the economy and found this:

As noted in the previous section, the Big 4 seem to rarely serve local community need outside the Nordic countries. So why are they in all these tax haven locations? It can only be to service international interests - or offshore, in other words.

And since offshore - most especially when undertaken behind the veil of secrecy that many of these places still provide - is heavily associated with corruption - then offshore activity does represent a threat.

I stress when saying so that I am not suggesting for a moment that the Big 4 firms do in fact supply the corrupt services. There is no reason for them to do so. But what they do supply is the underpinning of the architecture of the financial services industry of all these locations, largely by acting as auditors to the local banks who are, by large, branches of banks located elsewhere, adding in that indirect way the underpinning for this offshore economy.

What I also stress is that they do not need that direct relationship with the corruption to be its facilitators. It is precisely by providing this architecture in which corruption can take place that these firms pose a threat, even if indirect, to democracy itself.

My challenge to every partner in the Big Four firms (and those accountants and auditors outside that group that copy them), is in that case very simple. It is to ask them what are they going to do to end the threat to democracy that their firm's operations in tax havens represent? If these firms shut down their offshore operations then this problem would be well on its way to being solved. So why won't they take that necessary action?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I think the reason is called ‘Fees’.

A rather effective head turner from what I’m told.

Last month I linked up a video detailing how the big 4 are embedded within government, the revolving door of staff and them effectively writing the tax loophole laws for the government so their clients can take advantage, yet you played down the issue. Would you mind watching that video again and clarifying?

https://www.taxresearch.org.uk/Blog/2022/01/20/kpmg-is-failing-but-the-task-it-is-failing-at-is-one-so-badly-defined-that-systemic-reform-is-required/#comment-894803

Clarifying what? I am not sure I follow your request

It is the same question to formulate to the big banks. Why do they continue to operate through tax havens?

Funny how you manage the whole article without mentioning Putin.

President Trump could barely sneeze without you condemning his actions but Putin’s actions on the Ukraine border and the corruption that is actually what the tweets you quote are all about get no mention at all.

Ah, but of course, you’ve happily appeared on a Putin sponsored media channel so no doubt don’t want to be critical and spoil your chance of another chance to appear.

As for what the big 4 – or any other accountancy practice does – unless you’re accusing them of doing anything illegal, why are you whining at them? Your ‘challenge to every partner’? What a joke. 99.9% of their partners have never heard of you and the odd one that has probbaly laughs every time you are mentioned.

Wow, what a warped world view, let alone opinion of me

Did you read what I wrote on Sunday?

Come back and tell me how that could be reconciled in any way with supporting Putin

A full explanation, please

Back in the 60’s ^ 70’s while taxation was higher the ‘respectable’ end of finance (If there is such a thing) semed to shy away from tax avoidance leaving it to fringe operators, Rossminster springs to mind.

I wonder if thats the sort of culture shift that is needed?

They claim that has already happened … but I am not wholly convinced